UV Air Purifier Market Outlook:

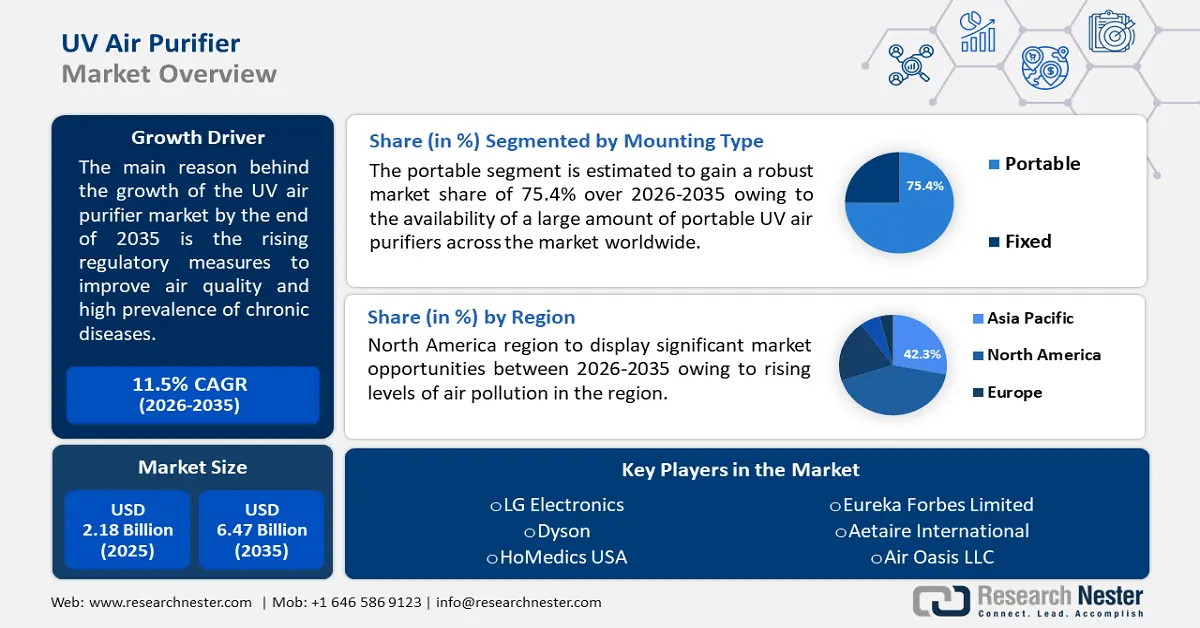

UV Air Purifier Market size was valued at USD 2.18 billion in 2025 and is expected to reach USD 6.47 billion by 2035, expanding at around 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of UV air purifier is evaluated at USD 2.41 billion.

The market growth is driven by the steady rise in the transmission of airborne diseases such as influenza, measles, and mumps. According to the World Health Organization’s (WHO) March 2024 data, about 1 billion people are infected by seasonal influenza annually, resulting in rising need for high quality air purifiers, including Ultraviolet light (UV) air purifiers. UV air purifiers use UV-C radiation to filter bacteria, and viruses out of the air and reduce the threat of airborne spread. As per data issued in April 2022, nearly 99% of the global population breathes air that exceeds WHO air quality limits, endangering their health.

Key UV Air Purifier Market Insights Summary:

Regional Highlights:

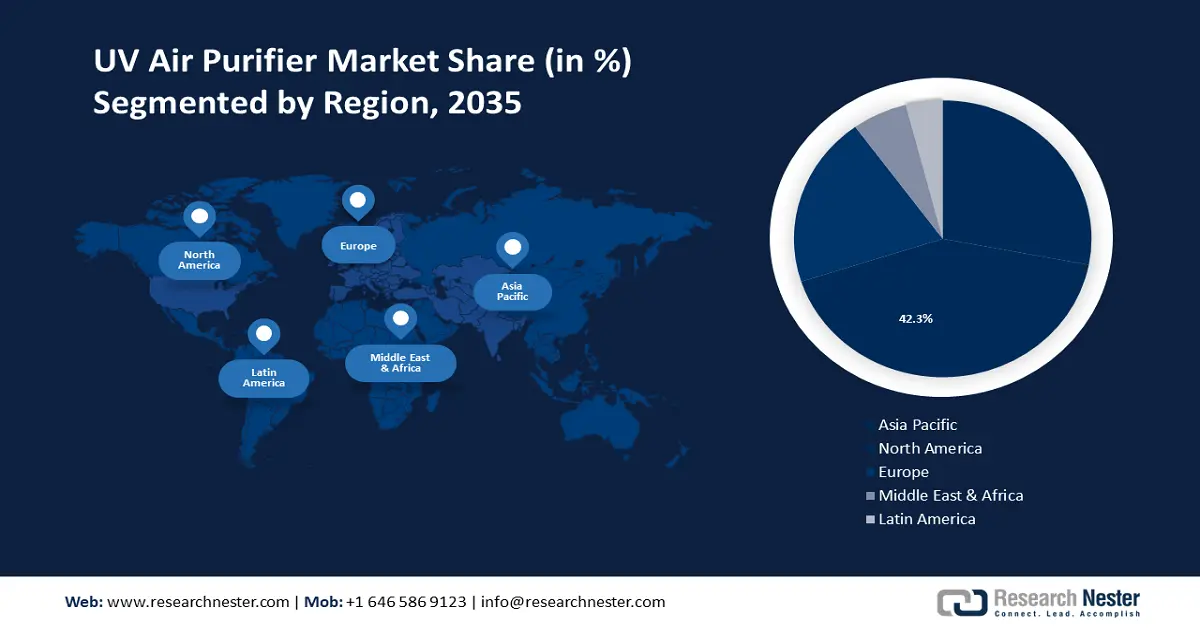

- The North America UV air purifier market will secure over 42% share by 2035, driven by increasing levels of air pollution, leading to rising adoption of advanced UV air purifiers.

- The Asia Pacific market will register notable growth during the forecast timeline, driven by growing population and rising production activities such as burning fossil fuels and manufacturing chemicals.

Segment Insights:

- The portable segment in the uv air purifier market is expected to capture a significant share by 2035, attributed to high preference for portable UV air purifiers due to enhanced convenience and portability.

- The offline distribution segment in the uv air purifier market is anticipated to achieve a 70.30% share by 2035, driven by the widespread availability of UV air purifiers at traditional retail stores.

Key Growth Trends:

- Emerging trend in UV LED technology

- Increasing regulatory measures to improve air quality

Major Challenges:

- High processing cost

- Rising concerns related to air purifier efficiency

Key Players: LG Electronics, Dyson, HoMedics USA, Eureka Forbes Limited, Aetaire International, Air Oasis LLC., COWAY CO., LTD., Vesync Co., Ltd., Guardian Technologies LLC, Samsung Electronics, Airpura Industries, Midtherm Flue Systems Limited, Toshiba Corporation, Daikin Industries, Ltd., Asahi Kasei Corporation, Airex Co., Ltd., Azumi Filter Paper Co., Ltd..

Global UV Air Purifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.18 billion

- 2026 Market Size: USD 2.41 billion

- Projected Market Size: USD 6.47 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

UV Air Purifier Market Growth Drivers and Challenges:

Growth Drivers

- Emerging trend in UV LED technology - Advanced UV lighting technologies are used in air purifiers to consume minimal power and generate reduced heat. Manufacturers are utilizing these advanced technologies in UV LED to launch more effective and affordable products. For instance, in June 2022, ams-OSRAM AG announced the use of high-performance OSLON UV 3636 UV-C LEDs by Taiwan-based Ledtech to reduce bacteria, airborne viruses, and fungi from the air. UV-C LEDs work along with active carbon filters to purify air in offices, homes, and public buildings.

- Increasing regulatory measures to improve air quality –Several governments across the globe are implementing new stringent regulations and standards to improve product performance. These standards specify the performance requirements and test procedures for air purifiers. For instance, the United States Department of Energy in April 2023, established a new energy conservation standard for air cleaners in the Federal Register. In addition, the government of India made ISI mark mandatory for all air purifiers, due to the rising quality concerns. By adhering to ISI quality standards, Indian manufacturers can ensure that their air purifiers are reliable and safe for consumers.

- Prevalence of chronic diseases among the elderly population- The aging population tends to have a higher prevalence of chronic diseases such as asthma, and chronic pulmonary diseases (COPD) due to constant exposure to poor-quality air. As per a study in May 2024 by the Council of Aging, around 95% of adults in the U.S. aged 60 and above have at least one chronic condition. This has resulted in growing inclination towards advanced air purifiers.

Challenges

- High processing cost - The UV lamps and bulbs used in air purifiers need to be changed frequently, which can be expensive. The lifespan of UV lamps and bulbs varies across manufacturers but usually, they need to be replaced once a year as its detoxification ability gradually diminishes over time. In addition, the overall cost of UV air purifier operations increases with the growing cost of the electricity required to power these devices.

- Rising concerns related to air purifier efficiency – Many UV air purifiers lack the ability to remove multiple types of contaminants such as pollen, dust, and other minute pathogens from the air. This has resulted in rising concerns about its efficacy among consumers. Moreover, UV air purifiers generate heat that turns the molecules of water, and oxygen into dangerous ground-level ozone. As a result, consumers looking for efficient air filtering solutions, find UV air purifiers less appealing.

UV Air Purifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 2.18 billion |

|

Forecast Year Market Size (2035) |

USD 6.47 billion |

|

Regional Scope |

|

UV Air Purifier Market Segmentation:

Mounting Type Segment Analysis

Portable segment is set to hold over 75.4% UV air purifier market share by the end of 2035. This growth can be attributed to high preference for portable UV air purifiers due to enhanced convenience and portability. Manufacturers are investing in R&D activities to launch products with features such as voice control, light sensors, and smart IoT. In May, 2023, LG Electronics (LG) announced the introduction of their unique innovation known as PuriCare AeroFurniture. The portable product has a filter that can eliminate up to 99.9% of airborne bacteria, and ultrafine dust particles as small as 0.01 microns.

Distribution Channel Segment Analysis

By 2035, offline segment is anticipated to capture over 70.3% UV air purifier market share. The offline distribution channel's dominance is one of the major factors for the widespread availability of UV air purifiers at traditional retailers, shopping centers, and home utility stores. Companies are integrating innovative technologies into the retail space design to provide customers with unique, enjoyable, and memorable experiences when they visit. For instance, in August 2022, Dyson launched its first-ever Dyson Demo Store Owner Center in Dallas to let people experience their technology. Dyson Owner Center has a dedicated team of experts to provide maintenance tips, and technical support directly from the people who made the product.

End use Segment Analysis

In UV air purifier market, commercial segment is predicted to capture over 58.3% revenue share by 2035 owing to the rising need to purify indoor air quality in commercial buildings, such as malls, schools, hospitals, hotels, and companies. Maintaining indoor air quality in these commercial spaces is crucial as it adversely impacts the health and productivity of the building occupants. As per a 2022 study by the National Library of Medicine (NIH), indoor pollution levels can be up to five or even 100 times greater than outside pollution levels. On an average, people spend approximately 90% of their time indoors.

Companies are focused on developing alternative solutions to traditional purifiers to deliver purified air in commercial places. In April 2022, Dyson announced the launch of purifying headphones known as Dyson Zone in the U.S. for delivering pure audio, and air. The first ever wearable purifier that tackles the urban issues of noise pollution, and air quality.

Our in-depth analysis of the global UV air purifier market includes the following segments:

|

Technology |

|

|

Mounting Type |

|

|

Power (Watt) |

|

|

Air Flow Range |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

UV Air Purifier Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 42% by 2035, due to the increasing levels of air pollution. American Lung Association in 2024 reported that 4 in 10 people in America still live in a place with unhealthy levels of air pollution. This has resulted in increasing adoption of advanced UV air purifiers.

The emergence of different government policies to combat air pollution is fostering market expansion in the U.S. For instance, the U.S. Clean Air Act and the U.S. EPA's national ambient air quality regulations, are two models of air quality legislation in the country.

Increasing research and development for the advancement of air purifiers supports the growth of the UV air purifier market in Canada. Companies such as Airpura Industries, and Dyson are undertaking research and development activities to introduce new air purifier products in the country. In March 2021, Dyson launched its new range of purification machines including formaldehyde-destroying technology in Canada to capture dust, and allergens, and destroy formaldehyde. In addition, the growing industrial activities, along with the introduction of stringent regulations in the industrial sector are expected to have a positive impact on the UV air purifier market demand in this country.

APAC Market Insights

The Asia Pacific UV air purifier market is predicted to show notable growth during the forecast period. This growth can be attributed to the growing population in the region leading to rising production activities such as burning of fossil fuels, and manufacturing chemicals. In 2023, the United Nations estimated that out of the 8 billion global population, over 60% of the world's population resides in the Asia Pacific region.

Rapid industrialization and urbanization in China in recent years have resulted in the degradation of overall air quality. Growing awareness about the health risks associated with poor air quality is further driving UV air purifier market growth in the country. As a result, consumers are increasingly looking for options to protect themselves from harmful pollutants.

The availability of various air purifier options at affordable prices, coupled with the growing retail trading sector, is projected to drive the revenue share of the UV air purifier market in India. In May 2024, India Brand Equity Foundation published that India’s retail trading sector attracted nearly USD 4.63 billion FDIs between April 2000-March 2024.

In South Korea, air pollution has become a severe issue, leading to skin issues. The demand for air purification devices has grown significantly in recent years to cater to these challenges. Individuals are also investing in residential air purification systems due to the growing awareness of indoor air quality in the country.

UV Air Purifier Market Players:

- LG Electronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dyson

- HoMedics USA

- COWAY CO., LTD.

- Samsung Electronics

- Eureka Forbes Limited

- Aetaire International

- Air Oasis LLC

- Vesync Co., Ltd

- Guardian Technologies LLC

- Airpura Industries

Key players in the UV air purifier market are adopting different marketing strategies such as social media, and healthcare awareness campaigns to reach the uncovered population. Several local, regional, and international producers of UV air purifiers create a fragmented industry. The major companies are investing and carefully organizing the projects to boost the creation of product income. Some prominent key players in the UV air purifier market are:

Recent Developments

- In June 2024, COWAY CO., LTD., introduced Airmega 100 air purifiers offering a robust solution for smaller spaces in Europe. In an effort to protect Europeans against hay fever and allergy season, Coway launched the Airmega 100 with the cylindrical model.

- In March 2023, Samsung Electronics expanded its air purifier range to launch the Versatile Plus Air Purifier AX46 in Australia. It uses 3-way air flow to complete the purification process quickly and is designed to strike a balance between powerful features, and premium aesthetics.

- Report ID: 6281

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

UV Air Purifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.