Utility Scale PV Inverter Market Outlook:

Utility Scale PV Inverter Market size was over USD 14.12 billion in 2025 and is poised to exceed USD 27.01 billion by 2035, growing at over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of utility scale PV inverter is estimated at USD 14.97 billion.

The market is anticipated to benefit from the growing amount of public and private financing allocated to electrification projects in emerging nations' off-grid or grid-island locations. The absence of efficient grid infrastructure causes power lags and blackouts in many rural parts of developing economies. The market for utility scale PV inverters is expanding due to favorable legislative actions and an increase in industry players. The Asia Development Bank (ADB) and Avaada Energy Private Limited announced in 2020 that they would be working together to invest more than USD 15 million in increasing the capacity of photovoltaic solar energy generation in the Indian subcontinent. The need for PV inverters is increased as a result of these financial initiatives, which also help to create a favorable economic climate for the global deployment of sustainable electricity systems.

Further, supportive government policies, incentives, and subsidies can significantly impact the utility scale PV inverter market. Many governments worldwide offer financial incentives, tax credits, and favorable regulatory frameworks to promote the adoption of solar energy. These Policies create a positive environment for utility scale solar projects. A observed by Research Nester analysts, the global investment in Solar energy is expected to reach USD 380 billion by 2023. This represents 14% of the total investments in energy around the world.

Key Utility Scale PV Inverter Market Insights Summary:

Regional Highlights:

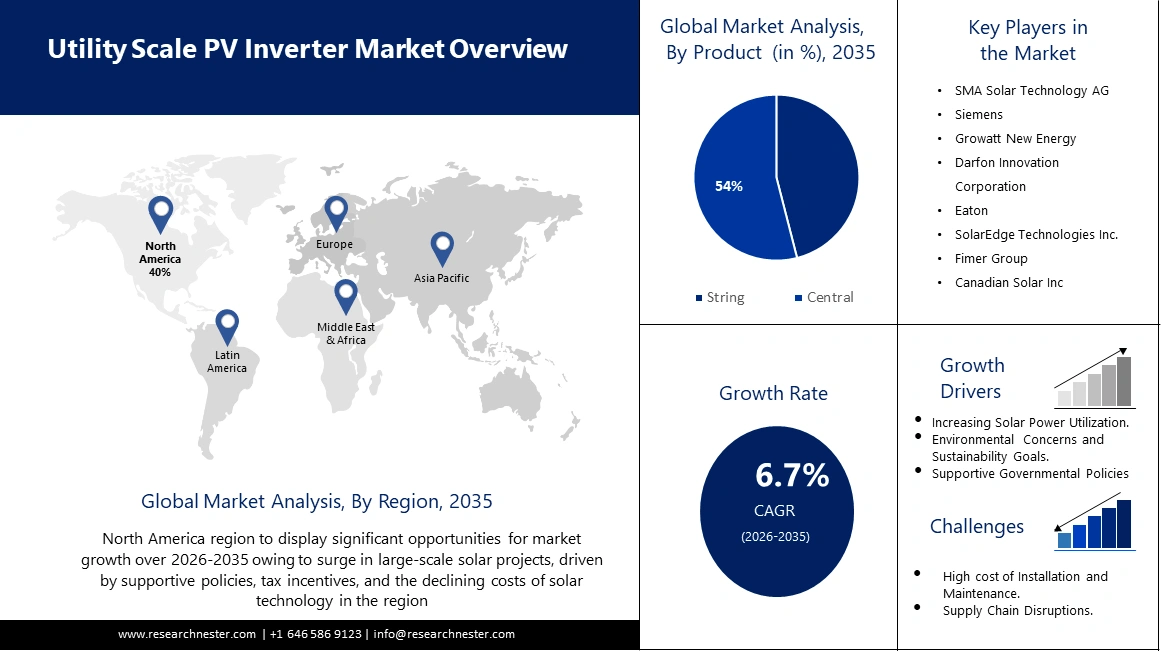

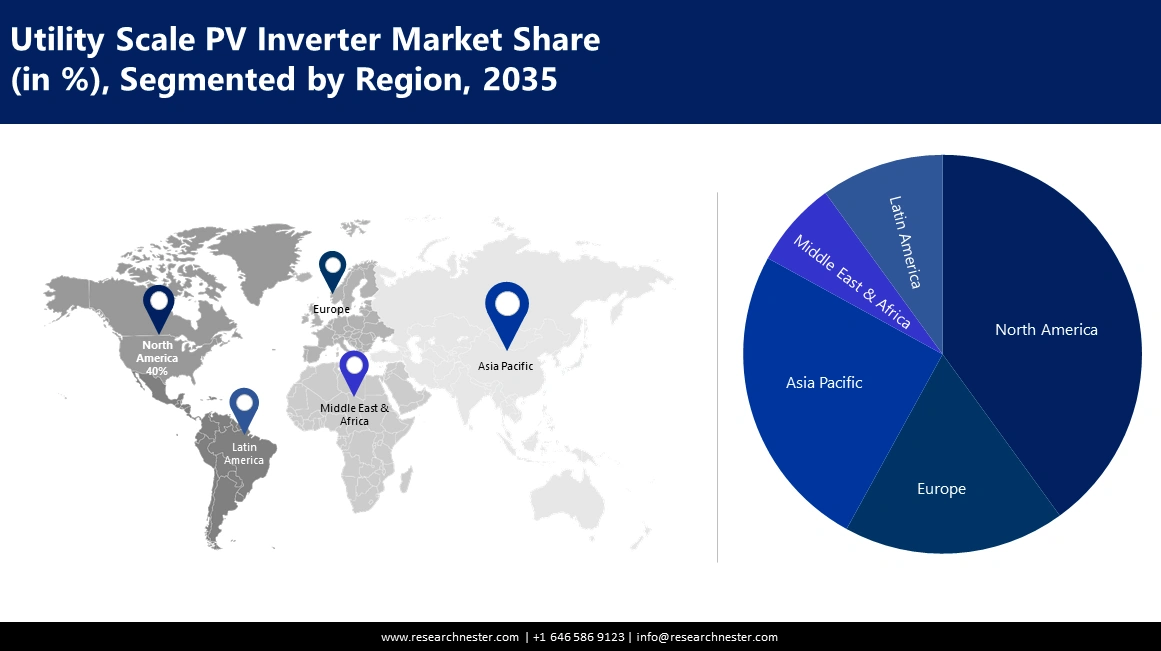

- North America utility scale pv inverter market will dominate more than 40% share by 2035, driven by increasing emphasis on renewable energy, supportive policies, and declining costs.

Segment Insights:

- The central segment in the utility scale pv inverter market is anticipated to capture a 54% share by 2035, driven by the rising demand for centralized power control in utility-scale solar projects.

- The < 1500 v segment in the utility scale pv inverter market is expected to achieve the largest share by 2035, driven by increasing awareness of low-CO₂ products and benefits like easier installation and enhanced monitoring.

Key Growth Trends:

- Increasing Solar Power Installations

- Environmental Concerns and Sustainability Goals

Major Challenges:

- High Initial Costs

Key Players: Sungrow Power Supply Co., Ltd., SMA Solar Technology AG, Siemens, Growatt New Energy, Darfon Innovation Corporation, Eaton, SolarEdge Technologies Inc., Fimer Group, Canadian Solar Inc, Jinlang Technology Co., Ltd.

Global Utility Scale PV Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.12 billion

- 2026 Market Size: USD 14.97 billion

- Projected Market Size: USD 27.01 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Utility Scale PV Inverter Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Solar Power Installations- The continuous increase in solar power generation technologies worldwide. Governments, businesses, and utilities are investing heavily in solar energy projects to meet renewable energy targets and reduce carbon footprints. Additionally, the cost of solar photovoltaic systems, including PV inverters, has been decreasing over the years. This cost reduction is mainly due to advancements in technology, economies of scale, and increased competition in the solar industry. Lower costs make solar energy more economically viable, driving the demand for utility scale PV inverters.

- Environmental Concerns and Sustainability Goals- growing awareness of environmental issues and the need for sustainable energy sources have prompted businesses and governments to prioritize renewable energy projects. Utility-scale PV inverters play a crucial role in achieving sustainability goals by facilities the integration of large scale solar power into the energy mix. Also, the global shift towards a more sustainable and low carbon energy future is a significant driver for the Utility scale PV inverter market. As countries strive to reduce dependence on fossil fuels, solar energy, supported by efficient PV inverters, becomes a key component of the energy transition.

- Energy Storage Integration- The integration of energy storage systems with utility scale PV projects is becoming more common. Utility scale PV inverters that can seamlessly integrate with energy storage solutions contribute to grid stability and enable the storage of excess energy for use during periods of low solar generation. As analyzed by Research Nester Analysts, global PV power generation capacity increased by 239 GW in 2022, reaching nearly 1,200 GW, or 1.2 Terawatt TWh.

Challenges

- High Initial Costs -The initial capital costs of utility scale solar projects, including PV inverters, can be high. Financing these projects and obtaining favorable terms can be challenging, especially for developing countries or regions without established financial mechanisms for renewable energy projects.

- Disruptions in the supply chain, whether due to geopolitical factors, trade tensions, or unexpected events (such as pandemic), can impact the availability and cost of key components.

- Limited advancements in energy storage technology and the associated costs can hinder the widespread integration of storage solutions with utility scale PV projects.

Utility Scale PV Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 14.12 billion |

|

Forecast Year Market Size (2035) |

USD 27.01 billion |

|

Regional Scope |

|

Utility Scale PV Inverter Market Segmentation:

Product Segment Analysis

The central segment is expected to hold 54% share of the global utility scale PV inverter market by 2035. The increasing emphasis on distributed generating technologies in conjunction with the development of sustainable energy systems is credited with the segment's significant rise. Product acceptance will soar because to low operating and maintenance costs, simple installation, and upgraded manufacturing facilities. These systems include centralized power control, which makes it simple to manage products and optimize costs, both of which will spur market expansion. Globally, utility-scale solar projects are becoming more and more popular. To handle the larger capacity, these large-scale installations need central inverters with high power ratings. Manufacturers of central inverters thus concentrated on creating and refining their goods for utility-scale uses. Manufacturers of central inverters constantly spend money on R&D to improve the effectiveness, dependability, and performance of their machines. Power density, thermal control, and grid integration capabilities were among the technological advances. Furthermore, several manufacturers began adding sophisticated capabilities to their central inverters, such as data analytics, remote monitoring, and grid support functions, which accelerated the expansion of the market.

Voltage Segment Analysis

The < 1500 V segment in the utility scale PV inverter market is anticipated to hold the largest revenue share. Growing consumer knowledge of the benefits of using low-CO2 products to reduce greenhouse gas emissions is credited with the segment's expansion. <1500V string inverters have a number of benefits, such as module-level MPPT, easier installation, and enhanced system monitoring. When tiny to medium-sized PV arrays are used in residential and commercial settings, these inverters are especially well-liked. Due to their minimal management and maintenance requirements, these systems are expected to fuel the market's growth. In particular, 1500V systems are capable of providing 50% longer strings and larger inverters with an output up to 40% more. The power density and performance of this system are the highest in terms of PV systems.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Voltage |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Utility Scale PV Inverter Market Regional Analysis:

North American Market Insights

North America industry is predicted to account for largest revenue share of 40% by 2035. The region has experienced robust growth, fuelled by the region’s increasing emphasis on renewable energy and sustainability. In 2022, solar technology accounted for 3.4% of the United States' electricity. The United States, in particular, has witnessed a surge in large-scale solar projects, driven by supportive policies, tax incentives, and the declining costs of solar technology. The market is characterized by a competitive landscape with both domestic and international players contributing to technological advancements. Stringent environmental regulations and the commitment to reduce carbon emissions further propel the demand for utility-scale PV inverters. The integration of energy storage solutions, grid modernization efforts, and the expansion of utility-scale solar installations across Canada and Mexico also contribute to the market’s expansion. As North America continues its transition towards cleaner energy sources, the market remains a critical component of the region’s sustainable energy future.

APAC Market Insights

Asia Pacific’s utility scale PV inverter market is also slated to garner a significant revenue share over the forecast period. The region emerged as a key player in the global solar energy landscape, driven by the region’s growing demand for clean and sustainable power. Rapid industrialization, population growth, and government initiatives to address environmental concerns have fuelled the adoption of utility scale solar projects. Countries like China, India, and Japan are at the forefront of this expansion, implementing ambitious renewable energy targets and favorable policies. The market is characterized by intense competition among domestic and international inverter manufacturers, leading to technological innovations and cost reductions. Challenges such as land constraints and intermittency issues are being addressed through advancements in energy storage integration. With a focus on energy transition and reducing reliance on traditional sources, the Asia Pacific market plays a crucial role in shaping the region’s energy landscape toward a more sustainable and resilient future.

Utility Scale PV Inverter Market Players:

- Sungrow Power Supply Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SMA Solar Technology AG

- Siemens

- Growatt New Energy

- Darfon Innovation Corporation

- Eaton

- SolarEdge Technologies Inc.

- Fimer Group

- Canadian Solar Inc

- Jinlang Technology Co., Ltd.

Recent Developments

- Sungrow unveiled the SG200HX-US, of their newest string inverter during 2023’s RE+ in Las Vegas, NV held from September 11-14. . The product works with bigger format PV modules and has a maximum current of 20A per string. The product ensures proven safety by removing the potential of a string reverse connection with its one MPPT for two strings design.

- Siemens announced that, in Kenosha, Wisconsin, where the company will manufacture utility scale solar components specifically designed to serve the US market, it will begin production of PV string inverters.

- Report ID: 5619

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Utility Scale PV Inverter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.