U.S. Overhead Conductor Market

- An Outline of the U.S. Overhead Conductor Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS Approach

- Executive Summary

- U.S. Industry

- Country Synopsis

- Industry Supply Chain Analysis

- DROT

- Government Regulation

- Competitive Landscape

- 3M

- Bahra Electric

- CTC Global Corporation

- National Strand

- Nexans

- Prysmian

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- TS Conductor

- zmscable.com

- Planned/ Approved Overhead Transmission Lines (US & Canada)

- US Overhead Conductor Import and Export (2022-2024)

- Demand Distribution By Conductor Type

- Ongoing Technological Advancements

- SWOT Analysis

- Patents Filed in the Industry

- Product Type Analysis

- Root Cause Analysis (RCA) for the Market

- Recent News/ Developments

- Porter Five Forces Analysis

- Industry Risk Assessment

- Growth Outlook

- EXIM Analysis

- U.S. Industry Overview

- U.S. Overview

- Market Value (USD Million), Volume (Million Meters), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- U.S. Segmentation (USD Million), 2019-2037, By

- Type, Value (USD Million)

- AAC (All Aluminum Conductor)

- ACSR (Aluminum Conductor Steel Reinforced)

- ACAR (Aluminum Conductor, Alloy Reinforced)

- AAAC (All Aluminum Alloy Conductor)

- Aluminum Clad Steel Conductor (ACS)

- Aluminum Clad Invar (ACI)

- Others

- Material, Value (USD Million)

- Aluminum

- Steel

- Aluminum Alloy

- Others

- Voltage, Value (USD Million)

- Up to 170kV

- 221-345kV

- 550 - 745kV

- Above 745kV

- Current Type, Value (USD Million)

- HVAC (High Voltage Alternating Current)

- HVDC (High Voltage Direct Current)

- Rated Strength, Value (USD Million)

- High Rated Strength

- Extra High Rated Strength

- Ultra-High Rated Strength

- Application, Value (USD Million)

- Power Distribution

- Transmission Line

- Type, Value (USD Million)

- U.S. Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

U.S. Overhead Conductor Market Outlook:

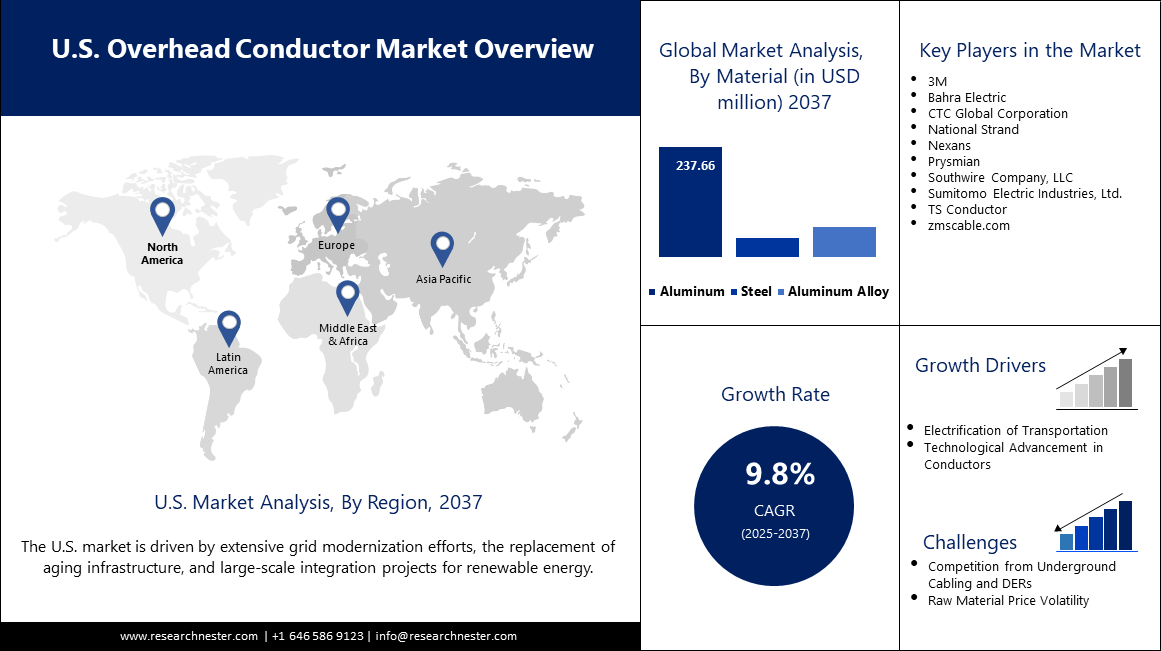

U.S. Overhead Conductor Market size was valued at USD 121.5 million in 2024 and is projected to reach a valuation of USD 393.4 million by the end of 2037, rising at a CAGR of 9.8% during the forecast period, i.e., 2025-2037. In 2025, the industry size of U.S overhead conductor is assessed at USD 127.5 million.

The U.S. overhead conductor market is driven by the urgent need to replace aged-out grid infrastructure and enable the country's clean energy transformation. With demand for electricity increasing in response to electrification trends and the expansion of the digital economy, utilities are optimizing the utilization of next-generation conductors to enhance transmission capacity and reliability. Integration of renewable energy sources such as wind and sun into the grid is ushering in an imminent requirement for high-performance transmission lines that can manage variable loads over long distances. In January 2024, Prysmian launched a new series of low-carbon conductors in its TransPowr product line made from recycled aluminum and featuring E3X coatings that reduce losses and emissions, aligned with federal decarbonization objectives.

Regional differences in grid needs continue to influence market growth, with coastal areas and fire-prone areas being resilience-led, and industrial hubs advancing in capacity expansion. According to statistics provided by the U.S. Energy Information Administration, over 70% of the transmission lines are 25 years or older as of June 2023, an indicator of the widespread need for reconductoring and upgrading. This chart indicates the scope for producers to supply innovative materials that address end-of-life infrastructure issues. Growth in the use of public-private partnerships is accelerating project timelines, while legislation such as the Bipartisan Infrastructure Law continues to shift funds into energy projects. New technologies like dynamic line rating systems are becoming trendy to optimize existing lines. These factors together position the U.S. market for sustained growth and innovation in overhead conductor solutions.

Key U.S. Overhead Conductor Market Insights Summary:

Regional Highlights:

- California is projected to dominate the U.S. Overhead Conductor Market by 2035, owing to its aggressive clean energy mandates and the pressing demand for grid resilience amid increasing wildfire risks.

Segment Insights:

- The AAAC segment is projected to account for a 38.9% share in the U.S. Overhead Conductor Market during 2026–2035, propelled by its superior conductivity-to-weight ratio and corrosion resistance.

- The aluminum segment is estimated to capture a 60.0% market share by 2037, driven by its lightweight and high conductivity advantages over copper.

Key Growth Trends:

- Renewable energy integration

- Grid modernization efforts

Major Challenges:

- Regulatory and permitting delays

- Supply chain and material constraints

Key Players: Southwire Company, LLC, CTC Global Corporation, Encore Wire Corporation, General Cable (acquired by Prysmian), Coleman Cable, Inc., American Wire Group, Erickson Electrical Equipment Co., Luvata Waterbury, Inc., MacCabe Electric Conductors, Inc., Gavitt Wire and Cable Co., Inc., Erie Industrial Products.

Global U.S. Overhead Conductor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 121.5 million

- 2026 Market Size: USD 127.5 million

- Projected Market Size: USD 393.4 million by 2037

- Growth Forecasts: 9.8% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: California (Leading Share by 2037)

- Fastest Growing Region: California

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 October, 2025

U.S. Overhead Conductor Market - Growth Drivers and Challenges

Growth Drivers

- Renewable energy integration: Renewable energy penetration into the U.S. grid is a significant impetus for the U.S. overhead conductor market because solar and wind farms often need long-distance transmission to points of consumption. With ambitious state and national targets for carbon zero, utilities are being compelled to connect distant renewable projects to urban grids affordably. High-capacity, low-loss conductors are becoming more necessary to handle the variability of renewable power and minimize curtailment. Federal measures and incentives towards the development of more clean energy infrastructure facilitate such a shift. In August 2023, Pattern Energy debuted its 550-mile SunZia HVDC transmission line from New Mexico to Arizona, leveraging high-capacity HTLS and composite conductors to deliver 3,000 MW of wind power. This is a demonstration of the growing need for high-tech conductors in renewable-dominated grids.

- Grid modernization efforts: Grid modernization is a key growth driver, as the U.S. seeks to make the grid more reliable and resilient in the face of rising electricity demand and climate stresses. Aging infrastructure combined with the demand to charge electric vehicle loads and data centers is driving utilities to replace transmission lines with newer materials and technologies. Significant funding is provided by federal programs to drive these efforts forward, targeting smart grid integration and efficiency enhancement. The trend toward digital technology to monitor and optimize power flow is also redesigning conductor specifications. In June 2024, the U.S. Department of Energy began awarding contracts under its USD 10.5 billion Grid Resilience Initiative, funding next-generation conductors for renewable-dominant grids and hardening efforts. The initiative is establishing a robust pipeline of opportunities for conductor manufacturers.

Challenges

- Regulatory and permitting delays: Regulatory and permitting delays are a significant obstacle to the U.S. overhead conductor market, slowing down critical grid upgrade projects. Challenges in fractured federal and state permitting procedures, combined with environmental and public opposition, have a tendency to delay projects by years. These delays impede the timely installation of required advanced conductors to address capacity requirements and allow for renewable integration. The challenge of navigating multiple regulatory institutions creates uncertainty for utilities and developers who seek to construct a transmission buildout. In February 2023, the U.S. Government Accountability Office (GAO) issued an analysis identifying delays in HTLS adoption due to regulatory lag and varying utility standards as requiring DOE-led standards to unify procurement. This issue continues to be a factor in infrastructure modernization rates.

- Supply chain and material constraints: Supply chain limitations and material scarcity are pressing matters to deal with for the U.S. overhead conductor market, affecting raw material access like aluminum and advanced composites. Global trade tensions and supply chain bottlenecks have driven shortages and price movements, decelerating manufacturing and project execution. Relying on imported materials for high-performance conductors poses a further threat to supply stability. In February 2024, some Midwestern utilities issued joint procurement notices for HTLS-compatible conductor systems, citing supply chain limitations as a barrier to making upgrades in a timely manner, echoing the broader challenge of meeting demand with limited means. Beating these challenges requires strategic investments in domestic production and diversified sourcing.

U.S. Overhead Conductor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

Base Year |

|

Forecast Year |

2025-2037 |

|

CAGR |

9.8% |

|

Base Year Market Size (2024) |

USD 121.5 million |

|

Forecast Year Market Size (2037) |

USD 393.4 million |

U.S. Overhead Conductor Market Segmentation:

Type Segment Analysis

The AAAC segment is expected to hold a 38.9% market share in the U.S. overhead conductor market during the forecast period, owing to its superior conductivity-to-weight ratio and corrosion resistance. AAAC conductors are gaining popularity with medium and long-distance transmission lines, especially in coastal and wet climatic regions where environmental durability is an additional factor. Their lightweight reduces installation costs and structural loading on towers and is thus an economic solution for reconductoring and grid expansion projects.

The segment expansion is further fueled by rising demand for efficient power distribution in industrial and urban areas with mounting electricity consumption. National Strand expanded its portfolio in November 2023 with new Aluminum Conductor Steel Reinforced (ACSR) products and also marketed AAAC versions to Midwest and coastal markets with corrosion problems, thereby fulfilling unique regional needs. This adaptability ensures AAAC's strong market position.

Material Segment Analysis

The aluminum segment is estimated to maintain a 60.0% share in the U.S. overhead conductor market by the year 2037 due to its lightweight, extremely conductive, and economic advantages over copper. Aluminum conductors are the backbone of most transmission and distribution networks, particularly in long-distance transmissions where cost savings and weight reduction are primary concerns. Increased growth in the segment is driven by universal grid modernization efforts and the need to convert to greater loads of electricity due to urbanization and industry.

The recyclability and natural corrosion resistance of aluminum align with sustainability goals and are a material of preference in the presence of environmental controls and regulations. In January 2024, Ameren started replacing over 300 miles of transmission lines using aluminum alloy conductors in Missouri for the purpose of facilitating renewable integration from new wind power facilities. The project highlights aluminum's critical role in novel grid applications.

Voltage Segment Analysis

The 221-345kV segment is poised to capture 50.7% of the U.S. overhead conductor market by 2037, due to its critical role in medium- to long-distance power transmission. This voltage class is best suited for connecting regional grids and transmitting electricity from power plants to substations, balancing efficiency and the cost of infrastructure. The growth of the segment is driven by increasing electricity demand from industrial facilities, city centers, and the integration of renewable energy sources that need stable transmission networks.

As grid modernization is gaining momentum, utilities are replacing lines in this voltage class to accommodate higher loads and alleviate congestion. For instance, in March 2024, the U.S. Department of Energy updated its Grid Modernization Plan with an emphasis on reconductoring in the 221-345kV range with innovative HTLS and AECC conductors to resolve congestion and support reliability. The policy priority here serves to underscore the segment's importance.

Our in-depth analysis of the U.S. overhead conductor market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Material |

|

|

Voltage |

|

|

Current Type |

|

|

Rated Strength |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

U.S. Overhead Conductor Market - Regional Analysis

California is one of the leading states in the U.S. overhead conductor market, driven by its ambitious clean energy goals and urgent need for grid resilience in the presence of recurring wildfires and extreme weather. The state's dense electricity load, backed by tech corridors and growing EV infrastructure, requires high-performance conductors to allow capacity expansion and renewables integration. California's policy framework stresses green transmission alternatives, and utilities have an incentive to deploy high-performing materials. In April 2024, PG&E reported a 40% rise in grid power requests due to EV load growth and AI-powered data centers, prompting the imperative reviews for overhead conductor upgrades to meet the transmission constraints. The state is also a testing ground for dynamic line rating systems and smart grid technology. The focus on carbon emissions reduction ensures ongoing demand for new conductor solutions.

Texas is another significant U.S. overhead conductor market state, driven by its substantial energy production, robust industrial economy, and rapidly growing population, which fuels electricity demand. The state's extensive wind resources, particularly in West Texas, require robust transmission lines to connect isolated generation with city load centers. Texas's isolated grid, managed by ERCOT, has specific supply and demand balancing issues that stimulate investments in conductor upgrades. In October 2023, the Western Area Power Administration (WAPA) announced plans to replace 1,100 miles of overhead lines across several states, including Texas, with a focus on HTLS and ACCC conductors for heat endurance and load growth. The state's vulnerability to harsh weather, including hurricanes and heat waves, drives the need for high-capacity, high-strength conductors. Texas is further supported by a business-friendly environment that promotes private investment in grid projects. These conditions render Texas a critical hub of conductor market expansion.

Key U.S. Overhead Conductor Market Players:

- Southwire Company, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CTC Global Corporation

- Encore Wire Corporation

- General Cable (acquired by Prysmian)

- Coleman Cable, Inc.

- American Wire Group

- Erickson Electrical Equipment Co.

- Luvata Waterbury, Inc.

- MacCabe Electric Conductors, Inc.

- Gavitt Wire and Cable Co., Inc.

- Erie Industrial Products

The U.S. overhead conductor market is highly competitive, with leading companies focusing on innovation, environmentally friendly solutions, and strategic alliances to capture market share. One key event that shaped the competitive landscape occurred in February 2024, when TS Conductor announced a new U.S. manufacturing plant dedicated to AECC conductor production with a carbon composite-aluminum construction that offers 50% reduced losses and 3x capacity of conventional ACSR. The move enhances the in-country supply of high-performance conductors and simplifies adoption for utility companies through the deployment of standard installation methods. Companies are also making partnerships with utilities to test pilot smart conductor technologies and secure contracts under federal funding programs. This dynamic setting is a reminder of the necessity for flexibility and creativity for remaining competitive in the U.S. market.

Here are some leading companies in the U.S. overhead conductor market:

Recent Developments

- In July 2024, TS Conductor secured USD 60 million in funding to open a second U.S. manufacturing facility. The investment aims to scale AECC conductor production, enhance grid reliability, and support renewable integration. The plant expansion boosts TS Conductor's output twentyfold and adds over 450 jobs in South Carolina.

- In May 2024, Southwire began phasing in low-carbon aluminum sources across its U.S. conductor operations. The move supports utilities seeking sustainable transmission infrastructure under ESG mandates. This material transition also enables compliance with California and New York state procurement rules.

- In May 2024, PLP introduced Aeolus, a real-time conductor motion monitoring system. Aeolus uses sensors to track vibration, sag, and wind-induced stress across transmission corridors. It allows utilities to detect thermal overloads and pre-empt failure risks using live data.

- In March 2024, Kinectrics inaugurated its Kentucky-based advanced testing center for grid materials. The facility supports qualification, reliability testing, and certification of overhead conductor technologies. It plays a key role in verifying HTLS and composite-core solutions under North America grid standards.

- Report ID: 7915

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

U.S. Overhead Conductor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.