U.S. Crowd Management and Event Security Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- U.S. Industry Overview

- Regional Synopsis

- DROT

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Allied Universal

- Andy Frain Services

- Constellis

- Contemporary Services Corporation (CSC)

- GardaWorld

- International Protective Service, Inc. (IPS)

- Per Mar Security Services

- Prosegur

- Securitas AB

- Ongoing Technological Advancements

- Recent News/Developments

- Strategic Initiatives

- SWOT Analysis

- End-Use Industry Analysis

- Trump Government Tariff Impact

- Case Study of Security Failures and Regulatory Outcomes

- Comparison of In-House and Outsourced Event Security Models

- Event Security Staffing vs. Tech-based Security Solutions

- Global Market Synopsis

- Root Cause Analysis

- PESTLE Analysis

- PORTER Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- U.S. Segmentation (USD Million), 2019-2037, By

- Component, Value (USD Million)

- Event Security Staffing

- Video Surveillance Solutions

- Event Global Security Operations Center (GSOC)

- Access Control Systems

- Alarm & Notification Systems

- Crowd Monitoring & Analytics Software

- Emergency Response & Communication Tools

- Other Security Services

- Deployment Mode, Value (USD Million)

- On-Premise

- Cloud based

- Security Management Model, Value (USD Million)

- In-house

- Outsourced

- End user, Value (USD Million)

- Venue Security Operators

- Venue Patrons (Public Attendees / Guests)

- Transportation Hubs (Airports, Stations)

- Retail Establishments & Shopping Malls

- Hospitality and Tourism Venues (Hotels, Convention Centers, Theme Parks)

- Others

- Component, Value (USD Million)

- Global Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

U.S. Crowd Management and Event Security Market Outlook:

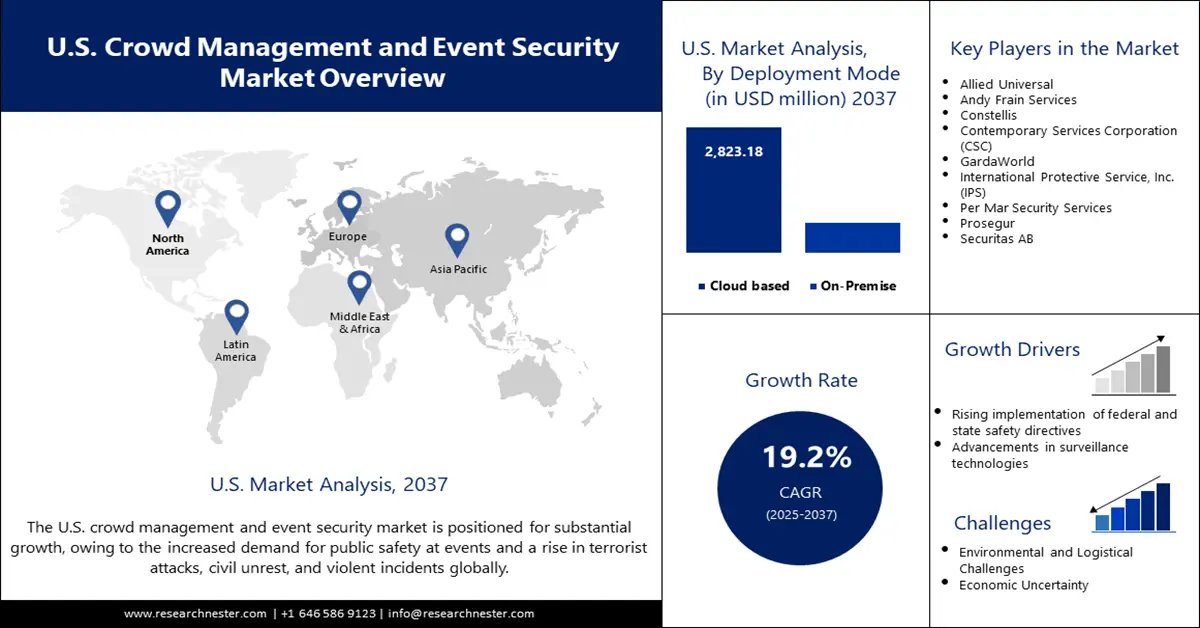

U.S. Crowd Management and Event Security Market size was valued at USD 368.5 million in 2024 and is projected to reach a valuation of USD 3,529.4 million by the end of 2037, rising at a CAGR of 19.2% during the forecast period, i.e., 2025-2037. In 2025, the industry size of U.S. crowd management and event security is estimated at USD 427.1 million.

The U.S. crowd management and event security market is undergoing a major transformation, characterized by the adoption of innovative technologies and strategic acquisitions. In April 2025, Allied Universal’s acquisition of Pinnacle Security increased its footprint in the southeastern U.S and improved its portfolio of event security in Atlanta and New Orleans. This expansion is consistent with the firm’s nationwide growth strategy, which is indicative of the industry’s trend towards comprehensive security solutions. The use of AI-powered surveillance and biometric access controls is on the rise, with the use of facial recognition systems at large events being an example. These developments are aimed at enhancing threat detection and smoothing entry processes to meet the changing needs of large venues and assemblies.

Regulatory developments and the rising demand for specialized security services have also contributed to the U.S. crowd management and event security market’s growth. Several event security firms are offering advanced surveillance and SOC capabilities, in line with the company’s move towards smart security solutions. This trend is further supported by the U.S Department of Commerce’s announcement in June 2024 on new insurance guidelines for large-scale events, which stipulate crowd AI, certified staff, and metal detection for underwriting eligibility. Such policies encourage the use of tech-integrated security packages to ensure compliance and optimize general safety measures.

Key U.S. Crowd Management and Event Security Market Insights Summary:

Regional Insights:

- The New York market is projected to secure around 26.4% share of the u.s. crowd management and event security market by 2035, spurred by the rising need for robust security and crowd control for high-frequency events.

- The Los Angeles market is anticipated to grow at a CAGR of 15.3% through 2035, supported by the increasing number of large-scale events that demand advanced crowd management solutions.

Segment Insights:

- The cloud-based segment is expected to hold about 80.0% share by 2035 in the u.s. crowd management and event security market, propelled by the scalability and flexibility of cloud-enabled security operations.

- The outsourced segment is estimated to capture nearly 54.0% share by 2037, bolstered by the shift toward leveraging specialized security firms for comprehensive event safety management.

Key Growth Trends:

- AI and biometric integration

- Stringent safety laws

Major Challenges:

- Digital security risks

- Rising implementation expenses

Key Players: NEC Corporation, Nokia Corporation, BriefCam Ltd., Axis Communications AB, Hikvision Digital Technology, Crowd Dynamics, AGT International GmbH, Samsung Electronics Co., Ltd., Spigit, Inc., Crowd Vision Limited, Hanwha Techwin, Qognify, Ipsotek Ltd., VADS Berhad.

Global U.S. Crowd Management and Event Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 368.5 million

- 2025 Market Size: USD 427.1 million

- Projected Market Size: USD 3,529.4 million by 2037

- Growth Forecasts: 19.2% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: New York (26.4% Share by 2035)

- Fastest Growing Region: Los Angeles

- Dominating Countries: United States, Canada, United Kingdom, Germany, Australia

- Emerging Countries: India, Brazil, Mexico, United Arab Emirates, Singapore

Last updated on : 29 September, 2025

U.S. Crowd Management and Event Security Market - Growth Drivers and Challenges

Growth Drivers

- AI and biometric integration: The combination of AI and biometric technologies is transforming the event security process. Also, progressive laws are encouraging new technologies to aid in protecting the public. Large venues and events have a growing desire for smarter, faster, and more reliable security methods that are pushing the market forward, with some new technologies including AI-enabled threat analytics, multimodal biometric sensors, etc. AI and biometric technologies are changing safety and compliance, and fostering the development of the U.S. crowd management and event security market.

- Stringent safety laws: The market is propelled by several government regulations. This legislation establishes a national precedent that forces event organizers to comply with strict safety requirements. In addition, such regulations emphasize the significance of compliance for winning contracts and ensuring public safety. With the strengthening of regulatory frameworks, they are expected to facilitate the implementation of advanced security across the industry. As large crowd events (i.e., concerts, sporting events, political rallies) are able to attract significant numbers of attendees, a corresponding demand will exist for security professionals and surveillance technologies that meet these requirements.

- Growth of large-scale events and urban gatherings: There is an increasing incidence of large-scale public events in the U.S. Concerts, sports, festivals, and political protests represent events that draw attendance in the thousands to millions of people. All this raises the stakes around effective crowd management and threat detection. Planners and event organizers are investing substantial resources into measures that can mitigate or prevent crowd trampling, uninvited or unauthorized crowd entry, and violence. US cities are trending increasingly larger, the national event culture appears to have rebounded (or thrived) since the pandemic, and event size and frequency are growing.

Americans’ Views on the Importance of Privacy in Everyday Life

|

Privacy Concern |

Very Important |

Somewhat Important |

Not Very Important |

Not at All Important |

Don’t Know |

|

Being in control of who can get info about you |

74% |

19% |

3% |

1% |

3% |

|

Being able to share confidential matters with someone you trust |

72% |

21% |

2% |

1% |

2% |

|

Not having someone watch/listen to you without permission |

67% |

20% |

8% |

1% |

2% |

|

Controlling what information is collected about you |

65% |

25% |

5% |

1% |

5% |

|

Not being disturbed at home |

56% |

29% |

9% |

2% |

5% |

|

Being able to have times when you are completely alone |

55% |

30% |

9% |

2% |

5% |

|

Not being asked highly personal questions in social/work settings |

44% |

36% |

13% |

2% |

4% |

|

Being able to go around in public without always being identified |

34% |

29% |

25% |

6% |

4% |

|

Not being monitored at work |

28% |

28% |

22% |

6% |

15% |

Source: Pew Research Center

Challenges

- Digital security risks: The growing use of digital systems in event security increases data protection concerns. This requirement is intended to protect sensitive information as well as protect the organization from cyberattacks. Smaller firms, however, might experience difficulties in achieving these standards owing to the scarcity of resources. It is important to ensure robust cybersecurity measures to safeguard both organizational data and public safety.

- Rising implementation expenses: The adoption of sophisticated security technologies and compliance with rigid regulations can cause enhanced operating costs. The balancing act between increased security and budgetary issues is still a critical challenge. Organizations need to strategize to maximize resources, but at high safety levels.

U.S. Crowd Management and Event Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

19.2% |

|

Base Year Market Size (2024) |

USD 368.5 million |

|

Forecast Year Market Size (2037) |

USD 3,529.4 million |

|

Regional Scope |

|

U.S. Crowd Management and Event Security - Market Segmentation

Deployment Mode Segment Analysis

The cloud-based segment in the U.S. crowd management and event security market is projected to hold a share of 80.0% during the forecast period. This dominance is achieved due to the scalability and flexibility provided by cloud solutions, allowing instant access to data and efficient operations. The deployment of cloud-based surveillance in large-scale events such as the Super Bowl in Las Vegas in June 2024 highlights the segment’s growth. Such systems make it easy to manage crowds and respond quickly to incidents. With events becoming increasingly complicated, the demand for cloud-based security solutions is likely to increase.

Security Management Model Segment Analysis

The outsourced segment in the U.S. crowd management and event security market is expected to account for a share of 54.0% by 2037. Companies are increasingly outsourcing the management of event safety to specialized security firms that use their knowledge and resources. The acquisition of Unified Command by Allied Universal in December 2024 is an example of this trend that has improved its capabilities in tech-enabled event security. Outsourcing enables event organizers to concentrate on core activities while at the same time providing complete security coverage. This model provides flexibility and access to modern technologies, which contributes to its popularity in the market.

End user Segment Analysis

The transportation hubs segment in the U.S. crowd management and event security market is anticipated to account for a share of 40.0% during the forecast period. Due to the high footfall and strategic value of these places, strong security measures are required. These systems make use of drone surveillance and predictive analytics for effective management of crowding. With the further development of the transportation infrastructure, the demand for state-of-the-art security solutions in this segment is likely to increase.

Our in-depth analysis of the U.S. crowd management and event security market includes the following segments:

|

Segment |

Sub-Segments |

|

Component |

|

|

Deployment Mode |

|

|

Security Management Model |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

U.S. Crowd Management and Event Security Market - Regional Analysis

New York Market Insights

The New York Market is expected to account for the largest revenue share of around 26.4% of the U.S. crowd management and event security market, owing to the rising need for robust security and crowd control for city’s high frequency events such as New Year’s Eve in Times Square, the NYC Marathon, the UN General Assembly, and the Macy’s Thanksgiving Parade. The adoption of smart city technologies supported by the NYC Department of Information Technology to enhance real-time crowd analytics is also expected to boost market growth. In addition, the presence of a dense urban environment and high risks of terror attacks and security threats is encouraging key players to develop and launch novel and advanced products.

Los Angeles Market Insights

The Los Angeles U.S. crowd management and event security market is likely to expand at a CAGR of 15.3% during the forecast period, owing to the rising number of events such as the Oscars, the Lakers, and the LA Marathon that require advanced crowd management solutions. Growing smart city and public safety initiatives and rising adoption of advanced surveillance systems for better crowd management during events are expected to fuel market growth going ahead. In addition, partnerships between local municipalities, private security companies, and technology vendors are driving innovation in artificial-intelligence-powered surveillance, real-time crowd analysis, and emergency response protocols. These advancements improve efficiencies in crowd control and reinforce the city’s broader smart city vision, creating a market in Los Angeles that is among the fastest-growing U.S. crowd management and event security market.

Key U.S. Crowd Management and Event Security Market Players:

- CrowdStrike, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NEC Corporation

- Nokia Corporation

- BriefCam Ltd.

- Axis Communications AB

- Hikvision Digital Technology

- Crowd Dynamics

- AGT International GmbH

- Samsung Electronics Co., Ltd.

- Spigit, Inc.

- Crowd Vision Limited

- Hanwha Techwin

- Qognify

- Ipsotek Ltd.

- VADS Berhad

The U.S. crowd management and event security market is dominated by the presence of several key players such as Allied Universal, Andy Frain Services, Constellis, Contemporary Services Corporation (CSC), GardaWorld, International Protective Service, Inc. (IPS), Per Mar Security Services, Prosegur, and Securitas AB. These companies are aggressively involved in strategic acquisitions, technological innovations, and service expansions to enhance their market positions. Their emphasis on the adoption of advanced technologies and adherence to regulatory standards highlights the competitive nature of the industry.

The introduction of Yellow, an AI-driven robotic canine for event security by Prosegur in February 2025, demonstrates the focus on technological innovation. Such developments point to a dynamic market environment with companies utilizing acquisitions and cutting-edge technologies to address changing security needs. This showcases the ongoing drive within the industry to integrate sophisticated AI solutions for enhanced safety and operational efficiency. The market is clearly evolving rapidly, with a strong emphasis on leveraging advanced technology to meet the increasingly complex demands of crowd management and event security.

The following is the list of the key players dominating the U.S. crowd management and event security market:

Recent Developments

- In January 2023, GardaWorld subsidiary Crisis24 acquired Topo.ai, adding TopoONE’s real-time CEM platform to its portfolio. The integration improves operational resilience for large-scale events. It supports rapid decision-making and digital threat mapping. This acquisition reinforces tech-enabled event risk management.

- In April 2025, Constellis received a USD 95 million federal contract to protect the FDA headquarters. The task order covers armed guards, supervisors, and command operations. It confirms Constellis' leading role in safeguarding federal infrastructure. The award reflects trust in its operational leadership.

- In February 2025, Prosegur partnered with Kinetic Global to enhance its virtual SOC with AI-based critical event management. The alliance boosts real-time risk intelligence and operational resilience. It brings AI-powered modules into event monitoring. This expands Prosegur’s global security tech reach.

- Report ID: 7691

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

U.S. Crowd Management and Event Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.