Urology Supplements Market Outlook:

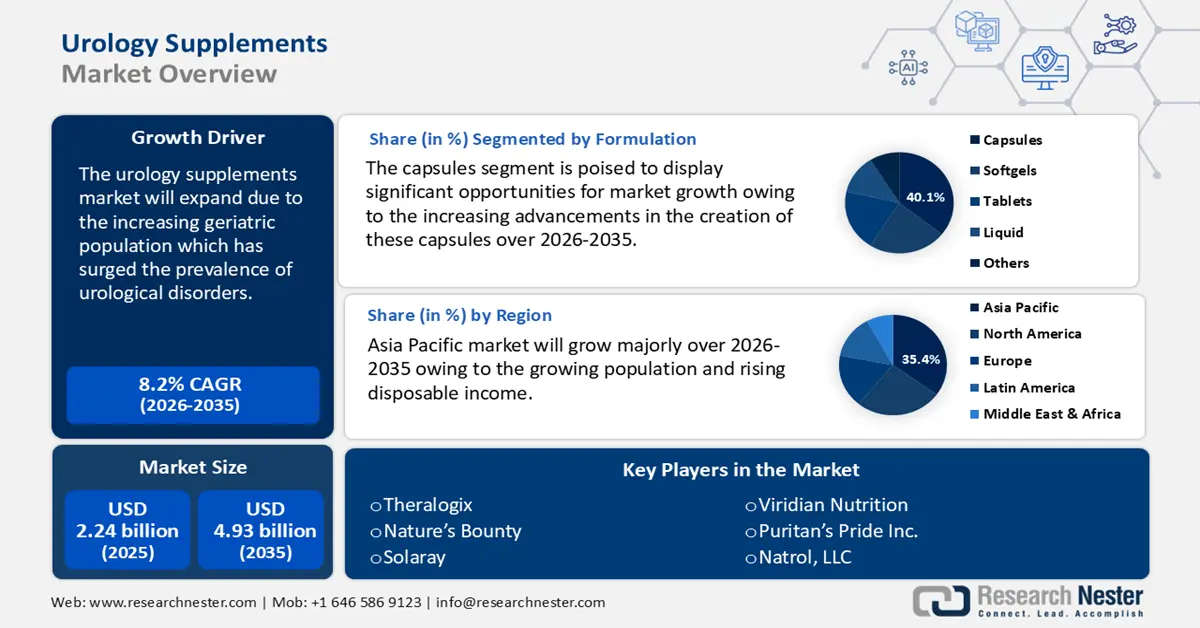

Urology Supplements Market size was over USD 2.24 billion in 2025 and is projected to reach USD 4.93 billion by 2035, growing at around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of urology supplements is evaluated at USD 2.41 billion.

The urology supplements market is expanding due to the increasing geriatric population which has surged the prevalence of urological disorders such as urinary incontinence and kidney stone conditions. The National Institutes of Health (NIH) reported that over 800 million people, or more than 10% of the global population, suffer from chronic kidney disease, a degenerative illness. Adults with diabetes mellitus, hypertension, women, older adults, and members of racial minorities are more likely to have chronic kidney disease.

Urology supplements are dietary formulations designed to enhance the health of the urogenital apparatus and aid in the treatment of various urinary tract problems. Pumpkin seed extract, saw palmetto, beta-sitosterol, and cranberry extract are among the active components. These dietary supplements are not used as medications to treat pathological or medical diseases but as supportive management regimens for the urinary system's health.

Key Urology Supplements Market Insights Summary:

Regional Highlights:

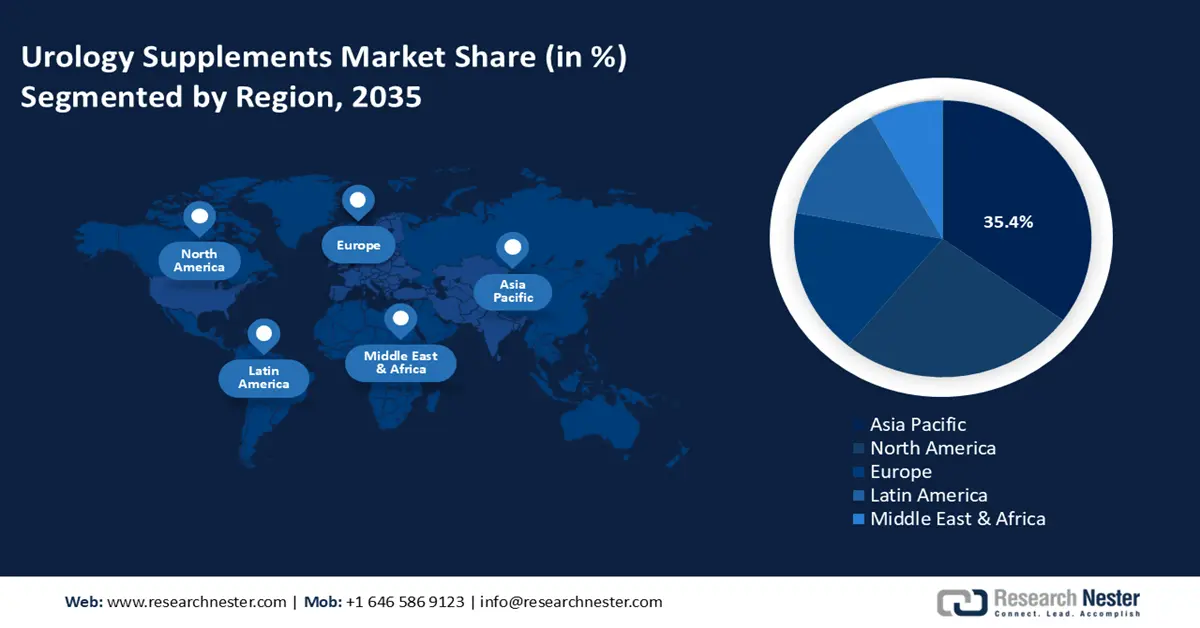

- Asia Pacific dominates the Urology Supplements Market with a 35.4% share, propelled by rising health consciousness, increasing disposable income, and government support for natural supplements, fostering strong growth through 2035.

- North America's Urology Supplements Market is projected to see substantial growth by 2035, attributed to the increasing prevalence of lifestyle-related urological diseases and growing awareness of urological health.

Segment Insights:

- The UTI Segment is expected to capture a notable share by 2035, driven by increasing awareness and preventive supplementation for urinary tract infections.

- The Capsule Segment is expected to capture a 40.10% share by 2035, driven by ease of consumption and improved nutrient absorption.

Key Growth Trends:

- Shift towards herbal and natural supplements

- Growing focus on preventive healthcare

Major Challenges:

- Stringent regulatory laws and safety concerns

- Intense competition with pharmaceutical treatments

- Key Players: Theralogix, Nature’s Bounty, Solaray, Viridian Nutrition, Puritan’s Pride Inc., Schiff Nutrition International, Natrol, LLC, Biotex Life, Himalaya Wellness, Strava Healthcare Pvt. Ltd..

Global Urology Supplements Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.24 billion

- 2026 Market Size: USD 2.41 billion

- Projected Market Size: USD 4.93 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Urology Supplements Market Growth Drivers and Challenges:

Growth Drivers

- Shift towards herbal and natural supplements: Customers are seeking natural products and medications for their physical health as they become more aware of the advantages of preventive healthcare. According to the NIH, over the past three decades, herbal supplements and medicinal items have grown significantly, and at least 80% of people worldwide now rely on them for some aspect of their basic healthcare. For instance, due to the current pandemic, echinacea, a natural substance, has become very popular due to its immune-boosting qualities. Herbal supplements are widely used for their therapeutic qualities and efficient synthetic substitutes and therapies for various ailments.

These natural supplement ingredients improve mental and physical wellness. They have minimal adverse effects and are made from plant materials.

To maximize demand from health-conscious consumers seeking natural cures for their well-being, manufacturers have heavily capitalized on the natural labeling of herbal supplements. Additionally, the industry has grown due to the popularity of adaptogenic herbs such as ashwagandha and Rhodiola rosea. These herbs are in high demand in today's hectic environment due to their well-known capacity to lessen anxiety and assist the body in adjusting to stress. - Growing focus on preventive healthcare: Globally, there is an increasing emphasis on preventive healthcare as more individuals seek methods to stay healthy and avoid diseases. Urology supplements will capitalize on this trend by positioning themselves as a proactive means of promoting urological health and averting ailments like kidney stones and urinary tract infections. To reduce the risk of disease and enhance general well-being, more people are incorporating vitamins, minerals, probiotics, and other nutrients into their daily routines as they become more conscious of the significance of maintaining appropriate nutrient levels. These supplements are a desirable choice for people interested in long-term preventative health techniques since they offer specialized methods for addressing particular deficits and promoting specific health goals. prevent

- Advanced product launches: New product formulations enable the creation of urological supplements with enhanced bioavailability and effectiveness. Particularly, sustained-release formulations allow for the gradual release of active substances, maintaining steady nutritional levels in the body and maximizing absorption. Encapsulation techniques, stabilizers, and protective coatings help maintain the integrity of sensitive ingredients, ensuring product efficacy and customer satisfaction. Additionally, advancements in formulation technologies contribute to the improved stability and shelf-life of urology supplements, lowering the risk of degradation and loss of potency over time.

Challenges

- Stringent regulatory laws and safety concerns: Dietary supplement regulations can be complicated and differ from one nation to another. For manufacturers, maintaining regulatory compliance and resolving safety issues can be difficult. Concerns over the safety and effectiveness of urological supplements have also been raised by reports of them carrying dangerous ingredients or failing to fulfill quality requirements. Due to their impact on customer confidence and regulatory clearance procedures, these issues may impede the expansion for urology supplements market.

- Intense competition with pharmaceutical treatments: Pharmaceutical drugs, easily accessible and prescribed by medical professionals, are frequently used to treat urological problems like BPH and urinary tract infections. It might be difficult to persuade patients and medical professionals of the advantages and effectiveness of urological supplements over prescription medications. It is difficult for urology supplements to get market share and recognition as a practical therapy choice because pharmaceutical treatments are frequently thought to be more effective and dependable.

Urology Supplements Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 2.24 billion |

|

Forecast Year Market Size (2035) |

USD 4.93 billion |

|

Regional Scope |

|

Urology Supplements Market Segmentation:

Formulation (Capsules, Softgels, Tablets, Liquid)

In urology supplements market, capsule segment is poised to capture revenue share of over 40.1% by 2035. One of the easiest ways to take supplements is in capsule form. Compared to other forms like pills or powders, they are more pleasant to customers because they are simple to take and don't have a strong flavor or odor. Due to their simplicity of use, capsules are quite popular with customers, which helps them dominate the urology supplements market. Compared to other forms, capsules frequently offer more nutritional absorption, improving the effectiveness of the product.

The rapid breakdown of capsules in the digestive tract facilitates the more effective release and absorption of the vitamins and minerals they contain. Due to this improved absorption, the body can utilize the nutrients from the supplement more effectively, producing more pronounced and beneficial effects. Moreover, the creation of vegetarian and vegan capsules using HPMC or Pullulan, for instance, appeals to a wider market and reflects the ideals of the increasing number of health-conscious customers.

Application (Urinary Tract Infections, Kidney Health, Prostate Health, Bladder Health)

The urinary tract infections (UTI) segment in urology supplements market will garner a notable share in the forecast period. The segment growth can be attribute to the increased awareness about UTIs and their risk factors have led to greater consumer interest in preventive measures, including supplements. Since UTIs are so common, a sizable market for supplements designed to manage and prevent these infections. For instance, in 2019, there were 404.61 million UTI cases, 236,790 deaths, and 520,200 DALYs worldwide. Numerous businesses offer urology supplements to treat urinary tract infections such as the Cranberry Caps and Urinary Tract Essentials capsules from Azo, Now Foods, and Swanson.

Our in-depth analysis of the global urology supplements market includes the following segments:

|

Type |

|

|

Application |

|

|

Formulation |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urology Supplements Market Regional Analysis:

APAC Market Statistics

Asia Pacific in urology supplements market is poised to capture over 35.4% revenue share by 2035. Consumers around the APAC area are becoming more conscious of and interested in health and wellness. People are looking for urological items that support general well-being as they become more aware of their lifestyle choices. Customers in countries are willing to spend more on health-improving goods as their disposable income increases, escalating the urology supplements market growth. For instance, 95% of the increase in the global urban population over the next ten years will come from cities in emerging and developing markets. By 2033, it is anticipated that 18 megacities in Asia Pacific will witness a rise in disposable income per capita of more than 50%.

The urology supplements market in China will experience an increase in demand for components that are derived sustainably. Customers in the country seek products that contain organic, non-GMO, and responsibly sourced ingredients as they become more conscious of the environmental impact of their purchases. To meet customer expectations and lessen their environmental impact, businesses are being compelled by this trend to implement more sustainable supply chains. Moreover, the urology supplements market is also benefiting from the increasing accessibility of urology supplements through e-commerce channels, making it easier for consumers to purchase these products online. According to the International Trade Administration, over 710 million Chinese consumers made purchases online in 2020, totaling USD 2.29 trillion in transactions.

In India, innovation in natural and plant-based products has been fueled by the government's backing of the AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) sector and the popularity of Ayurvedic and herbal-based supplements. Furthermore, urbanization and the quick growth of e-commerce platforms have made a variety of supplements more accessible, especially to millennials and health-conscious shoppers in metro and tier-2 cities.

North America Market Analysis

North America urology supplements market is expected to witness substantial growth in 2035. The increasing prevalence of lifestyle-related urological diseases, increased knowledge of urological health, and easy access to supplement-based remedies are some of the reasons propelling the urology supplements market's expansion. Additionally, the region's demand for urology supplements is strong due to the growing awareness of urological health and changes in lifestyle habits, which have led to a surge in consumers looking for long-lasting, noninvasive ways to improve their overall urological well-being.

In the U.S., people are turning to supplements to strengthen their immune systems and fend against diseases due to concerns about immunity and general health. As a result, the urology supplements market is growing faster due to the increased demand for immune-supporting supplements including zinc, vitamin C, and vitamin D. With 74% of U.S. adults taking dietary supplements and 55% identifying as regular users, the 2023 CRN Consumer Survey on Dietary Supplements demonstrates the widespread use of supplements and their significance in the life of the majority of Americans.

Urological disorders such as kidney stones, benign prostatic hyperplasia (BPH), erectile dysfunction, and urinary tract infections (UTIs) are more common in Canada as the population ages. For instance, in the 2021 Census, there were more than 861,000 persons 85 and older, more than twice as many as in the 2001 Census. With a 12% growth over 2016, the population 85 and older is one of the fastest-growing age groups. At the moment, 2.3% of people are 85 years of age or older. The number of people 85 and older might increase to about 2.5 million by 2046.

Key Urology Supplements Market Players:

- Theralogix

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nature’s Bounty

- Solaray

- Viridian Nutrition

- Puritan’s Pride Inc.

- Schiff Nutrition International

- Natrol, LLC

- Biotex Life

- Himalaya Wellness

- Strava Healthcare Pvt. Ltd.

Along with expansion as a tactic to boost production and research operations, product approvals are assisting market participants in expanding the urology supplements market reach and improving product availability in a variety of geographic areas. To improve their market position, several industry participants are also purchasing smaller competitors. Businesses can enhance their expertise, diversify their product offerings, and boost their capabilities with this approach.

Recent Developments

- In April 2024, Pivya (pivmecillinam) tablets was approved by the US Food and Drug Administration for the treatment of female adults with uncomplicated urinary tract infections (UTIs) caused by susceptible Escherichia coli, Proteus mirabilis, and Staphylococcus saprophyticus strains.

- In February 2021, Viridian announced the debut of a new Vitamin C food supplement line. The line includes seven vitamin C-rich formulations made from naturally sourced ingredients created by Viridian's experienced nutritionists.

- Report ID: 6947

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urology Supplements Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.