- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Accuryn Medical

- BECTON, DICKINSON AND COMPANY

- Beckman Coulter, Inc.

- Cardinal Health

- DiaSys Diagnostics India Pvt Ltd

- F. Hoffmann-La Roche Ltd

- FIZE Medical

- Hollister Incorporated

- Laborie

- Siemens Healthcare Private Limited

- Sysmex Corporation

- Teleflex Incorporated

- Sensica Overview & Market Insights

- Key Trends in Installation & Impact on The Urine Monitoring System Market

- Ongoing Technological Advancements

- Price Benchmarking

- SWOT Analysis

- Product Type Analysis

- Root Cause Analysis (RCA) for Urine Monitoring Systems Market

- Patent Analysis

- Key Development Analysis

- Industry Risk Assessment

- Gobal Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Regional Synopsis (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Product Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Product Type, Value (USD Million)

- U.S. Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Product Type, Value (USD Million)

- U.S. Industry Overview

- U.S. Urine Monitoring Systems Market Outlook

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Market Share in the U.S. – By Product Type

- Automatic Urine Output Monitoring Devices – By Medical Condition

- End user Analysis

- Overview

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Product Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Country Level Analysis, Value (USD Million)

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Malaysia

- Thailand

- Vietnam

- Rest of Asia Pacific

- Product Type, Value (USD Million)

- China Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Product Type, Value (USD Million)

- China Industry Overview

- China Urine Monitoring Systems Market Outlook

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Market Share in China – By Product Type

- Automatic Urine Output Monitoring Devices – By Medical Condition

- End user Analysis

- Overview

- Japan Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Product Type, Value (USD Million)

- Japan Industry Overview

- Japan Urine Monitoring Systems Market Outlook

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Market Share in Japan– By Product Type

- Automatic Urine Output Monitoring Devices – By Medical Condition

- End user Analysis

- Overview

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Country Level Analysis, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Product Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Product Type, Value (USD Million)

- Urine Output Monitoring Systems

- Automated Urine Output Monitors

- Manual Urine Output Monitors

- Smart Urine Output Monitoring Devices

- Urine Analysis Monitoring Systems

- Automated Urine Analyzer

- Semi-Automated Urine Analyzer

- Point-of-Care Urine Analyzer

- Non-Invasive Urine Monitoring System

- Urine Collection Devices

- Urine Collection Bags

- Urinary Catheter

- Others

- Urine Output Monitoring Systems

- Usage, Value (USD Million)

- Urine Collection Bags

- Disposable

- Reusable

- Urine Catheter

- Disposable

- Reusable

- Urine Collection Bags

- Medical Condition, Value (USD Million)

- Chronic Kidney Disease (CKD)

- Acute Kidney Injury

- Post-Surgical & Intensive Care

- Sepsis and Shock

- Others

- End user, Value (USD Million)

- Hospital & Clinics

- Diagnostic Laboratories

- Others

- Country Level Analysis, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Product Type, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

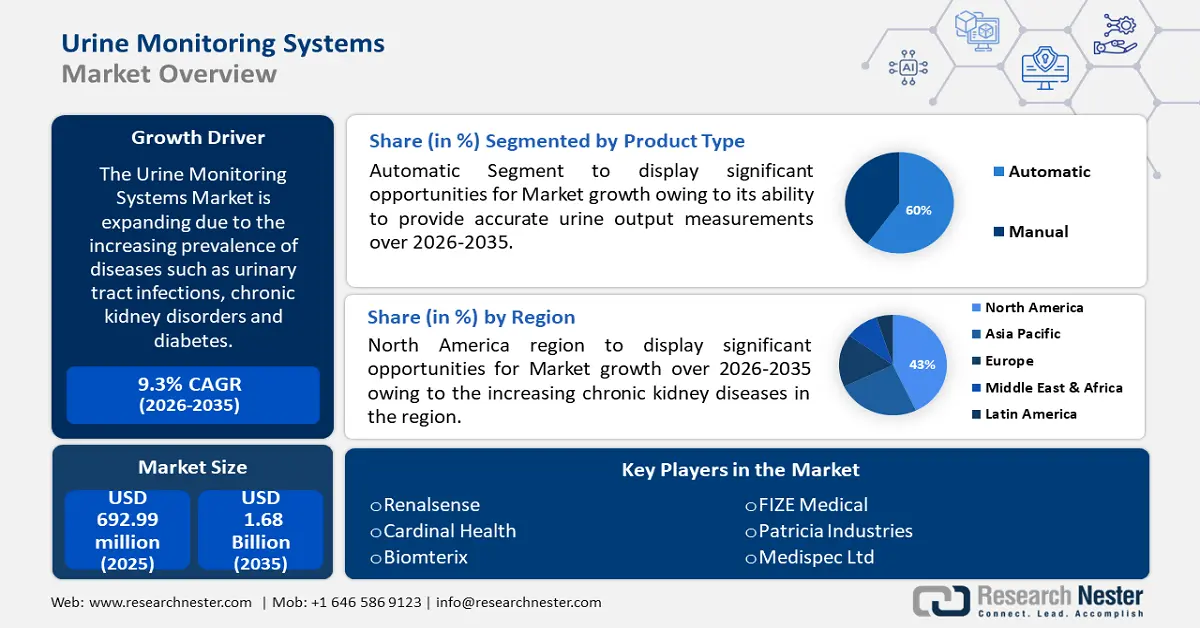

Urine Monitoring Systems Market Outlook:

Urine Monitoring Systems Market size was valued at USD 692.99 million in 2025 and is set to exceed USD 1.69 billion by 2035, expanding at over 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of urine monitoring systems is estimated at USD 750.99 million.

The urine monitoring systems market is expected to witness a rapid surge due to the rising demand for advanced diagnostic tools across healthcare settings. Innovations such as wireless and non-invasive solutions reshape the landscape and make diagnostics accurate and friendly for patients. For example, Bright Uro raised USD 23 million in Series A funding for developing a catheter-free urodynamics system in December 2023, a recent innovation that points to a shift in the direction of improvement not just of patient comfort but of diagnostic accuracy as well. Governments also emphasize the development of diagnostic solutions and encourage grants and policies to look forward to better prospects of using advanced technologies.

The demand for urine monitoring systems is underpinned by ongoing regulatory support and technological advances in widening the scope of critical care and chronic disease management applications. For example, in September 2024, PreAnalytiX GmbH came up with the PAXgene Urine Liquid Biopsy Set to enable the analytically reliable analysis of cfDNA from urine. This launch highlights the focus of companies on precision diagnostics and non-invasive technologies. Furthermore, governments are contributing by investing in healthcare infrastructure, with various grants that are being used to improve the diagnostic capabilities in various regions across the world, hence improving patient outcomes.

Key Urine Monitoring Systems Market Insights Summary:

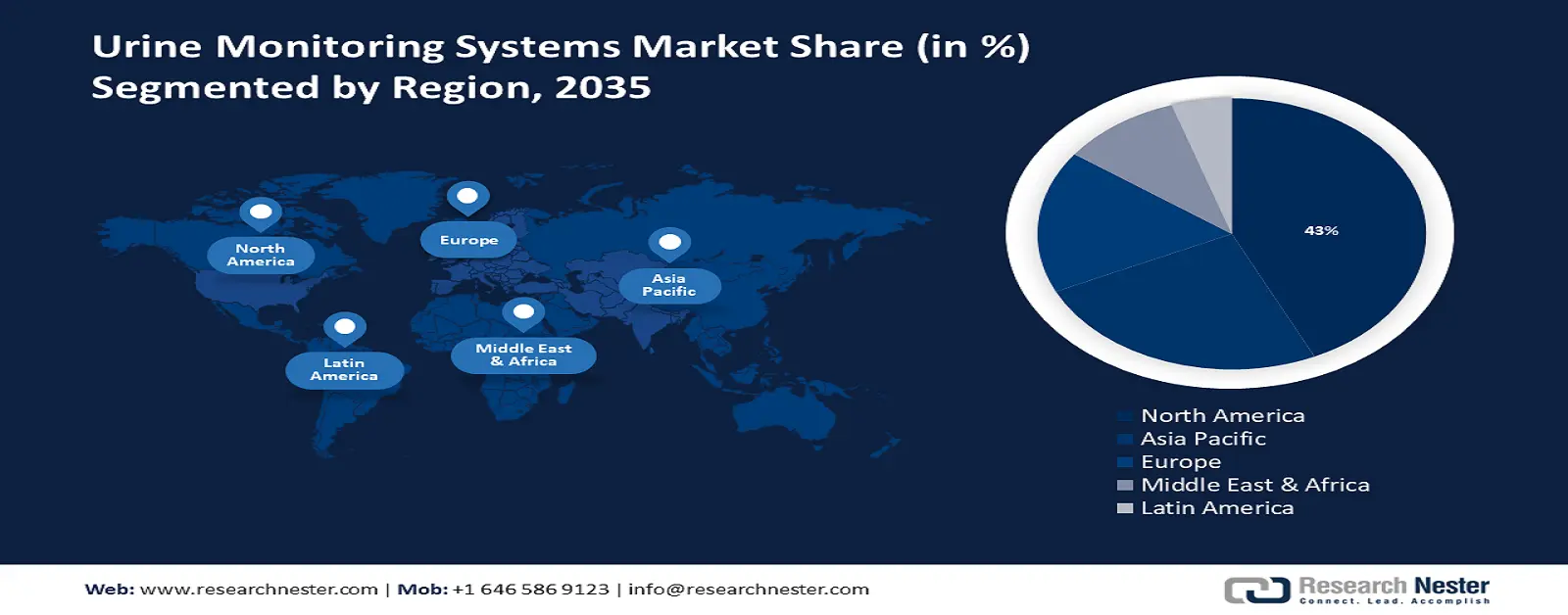

Regional Highlights:

- North America urine monitoring systems market will hold more than 38% share by 2035, driven by innovations in diagnostic technologies and government funding programs.

- Asia Pacific market will achieve substantial CAGR during 2026-2035, driven by increasing healthcare needs, urbanization, and healthcare infrastructure.

Segment Insights:

- The disposable urine collection bags segment in the urine monitoring systems market is projected to see substantial growth till 2035, fueled by their convenience and widespread medical utility.

- The urine analysis monitoring systems segment in the urine monitoring systems market is projected to hold a 46% share by 2035, driven by their critical role in diagnosing chronic diseases.

Key Growth Trends:

- Increasing prevalence of chronic kidney diseases

- Non-invasive diagnostic technologies

Major Challenges:

- Cost impediment to emerging markets

- Limited standardization across healthcare systems

Key Players: Accuryn Medical, BECTON, DICKINSON AND COMPANY, Beckman Coulter, Inc., Cardinal Health, DiaSys Diagnostics India Pvt Ltd, F. Hoffmann-La Roche Ltd, FIZE Medical, Hollister Incorporated, Laborie.

Global Urine Monitoring Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 692.99 million

- 2026 Market Size: USD 750.99 million

- Projected Market Size: USD 1.69 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Urine Monitoring Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing prevalence of chronic kidney diseases: The growth exhibited by various CKD and urinary disorders continues to create a surge in the urine monitoring systems market. For instance, in March 2022, the EMPA-KIDNEY trial demonstrated that Jardiance could slow down the progression of CKD in patients, further solidifying that diagnostic tools are instrumental in allowing timely diagnosis and treatment. As a result, the increasing burden of kidney diseases globally has created a demand for appropriate monitoring systems in healthcare settings.

- Non-invasive diagnostic technologies: The urine monitoring systems market is also being driven by inventions in the fields of non-invasive solutions and wireless diagnostics. In May 2023, Withings launched the U-Scan, a connected urine analysis device suitable for home use, with biomarker testing enabled via interchangeable cartridges. Such developments indicate an increasing demand by consumers for non-complicated, easy-to-operate diagnostic solutions from the comfort of their homes.

- Government and Institutional Investments: The initiatives of governments to upgrade health infrastructures are driving the growth of the urine monitoring systems market. In April 2023, Status Medical Equipment India received various manufacturing licenses regarding advanced urological devices, including Uroflowmeters, which are proof that regulatory bodies are supporting local manufacturing as well. These initiatives are creating opportunities in advanced diagnostic solutions development and also in their adoption globally.

Challenges

-

Cost impediment to emerging markets: Advanced systems for urine monitoring boast high costs, hence being one of the major impediments to emerging urine monitoring systems markets. Many healthcare institutions in emerging economies have limited budgets and hence prefer basic medical equipment and treatment rather than advanced diagnostic systems. Besides this, the non-availability of financing options or subsidies also hinders smaller hospitals or clinics from accessing these systems.

- Limited standardization across healthcare systems: The absence of uniform protocols and regulations for urine monitoring stands as a major barrier toward wide-scale adoption. Variations in healthcare practice, methods of data collection, and regulatory frameworks within geographical regions create enormous difficulties in the implementation of such a system. For example, discrepancies in EHR compatibility or different technical requirements for devices impede smooth integration into existing infrastructures.

Urine Monitoring Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 692.99 million |

|

Forecast Year Market Size (2035) |

USD 1.69 billion |

|

Regional Scope |

|

Urine Monitoring Systems Market Segmentation:

Product Type Segment Analysis

The urine analysis monitoring systems segment in urine monitoring systems market is expected to hold a 46% share by 2035, due to the vital role they play in the diagnosis and management of several chronic diseases, such as kidney disorders, diabetes, and urinary tract infections. These systems help healthcare professionals obtain critical diagnostic information for early intervention and treatment. Growth prospects further increased with the advancements in technology. For example, in September 2022, Sysmex Corp. launched an advanced urine particle analyzer-UF-1500-to help raise diagnostic capabilities and productivity through automation. This innovation meets expanding demands for fast, reliable diagnostic solutions within both hospital and outpatient settings.

Usage Segment Analysis

Disposable urine collection bags are expected to hold the largest share of 61% in the urine monitoring systems market by 2035, which could be attributed to the wide utility of the product in hospitals, clinics, and home healthcare settings. Their ease of use, cost-effectiveness, and hygienic design have made them an indispensable tool for treatment, from acute to long-term care. Moreover, this segment is seeing incredible innovations in patient monitoring and data collection. For instance, the world's first self-operating IoT Uroflowmeter that Oruba Technology launched in November 2021 demonstrated how innovations can be integrated into advanced technology on a disposable solution. This, among other similar innovations, places a high demand for innovative products that enhance patient experience and clinical outcomes and fuel urine monitoring systems market dominance of disposable solutions.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Usage |

|

|

Medical Condition |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urine Monitoring Systems Market Regional Analysis:

North America Market Insight

North America in urine monitoring systems market is anticipated to account for around 38% revenue share by 2035, driven by innovations in diagnostic technologies and government funding programs. Large investments, such as the United States Department of Agriculture to grant USD 42.3 million for telemedicine infrastructure in 2021, improve healthcare access in the areas. These developments underline the commitment of the region towards better diagnostic capabilities and healthcare delivery. Adoption in both hospitals and outpatient settings is driven by technological innovation and funding support. This satisfies the fact that North America remains at the forefront of the global urine monitoring systems market.

The U.S. dominates North America market owing to substantial investments in innovative healthcare technologies. In January 2023, Starling Medical launched StarStream, an at-home urine diagnostic and monitoring platform. It eliminates the need for containers or dipsticks, offering hassle-free urine testing. The technology provides accurate, real-time diagnostics for healthcare monitoring. Such innovation represents the country's emphasis on patient-oriented solutions and increasing diagnostic precision. These factors position the U.S. as a lucrative market for players looking to expand their product offerings.

Canada is anticipated to witness steady growth in the urine monitoring systems market. Advanced diagnostic technologies are being adopted in Canada healthcare system to improve the clinical outcomes of patients. Government grants for firms operating in diagnostic technologies and partnerships further accelerate the adoption of various types of urine monitoring systems across the country. Such a collaborative approach increases access to novel tools in hospitals and clinics. Besides, the focus on non-invasive diagnostics aligns with Canada objective for better patient-centric care. These factors drive the uptake of advanced urine monitoring solutions within the region.

Asia Pacific Market Insight

Asia Pacific region is poised to witness substantial growth through 2035, due to the increasing healthcare needs and awareness about urinary health. Other factors that could enable such major growth are rapid urbanization and expansion of healthcare infrastructures. Addressing unmet diagnostic needs, governments and private entities in the region continue to invest in healthcare innovations. In countries with high prevalence rates of urinary disorders in the region, the demand for advanced urine monitoring solutions is surging, hence opening huge opportunities for expansion and innovation in the market.

China represents a large portion of Asia Pacific urine monitoring systems market due to the high prevalence of conditions concerning the urinary system, driving the need for advanced diagnostics. Increased healthcare expenditures and growing awareness about urinary health are contributing to market growth. Government initiatives support the integration of advanced diagnostic technologies into both urban and rural settings. All these factors put China in a critical position for innovation and adoption.

India is emerging as one of the key urine monitoring systems markets for urine monitoring systems, with support from domestic manufacturers and regulatory approvals. For instance, Status Medical Equipments India received licenses to manufacture advanced urological devices in April 2023. This underlines the growing impetus through which the region makes healthcare more accessible and enhances diagnostic capabilities. Government initiatives and growing investments in healthcare are contributing to the increasing application of these systems. India offers various coveted growth opportunities for both manufacturers and healthcare providers due to its increasing prevalence of urinary conditions.

Urine Monitoring Systems Market Players:

- Accuryn Medical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BECTON, DICKINSON AND COMPANY

- Beckman Coulter, Inc.

- Cardinal Health

- DiaSys Diagnostics India Pvt Ltd

- F. Hoffmann-La Roche Ltd

- FIZE Medical

- Hollister Incorporated

- Laborie

- Siemens Healthcare Private Limited

- Sysmex Corporation

- Teleflex Incorporated

The nature of competition in the urine monitoring systems market is high, with multiple players such as Accuryn Medical, Becton Dickinson and Company, Beckman Coulter Inc., Cardinal Health, and F. Hoffmann-La Roche Ltd. at the front. These companies invest considerably in research and development to meet the growing demand for diagnostic solutions that are accurate, efficient, and friendly to patients. The innovative approach aids the players in developing advanced technologies that enable the development of leading market positions but also helps them answer emerging healthcare needs.

For example, the introduction of the PAXgene Urine Liquid Biopsy Set by PreAnalytiX GmbH in September 2024 reflects the move of the industry toward diagnostics that are non-invasive and of high value. This latest system for cfDNA analysis from urine emphasizes the growing impetus on better diagnostics and enhancing patient friendliness. These types of product innovations are not only expanding the demand for urine monitoring systems but are also driving improved health outcomes globally.

Here are some leading companies in the urine monitoring systems market:

Recent Developments

- In November 2024, Euglena Co Ltd introduced a urine test kit capable of detecting levels of 11 items, including calcium and zinc. This development aims to provide consumers with a convenient method to monitor their nutritional status and adjust their dietary intake accordingly.

- In September 2024, A. Menarini Diagnostics and Nucleix announced a strategic partnership to market the non-invasive Bladder EpiCheck test in Europe. This urine-based test is designed to detect and monitor the recurrence of bladder cancer and upper tract urothelial carcinoma (UTUC), offering patients and clinicians a less invasive diagnostic option.

- In May 2024, Thermo Fisher Scientific launched the CXCL10 testing service to aid in the management of kidney transplant patients. This service detects elevated urinary CXCL10 levels, which are associated with inflammation and early kidney transplant rejection, providing valuable information for patient care.

- Report ID: 6178

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urine Monitoring Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.