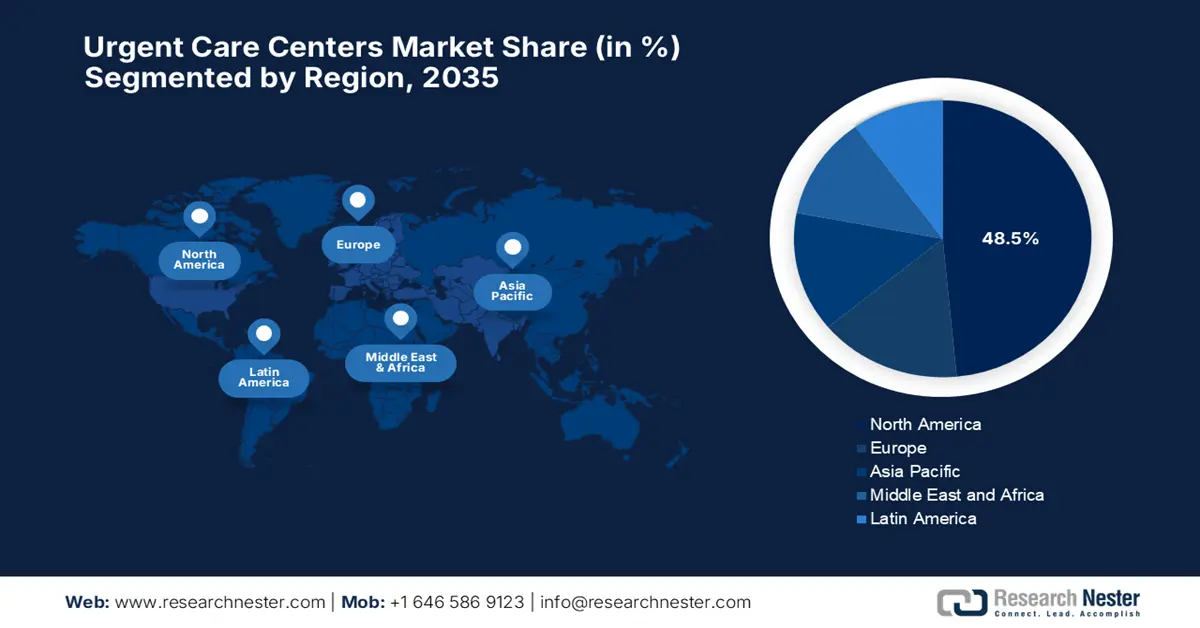

Urgent Care Centers Market - Regional Analysis

North America Market Insights

North America is set to garner the largest revenue share of 48.5% in the market by the end of 2035. The well-established healthcare systems and widespread awareness of these centers are the primary fueling factors for this leadership. In July 2024, Virginia Mason Franciscan Health reported that it had partnered with Intuitive Health to expand access to care in the Puget Sound region, particularly in Kitsap County. It also stated that to meet rising demand and workforce shortages, VMFH will open a second hybrid Emergency Department or an Urgent Care clinic in Port Orchard, hence positively influencing market growth.

The U.S. is set to dominate the regional urgent care centers market owing to the rising burden of acute respiratory infections dominating service demands, cost advantages over primary care and emergency departments, and rapid telemedicine adoption. As evidence, UCA revealed that between January and March 2024, 5 million visits occurred after 5 p.m., highlighting strong after-hours demand, whereas 41% of medical groups benchmark their data externally at least quarterly, supporting continuous performance optimization in the urgent care sector.

Canada’s market of urgent care centers is rapidly growing due to the extreme necessity of timely care and persistent overcrowding in healthcare settings. NIH study in April 2023 revealed that a cross-sectional study in Ontario analyzed 1,148,151 visits by 562,781 patients to 72 walk-in clinics, revealing that 70% of users were already enrolled with a family physician. Besides, walk-in clinic patients were generally younger but had higher healthcare utilization and more comorbidities than the general population. Hence, this pattern underscores that convenience and accessibility as key drivers in this field.

U.S. Urgent Care Center Growth (2022-2024)

|

Year |

Number of Centers |

|

2022 |

12,000 |

|

2023 |

13,500 |

|

2024 |

15,000 |

Source: Urgent Care Association

APAC Market Insights

Asia Pacific’s urgent care centers market is likely to emerge as the fastest-growing region between the timeframe 2026 to 2035. The region’s development in this field is facilitated by the growing urban populations, increasing healthcare awareness, and rising demand for efficient and accessible care alternatives. In April 2023, TXP Medical Co. Ltd. stated that its NEXT Stage ER (NSER) data platform is making an entry into four Malaysia-based hospitals to improve emergency medicine operations. Also, the project, selected by JETRO as a key DX initiative, integrates prehospital and in-hospital patient data using tools like NSER mobile for ambulance paramedics and the TXP Self-Assessment System for patient interviews.

There is a huge opportunity for the market in India, driven by private-sector-led clinics and chains offering walk-in consultations, diagnostics, and minor procedures. The country also received huge support from the government of India, which implemented the Ayushman Bharat Digital Mission (ABDM). Besides, these centers can leverage telemedicine platforms such as e-Sanjeevani to provide accessible, timely care for non-emergency conditions, especially in underserved and rural areas. Integration with digital health IDs and electronic medical records enables proper patient management and improved health outcomes.

Australia in the market is rapidly growing, which is supported by government initiatives and enhanced healthcare access. In this regard, Medicare UCCs in Australia are offering bulk-billed urgent care for non-life-threatening conditions, wherein no appointments or referrals are needed, operating extended hours. Also, the country received a total fund of USD 1.4 billion in government investment, which also includes USD 644.3 million from 2025 to 2026. The network is expanding to 137 clinics nationwide by the end of 2028, hence suitable for standard market development.

DTP3 Immunization Coverage and Unvaccinated Children in Key APAC Markets (2024): Implications for Urgent Care Demand

|

Country |

Coverage (%) |

Vaccinated |

Unvaccinated |

|

Indonesia |

78 |

3.4 million |

969,000 |

|

Philippines |

71 |

5,000 |

525,000 |

|

China |

97 |

8.5 million |

263,000 |

|

Malaysia |

93 |

<1,000 |

31,000 |

|

Thailand |

92 |

25,000 |

46,000 |

Source: UNICEF

Europe Market Insights

Europe market is expected to grow at a considerable rate, with an increased demand for convenient, cost-effective, and timely medical care outside these hospital settings. Also, factors such as aging populations and chronic disease burden are also propelling the need for urgent care. In May 2021, ConvenientMD reported that it secured an investment from Bain Capital Double Impact to expand ConvenientMD’s affordable and flexible urgent care services by opening new locations in underserved areas and broadening service offerings.

Germany is augmenting its leadership in the regional urgent care centers market to reduce pressure on overcrowded hospital emergency departments and address the needs of an aging population. In March 2025, AMBOSS, and medical education platform, secured a substantial €240 million in funding from long-term investors, including KIRKBI, M&G Investments, and Lightrock. The company further stated that the investment supports AMBOSS's international expansion and broadens its offerings to include nurses and other healthcare professionals, hence a positive market outlook.

The U.K. in the urgent care centers market is projected for robust growth that operates under the National Health Service (NHS) and includes Urgent Treatment Centres (UTCs), Minor Injury Units (MIUs), and Walk-in Centres. In June 2025, the UK government announced a £450 million urgent care plan for the tenure 2025 to 2026, which will deliver 40 new same-day emergency care centers, 15 mental health crisis centers, and nearly 500 new ambulances. Besides, this initiative also aims to cut A&E wait times for 800,000 patients on a yearly basis.