UPS Battery Market Outlook:

UPS Battery Market size was over USD 11.08 billion in 2025 and is projected to reach USD 30.9 billion by 2035, witnessing around 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of UPS battery is assessed at USD 12.16 billion.

The increasing electricity consumption is raising the demand for energy supply to be used in the absence of continuous power flow. According to an IEA report published in July 2024, the global electricity demand grew by 4% in the same year. The inflated usage of AI and other data computing technologies is raising the need for an uninterrupted power supply for continuous operations.

The integration with systems to utilize stored energy has also influenced the UPS battery market. The storage and supply systems are capable of empowering equipment during power outages or low production. Reliance on sensitive electronics such as computers, servers, and medical equipment has propelled the need for UPS batteries. These systems help to prevent data loss and system failure due to electricity disruptions. In addition, energy-efficient UPS batteries can reduce the cost of overall power management in businesses. For instance, in May 2023, C&D Technologies launched Pure Lead Max UPS VRLA battery with an 8-year warranty. These energy storage tools can lower the maintenance and ownership costs of data centers.

Key UPS Battery Market Insights Summary:

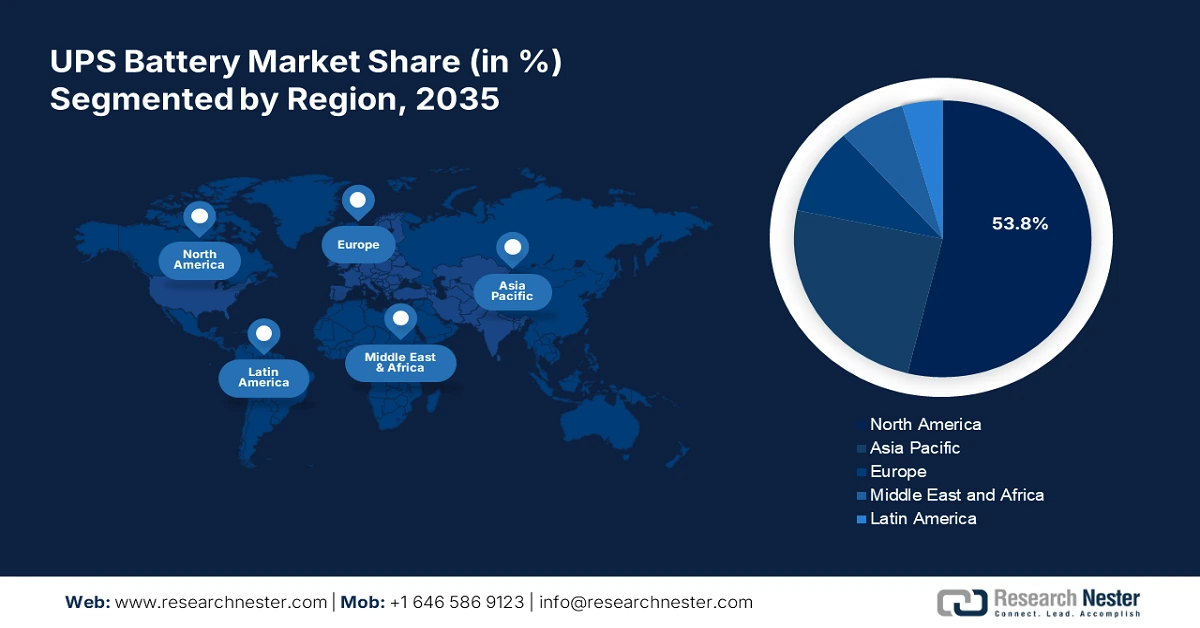

Regional Highlights:

- North America commands a 53.8% share in the UPS battery market, fueled by expansion of data centers and tech innovation, driving growth through 2026–2035.

- Asia Pacific's UPS battery market is projected to be the fastest-growing by 2035, driven by urbanization and smart battery innovations.

Segment Insights:

- The Small and Medium Enterprises segment is projected to hold a 79.40% share by 2035, fueled by the demand for uninterrupted power supply across IT, retail, and healthcare sectors.

Key Growth Trends:

- Growth in the data center industry

- Technological advancements

Major Challenges:

- High production cost

- Complex power and load management

- Key Players: CSB Energy Technology Co., Ltd., East Penn Manufacturing, Eaton, Exide Industries Ltd., FIAMM Energy Technology S.p.A., Leoch International Technology Limited, Schneider Electric, Vertiv, EnerSys, Active Power, Socomec, Kehua Data Co., Ltd., Kokam Co., Ltd, Saft Batteries.

Global UPS Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.08 billion

- 2026 Market Size: USD 12.16 billion

- Projected Market Size: USD 30.9 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (53.8% Share by 2035)

- Fastest Growing Region: Middle East and Africa

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

UPS Battery Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the data center industry: The increasing number of data centers is driving the surge in the UPS Battery market. According to the U.S. International Trade Commission report, published in May 2021, there were around 8000 data centers worldwide. The industry is emphasizing each year with the inflating demand for data processing and storage. Energy-intensive technologies used in these organizations have significantly propelled the need for such reliable power sources. The push from regulatory frameworks to maintain compliance has also contributed to the implementation of UPS power generators.

- Technological advancements: Innovative designs and power outputs have greatly influenced the UPS battery market. The upgraded models can flexibly integrate with a diverse range of applications to boost performance by increasing their energy efficiency. New technologies are being developed to serve with longer lifespans and higher energy density, elevating the standards of available products. Many companies are focusing on inducing faster charging features to reduce downtime and enhance operational effectiveness. For instance, in February 2024, Consistent Infosystems launched a new UPS battery, equipped with fast charging technology, eco-friendly materials, and a longer lifespan.

Challenges

- High production cost: Additional expenses during production due to material shortage or price volatility may hinder the pricing strategy in the UPS battery market. The disrupted supply chain of components can cause unplanned loss due to delays in manufacturing. In addition, batteries that are built with materials such as lithium, cobalt, and nickel may also face difficulty in production, led by geopolitical tensions, natural disasters, and resource scarcity.

- Complex power and load management: As UPS systems are a crucial part of the whole electrical distribution, these are majorly responsible for any energy loss in the setup. The diminishing battery capacity can lead to such loss in efficiency, which further requires extended management, monitoring, or switching systems to deliver consistent performance. This may refrain organizations from investing in the UPS battery market due to complex operations of products.

UPS Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 11.08 billion |

|

Forecast Year Market Size (2035) |

USD 30.9 billion |

|

Regional Scope |

|

UPS Battery Market Segmentation:

Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises)

In terms of organization size, the small and medium enterprises (SMEs) segment is expected to capture around 79.4% UPS battery market share by the end of 2035, due to the need for continuous power supply for uninterrupted operations. The diverse applications in sectors including IT, retail, healthcare, and manufacturing facilities have driven the demand for reliable power-generating devices. As SMEs seek cost-effective and scalable solutions, the UPS systems fit perfectly with their current needs. The segment is growing with the enlarging consumer base due to growing awareness about the importance of power protection. Thus, they are adopting these batteries to safeguard their sensitive equipment such as servers, point-of-sale systems, networking devices, and industrial machinery.

Battery Type (Lead Acid, Nickel Cadmium, Li-ion)

Based on battery type, the li-ion segment is poised to generate remarkable revenue in the UPS battery market. Industries including data centers, telecom, and healthcare have driven the demand for these energy storage systems to empower their critical operations. Such energy-efficient solutions are securing a leading position in the usage of emergency power backup. Companies are curating innovative technologies and eco-friendly materials to optimize the performance and sustainability of these batteries. For instance, in June 2023, AEG launched Protect D Li-Ion for various IT applications. The compact UPS consists of cutting-edge lithium-ion technology to offer unmatched data and equipment protection while ensuring smooth operations.

Our in-depth analysis of the global market includes the following segments:

|

Organization Size |

|

|

Battery Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

UPS Battery Market Regional Analysis:

North America Market Analysis

In UPS battery market, North America region is expected to hold more than 53.8% share by 2035. Significant expansion of data centers due to technological advancement through digitalization has positioned the region on top of this sector. The institutions require large-scale UPS systems to run their computing devices and servers uninterruptedly, preventing service disruptions. The government is now focusing on promoting energy-efficient UPS power sources. For instance, in December 2022, the U.S. government issued the Federal Energy Management Program, setting standards for power storage technology. This acts as a guide for UPS product application in residential and commercial fields, propelling innovation in this region.

The growth in the U.S. UPS battery market is majorly driven by innovation in power storage and supply technology. Global leaders situated in this country are focusing on introducing power sources, suitable for emphasized commercial usage. For instance, in July 2024, Numeric launched its new monolithic UPS system, Keor MP. The three-level IGBT-based converter and lithium battery technology of this compact 3-phase online double conversion device features 96% efficiency with 43% lesser footprint. Such innovative products are inflating demand for more sustainable power supply.

Canada is also diving deeper into the UPS battery market through technological development, creating lucrative opportunities for companies. With the target of achieving energy security and resilience, the country has ensured the optimum adoption of UPS systems to withstand power cuts, especially during natural disasters. This has further enlarged the industry through improved battery performance and extensive features. Many global leaders have shown interest in investing to introduce their high-performance UPS batteries to meet the enlarging demand.

APAC Market Statistics

The Asia Pacific landscape of the UPS battery market has presented great opportunities due to rapid urbanization. Developing countries including Japan, China, India, and South Korea are demanding uninterrupted power supplies to retain their progress. Many domestic companies are launching a series of batteries with attractive features, offering smart power management in large-scale data processing organizations. For instance, in June 2024, Delta launched the UZR Gen3 Series UPS Li-ion Battery System, designed for the data center industry. The innovative engineering of the power supplier can be seamlessly integrated with electrical equipment, cooling systems, and hardware, reducing the TOC of these businesses.

India is emerging to be one of the fastest-growing countries in the UPS battery market. Many large-scale industries are seeking efficient power backup solutions for continued production and distribution flow. Thus, companies are targeting these consumers by introducing revolutionary technologies, delivering as per need. For instance, in October 2022, Su-vastika launched Heavy Duty UPS 3P-3P for industrial power supply with a reduced switching time of ≤ 2milli seconds, preventing sensitive equipment from resetting. The long-lasting UPS batteries are capable of offering a wide range of outputs from 10 KVA to 500 KVA.

China is also gaining traction in the global UPS battery market through its large consumer base. The large manufacturing facilities, population, and reservoir of key components have made this country a good trading space for domestic and global leaders. The expansion of data management institutions and the adoption of advanced technologies have influenced global leaders to invest in this landscape. Integration of these power sources for remote and on-premises healthcare facilities is driving the demand for smart UPS solutions. This is further emphasizing the need for future developments in this sector.

Key UPS Battery Market Players:

- CSB Energy Technology Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- East Penn Manufacturing

- Eaton

- Exide Industries Ltd.

- FIAMM Energy Technology S.p.A.

- Leoch International Technology Limited

- Schneider Electric

- Vertiv

- EnerSys

- Active Power

- Socomec

- Kehua Data Co., Ltd.

- Kokam Co., Ltd

- Saft Batteries

- ABM

As the UPS battery market shifts toward sustainable options, the leading companies are changing the dynamics by introducing revolutionary technologies to meet the need for cost and emission reduction. They are evolving the process of production through eco-friendly materials and advanced manufacturing methods. Many are focusing on expanding product utility for optimum adoption. While some are focusing on attaining certification for building stronger consumer trust upon newly launched products, increasing their reach. For instance, in September 2024, CSB achieved UL 1973:2022 certification for their selected battery products for safe deployment in data center UPS. Such key players include:

Recent Developments

- In June 2024, Schneider Electric launched APC Back-UPS Pro Gaming in Europe, designed with gamers, streamers, and influencers. This provides uninterruptable power protection to secure the connection of GPU-powered PCs, even in regions with unstable grids.

- In June 2024, ABM acquired Quality Uptime Services in a transaction of USD 119 million. The acquisition will allow ABM to consolidate its presence in the emerging data-center industries by enhancing UPS power supply services and utilizing its expertise in electrification infrastructure and microgrids.

- Report ID: 6678

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

UPS Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.