Upper Limb Prosthetics Market Outlook:

Upper Limb Prosthetics Market size was valued at USD 431.7 million in 2025 and is projected to reach USD 645.2 million by the end of 2035, rising at a CAGR of 4.5% during the forecast period, i.e., 2026 2035. In 2026, the industry size of upper limb prosthetics is assessed at USD 449.5 million.

The escalating instances of road traffic accidents and advancements in prosthetic technologies are the key growth engines fueling the expansion of the upper limb prosthetics market. As per an article published by the World Health Organization in December 2023, around 1.19 million people lose their lives across the world from road traffic crashes each year, wherein, with 20 to 50 million non-fatal injuries, which are resulting in disability, highlighting the sustained need for efficient limb prosthetic devices.

Furthermore, payers, such as insurance providers and government health programs, play a pivotal role in determining the accessibility of these devices to patients with their expanded reimbursements. Testifying, this BSNL in January 2025 reported that reimbursement for prosthetic limbs relies on the rates and lists approved under the central government health scheme. It also stated that the high-end, externally powered myoelectric prostheses are reimbursable up to a defined ceiling, such as ₹1,29,500 (USD 1,554) for a trans-radial arm, but only for specific eligible categories.

Key Upper Limb Prosthetics Market Insights Summary:

Regional Highlights:

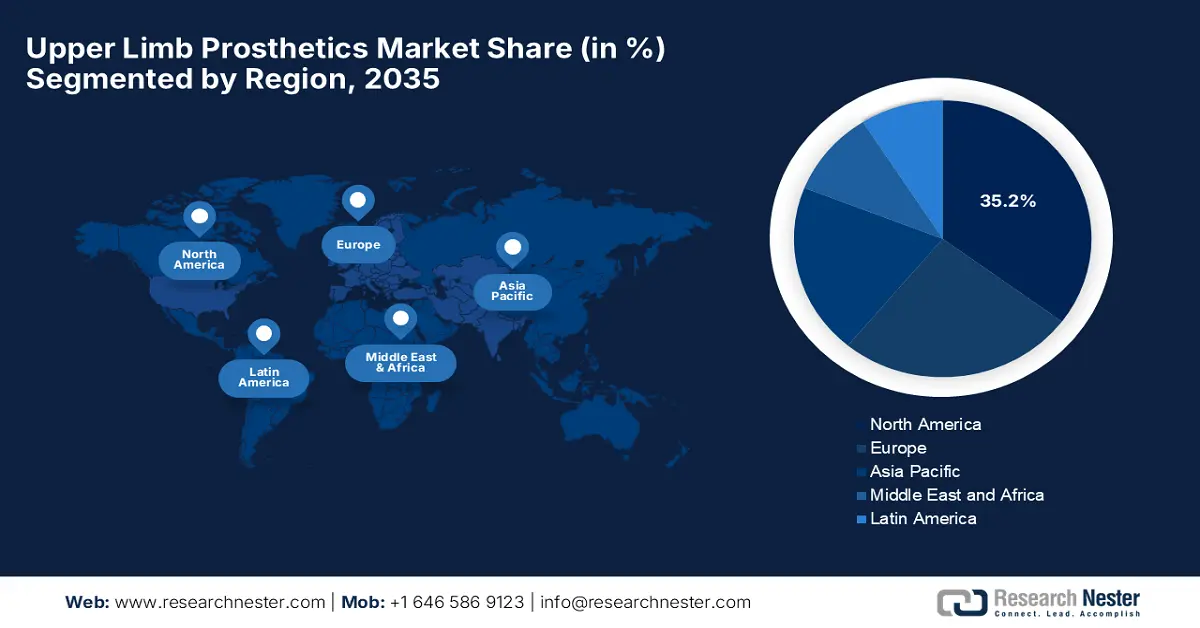

- North America region in the Upper limb prosthetics market is forecasted to command a 35.2% revenue share, underpinned by its robust medical infrastructure that accelerates the adoption of advanced prosthetic technologies.

- Asia Pacific is poised to be the fastest-growing region from 2026–2035, supported by rising investments in advanced medical technologies such as 3D printing and sensor-enabled prosthetics.

Segment Insights:

- By 2035, the myoelectric prosthetics segment in the upper limb prosthetics market is expected to achieve a 38.6% share, fueled by technological advancements that deliver superior functionality and near-natural movement.

- The electric-powered technology segment is set to hold a 35.3% share by 2035, supported by increasing adoption enabled by enhanced support, sensory feedback, and cosmetic appeal.

Key Growth Trends:

- Technological transformations

- Aging demographics

Major Challenges:

- High cost & affordability

- Regulatory & reimbursement barriers

Key Players: Össur (Iceland), Ottobock (Germany), Fillauer LLC (U.S.), COVVI (U.K.), Open Bionics (U.K.), Touch Bionics (a Össur company) (U.S./UK), Shadow Robot Company (U.K.), Vincent Systems GmbH (Germany), Mobius Bionics (a DJO company) (U.S.), Naked Prosthetics (U.S.), Point Designs LLC (U.S.), UNYQ (U.S.), Psyonic, Inc. (U.S.), BionIT Labs (Italy), Rehabtronics Inc. (Canada), Mitsubishi Electric Corporation (Japan), B-Temia Inc. (Canada), Stochastic Pty Ltd (Australia), Bionic Prosthetics & Orthotics (India)

Global Upper Limb Prosthetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 431.7 million

- 2026 Market Size: USD 449.5 million

- Projected Market Size: USD 645.2 millionc by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, Brazil, South Korea, Mexico, United Arab Emirates

Last updated on : 23 October, 2025

Upper Limb Prosthetics Market - Growth Drivers and Challenges

Growth Drivers

- Technological transformations: The magnificent innovations in terms of myoelectric prosthetics, bionic limbs, and AI-based devices are enhancing the uptake of the upper limb prosthetic devices market. For instance, in May 2023, WillowWood announced the launch of the Alpha Control Liner System in collaboration with Coapt, marking the first prosthetic liner with embedded electronics, which improves both patient outcomes and clinician efficiency, thereby setting a new standard in upper extremity prosthetic care.

- Aging demographics: The worldwide escalation in the number of elderly populations has resulted in higher instances of age-associated conditions that create an extensive need for upper limb prosthetics in recent years. According to the article published by WHO in October 2025, the worldwide population aged above 60 and over is expected to double by the end of 2050, wherein 80% live in low- and middle-income countries. Therefore, this reflects a rapid pace of population aging, which is also accompanied by multiple health challenges, including chronic diseases and geriatric syndromes.

- Increased healthcare awareness: The increasing awareness and healthcare access are the foundational factors driving growth in the upper limb prosthetics market. The university hospital of Kharkiv national medical university in September 2025 reported that it inaugurated a prosthetics and orthotics lab, offering services such as physical therapy, psychological support, and prosthetic care. It also stated that this initiative is a collaboration between the Ministry of Health of Ukraine, the ICRC, and the university, which aims to offer full-cycle rehabilitation and train future prosthetists.

Worldwide Road Traffic Injury and Fatality Statistics Annually

|

Statistic |

Details |

|

Annual road traffic deaths |

Approximately 1.19 million |

|

Leading cause of death (age group) |

Individuals aged 5-29 years |

|

Economic cost of road traffic crashes (annual) |

Around USD 3.6 trillion |

Source: CDC, August 2025

Challenges

- High cost & affordability: This is the major challenging factor for the manufacturers and consumers from price-sensitive regions. The advanced devices in the upper limb prosthetic market, such as myoelectric, bionic, or neuro-controlled ones, are expensive to design, manufacture, fit, and maintain. Therefore, this hinders adoption, wherein the capital costs, material costs, and labor costs add additional burden, thereby resulting in many people either never getting access or having access only to more basic, less functional prosthetics.

- Regulatory & reimbursement barriers: The market faces considerable challenges in navigating through upper limb prosthetic market. The approval process can be slow and expensive, which involves rigorous safety and performance testing as well. Meanwhile, in terms of the reimbursement aspect, the insurance and government subsidies are often patchy and inconsistent, making the devices extremely expensive. Therefore, this negatively impacts both innovation and access in this field.

Upper Limb Prosthetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 431.7 million |

|

Forecast Year Market Size (2035) |

USD 645.2 million |

|

Regional Scope |

|

Upper Limb Prosthetics Market Segmentation:

Product Type Segment Analysis

Based on product type myoelectric prosthetics segment is expected to garner the largest share of 38.6% in the upper limb prosthetics market during the forecast duration. The technological advancements providing superior functionality and near-natural movement are the key factors behind the leadership. In November 2024, Purdue University’s Weldon School of Biomedical Engineering reported that its professor Chi Hwan Lee has developed a myoelectric control system that significantly improves the precision and usability of prosthetic limbs. The organization also underscores that this innovation offers more natural, intuitive control, enhancing user experience and functionality, hence denoting a wider segment scope.

Technology Segment Analysis

The electric-powered technology segment is projected to gain a considerable share of 35.3% in the market by the end of 2035. The growth in the segment is highly attributed to the increasing adoption facilitated by enhanced support, sensory feedback, and cosmetic appeal. Besides the existence of government and organizational initiatives are also prompting a profitable business environment for the upper limb prosthetics industry. Furthermore, the recommendations for insurance coverage are appreciably enhancing access to these technologies.

End user Segment Analysis

The hospitals segment is projected to attain the largest revenue share of 41.8% in the upper limb prosthetics market during the projected time frame. The segment’s dominance in this field is effectively attributed to its role as the primary point of care for traumatic amputations and complex surgical procedures. Besides, the hospitals host multidisciplinary teams that include surgeons and physiatrists who are highly essential for post-amputation fitting and rehabilitation.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

End user |

|

|

Component |

|

|

Level of Amputation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Upper Limb Prosthetics Market - Regional Analysis

North America Market Insights

North America market is expected to be the dominating region, grabbing the largest revenue share of 35.2% by the end of 2035. The robust medical infrastructure, leading to widespread adoption of prosthetic technologies, is the key factor propelling the region’s leadership in this field. TASKA Prosthetics in September 2025 reported that it introduced three major innovations at the AOPA 2025, which include the PowerCore, a waterproof power system especially designed for clinicians and consumers. Further, the event also underscored the firm’s focus on high-performance solutions, while also discussing the strength of its ongoing partnership with Fillauer Companies.

The U.S. is expanding its leadership in the regional dynamics of the market, bolstered by the presence of a large patient population and skilled professionals supports the demand for both basic and sophisticated prosthetic solutions. As per the article published by NIH in May 2023, prosthetic technology in the U.S. has advanced from basic wooden limbs to advanced bionic devices powered by brain signals. It also stated that, along with NIH, other federal bodies aim to improve mobility, independence, and quality of life for the nearly 2 million people in the country living with limb loss, denoting the presence of huge potential.

Canada has gained enhanced momentum in the upper limb prosthetics market, strongly backed by a public healthcare system and government-funded programs and initiatives that contribute to the accessibility of prosthetic devices for patients across the country. The country’s government in September 2025 stated that, as per the non-insured health benefits program, eligible First Nations and Inuit clients can access a wide range of prosthetics, which include upper and lower limb devices, supplies, and repair services. The policy also outlined specific prescriber and provider requirements, before the approval processes, and replacement guidelines, thereby ensuring a constant support for medically necessary and cost-effective prosthetic care.

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the market from 2026 to 2035. The increasing investments in advanced medical technologies, such as 3D printing and sensor-enabled prosthetics, to provide more efficient and cost-effective solutions, are the key factors driving progress in this region. TASKA Prosthetics in September 2024 notified the launch of its TASKA CX medium, further expanding its advanced prosthetic hand product line. It also stated that the system possesses the same high-performance technology as the small CX; the medium version offers greater dexterity, grip strength, and touchscreen compatibility in a larger size.

China market is solidifying its dominance in the regional owing to the increasing adoption of prosthetic arms, particularly those with higher functionality, such as myoelectric devices. Also, the technological progress and government support are the assets of this landscape, which is readily prompting the development and domestic production of more prosthetic components. Furthermore, the demand in the country is emerging from both trauma and non-trauma causes, hence making it suitable for standard market growth.

India is readily blistering growth in the upper limb prosthetics market, owing to the suitable insurance coverage and government health schemes, which are aimed at lessening the financial barriers among underprivileged patients. Testifying this in July 2024 Ministry of Road Transport & Highways reported that the country witnessed a very high fatalities from road accidents, wherein it aims to reduce these deaths by the end of 2030 through a multi-faceted approach. Therefore, such steps towards improved road safety can reduce accident-related concerns, encouraging better healthcare policies and innovation, and positively influencing the market expansion.

Europe Market Insights

Europe market is likely to retain its position as the second-largest stakeholder during the analyzed time frame. The presence of major market leaders, which are focused on developing prosthetics that offer improved functionality, comfort, is the key factor propelling growth in this region. For instance, in June 2024, EBRD reported that it had invested USD 1.25 million in Esper Bionics to expand production of affordable bionic upper-limb prosthetics, thereby assisting in war veterans and amputees in rehabilitation and workforce reintegration, hence contributing to market expansion.

Germany stands at the forefront of the upliftment in the regional upper limb prosthetics market, readily backed by the existence of organizations that are producing a wide range of prosthetic devices that satisfy diverse patient needs. For instance, in March 2024, Q.ANT and Fraunhofer IPA together announced that they are establishing a competence center for human-machine interface in Stuttgart, with a collective goal to revolutionize prosthetic hand control using quantum magnetic field sensors, hence denoting a positive market outlook.

The U.K. has a huge potential to capitalize on the market owing to the growing emphasis on integrating cutting-edge technologies, such as myoelectric and bionic prosthetics, into patient care. In August 2024, Metacarpal reported that it deliberately secured £800,000 (USD 980,000) in seed funding to develop the world’s first-ever fully mechanical bionic hand. Furthermore, this innovative prosthetic combines body-powered control with the advanced functionality of myoelectric devicesoffering individual finger motion, multiple grips, and wrist positions without electronics.

Key Upper Limb Prosthetics Market Players:

- Össur (Iceland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ottobock (Germany)

- Fillauer LLC (U.S.)

- COVVI (U.K.)

- Open Bionics (U.K.)

- Touch Bionics (a Össur company) (U.S./UK)

- Shadow Robot Company (U.K.)

- Vincent Systems GmbH (Germany)

- Mobius Bionics (a DJO company) (U.S.)

- Naked Prosthetics (U.S.)

- Point Designs LLC (U.S.)

- UNYQ (U.S.)

- Psyonic, Inc. (U.S.)

- BionIT Labs (Italy)

- Rehabtronics Inc. (Canada)

- Mitsubishi Electric Corporation (Japan)

- B-Temia Inc. (Canada)

- Stochastic Pty Ltd (Australia)

- Bionic Prosthetics & Orthotics (India)

- Ottobock SE & Co. KGaA is the predominant leader in this field, which has a strong international presence due to its large product portfolio. The company’s strength lies in extensive R&D, large-scale production, and strong brand recognition. Genium arm, Michelangelo Hand, and DynamicArm are among their top products, hence solidifying their dominance over the global landscape.

- Össur hf is based in Iceland and holds an extremely strong position in bionic and myoelectric upper limb devices. The company also owns Touch Bionics, which produced the i-Limb line and has invested substantially in technologies such as AI‑sensor fusion, haptic feedback, etc. The firm’s R&D intensity and patent portfolio are the competitive advantages allowing it to emerge in this sector.

- Steeper Group is a UK-based prominent organization that is best known for advanced prosthetic hands and custom solutions. The firm also provides both standard myoelectric arms or hands and high-performance options and focuses strongly on patient customization, prompting a positive adoption rate.

- Fillauer LLC is based in the U.S, which is a specialist in prosthetic components which including upper limbs as well as sockets, joints, etc. It also established a footprint in the hybrid or modular device space, enabling custom fittings. The company plays a pivotal role in the domestic landscape owing to its reliability and compatibility with local prosthetic ecosystems

- Open Bionics is a recent entrant that is currently offering more affordable bionic (myoelectric) prosthetic arms, especially for below-elbow amputees, often making use of 3D printing, modular design, and lighter components. The firm emphasizes making prosthetics more accessible, especially for younger users or in settings with constrained budgets.

Below is the list of some prominent players operating in the global market:

The global market is partially consolidated, wherein the established entities such as Ottobock and Össur lead through exclusive product portfolios and global distribution networks. Research & development focused on creating more intuitive devices, and mergers & acquisitions are a few strategies implemented by the pioneers to thrive in this field. In November 2024, Eqwal reported that it finalized its acquisition of LimbTex Ltd, which is a major player in the prosthetics and orthotics materials and equipment. Furthermore, this strategic move enhances Eqwal’s global capabilities by integrating LimbTex’s technical expertise, thereby enhancing its worldwide presence.

Corporate Landscape of the Upper Limb Prosthetics Market:

Recent Developments

- In September 2025, Fillauer announced that it was named the primary U.S. distributor of the Zeus S Hand, which is an advanced upper limb prosthetic developed by Aether Biomedical, thereby aiming to enhance both patient independence and clinical efficiency.

- In January 2025, Motorica reported that it successfully inaugurated a new office in New Delhi, India, marking a major step in its international expansion strategy. The move strengthens its partnerships with over 25 clinics in the country and deepens collaboration with local universities to boost research, innovation, and training in prosthetics.

- Report ID: 5241

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Upper Limb Prosthetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.