Unmanned Aerial Vehicle Market Outlook:

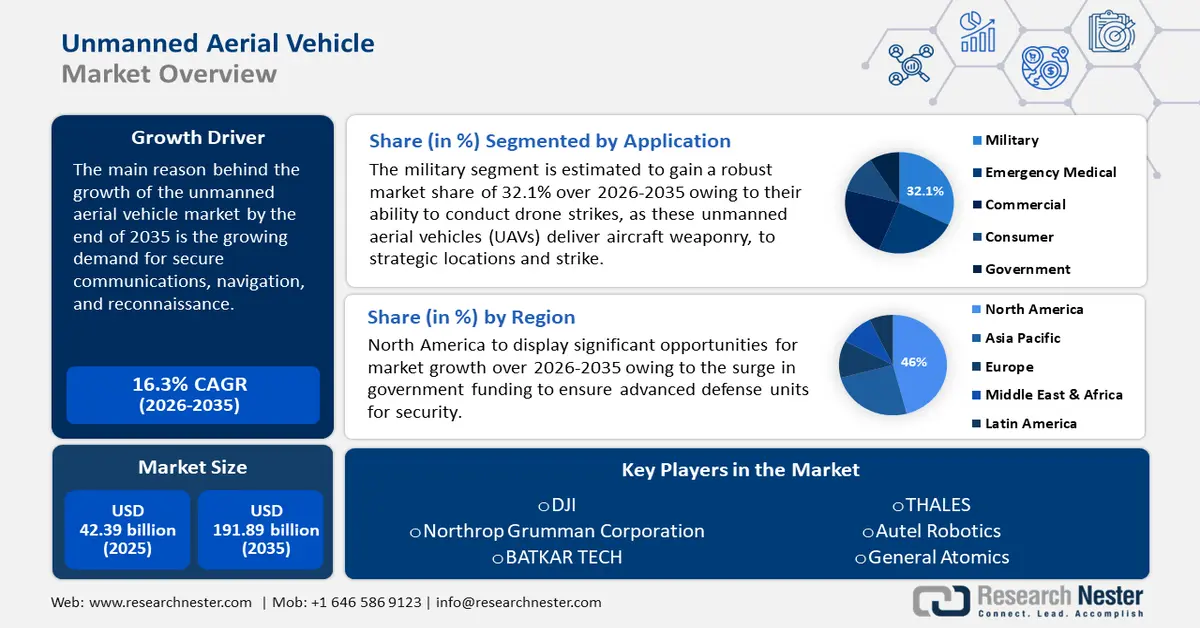

Unmanned Aerial Vehicle Market size was over USD 42.39 billion in 2025 and is anticipated to cross USD 191.89 billion by 2035, witnessing more than 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of unmanned aerial vehicle is assessed at USD 48.61 billion.

Growing demand for secure communications, navigation, and reconnaissance has boosted the requirement for unmanned aerial vehicles (UAVs). UAV offers advanced aviation tools and features such as video surveillance missions, power-line inspection, relief operations in disaster environments, search and rescue, and remote sensing. Additionally, several governments are increasing their investments in the military sector to ensure that the national security agencies have the most up-to-date resources possible. For instance, Campaign on Military Spending-UK 2024 stated that in 2023, global military spending showed a growth rate of 6.8% surpassing USD 2.44 trillion since the Cold War ended.

Key Unmanned Aerial Vehicle Market Insights Summary:

Regional Highlights:

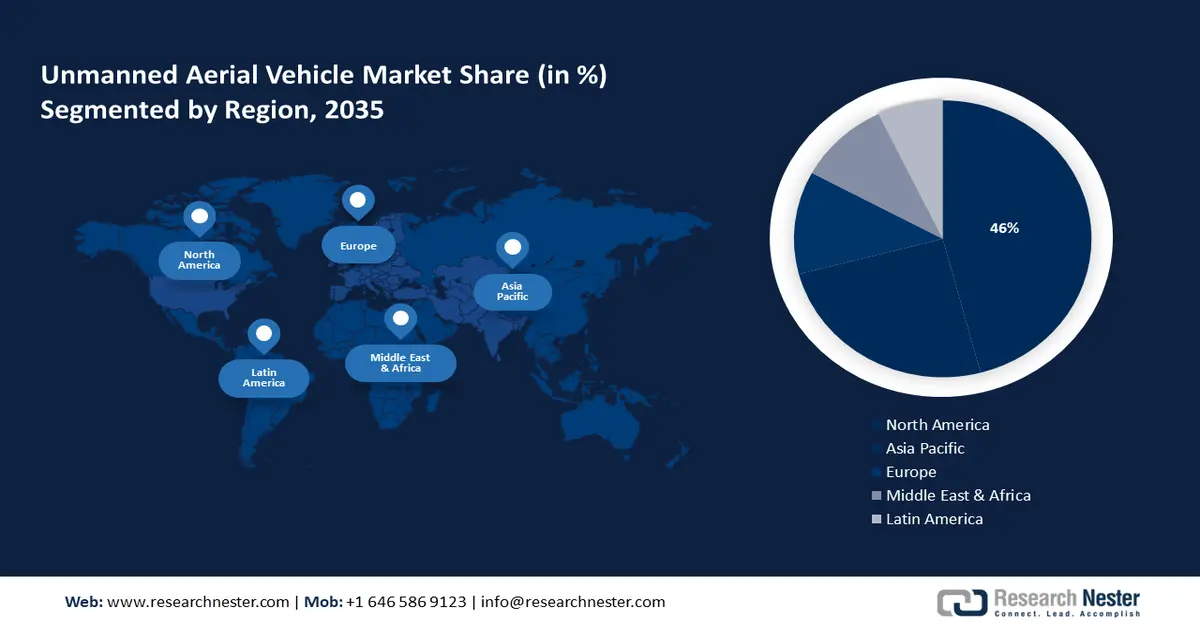

- The North America unmanned aerial vehicle (UAV) market will secure over 46% share by 2035, driven by surge in government funding for advanced defense and UAV technology.

Segment Insights:

- The emergency medical segment in the unmanned aerial vehicle market is expected to experience significant growth till 2035, attributed to the increased use of medical drones in emergencies and pandemic conditions for faster, contactless delivery.

- The government & defense segment in the unmanned aerial vehicle market is projected to achieve a substantial share by 2035, driven by the expanding application of UAVs in military and homeland security tasks like surveillance and refueling.

Key Growth Trends:

- Integration of AI with drone-in-a-box (DiaB) technology

- Carrier in difficult terrains and last-mine delivery

Major Challenges:

- High production cost

- Risk of Intellectual Property (IP) theft

Key Players: Delair SAS, DJI, Northrop Grumman Corporation, BATKAR TECH, THALES, Autel Robotics, General Atomics, Boeing, Teledyne Technologies Inc., Elbit System Ltd.

Global Unmanned Aerial Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.39 billion

- 2026 Market Size: USD 48.61 billion

- Projected Market Size: USD 191.89 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Unmanned Aerial Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Integration of AI with drone-in-a-box (DiaB) technology: A drone that can fly, return from a location, and begin self-charging when it returns from a mission is part of the drone-in-a-box (DiaB) technology. Artificial intelligence (AI) adds several features such as automated and unified visual data collection. For instance, Percepto launched Percepto AIR Max and Percepto AIR Max OGI drones in 2021 and 2024 respectively. These drones are integrated with AI, which allows power grid inspection, detects intrusion, and can collaborate and act on insights. The inspection drones share has increased, augmented by the rising DiaB technology.

- Carrier in difficult terrains and last-mine delivery: The widespread adoption of UAVs among delivery services is expected to drive the UAV market expansion, as there is a growing demand for carriers in difficult terrains under emergencies. UAVs can be an affordable substitute for helicopters, as drones are claimed to be the last-mile delivery technology of the future for consumer goods as they will cut delivery times and costs per delivery. For instance, Nokia announced its contract with Citymesh- a Belgian telecom operator for supplying the Nokia Drone Network platform along with 70 DiaB units.

Additionally, autonomous delivery or human-less services will gradually become advantageous as delivery workers' wages rise, particularly in developed nations. This technology would reduce the need for human intervention while increasing applications across a variety of industries including telecom, agriculture, space, and maritime. Moreover, a recent report by Research Nester in 2024 estimated that drones could cover about 50 miles under 30 minutes.

Challenges

- High production cost: UAVs operate on advanced technologies that require extensive research and development (R&D). It could take a company several years to create a functional prototype. Furthermore, the high cost of the raw materials needed to produce UAVs results in extra expense. UAV maintenance also requires a lot of resources, and while in the air, there's always a chance of losing contact with the drones. As a result, it is important to ensure that UAVs offer cost-efficiency, which may be challenging to attain.

- Risk of Intellectual Property (IP) theft: Unmanned aerial systems use unique systems like DaiB, these are advanced devices that have taken years of study and invention. However, there is a chance of intellectual property theft as UAVs are vulnerable to theft or being taken down by adversaries. Terrorist organizations might try to comprehend the accurate systems and technologies employed in the development process by reverse-engineering intercepted unmanned aerial vehicles (UAVs). This could pose a threat to international UAV manufacturers.

Unmanned Aerial Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 42.39 billion |

|

Forecast Year Market Size (2035) |

USD 191.89 billion |

|

Regional Scope |

|

Unmanned Aerial Vehicle Market Segmentation:

Application Segment Analysis

By 2035, military segment in the unmanned aerial vehicle (UAV) market is estimated to generate highest revenue share. Significant growth in the revenue share is anticipated as a result of their ability to conduct drone strikes. UAVs deliver aircraft weaponry, such as bombs, ATGMs, or missiles, to strategic locations and strike. Combat UAVs have varying levels of control and are usually controlled by humans in real-time. For instance, according to Defence Industry Europe in 2023, the Turkish drone manufacturer Baykar and the Romanian Ministry of National Defense made a deal for Bayraktar TB2 UAVs. Romanian Ministry also awarded USD 321 million to the Turkish defense in this purchase.

In addition, the emergency medical segment in the UAV market is predicted to record significant growth during forecast period. In the situation of environmental calamity, where quick action is essential to boost patient care, this is the most promising service. During the pandemic, medical drones gained popularity all over the world. Where direct human-to-human contact was avoided for infection control reasons, PPE (personal protective equipment), COVID-19 tests (SARS CoV-2), laboratory specimens, and vaccines were delivered via drones.

End use Segment Analysis

The government & defense segment in the UAV market is expected to be the dominating sub-segment with a substantial share attributed to the increasing military and security community's use variety of tasks, such as monitoring, surveying, mapping, transport, and combat. For instance, to create opportunities for the future integration of UAVs for refueling in military operations, the U.S. Navy and Boeing have demonstrated air-to-air refueling operations using an Unmanned Aerial Vehicle, specifically Boeing's proprietary MQ-25 T1 test vehicle. Growth in this sector will boost the home security drone value in the near future.

Fully Autonomous Segment Analysis

The individual autonomous system in the unmanned aerial vehicle (UAV) market is poised to be a faster-growing segment with a notable CAGR by the end of the forecast period. This tremendous gain is credited to the device that requires a whole system to function and is controlled by software. The need for individual autonomous systems is a surge since they can function independently to complete tasks and missions. As part of Autonomy Prime, Near Earth Autonomy announced that it has been chosen by the US Air Force's AFWERX program in 2023 to develop a Reliability Standard for Autonomous Aerial Transport. This partnership demonstrates Near Earth's dedication to pushing the boundaries of autonomous aircraft development.

Our in-depth analysis of the UAV market includes the following segments:

|

Application |

|

|

Fully Autonomous |

|

|

Operational Mode |

|

|

End use |

|

|

System |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Unmanned Aerial Vehicle Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 46% by 2035.The surge in government funding to ensure advanced defense units for national security drives the growth of unmanned aerial vehicles in this region. Peter G. Peterson Foundation in 2024 estimated that defense spending in the United States observed a gain of USD 55 billion between 2022 and 2023.

There is an increase in spending on autonomous drones in the United States. A recent report by Research Nester in 2024 stated that the Pentagon's 2023 Replicator program is an attempt to quickly assemble and install a large number of low-cost drones in a timeframe of 18 to 24 months. The Pentagon impacted spending of USD 500 million in 2024 and USD 500 million in 2025.

The economic development in Canada is fueling the UAV market share as this increases the exports of UAVs. According to the World Bank 2024, Canada’s GDP in 2022 was slated to be USD 2.14 trillion. This is highly based on imports and exports of goods and services, as this makes up to 1/3rd of the GDP.

Asia Pacific Market Insights

Asia Pacific will also encounter huge growth in the unmanned aerial vehicle (UAV) market value during the forecast period with a share of 25%. This region will account for the second position in this landscape owing to the increasing spending and investments in the military in this region. According to The International Institute for Strategic Studies in 2024, the defence spending in Asia surpassed USD 510 billion in 2023.

China has introduced several technologically advanced UAVs, especially for the armed forces such as WZ-7 & WZ-8. Moreover, Asia Pacific Defence Reporter in 2022 stated that a new 8x8 UGV called Dragon Horse II was introduced by the PLA Army for use in carrying ammunition. The gain in this sector will augment the drone battery value in the near future.

It is anticipated that the mining and construction industries in Japan will place a greater focus on the development of cutting-edge drone navigation technologies. That can quickly and easily create a site map and detect object movement in real time. A report by Research Nester estimated in 2024 that in 2022, constructional investments were valued at 68.8 trillion yen. One of the major reasons for using UAV technology is to increase operational efficiency and worker safety.

Unmanned Aerial Vehicle Market Players:

- Delair SAS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DJI

- Northrop Grumman Corporation

- BATKAR TECH

- THALES

- Autel Robotics

- General Atomics

- Boeing

- Teledyne Technologies Inc.

- Elbit System Ltd.

Unmanned aerial vehicle market expansion is estimated to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous spike in investments in the automation and military sectors globally. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the unmanned aerial vehicle (UAV) market will observe emerging competitors and a growing demand for unmanned aerial vehicles around the world.

Some of the key players include in the UAV market:

Recent Developments

- In September 2023, Delair SAS was awarded a contract by the French Defense Ministry to supply 150 DT-46 drones to Ukraine. The drone's ISR payload combines LiDAR (Laser Detection and Ranging) and EO/IR sensors.

- In July 2023, DJI launched their DJI Air 3 drone, it is equipped with a 24mm focal length f/1.7 primary camera and a 70mm focal length f/2.4 telephoto lens.

- Report ID: 6364

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Unmanned Aerial Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.