Market Overview and Growth Highlights 2019-2028

The U.S. aftermarket for exhaust manifolds for the heavy-duty truck market has shown significant growth over the years on account of the increasing demand for heavy-duty vehicles in the automotive industry. Moreover, backed by the influence of globalization, there has been a significant growth in the industrialization processes, which on the other hand has also helped to push forward the market for U.S. aftermarket for exhaust manifolds for the heavy-duty trucks. The market is also anticipated to grow on account of the growing demand for aftermarket vehicle spare parts from the transportation and logistics industries, backed by the increasing adoption of technology along with the automation of processes in these industries. Moreover, increasing implementation of stringent regulations by the U.S. government for their focus to reduce emissions from heavy-duty vehicles is also anticipated to promote towards the growth of the U.S. aftermarket for exhaust manifolds for the heavy-duty truck market.

Further, the U.S. aftermarket for exhaust manifolds for the heavy-duty truck market registered a value of USD 63.4 million in the year 2019 and is projected to touch USD 91.6 million by the end of 2028 by growing at a CAGR of 6.05% during the forecast period, i.e. 2020-2028.

Market Segmentation

By Material

The U.S. aftermarket for exhaust manifolds for the heavy-duty truck market is segmented on the basis of material into stainless steel and cast iron. The cast iron segment registered the largest market share along with a value of USD 46.9 million in the year 2019 and is projected to reach USD 66.0 million by the end of 2028 by growing at a CAGR of 5.76% during the forecast period. The exhaust manifolds manufactured with cast iron are less expensive and pocket friendly. The cast iron material exhaust manifolds also provide various benefits including high durability, long shelf life and others. Moreover, these are found to be convenient for bulk production during peak demand period as it is developed by using special tools. The stainless-steel exhaust manifolds, on the other hand, provides better protection, strength and corrosion resistance as compared to other materials. Stainless-steel is also used to for manufacturing traditional log style and tubular exhaust manifolds. Stainless-steel exhaust manifolds are found to be resistant upon exposure to extreme temperatures. The stainless-steel exhaust manifold segment is also anticipated to grow with the highest CAGR of 6.85% during the forecast period.

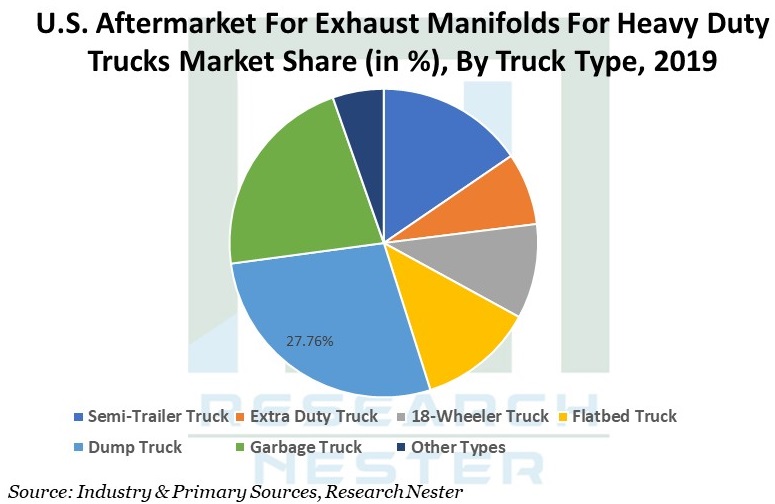

By Truck Type

The U.S. aftermarket for exhaust manifolds for the heavy-duty truck market is also segmented on the basis of truck type into semi-trailer, extra duty, 18-wheeler, flatbed, dump, garbage and others. The dump truck segment registered the largest market share of 27.76% in the year 2019 and is further anticipated to grow by a CAGR of 6.70% during the forecast period. The segment registered a value of USD 17.6 million in the year 2019 and is further projected to reach a value of USD 26.8 million by the end of 2028. The dump trucks are used for commercial and residential purposes, such as dumping of waste materials from construction sites, hospitals, railway stations, societies, restaurants, markets, and others. The dump trucks are mostly tipper trucks and are equipped with 4 or 6 cylinders to support the turbo engine. Exhaust manifolds are used widely in dump trucks to eliminate the gases from these engine cylinders, which is anticipated to drive the growth of the dump truck segment during the forecast period. CLICK TO DOWNLOAD SAMPLE REPORT

Market Drivers & Challenges

Growth Indicators

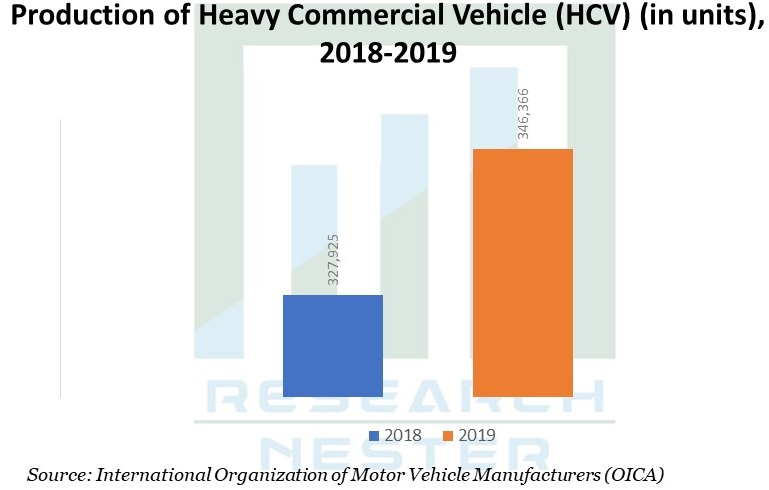

Increasing Production and Sales of Heavy Commercial Vehicles Across the United States

According to the statistics by the International Organization of Motor Vehicle Manufacturers (OICA), the U.S. produced nearly 346, 366 units of heavy commercial vehicles during 2019, which was an increase by 5.6% from the year 2018.

The engines of heavy trucks use exhaust manifolds for greater efficiency of the engines. Backed by the growing production of heavy commercial vehicles in the U.S., the demand for exhaust manifolds is anticipated to grow significantly over the years and in turn drive the market growth. Additionally, the nation has also observed a surge in the sales of the heavy commercial vehicles during the recent past, which has also pushed forward the demand for exhaust manifolds in the aftermarket.

On the other hand, the automotive parts makers have changed their focus towards the use of lightweight and advanced alloys for the manufacturing of the automotive parts as it increases the overall performance of the exhaust systems in the heavy-duty vehicles. Alloys with superior mechanical properties, such as aluminized steel and stainless steel, have high thermal expansion coefficients, which in turn raises the overall performance and reliability of the engine. Such a factor is also anticipated to raise the need for modern exhaust manifolds, thereafter, driving the growth of the U.S. aftermarket for exhaust manifolds for the heavy-duty truck market.

Barriers

Although the U.S. aftermarket for exhaust manifolds for the heavy-duty truck market is driven by numerous growth factors, yet there are several factors that are anticipated to hinder the market growth. Factors such as the high cost of stainless-steel exhaust manifolds, which are costlier than cast iron exhaust manifolds, limits the expansion of the advanced exhaust manifold technology in the market. Though, stainless-steel has several benefits, yet its properties of expansion and retraction during heat cycles and cooling can tear off the bolts or studs that hold the exhaust system together, thereby limiting the adoption of stainless-steel exhaust manifolds. On the other hand, surge in demand for electric vehicles may hamper the automotive exhaust manifold industry severely. Additionally, the decline in the overall automotive industry growth in the U.S. in the recent years is further anticipated to hamper the market growth during the forecast period.

Impact of COVID-19

The pandemic outbreak led to the temporary shutdown of the automobile manufacturing plants in the United States owing to the need to implement safety norms and to avoid the spread of the virus. Owing to such a factor, the supply and demand chain of the aftermarket for exhaust manifold got affected. Moreover, the commercial heavy-duty trucks were operating with limitations on account of lesser requirement of goods from various industries, resulting in a lower demand for aftermarket automotive spare parts. This was added with the decline in heavy-duty commercial truck sales, which was recorded to around 35-40% decrease in the year 2020. During Q1-2020, several truck manufacturers announced production shutdowns of their plants in the U.S. owing to lower demand for trucks in the market.

Top Featured Companies Dominating the Market

Some of the affluent industry leaders in the United States aftermarket for exhaust manifolds for heavy duty trucks market are Cadillac Casting, Inc., Aisin World Corp. of America, MetalTek International, CAB Incorporated and Wescast Inc.

Recent Developments

-

July 2020: Cadillac Casting, Inc. announced that it has partnered with Rogue Fitness, a gym-equipment manufacturer based out of Ohio, United States. The partnership is aimed towards the manufacturing of few of the products of Rogue Fitness and thereafter distribute them worldwide.

-

July 2019: Aisin World Corp. of America announced that the company has entered into a joint venture with an aftermarket import and sales company, Leon Import, S.A. to expand its business and serve customers across the Caribbean markets, along with the markets in Central and South America. The joint venture is also aimed to establish a new company, Aisin Sales Latin America S.A. (ASLA), which would further help expand sales of the organization.

- Report ID: 2789

- Published Date: Feb 15, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

United States Aftermarket For Exhaust Manifolds For Heavy Duty Trucks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert