UPS Market Outlook:

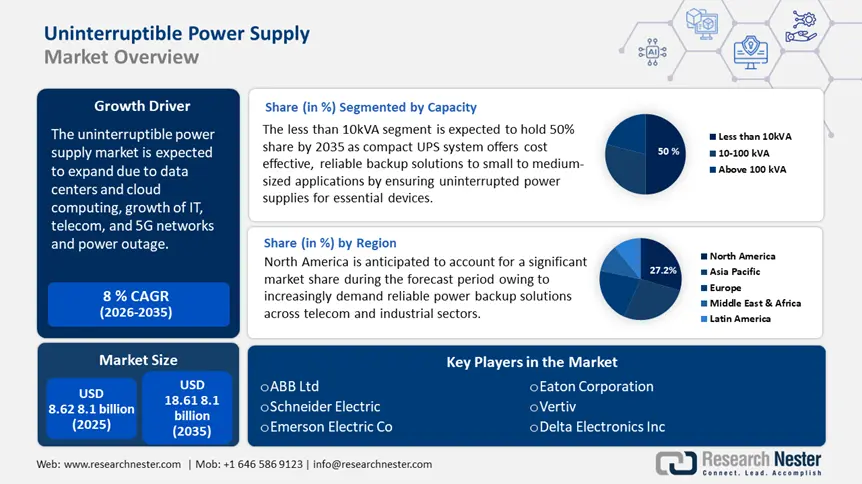

UPS Market size was valued at USD 8.62 8.1 billion in 2025 and is set to exceed USD 18.61 8.1 billion by 2035, expanding at over 8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of UPS is estimated at USD 9.24 8.1 billion.

The primary driver of the uninterruptible power supply (UPS) market is the increasing power outages and grid instability. The frequency of power disruptions is increasing as aging infrastructure networks struggle to keep up with the high electricity demand. This leads to frequent voltage fluctuations, blackout which disrupt businesses, industries and essential services. As a result, organizations are investing in UPS systems to ensure uninterrupted power supply. Moreover, as electricity demand surges due to the expansion of smart cities, EVs, and industrial automation, power grids face increasing pressure leading to instability. The International Agency Report (IEA) suggests that since 2010, nearly 1 billion people in Asia have been granted access to electricity. Almost 97% of the region were given access in 2023 as compared with only 79% in 2010. This rise in electric connections depicts the need for an uninterrupted power supply in developing countries.

Uninterruptible power supply has also become popular post-pandemic due to the rising work-from-home trends and remote work opportunities. This trend makes UPS highly necessary for home offices as they depend on computers, Wi-Fi routers, and devices that need stable power supply. Power outages or voltage fluctuations can lead to loss of work, and disruptions in meetings making uninterrupted power supplies necessary. Thus, the rising use of electronic devices and automation systems are key drivers for uninterruptible power supply systems.

Key Uninterruptible Power Supply Market Insights Summary:

Regional Highlights:

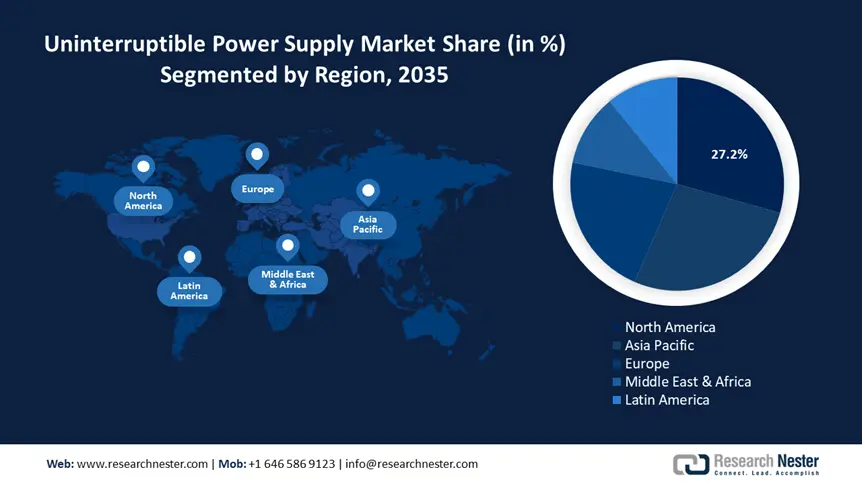

- North America dominates the UPS Market with a 27.2% share, propelled by rising investments in digital infrastructure and renewable energy integration, supporting robust growth through 2026–2035.

- Asia Pacific's UPS Market, the largest in 2024, is expected to grow significantly by 2035, driven by rapid industrialization, urbanization, and increasing power demands.

Segment Insights:

- The Less than 10kVA capacity segment is projected to capture 50% market share by 2035, driven by digital transformation increasing reliance on IT and telecom services.

Key Growth Trends:

- Expansion of data centers and cloud computing

- Growth of IT, telecom, and 5G networks

Major Challenges:

- High initial costs and maintenance costs

- Energy efficiency and sustainability

- Key Players: Schneider Electric, Emerson Electric Co., S&C Electric Company, Xiamen Kehua Hensheng Co. Ltd., Sendon International Ltd, Delta Electronics Inc.

Global Uninterruptible Power Supply Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.62 8.1 billion

- 2026 Market Size: USD 9.24 8.1 billion

- Projected Market Size: USD 18.61 8.1 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (27.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

UPS Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of data centers and cloud computing: The growing need for uninterrupted power in data centers, driven by cloud computing, AI, and big data boosts demand for continuous power. The expansion of data centers is necessarily due to digitalization which makes high-capacity UPS solutions very essential. The expanding data centers are a key factor for UPS systems growth. For instance, the IBEF Report 2024 suggests that India's data center market is projected to increase from USD 4.5 billion in 2023 to USD 11.6 billion by 2032. This anticipated rise will likely increase the demand for uninterruptible power supply solutions.

-

Growth of IT, telecom, and 5G networks: The increasing adoption of 5G technology and the expansion of telecom networks demand uninterrupted power for data transmission. This makes UPS solutions critical to ensure continuous power to base stations, data transmission systems, and communication networks. The rising internet penetration fuels demand for UPS in server rooms and network facilities. For instance, the global 5G connections in Q1 2024 were about 2 billion, with an additional 185 million new users. By 2028, these figures are expected to reach 7.7 billion. Additionally, the increase in data generation has expanded data centers, which serve as key drivers for UPS systems.

-

Industrial automation and smart manufacturing: The rapid adoption of industrial automation and smart manufacturing is also a key driver of the UPS market. As industries adopt robotics, IoT, AI, and data-driven processes, maintaining a stable power supply becomes essential to prevent downtime and costly disruptions. Any power interruption can halt operations leading to financial losses, equipment damage, and reduced productivity. A recent example highlighting the role of UPS systems in industrial automation is the UPS Velocity facility, which integrates over 700 robots utilizing smart automation, machine learning, and artificial intelligence to enhance operational efficiency. These advanced technologies need a stable and continuous power supply to function effectively, thus making uninterruptible power supply essential.

Challenges

-

High initial costs and maintenance costs: UPS systems especially high capacity and lithium-ion models are expensive to purchase and install. Further, regular battery replacements, servicing and maintenance add to operational costs. The small business owners and residential users may hesitate to invest in premium UPS solutions due to budget constraints. These high costs stand as a barrier to the adoption of an uninterruptible power supply.

-

Energy efficiency and sustainability: Traditional uninterruptible power supply system’s consume excess energy even when idle which reduces overall efficiency. Environmental concerns related to battery disposal; especially lead-acid batteries create waste management challenges. Moreover, industries tend to adopt eco-friendly and energy-efficient UPS solutions which may not be cost-effective.

UPS Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 8.62 8.1 billion |

|

Forecast Year Market Size (2035) |

USD 18.61 8.1 billion |

|

Regional Scope |

|

UPS Market Segmentation:

Capacity (Less than 10 kVA, 10-100 kVA, Above 100 kVA)

Less than 10kVA segment is projected to dominate UPS market share of around 50% by the end of 2035. The less than 10kVA segment primarily targets small to medium-sized applications such as server rooms, small data centers and network closets. It offers a balanced solution that delivers reliable backup power for critical IT and telecom equipment without requiring large-scale infrastructure. This capacity range is particularly attractive for small businesses and enterprises looking for cost-effective yet efficient power protection. The segment is bolstered by trends in digital transformation, where increased reliance on IT and telecom services drives the need for uninterrupted power. Advancements in energy-efficient designs and IoT-enabled remote monitoring are enhancing the performance and scalability of these systems.

Application (Data Center, Industrial, Telecommunications, Healthcare, Others)

The data center UPS segment in UPS market is anticipated to be the fastest-growing segment during the forecast period as uninterruptible power supply systems are essential in data centers to ensure continuous operation and protect critical IT infrastructure from power disruptions. They provide instant backup power during power outages, preventing data loss, hardware damage, and downtime. Additionally, it provides stable voltage regulation and protects sensitive servers and network equipment from fluctuations. Scalable and modular UPS solutions help data centers expand efficiently while optimizing energy usage. As data centers grow to support cloud computing, AI, and big data, the demand for high capacity and energy efficient UPS systems continues to rise.

A recent example highlighting the application of uninterruptible power supply systems in data centers is Vertiv’s introduction of the Vertiv Trinergy UPS in July 2024. This next-generation UPS is designed to handle the fluctuating load demands of data centers, particularly those driven by high-capacity AI applications. It supports both traditional and prefabricated deployments worldwide that ensures efficiency.

Our in-depth analysis of the global UPS market includes the following segments:

|

Capacity |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

UPS Market Regional Analysis:

North America Market Analysis

North America UPS market is projected to capture revenue share of around 27.2% by the end of 2035. The market is experiencing strong growth as data centers, telecom and industrial sectors increasingly demand reliable backup power. Industries such as healthcare, telecom and manufacturing rely on UPS systems to prevent downtime and protect critical equipment. Rising investments in digital infrastructure and renewable energy integration are driving the adoption of advanced uninterruptible power supply technologies.

The UPS market in the U.S. is expanding due to the rapid increase in AI-driven data centers and edge computing infrastructure. Growing concerns over cybersecurity and power reliability in financial institutions and government facilities are fueling demand for uninterruptible power supply solutions. The rise of electric vehicle charging stations and smart grids is creating new opportunities for backup power systems. Additionally, stricter energy efficiency regulations and sustainability goals are pushing businesses to adopt advanced eco-friendly UPS technologies.

The uninterruptible power supply in Canada is growing due to the increasing adoption of renewable energy and microgrids. Electricity production by the use of renewable sources of energy requires stable backup power solutions. Rising investments in smart cities and digital infrastructure are driving demand for uninterruptible power supply systems in urban and industrial applications. Additionally, the expansion of remote work and e-commerce logistics hubs has heightened the need for uninterrupted power in data storage and distribution centers.

Asia Pacific Market Analysis:

Asia Pacific is led the UPS market in 2024 owing to rapid industrialization and urbanization, increasing power demands across manufacturing and commercial sectors. The region’s booming e-commerce and fintech industries require reliable backup power to support massive transaction volumes and data security. Moreover, frequent power fluctuations and outages in emerging economies are encouraging businesses and households to invest in uninterruptible power supply solutions.

China's UPS market is rising due to the massive growth of AI-driven data centers and cloud computing. China is rapidly building hyperscale and AI-powered data centers that require high reliability uninterruptible power supply mechanisms for continuous operation. The country’s push for industrial automation and smart manufacturing is further increasing demand for UPS in factories. For instance, the Made in China 2025 initiative aimed at rapidly expanding high-tech sectors and developing an advanced manufacturing base increases demand for uninterruptible power supply. This state-led industrial policy that encourages robotics, IoT and AI-driven automation necessitates UPS in production lines. This government-backed initiative focuses on making China a dominant player in global high-tech manufacturing.

The UPS market is growing in India due to a rise in tier 2 and tier 3 city digitalization. Uninterruptible power supply solutions are becoming essential for expanding internet penetration and data usage by consumers. The country’s smart grid and electrification projects are driving UPS adoption to stabilize power supply in regions with frequent voltage fluctuations. The uninterruptible power supply (UPS) market is expanding due to a surge in startup ecosystems, co-working spaces and fintech growth as growth in these sectors eventually increase demand for UPS in IT hubs and business centers. Additionally, with record breaking heatwaves and extreme weather conditions in India, there is a dire need for advanced UPS solutions to counter power disruptions.

Key UPS Market Players:

- ABB Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Emerson Electric Co.

- S&C Electric Company

- Xiamen Kehua Hensheng Co. Ltd.

- Sendon International Ltd.

- Delta Electronics Inc.

- Beijing Dynamic Power Co. Ltd.

- Riello Elettronica SpA

- Eaton Corporation PLC

The top companies leading the UPS market are namely Schneider Electric, Eaton Corporation and Vertiv known for their advanced and energy efficient UPS solutions. ABB and Siemens are expanding their presence with industrial grade UPS systems catering to manufacturing, automation and data centers. These companies dominate the UPS market through technological advancements, global expansion and tailored solutions for diverse industries. Here are some leading players in the uninterruptible power supply market:

Recent Developments

- In December 2024, Pearce Services, a major company in infrastructure maintenance acquired Unified Power, a company specializing in the repair and maintenance services for uninterruptible power supply (UPS) systems and backup power generators.

- In June 2024, Schneider Electric introduced its APC Back-UPS Pro Gaming uninterruptible power supply in Europe. This system ensures a steady power supply for gaming and digital needs.

- In September 2023, Aggreko, a top provider of mobile power and energy solutions, purchased a large number of UPS systems to work with its temporary power generators. This multi-million-dollar investment supports uninterrupted broadcasting for major television networks and over a hundred professional sports games in U.S.

- Report ID: 7329

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Uninterruptible Power Supply Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.