Unilateral Biportal Endoscopy Market Outlook:

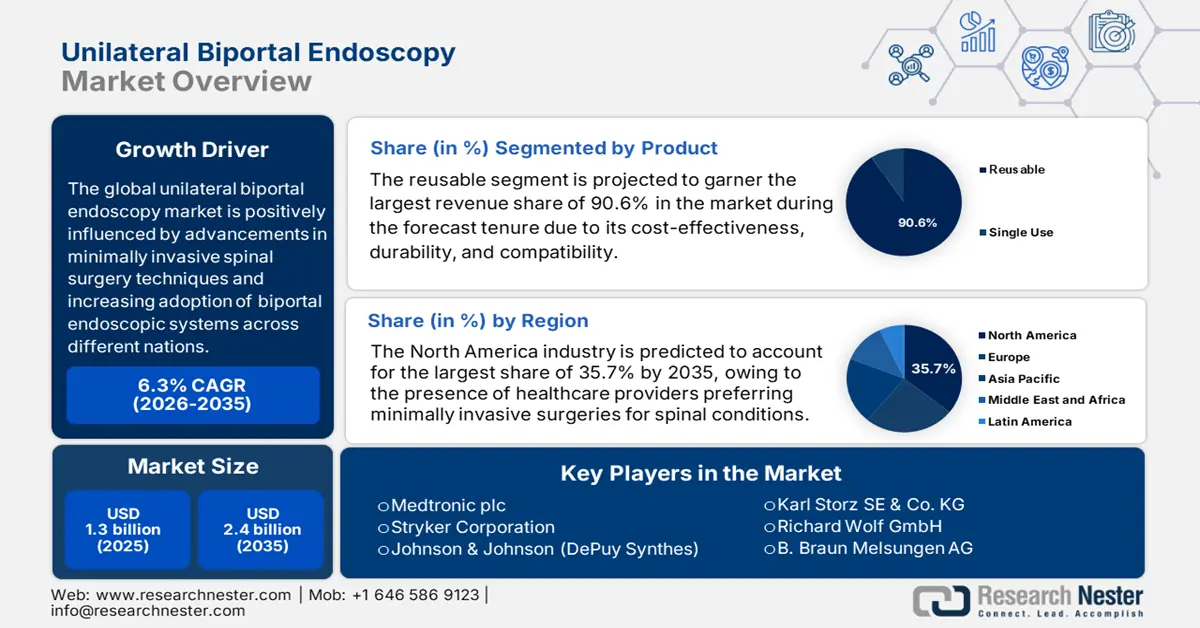

Unilateral Biportal Endoscopy Market size was valued at USD 1.3 billion in 2025 and is projected to reach USD 2.4 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of unilateral biportal endoscopy is evaluated at USD 1.5 billion.

The global market is positively influenced by advancements in minimally invasive spinal surgery techniques and increasing adoption of biportal endoscopic systems across different nations. In this regard NIH study published in January 2024 found that the prevalence was as high as 80% in individuals over 40, with symptomatic rates increasing with age. LSS is also the leading cause of spinal surgery in those over 65 and affects over 200,000 individuals in the U.S alone. Therefore, this data drives an increased necessity, thereby positively impacting market growth.

Furthermore, the growing awareness among healthcare providers about the benefits of biportal endoscopy is further supporting market expansion. A September 2023 study by JNS stated that ambulatory surgery centers offer significantly lower costs than hospital outpatient departments. Besides, in terms of decompression procedures, ASCs reduced total costs by nearly half when compared to HOPDs. Meanwhile, the fusion/instrumentation surgeries also showed lower facility fees and Medicare payments in ASCs, though patient copayments were higher in HOPDs.

Key Unilateral Biportal Endoscopy Market Insights Summary:

Regional Highlights:

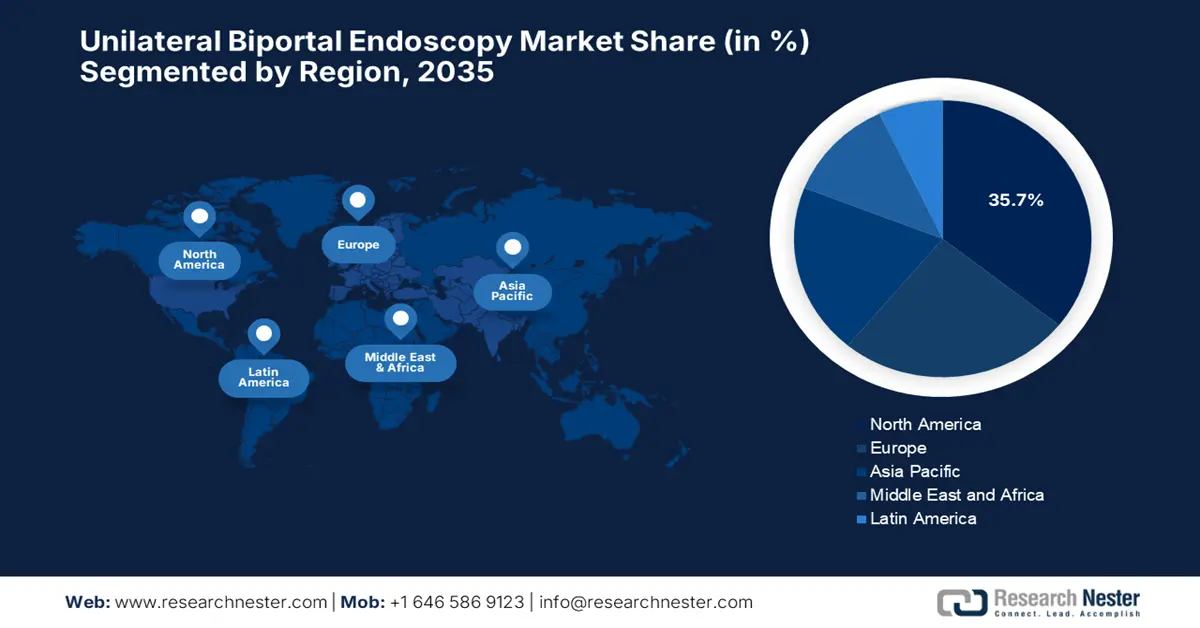

- By 2035, North America is anticipated to secure a 35.7% share in the unilateral biportal endoscopy market, attributable to the growing preference among healthcare providers for minimally invasive spinal interventions.

- Asia Pacific is projected to emerge as the fastest-advancing region from 2026–2035, supported by rising awareness of minimally invasive spinal procedures and enhanced medical technology adoption.

Segment Insights:

- The Reusable segment is forecast to command a 90.6% share by 2035 in the unilateral biportal endoscopy market, bolstered by its cost-efficiency, longevity, and strong compatibility advantages.

- The Hospitals segment is expected to attain a 50.6% share by 2035, supported by advanced clinical infrastructure, specialist availability, and favorable reimbursement mechanisms.

Key Growth Trends:

- Increasing geriatric populations

- Adoption of minimally invasive spine surgery

Major Challenges:

- Lack of skilled workforce

- Exacerbated instrument expenses

Key Players: Medtronic plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Karl Storz SE & Co. KG, Richard Wolf GmbH, B. Braun Melsungen AG, Smith & Nephew plc, Siemens Healthineers, Boston Scientific Corporation, Conmed Corporation, Cook Medical, Samsung Medison, LivaNova PLC, Lupin Pharmaceuticals, Favored Medical Devices.

Global Unilateral Biportal Endoscopy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.5 billion

- Projected Market Size: USD 2.4 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 25 August, 2025

Unilateral Biportal Endoscopy Market - Growth Drivers and Challenges

Growth Drivers

- Increasing geriatric populations: The growing geriatric population is highly susceptible to the spinal conditions that constantly drive demand for advanced procedures such as unilateral biportal endoscopy. Therefore, the report published by WHO in February 2025 stated that the population aged 60 and above, expected to reach 1.4 billion by the end of 2030, especially in developing regions. Hence, this demographic shift trend is a key factor fueling growth in the market of unilateral biportal endoscopy.

- Adoption of minimally invasive spine surgery: Unilateral biportal endoscopy is enabling considerable benefits such as reduced trauma and shorter hospital stays, making it preferable to a wider audience group. In April 2023, Orthofix launched its Lattus Lateral Access System and Fathom Pedicle-Based Retractor System, highlighting ongoing innovation in minimally invasive spine surgery (MIS), which combats key challenges such as access, disc preparation, and interbody device placement. Such advancements remarkably impact the unilateral biportal endoscopy market by broadening the surgeon's tools.

- Amplifying product innovations: Continuous innovations in terms of biportal-specific tools and enhanced surgeon training platforms are broadening the clinical use and acceptance across all nations. In September 2024, Medtronic expanded its AiBLE Spine Ecosystem in partnership with Siemens Healthineers, which includes an O-arm 4.3 software and UNiD ASI platform. The Mazor 5.1 robotic system now integrates AI for bone cutting and graft delivery, while the ModuLeX Spinal System enhances surgical visualization, hence suitable for standard market development.

Lumbar Spinal Stenosis (LSS): Key Epidemiological Highlights for UBE Market 2024

|

Epidemiological Insight |

Details |

|

Radiological Prevalence |

Moderate stenosis: up to 80%; Severe: 40% in those over 40 years |

|

Symptomatic Prevalence (Age-specific) |

40-49 yrs: 1.9%, 50-59 yrs: 4.8%, 60-69 yrs: 5.5%, 70-79 yrs: 10.8% (Japan) |

|

General Population Prevalence (Systematic Review) |

11%, rising to 25-39% in clinical settings |

|

Surgical Conversion Rate |

5.9 per 100 patients with lumbar degeneration undergo lumbar fusion within 1 year |

Source: NIH

Cost Comparison of Spine Surgeries: ASC vs HOPD (Medicare Data 2024)

|

Procedure Type |

Cost Category |

Ambulatory Surgery Center

|

Hospital Outpatient Department |

|

Decompression |

Total Cost |

$4,183 ± 411.07 |

$7,583.67 ± 410.89 |

|

Facility Fee |

$2,998 |

$6,397 |

|

|

Medicare Payment |

$3,345.75 ± 328.80 |

$6,064.75 ± 328.80 |

|

|

Patient Copayment |

$835.58 ± 82.13 |

$1,515.58 ± 82.13 |

|

|

Fusion / Instrumentation |

Facility Fee |

$10,436.6 ± 2,347.51 |

$14,161 ± 2,147.07 |

|

Medicare Payment |

$9,501.2 ± 1,732.42 |

$13,757 ± 2,037.58 |

|

|

Total Cost |

$11,876.8 ± 2,165.22 |

$15,601.2 ± 2,016.06 |

|

|

Patient Copayment |

$2,374.4 ± 433.48 |

$1,843.6 ± 73.42 |

|

|

Surgeon Fees (All) |

Surgeon Reimbursement |

Same in both settings |

Same in both settings |

Source: JNS

Challenges

- Lack of skilled workforce: One of the considerable challenges in the market is the need for specialized surgical training and expertise as well. Also, the unilateral biportal endoscopy is a relatively new and technically demanding procedure; therefore, surgeons must undergo training to make use of these exclusive instruments. This can further lead to slower adoption, and limited experience among surgeons can lead to longer learning durations and hesitation in integrating the technique into routine practice.

- Exacerbated instrument expenses: This is yet another factor negatively influencing growth in the unilateral biportal endoscopy market. The advanced endoscopic systems that include cameras, specialized instruments, and visualization tools necessitate huge investments from hospitals and clinics. Therefore, this financial aspect can restrict access, especially in terms of small-scale medical centers, thereby slowing down market growth.

Unilateral Biportal Endoscopy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 2.4 billion |

|

Regional Scope |

|

Unilateral Biportal Endoscopy Market Segmentation:

Product Segment Analysis

Reusable segment is projected to garner the largest revenue share of 90.6% in the market during the forecast tenure. Its cost-effectiveness, durability, and compatibility position the subtype in a dominant position in this field. In September 2024, Olympus Australia launched Sapphire, which is the first flexible endoscope sterilisation facility in Melbourne. The company also stated that after use, endoscopes are collected and sterilised at Sapphire, ensuring safe and efficient reprocessing for future procedures.

End user Segment Analysis

The hospitals segment is expected to gain a significant share of 50.6% in the market by the end of 2035. The advanced infrastructure, access to skilled surgeons, and favourable reimbursements are the key factors behind the leadership. In June 2025, Ambu launched the Ambu Recircle program, which is an endoscope recycling initiative aimed at reducing hospital waste and environmental impact. This is implemented in collaboration with hospitals such as UCLA Health in the US and Springfield Hospital in the UK. The program ensures single-use endoscopes are collected, cleaned, shredded, and recycled into non-medical products.

Application Segment Analysis

Decompression segment is anticipated to grow at a considerable rate with a share of 40.7% in the market. The segment’s growth originates from the increasing prevalence of degenerative spinal disorders, especially among the aging demographics, who are readily necessitating minimally invasive procedures. These procedures enable unique advantages such as smaller incisions, precise visualization, and reduced tissue damage, which ultimately result in a faster recovery.

Our in-depth analysis of the global unilateral biportal endoscopy market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

End user |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Unilateral Biportal Endoscopy Market - Regional Analysis

North America Market Insights

North America is expected to gain the largest market share of 35.7% by the end of 2035. The region’s upliftment in this field is effectively driven by the presence of healthcare providers who are increasingly preferring minimally invasive surgical options for spinal conditions. In December 2024, PENTAX Medical, a division of HOYA Group, announced that it received US FDA 510(k) clearance for new models in its i20c Video Endoscope Series, including the EC34-i20cL colonoscope, EG27‑i20c upper GI scope, and OE-B17 wheel extender. The firm also stated that these new endoscopes offer improved ergonomics and exclusive imaging capabilities and support physicians in delivering efficacious care.

The U.S. in the unilateral biportal endoscopy market is growing at a rapid pace owing to the country’s advanced healthcare infrastructure, suitable reimbursements, and high procedural volumes. This can be testified by the report published by NIH that found that insurance status significantly influences the likelihood of patients being recommended for spine surgery in neurosurgical settings. Besides, the analysis of 663 patients revealed that those covered by Medicare and Medicaid were more likely to receive surgical recommendations when compared to patients with private insurance, while uninsured patients showed no significant difference.

Canada has gained enhanced traction in the regional growth in the market, which is supported by its public healthcare system's focus on improving patient outcomes and surgical efficiency. In this regard, Olympus in May 2025 stated that it has launched the ScopeLocker Air, a new endoscope drying cabinet designed to improve reprocessing and infection prevention in healthcare facilities. The product is available in two sizes, and it can accommodate up to 18 endoscopes with options for powder-coated steel or stainless steel construction, hence suitable for market development.

APAC Market Insights

Asia Pacific unilateral biportal endoscopy market is considered to be the fastest-growing region from 2026 to 2035. The progress in the region is effectively catered to the increasing awareness of minimally invasive spinal surgery techniques and advancements in medical technologies. The region also benefits from rising investments in healthcare infrastructure that enables wider adoption of this procedure. Furthermore, the growing patient preference for less invasive treatments with faster recovery times is also propelling expansion across countries in this region.

China is emerging as the pivotal market of unilateral biportal endoscopy that is readily facilitated by the advancements in healthcare facilities and a growing number of skilled spine surgeons. In August 2022, Shenyang Shenda Endoscope Co., Ltd. launched its new 4K high-definition laparoscope that comprises an aspherical optical system for a wide viewing angle and distortion-free intraoperative imaging. Both the front and rear endoscope lenses are made of durable sapphire, ensuring resistance to high temperatures and plasma disinfection.

India also holds a strong position in the market, owing to the existence of hospitals and clinics that modernize their surgical capabilities and surgeons adopt exclusive surgery methods. In April 2025, FUJIFILM India notified that it had launched its advanced ELUXEO 8000 Therapeutic Endoscopy Solution at the 22nd MUMBAI LIVE Endoscopy event hosted by Sir HN Reliance Foundation Hospital. Equipped with innovations like ACI, TNR, and E-DRIP, the system delivers sharp, high-quality images with reduced noise.

Financial Assistance to Spinal Injuries Centers (ASIC Scheme) - List of Centers in India 2023

|

Name of Spinal Injury Center |

Location |

Status |

|

Indian Spinal Injury Center, New Delhi |

39 B/C, Medicare Nursing Home, Gandhi Nagar, Jammu, Jammu and Kashmir 180004 |

Functional |

|

SSIC SMS Medical College, Jaipur |

New SMS Campus Rd, Gangawal Park, Adarsh Nagar, Jaipur, Rajasthan 302004 |

Functional |

|

SSIC, Sagar, Madhya Pradesh |

District Hospital Sagar- 470002 |

Under Development |

|

SSIC at J.L.N. Medical College, Ajmer |

Kala Bagh, Ajmer, Rajasthan 305001 |

Under Development |

Source: DEPWD

Europe Market Insights

Europe market is retaining its position as the second largest revenue booster during the discussed time frame. The increasing adoption of minimally invasive spine surgery techniques is the key fueling factor in the region. In June 2023, PENTAX Medical Europe reported that it had launched the AquaTYPHOON, which is a brushless automated pre-cleaning device for endoscopes that eliminates the need for manual brushing or detergent. The product was developed with PlasmaBiotics, which uses pulsed water and air flow to thoroughly clean even non-brushable endoscope channels, hence suitable for market upliftment.

Germany is also continuously growing in the region’s unilateral biportal endoscopy market on account of its well-established healthcare system and strong emphasis on medical innovation. In 2023, joimax launched its new iLESSYS Biportal Interlaminar Endoscopic Surgical System at EUROSPINE 2023 and other major spine surgery forums worldwide. The company stated that the system features separate instrument and endoscope ports, a Triangulation Tool, specialized working tubes with irrigation control, and powerful surgical tools designed for biportal spinal endoscopy.

The U.K. in Europe’s unilateral biportal endoscopy market is projected to grow at a robust pace, effectively driven by rising awareness of the benefits and ongoing training programs. In July 2023, Penlon Limited notified that it had launched a new endoscopic accessories division in the country through a partnership with its own sister company called Vedkang Medical. Besides, this division will supply high-quality single-use accessories for gastrointestinal endoscopy procedures, including tools for endoscopic mucosal resection, endoscopic submucosal dissection, and other GI tract treatments, hence suitable for market development.

Projected Trends in Posterior Spinal Fusion Procedures in Germany for 2060

|

Aspect |

Data / Projection |

|

Incidence rate increase |

~83% to 102% per 100,000 inhabitants |

|

Projected spinal fusions in 2060 (75+) |

38,974 procedures |

|

Increase in surgeries for women 75+ |

246% increase |

|

Increase in surgeries for men 75+ |

296% increase |

|

Trend for age groups <55 |

Constant or negative |

|

Gender surgery ratio |

Women are 1.3 times men (absolute numbers) |

Source: NIH

Key Unilateral Biportal Endoscopy Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Karl Storz SE & Co. KG

- Richard Wolf GmbH

- B. Braun Melsungen AG

- Smith & Nephew plc

- Siemens Healthineers

- Boston Scientific Corporation

- Conmed Corporation

- Cook Medical

- Samsung Medison

- LivaNova PLC

- Lupin Pharmaceuticals

- Favored Medical Devices

The unilateral biportal endoscopy market is extremely competitive, wherein the pioneers such as Medtronic, Stryker, and Johnson & Johnson are dominating owing to their strong R&D and global distribution networks. Meanwhile, the firms from Japan, such as Olympus and Fujifilm, are leading in terms of imaging technology, whereas Germany-based companies are deliberately emphasizing precision endoscopy. Besides mergers & acquisitions, partnerships with hospitals and AI-integrated surgical systems are a few strategies implemented by the players to uplift the market across all nations.

Recent Developments

- In July 2024, Integrated Endoscopy announced the launch of the Nuvis Wireless Camera System, which is an advanced solution that provides next-generation wireless communication for health centers and surgeons at a much lower cost than traditional wired camera systems.

- In September 2024, Stryker reported that it had launched its next-generation 1788 Advanced Imaging Platform in India, which is a surgical camera system that offers enhanced visualization across numerous specialties, thereby aiming to improve surgical precision and patient outcomes as well.

- Report ID: 8015

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.