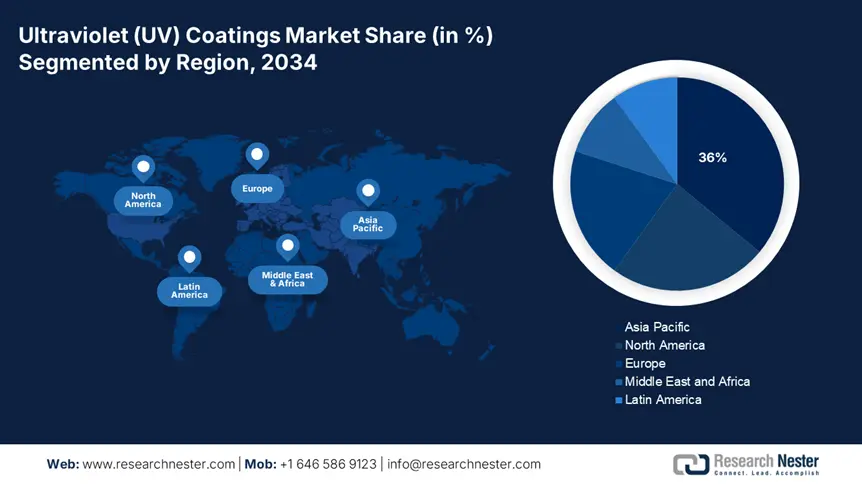

UV Coatings Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to dominate the global UV coatings market with a share of 36% by the end of 2034. The growth is also supported by fast industrialization of the electronics, automotive, and wood furniture industries. The increase in demand is being supported by stringent environmental regulations and adoption of low VOC UV formulations. The urgency in the adoption of UV-curable coatings is further encouraged by government investments in R&D for new technology, green manufacturing guidelines, and investment in the semiconductor supply chain.

China ultraviolet (UV) coatings market is expected to have the largest UV coatings revenue share by 2034. This will likely happen because of its enormous electronics, automotive, and furniture manufacturing sector, increasing domestic demand for UV curable finishes. In China, of approximately USD 19 billion of spending on advanced materials and semiconductor-edge chemical supply chain investment. Circular economy legislation, and government-led industrial-scale cleaner production centres, amplified uptake of sustainable UV across hundreds of thousands of firms. China is well-situated in the region to be the innovation and scale leader in UV coatings by 2034.

According to analysis, India is expected to have the fastest CAGR of all APAC ultraviolet (UV) coatings market cumulatively from 2025 to 2034. Key drivers for growth include the government's increased focus on achieving Make-in-India chemical sector targets. Policies that incentivize local manufacturing, increased domestic electronics and automotive manufacturing capacity, and regulatory pressure to use low-VOC finishes are promoting market demand for high-quality, price-competitive coatings. Industry programs like the National Chemical Industry Vision and public grants for green/coatings pilot programs from the DST will also help drive industry expansion.

Country-Level Demand, Market Size & Government Initiatives

|

Country |

Key Example / Stat |

|

Japan |

In 2024, METI and NEDO allocated 8% of national industrial R&D budget to advanced UV coatings. |

|

China |

Government spending on sustainable chemical tech rose 24% from 2018–2023, enabling over 400,000 firms to adopt cleaner UV‑curable coatings. |

|

India |

Ministry of Chemicals & FICCI report: green chemical funding rose 220% between 2015–2023. |

|

Malaysia |

MOSTI reports that green‑coatings adoption doubled from 2013 to 2023; government funding for low‑VOC coatings increased 42% during that period. |

|

South Korea |

KCIC & ME data show that South Korea’s green chemistry investment rose 34% from 2020 to 2024. |

North America Market Insights

North America is poised to register the highest pace of growth in the global UV Coatings Market by the end of 2034. The growth is driven by aerospace, automotive, electronics, and wood & furniture sectors demanding durable, high-gloss finish coatings. Regulatory pressure is propelling the change towards sustainable, water-based UV chemistries. The industrial demand, environmental regulation, R&D funding, and safety initiatives together will combine to create a strong North American market for UV coatings until 2034.

The federal government has significantly strengthened its support of clean chemicals manufacturing in the U.S. The Inflation Reduction Act (IRA) provided USD 26 billion through the EPA’s Greenhouse Gas Reduction Fund, which went directly to support the decarbonized manufacturing efforts. This includes the manufacture of UV coatings. The Department of Energy (DOE) provided USD 300 billion to invest in climate for chemical innovation. Programs like the EPA’s Safer Chemicals Grants programs have provided insight and research results leading to advances in UV-curable chemistries, reducing hazardous waste or toxicity.

In Canada, funding for advanced materials and for sustainable coatings from the National Research Council (NRC) and Environment and Climate Change Canada is increasing. The federal allocations in 2020-2024 for environmental protection and chemicals management grew by 28% and are supporting R&D into formulations of UV coatings that are VOC-free. Both countries are working together to help propel North America to become a leader in UV coatings innovation, sustainability, and regulatory alignment until 2034.

Europe Market Insights

The European UV Coatings Market is estimated to garner a notable industry value from 2025 to 2034. The expansion of this market is fueled by rapidly growing industrial industries, coupled with regulatory pressures from the EU on low-VOC, sustainable UV chemistries. Funding programs like Horizon Europe and the European Green Deal provide support for R&D programs on bio-based and eco-designed coatings that advance significant innovation and development of UV-curable formulations.

In the UK, UV coatings and some associated chemicals are receiving increased governmental support. For instance, in 2023, UK government support for GaAs chemical projects was 6% of the environmental technology allocation to develop semiconductor-grade UV-curable coatings.

Germany is anticipated to maintain its position at the forefront of Europe and the world, due to its strong chemical manufacturing ecosystem and adoption of low-VOC UV technologies early on. The strong adherence to ECHA regulatory compliance and CEFIC-compliant industry levels in Germany demonstrates that its chemical manufacturers must innovate with water-based UV chemistries. A number of key producers emphasize high concentration within this chemical market. Individual projects in the Green Deal and Horizon Europe further confirm Germany's continued leadership role in safe and reliable high-performance UV coatings.

7 European Countries Actively Spending on UV Coatings

|

Country |

Government Body / Industry Association |

Key Program or Stat |

|

France |

Ministry of Ecological Transition, France Chimie, CEA |

5% of industrial budget in 2023 allocated to UV coatings. |

|

Italy |

MiTE, Federchimica |

Active promotion of low-VOC coatings. |

|

Spain |

MITECO, FEIQUE |

Industrial decarbonization funds include coatings sector. |

|

Netherlands |

RVO, VNCI |

Strong push for bio-based UV-curable coatings under circular economy roadmap |

|

Belgium |

Essenscia, FPS Economy |

Government-backed projects focused on chemical sustainability, including coatings |