Global Ultra-High Molecular Polyethylene Market

- An Outline of the Global Ultra-High Molecular Polyethylene Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

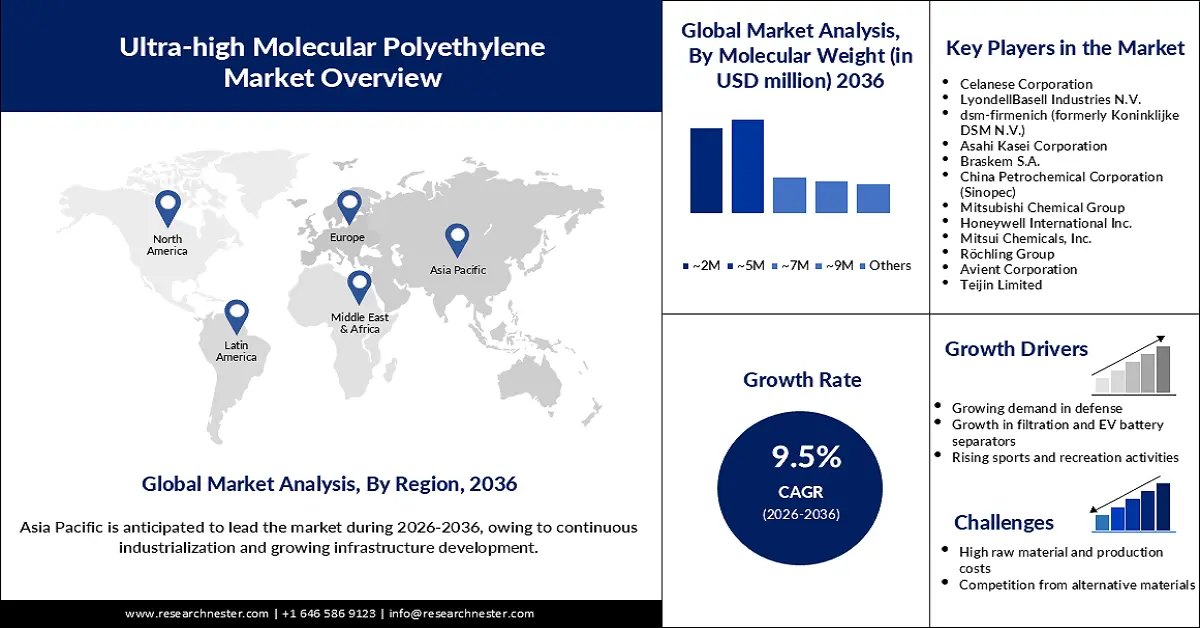

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Ultra-High Molecular Polyethylene

- Recent News

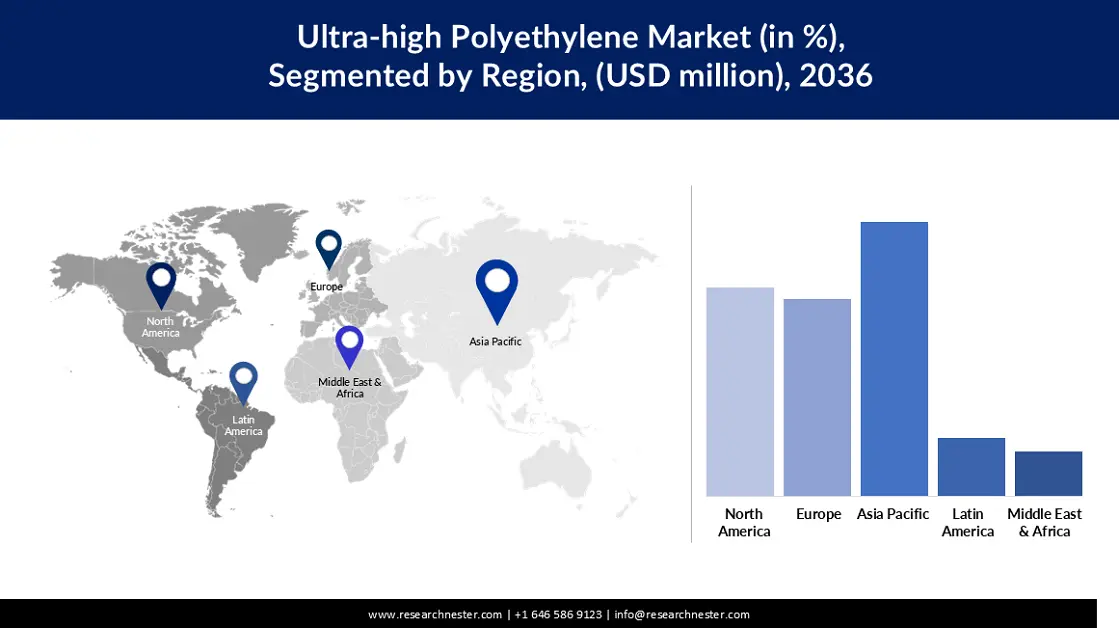

- Regional Demand

- Ultra-High Molecular Polyethylene Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Ultra-High Molecular Polyethylene Demand Landscape

- Ultra-High Molecular Polyethylene Demand Trends (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Ultra-High Molecular Polyethylene Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Ultra-High Molecular Polyethylene Market – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Celanese Corporation

- LyondellBasell Industries N.V.

- dsm-firmenich

- Asahi Kasei Corporation

- Braskem S.A.

- China Petrochemical Corporation

- Mitsubishi Chemical Group

- Honeywell International Inc.

- Mitsui Chemicals, Inc.

- Röchling Group

- Avient Corporation

- Teijin Limited

- Business Profile of Key Enterprise

- Global Ultra-High Molecular Polyethylene Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Ultra-High Molecular Polyethylene Market Segmentation Analysis (2026-2036)

- By Molecular Weight

- ~2M, Market Value (USD Million), and CAGR, 2026-2036F

- ~5M, Market Value (USD Million), and CAGR, 2026-2036F

- ~7M, Market Value (USD Million), and CAGR, 2026-2036F

- ~9M, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form Type

- Sheet, Market Value (USD Million), and CAGR, 2026-2036F

- Films, Market Value (USD Million), and CAGR, 2026-2036F

- Rods & Tubes, Market Value (USD Million), and CAGR, 2026-2036F

- Fiber, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Artificial Joints/Prosthetics, Market Value (USD Million), and CAGR, 2026-2036F

- Filtration, Market Value (USD Million), and CAGR, 2026-2036F

- Battery, Market Value (USD Million), and CAGR, 2026-2036F

- Fabrics, Market Value (USD Million), and CAGR, 2026-2036F

- Membranes, Market Value (USD Million), and CAGR, 2026-2036F

- Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Other, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Healthcare & Medical Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace & Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial Machinery & Equipment, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Molecular Weight

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Molecular Weight

- ~2M, Market Value (USD Million), and CAGR, 2026-2036F

- ~5M, Market Value (USD Million), and CAGR, 2026-2036F

- ~7M, Market Value (USD Million), and CAGR, 2026-2036F

- ~9M, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form Type

- Sheets, Market Value (USD Million), and CAGR, 2026-2036F

- Films, Market Value (USD Million), and CAGR, 2026-2036F

- Rods & Tubes, Market Value (USD Million), and CAGR, 2026-2036F

- Fiber, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Artificial Joints/Prosthetics, Market Value (USD Million), and CAGR, 2026-2036F

- Filtration, Market Value (USD Million), and CAGR, 2026-2036F

- Battery, Market Value (USD Million), and CAGR, 2026-2036F

- Fabrics, Market Value (USD Million), and CAGR, 2026-2036F

- Membranes, Market Value (USD Million), and CAGR, 2026-2036F

- Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Healthcare & Medical Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace & Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial Machinery & Equipment, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Molecular Weight

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Molecular Weight

- ~2M, Market Value (USD Million), and CAGR, 2026-2036F

- ~5M, Market Value (USD Million), and CAGR, 2026-2036F

- ~7M, Market Value (USD Million), and CAGR, 2026-2036F

- ~9M, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form Type

- Sheets, Market Value (USD Million), and CAGR, 2026-2036F

- Films, Market Value (USD Million), and CAGR, 2026-2036F

- Rods & Tubes, Market Value (USD Million), and CAGR, 2026-2036F

- Fiber, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Artificial Joints/Prosthetics, Market Value (USD Million), and CAGR, 2026-2036F

- Filtration, Market Value (USD Million), and CAGR, 2026-2036F

- Battery, Market Value (USD Million), and CAGR, 2026-2036F

- Fabrics, Market Value (USD Million), and CAGR, 2026-2036F

- Membranes, Market Value (USD Million), and CAGR, 2026-2036F

- Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Healthcare & Medical Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace & Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial Machinery & Equipment, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Molecular Weight

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036,

- By Molecular Weight

- ~2M, Market Value (USD Million), and CAGR, 2026-2036F

- ~5M, Market Value (USD Million), and CAGR, 2026-2036F

- ~7M, Market Value (USD Million), and CAGR, 2026-2036F

- ~9M, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form Type

- Sheets, Market Value (USD Million), and CAGR, 2026-2036F

- Films, Market Value (USD Million), and CAGR, 2026-2036F

- Rods & Tubes, Market Value (USD Million), and CAGR, 2026-2036F

- Fiber, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Artificial Joints/Prosthetics, Market Value (USD Million), and CAGR, 2026-2036F

- Filtration, Market Value (USD Million), and CAGR, 2026-2036F

- Battery, Market Value (USD Million), and CAGR, 2026-2036F

- Fabrics, Market Value (USD Million), and CAGR, 2026-2036F

- Membranes, Market Value (USD Million), and CAGR, 2026-2036F

- Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Healthcare & Medical Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace & Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial Machinery & Equipment, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Molecular Weight

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Molecular Weight

- ~2M, Market Value (USD Million), and CAGR, 2026-2036F

- ~5M, Market Value (USD Million), and CAGR, 2026-2036F

- ~7M, Market Value (USD Million), and CAGR, 2026-2036F

- ~9M, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form Type

- Sheets, Market Value (USD Million), and CAGR, 2026-2036F

- Films, Market Value (USD Million), and CAGR, 2026-2036F

- Rods & Tubes, Market Value (USD Million), and CAGR, 2026-2036F

- Fiber, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Artificial Joints/Prosthetics, Market Value (USD Million), and CAGR, 2026-2036F

- Filtration, Market Value (USD Million), and CAGR, 2026-2036F

- Battery, Market Value (USD Million), and CAGR, 2026-2036F

- Fabrics, Market Value (USD Million), and CAGR, 2026-2036F

- Membranes, Market Value (USD Million), and CAGR, 2026-2036F

- Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Healthcare & Medical Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace & Defense, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial Machinery & Equipment, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Molecular Weight

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Molecular Weight

- ~2M, Market Value (USD Million), and CAGR, 2026-2036F

- ~5M, Market Value (USD Million), and CAGR, 2026-2036F

- ~7M, Market Value (USD Million), and CAGR, 2026-2036F

- ~9M, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form Type

- Sheets, Market Value (USD Million), and CAGR, 2026-2036F

- Films, Market Value (USD Million), and CAGR, 2026-2036F

- Rods & Tubes, Market Value (USD Million), and CAGR, 2026-2036F

- Fiber, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Artificial Joints/Prosthetics, Market Value (USD Million), and CAGR, 2026-2036F

- Filtration, Market Value (USD Million), and CAGR, 2026-2036F

- Battery, Market Value (USD Million), and CAGR, 2026-2036F

- Fabrics, Market Value (USD Million), and CAGR, 2026-2036F

- Membranes, Market Value (USD Million), and CAGR, 2026-2036F

- Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Healthcare & Medical Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial Machinery & Equipment, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Molecular Weight

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Ultra-high Molecular Polyethylene Market Outlook:

Ultra-high Molecular Polyethylene Market size was valued at USD 3,061.1 million in 2025 and is projected to reach USD 8,435.82 million by the end of 2036, rising at a CAGR of 9.5% during the forecast period (2026-2036). In 2026, the industry size of ultra-high molecular polyethylene is estimated at USD 3,394.5 million.

A strong demand for UHMWPE across automotive, healthcare, and aerospace industries is fueling the ultra-high molecular polyethylene market growth. The material is highly in demand in the automotive sector for comfort, durability, and weight reduction purposes in vehicles. UHMWPE is widely used in the healthcare sector for its biocompatibility and smooth surface, helping to reduce tissue irritation and inflammation in surgical procedures. The use of the material is expected to remain consistent in the aerospace sector with the motive of fueling performance, minimizing weight, and extending the lifespan of components. The industry of astronomy and scientific research is also anticipated to show a strong demand for UHMWPE in the upcoming financial years. For instance, in August 2023, Mitsui Chemicals, Inc. announced that its NewLight ultra-high molecular weight polyethylene (UHMWPE) molding material had been selected for use as the lens material in the Atacama Large Millimeter/submillimeter Array (ALMA)’s new receivers. ALMA, a cutting-edge astronomical observatory, is operated by the National Astronomical Observatory of Japan (NAOJ) in collaboration with 22 countries and regions, underscoring the global recognition of Mitsui Chemicals’ advanced material technologies.

Shift of different industries towards sustainability and the circular economy can fuel the UHMWPE market growth significantly. The properties of the high-performance material, including recyclability, durability, bio-based production, waste reduction capacity, resource efficiency, and others, make it ideal for use in different industries to achieve sustainability and contribute to the circular economy. Companies are active in the supply of UHMWPE to help industries adopt renewable options. For instance, in March 2023, Biomedical unveiled Bio-based Dyneema Purity fiber. The renewable solution is capable enough to enable circularity and minimize scope 2 emissions in the healthcare sector. A state law in California, the Plastic Minimum Content Standards and Reporting (AB 793), obligated the beverage manufacturers to use at least 15%, 25%, and 50% recycled plastic by 2022, 2025, and 2030, respectively. This indicates the likelihood of a more widespread consumption of the UHMWPE in the years to come.

Key Ultra-High Molecular Polyethylene Market Insights Summary:

Regional Highlights:

- By 2035, the Asia Pacific region is projected to account for 39.6% of the ultra-high molecular polyethylene market, stemming from continuous industrialization and growing infrastructure development.

- Across 2026–2036, the North America region is expected to record a 9.3% CAGR, supported by the expansion of the consumer electronics sector.

Segment Insights:

- By 2036, the ~5M segment of the ultra-high molecular polyethylene market is anticipated to capture 37.1% share, bolstered by the compatibility of the materials in high-performance applications, including media implants that demand high impact resistance, durability, and others.

- Between 2026 and 2036, the sheet segment is projected to hold a 34.2% revenue share, underpinned by the high-performance capacities of the material, including impact strength, chemical durability, and abrasion resistance.

Key Growth Trends:

- Growing demand in defense

- Growth in filtration and EV battery separators

Major Challenges:

- High raw material and production costs

- Competition from alternative materials

Key Players: Celanese Corporation (U.S.), LyondellBasell Industries N.V. (U.S.), dsm-firmenich (formerly Koninklijke DSM N.V.) (Switzerland), Asahi Kasei Corporation (Japan), Braskem S.A. (Brazil), China Petrochemical Corporation (Sinopec) (China), Mitsubishi Chemical Group (Japan), Honeywell International Inc. (U.S.), Mitsui Chemicals, Inc. (Japan), Röchling Group (Germany), Avient Corporation (U.S.), Teijin Limited (Japan), Saudi Arabia Basic Industries Corporation (SABIC) (Saudi Arabia), Quadrant AG (part of Mitsubishi Chemical Group) (Switzerland).

Global Ultra-High Molecular Polyethylene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3061.1 million

- 2026 Market Size: USD 3394.5 million

- Projected Market Size: USD 8435.82 million by 2036

- Growth Forecasts: 9.5% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.6% Share by 2036)

- Fastest Growing Region: North America

- Dominating Countries: – United States, China, Germany, Japan, South Korea

- Emerging Countries: – India, Brazil, Vietnam, Mexico, Indonesia

Last updated on : 4 November, 2025

Ultra-High Molecular Polyethylene Sector: Growth Drivers and Challenges

Growth Drivers

- Growing demand in defense: Growing investments by governments in the national defense sector are expected to fuel the demand for ultra-high molecular polyethylene. The material’s exceptional impact resistance, high energy absorption, thermal stability, and lightweight characteristics make it highly attractive to the defense sector for integration into armor protection systems used in tanks, helicopters, radars, and naval vessels. For example, as disclosed by the National Defense Industrial Association (NDIA) in February 2024, the U.S. Army issued new next-generation combat helmets for 2,000 soldiers. UHMWPE was used in the development of the Next-Generation Integrated Head Protection System, or NG-IHPS, to enable ballistic and fragmentation protection capacity.

- Growth in filtration and EV battery separators: The growth of the filtration technology, crucial for the production of safe, high-performance, and reliable EV battery separators, is fueling the ultra-high molecular polyethylene market growth. The automotive industry is expected to increasingly attract UHMWPE to use in polyolefin separators in lithium-ion batteries due to the mechanical properties, chemistry, and cost-effectiveness of the material. Therefore, with the rising demand for EVs, the use of UHMWPE is expected to increase. As reported by the International Energy Agency, electric car sales reached 17 million in total in 2024, representing an increase of 3.5 million (20%) compared to 2023.

Global EV Sales Statistics in 2024

|

Countries and Continents |

Statistics |

|

China |

Car sales ceding 11 million (40% year-on-year increase) |

|

U.S. |

Sales of 1.6 million cars |

|

Norway |

Sales of 88% of battery electric cars and 3% of plug-in hybrid vehicles |

|

Denmark |

EV sales increase by 10% |

|

Asia |

A 40% surge in the sales of EVs |

|

Latin America |

Market share of EVs reached 4% with sales of around 125,000 vehicles |

|

Africa |

Doubled EV sales to around 11,000 |

Source:IEA

- Rising sports and recreation activities: The use of the UHMWPE is projected to increase with rising sports and recreation activities globally. According to the disclosure by the U.S. Department of Commerce in May 2025, the global outdoor recreation industry generated a revenue of USD 639.5 billion in 2023, an increase of USD 52.7 billion compared to 2022. The increasing participation of the global population in sports and recreational activities is driving demand for personal protective equipment (PPE) to safeguard against physical and mechanical injuries. UHMWPE is extensively utilized in the manufacture of such PPE due to its high strength and durability. Numerous companies are actively producing UHMWPE-enabled PPE, catering to a broad spectrum of protective applications.

Challenges

- High raw material and production costs: The need to use specialized catalysts, including metallocene, late transition metal catalysts, high-purity solvents, such as decahydronaphthalene, supercritical carbon dioxide, and others, makes the production costs of UHMWPE high. These factors create barriers to entry for new UHMWPE producers in the market. Existing companies may also face challenges, as rising raw material costs can compress profit margins and increase operational pressure.

- Competition from alternative materials: A vast pool of alternatives to ultra-high molecular polyethylene, such as HDPE, biomedical implants, hexagonal boron nitride (hBN), and others, is available in the global ultra-high molecular polyethylene market. These alternatives are more cost-effective and superior in terms of performance in specific applications, reducing the market attractiveness of UHMWPE. A wide number of companies are associated with the production of alternatives to the material.

Ultra-high Molecular Polyethylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 3,061.1 million |

|

Forecast Year Market Size (2036) |

USD 8,435.82 million |

|

Regional Scope |

|

Ultra-high Molecular Polyethylene Market Segmentation:

Molecular Weight Segment Analysis

The ~5M segment is expected to account for a ultra-high molecular polyethylene market share of 37.1% by the end of 2036, owing to the compatibility of the materials in high-performance applications, including media implants that demand high impact resistance, durability, and others. Severe companies are associated with the production of UHMWPE with a molecular weight of ~5M, contributing to increasing the market accessibility of the material. The use of the material with a molecular weight of ~5M is expected to increase in various industries in the upcoming business years, owing to the regulatory push for sustainability, circularity, lightweight, stronger, and long-lasting materials.

Form Type Segment Analysis

The sheet segment is projected to hold a revenue share of 34.2% between 2026 and 2036, due to the high-performance capacities of the material, including impact strength, chemical durability, and abrasion resistance. These properties of the material make it best-suited to be used in mining, marine applications, building material management, and food processing. Companies are also contributing to increasing the availability of the material in the global market through consistent production. UHMWPE sheets are in demand across manufacturing, healthcare, automotive, aerospace, marine, defense, and other industries, influencing the future dominance of the segment.

End use Segment Analysis

The healthcare and medical devices segment is projected to capture a 39.4% market share during the forecast period, driven by the growing use of orthopedic implants, surgical tools, and medical devices. The biocompatibility, durability, and high wear resistance of UHMWPE make it a preferred material in the medical and healthcare sector. Companies are actively integrating UHMWPE into their products to enhance performance and longevity. For example, in February 2023, Honeywell introduced a new ultra-fine denier fiber into its Spectra Medical Grade (MG) BIO fiber line. The resulting Spectra Ultra Fine (UF) BIO fiber is available in 25 decitex (dtex), supporting the design of minimally invasive cardiovascular and orthopedic devices while improving device durability.

Our in-depth analysis of the ultra-high molecular polyethylene market includes the following segments:

|

Segments |

Subsegments |

|

Molecular weight |

|

|

Form Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ultra-high Molecular Polyethylene Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific ultra-high molecular polyethylene market is poised to account for a revenue share of 39.6%, attributed to continuous industrialization and growing infrastructure development. As disclosed by Horasis in January 2025, governments of different countries across Asia are initiating 90% of investments in infrastructure development. As disclosed by the United Nations Industrial Development Organization in October 2024, the Asia Pacific made significant progress towards achieving sustainable development goals through the deployment of energy efficiency and industrial production. In addition, countries within the region are minimizing gaps in the infrastructure by 2.4% points each year. Infrastructure development and industrialization in the upcoming years are projected to fuel the use of the material for its abrasion resistance, impact strengths, chemical inertness, and low-friction properties. Growing defense investment by different governments can also increase the adoption of the UHMWPE in the years to come.

The UHMWPE market in China is projected to witness a CAGR of 10.6% during the stipulated timeframe, on account of the growing construction projects. This indicates a growing demand for the material to enhance the performance and longevity of construction structures. According to the report by the Green Finance & Development Center, published in July 2025, China recorded a construction industry engagement level of USD 66.2 billion in contracts, with an investment of USD 57.1 billion in the first half of 2025. The expansion of the automotive sector is also expected to fuel the use of the material in the production of lightweight EVs. As revealed by the International Energy Agency, China went through a 40% year-on-year increase in EV sales in 2024.

The Japan UHMWPE market is estimated to expand rapidly throughout the forecast period, due to the surging demand for the material in the healthcare sector. In March 2023, the National Center for Biotechnology Information reported that UHMWPE is widely used in THA and TKA. The demand for orthopedic services is likely to increase with the booming use of UHMWPE in orthopedic implants, driven by an aging population. As updated by the World Economic Forum in September 2023, the proportion of people aged 80 or over in 10 people is more than 1 in Japan. The adoption of the material for its high resistance and low friction properties is also likely to increase, with the expansion of automation, robotics, and manufacturing. According to the disclosure by the International Federation of Robotics in September 2024, Japan represented 38% of global robot production, and its exports reached 160,801 units in 2023.

North America Market Insights

The ultra-high molecular polyethylene market in North America is set to expand at a CAGR of 9.3% throughout the forecast timeline, due to the expansion of the consumer electronics sector. This is likely to lead to a growing integration of the material in the electrostatic dissipative properties of consumer electronics products to enable exceptional wear resistance, low friction, and impact resistance. The growing need for PPEs within the region, driven by the growth of the defense sector, can also increase the demand for the material. The need for drastic production of EVs, influenced by booming adoption, is also expected to lead to a surging use of the material in the automotive sector within the region.

The U.S. UHMWPE market is projected to expand at a CAGR of 9.3% from 2026 to 2036, with high defense investments, influencing a rising consumption of the material. In August 2025, the U.S. Department of Defense revealed that it spent USD 2.3 trillion among its sub-components in 2025. The advancement of the healthcare infrastructure of the country is also anticipated to boost the demand for UHMWPE. As reported by the Research America in January 2022, R&D investment in medical and health accounted for 5.9% of the entire health expenses. This type of focus on medical and health R&D is expected to fuel the integration of the material in the development of medical devices.

The Canada market is set to experience a robust expansion, owing to the growing dependence of the mining and oil extraction industry on UHMWPE films. Growth in mining and oil extraction activities is likely to fuel the consumption of the material in the near future. The Canadian Association of Petroleum Producers reported in September 2024 that the quarrying, mining, and oil and gas extraction sector contributed to the national GDP at around USD 116 billion. The rapid expansion of the automotive, manufacturing, consumer electronics, and other industries can also fuel the consumption of the material between 2026 and 2036.

Europe Market Insights

The ultra-high molecular polyethylene industry in Europe can go through a CAGR of 9.0% during the projection period, owing to rising investments in the defense sector across the region. As updated by the European Council in September 2025, expenditure in the defense sector by the member states exceeded USD 396.9 billion in 2024, and is estimated to reach USD 440.9 billion by the end of 2025. The rising adoption of defense equipment can lead to an increasing consumption of the material in the years to come. The use of the material can also be boosted with increasing investment in wastewater treatment across the region. The moisture absorption and corrosion resistance properties of the material can increase its application in marine applications. As disclosed by the European Commission in June 2025, the proportion of investment in wastewater management was 38.2% of overall environmental investments in Europe in 2024.

The Germany ultra-high molecular polyethylene market is set to display extensive growth throughout the forecast period, owing to strong demand for the material in the aerospace sector. The presence of a large number of automobile manufacturers involved in EV production is also influencing a drastic consumption of the material in the upcoming financial years. According to a report by the Clean Energy Wire, released in August 2025, a record-breaking 635,000 BEVs were produced by the automotive companies based in Germany in the first half of 2025.

The ultra-high molecular polyethylene industry is likely to grow exponentially in the UK during the study period, owing to the widespread use of the material in the defense and aerospace sectors. The growing preferences for sustainable consumption among the population are also forcing companies to adopt lightweight and durable materials. Government investments in material science can also lead to an enhancement in the production of UHMWPE. As revealed by Universities UK, the government spent USD 114.6 billion to boost innovation in the science and technology sector.

Key Ultra-high Molecular Polyethylene Market Players:

- Celanese Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LyondellBasell Industries N.V. (U.S.)

- dsm-firmenich (formerly Koninklijke DSM N.V.) (Switzerland)

- Asahi Kasei Corporation (Japan)

- Braskem S.A. (Brazil)

- China Petrochemical Corporation (Sinopec) (China)

- Mitsubishi Chemical Group (Japan)

- Honeywell International Inc. (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- Röchling Group (Germany)

- Avient Corporation (U.S.)

- Teijin Limited (Japan)

- Saudi Arabia Basic Industries Corporation (SABIC) (Saudi Arabia)

- Quadrant AG (part of Mitsubishi Chemical Group) (Switzerland)

- Mitsubishi Chemical Group is one of Japan’s leading chemical manufacturers, offering advanced polymer and specialty material solutions. In the UHMWPE market, the company develops high-performance grades used in industrial, medical, and defense applications. Its products are recognized for superior wear resistance, low friction, and durability. Mitsubishi leverages its R&D strengths and sustainability initiatives to support high-value UHMWPE innovations.

- Honeywell is a diversified technology and manufacturing company with a strong footprint in performance materials and advanced fibers. Within the UHMWPE market, Honeywell is known for its Spectra fiber, used extensively in ballistic protection, ropes, and industrial applications. The company’s UHMWPE products offer exceptional strength-to-weight ratios, supporting aerospace, defense, and safety industries worldwide.

- Mitsui Chemicals is a key player in high-performance materials and polymers, offering advanced UHMWPE products under the NewLight brand. Its UHMWPE is valued for applications in medical implants, industrial components, and optical instruments. The company emphasizes innovation and collaboration, as seen in its use of UHMWPE molding for telescope lenses and precision engineering applications.

- Röchling Group is a global leader in high-performance plastics and composites, offering UHMWPE products through its Industrial Division. Its UHMWPE sheets, rods, and profiles are widely used in material handling, machinery, and medical applications. The company focuses on lightweight, wear-resistant, and customizable UHMWPE solutions to enhance operational efficiency across industries.

- Avient Corporation provides specialty polymer solutions and high-performance materials, including UHMWPE-based compounds and blends. Its UHMWPE products are utilized in industrial, healthcare, and consumer applications for their durability, abrasion resistance, and biocompatibility. Avient’s focus on sustainability and material innovation strengthens its position in the advanced polymer market.

Below is the list of the key players operating in the global UHMWPE market:

The players operating in the global ultra-high molecular polyethylene market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialized manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate Landscape of the Global Ultra-High Molecular Polyethylene Market:

Recent Developments

- In July 2025, Avient Corporation unveiled a next-generation composite fabric material. The UHMWPE is offering 10 times more abrasion resistance, a 34% reduction, and 5 times enhanced tear resistance.

- In February 2024, Repsol announced an investment of USD 121.5 million for the establishment of an ultra-high molecular weight polyethylene production plant. The plant was planned to be operational in 2024 and enabled with a production capacity of 15,000 tons annually.

- In March 2021, Celanese Corporation unveiled its plan to invest in the expansion of its production capacity of GUR ultra-high molecular weight polyethylene in Europe. The initiative was taken to proliferate production capacity to 15KT per year.

- Report ID: 3081

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.