Turboexpander Market Outlook:

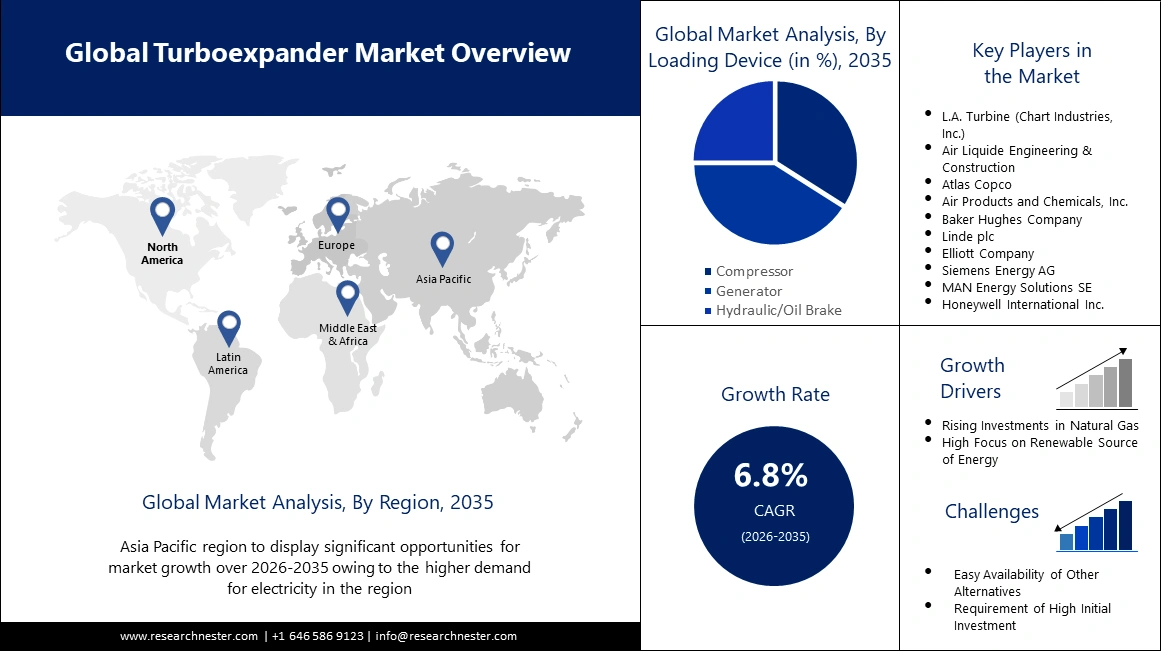

Turboexpander Market size was valued at USD 1.1 billion in 2025 and is set to exceed USD 1.69 billion by 2035, expanding at over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of turboexpander is estimated at USD 1.14 billion.

The demand for natural gas to create a sustainable living is anticipated to increase the usage of turboexpanders owing to their effectiveness in producing energy. In 2021, the global consumption of natural gas increased by around 4% and reached almost 4 trillion cubic meters.

Turbo expanders are highly efficient in hydrocarbon processing and air separation plants. The latest development in the design of turboexpanders has also facilitated its application in the liquefaction of gases, heat recovery, and geothermal. They are considered to be an important part of any compressor system. Hence, it is projected that the global turboexpander market is bound to expand owing to the escalation in demand from various industrial applications.

Turboexpander Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Trend of Automotive Natural Gas Vehicles – Growing urbanization has increased the adoption of LNG vehicles across the globe and is anticipated favor market growth as turboexpander helps utilize natural gas rather than other fuels. The U.S. Department of Energy stated that natural gas powers more than 23 million vehicles worldwide.

-

Increasing Awareness to Reduce Green House Gas (GHG) Emission – Recent industrialization has led to the rise in Green House Gas emissions. However, the constant government focus on reducing Green House Gas (GHG) is estimated to drive the global turboexpander market expansion in the future as turboexpanders are needed in geothermal and heat recovery from natural gas applications which is a cleaner source of energy and emit less carbon dioxide. The International Energy Agency (IEA) stated that in 2020, the total global GHG emission by fuel combustion accounted for 32,252 MtCO2eq.

- Escalation in Global Electricity Consumption – Burgeoning population along with advancements has led to the high consumption of electricity. This factor is anticipated to help in increasing the turboexpander sector value as the turboexpander is efficient in producing energy through natural gas. Global electricity consumption increased from 22,848 TWh in 2019 to 25,300 TWh in 2021 and is continue to grow by 1-2% every year, as per the International Energy Agency (IEA).

Challenges

-

Easy Availability of Other Alternatives – The share of other renewable sources of energy such as solar and wind energy has grown considerably in the past few years owing to the high investments and easy-to-operate advantages. This factor is estimated to hinder the market growth during the projected timeline.

-

High Cost of Installation Process

- Low Awareness Level Among the Developing Countries

Turboexpander Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.8% |

|

Base Year Market Size (2024) |

USD 1.08 billion |

|

Forecast Year Market Size (2037) |

USD 2.54 billion |

|

Regional Scope |

|

Turboexpander Market Segmentation:

Loading Device Segment Analysis

The generator equipment segment in the turboexpander market is anticipated to generate the largest revenue share by the end of 2035 and holds 41% share, owing to the high demand for hydrogen turboexpanders that is imperative during the hydrogen liquefaction process. Along with that, also the high demand for blue and green hydrogen in aerospace and automotive is estimated to bring lucrative growth opportunities for segment expansion. Moreover, with the surge in the demand for hydrogen generation, OEMs are focusing on providing the best kind of experience with generator-loaded turboexpanders.

End-Use Segment Analysis

The oil and gas segment is projected to hold 35% share of the global turboexpander market during the forecasted timeframe. The primary reason for segment size expansion is the increasing use of on-shore and off-shore LNG in various applications. Furthermore, the rapidly growing demand for industrial, commercial, and residential sectors is considered to favor the expansion of segment growth in the upcoming years.

Our in-depth analysis of the global turboexpander market includes the following segments:

|

Product Type |

|

|

Loading Device |

|

|

Power Capacity |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Turboexpander Market Regional Analysis:

APAC Market Segment Insights

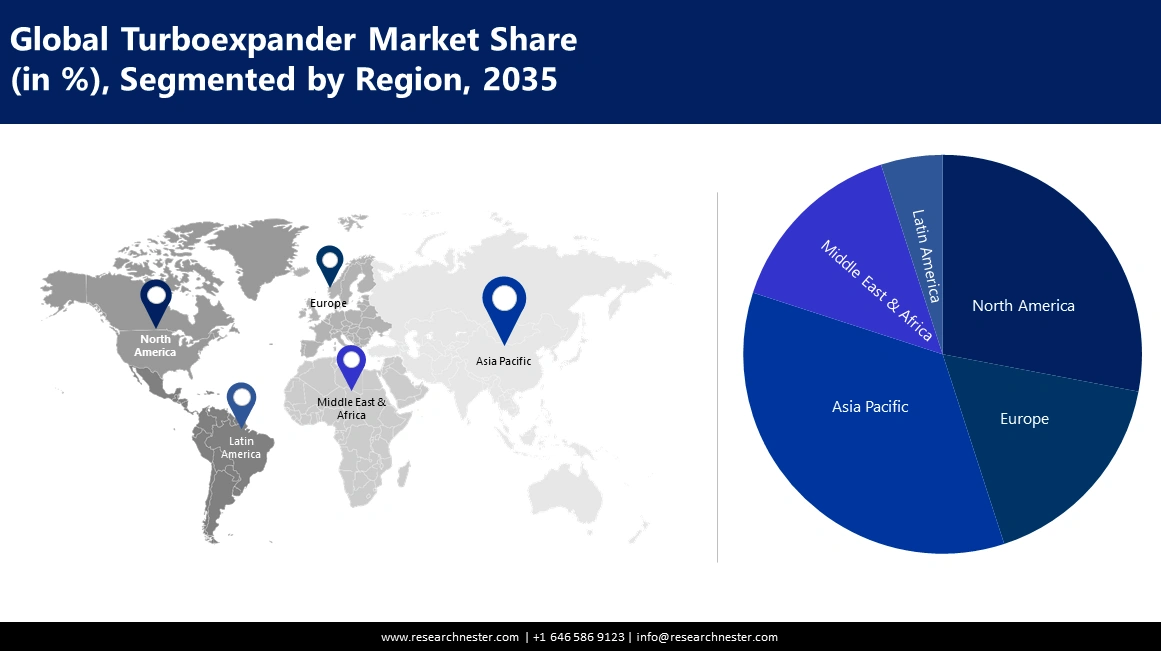

Asia Pacific industry is likely to dominate majority revenue share of 35% by 2035, owing to high focus on using cleaner energy sources in the region. Asia Pacific region holds the highest market potential owing to the high focus on using cleaner energy sources, especially, in China, India, Japan, and Malaysia. In addition to that, the presence of favorable government initiatives to boost and promote the hydrogen economy is the largest favorable factor for the growth of the region in the upcoming years.

North American Market Insights

The North American turboexpander market is set to hold 24% of the revenue share by the end of the projected timeframe. The rapid growth of investments by the United States and Canadian governments in shale gas exploration is anticipated to be the primary factor for the growth of the market in the region. Also, the high investments in natural gas production are anticipated to drive market expansion in the forecast period.

Turboexpander Market Players:

- L.A. Turbine (Chart Industries, Inc.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide Engineering & Construction

- Atlas Copco

- Air Products and Chemicals, Inc.

- Baker Hughes Company

- Linde plc

- Elliott Company

- Siemens Energy AG

- MAN Energy Solutions SE

- Honeywell International Inc.

Recent Developments

- L.A. Turbine, a subsidiary of Chart Industries, Inc. has announced its latest ARES active magnetic bearing (AMB) turboexpander-compressor. The ARES AMB turboexpander-compressor is capable of a flow rate of 200 million ft3/d and can be used for natural gas liquid (NGL) processing.

- Air Liquide Engineering & Construction has announced its acquisition of the cryogenic turboexpander business line of Nikkiso Cryogenic Industries. The acquisition is estimated to strengthen the company’s expertise in cryogenic processes as well as enhance the maintenance and services of turboexpanders.

- Report ID: 5080

- Published Date: Nov 15, 2024

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Turboexpander Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert