Tubeless Insulin Pump Market Outlook:

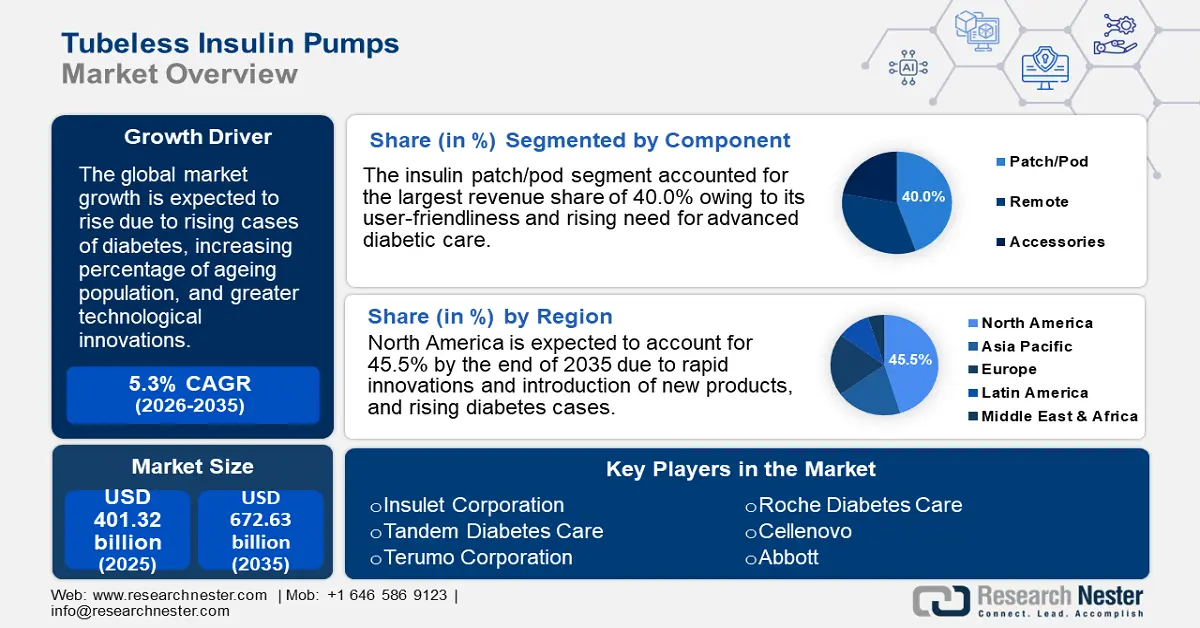

Tubeless Insulin Pump Market size was over USD 2.4 billion in 2025 and is poised to exceed USD 16.69 billion by 2035, witnessing over 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tubeless insulin pump is estimated at USD 2.86 billion.

The tubeless insulin market is driven by the rising incidence of type 1 diabetes across the globe. In 2022, a report published by the National Library of Medicine, the incidence of type 1 diabetes has drastically increased after the COVID-19 pandemic. Tubeless insulin pumps are cost-effective, user-friendly, and can be worn beneath any garment. As per a World Health Organization (WHO) report published in 2022, the world population is aging, and by 2050, 22% of the world population will be 60 years or above.

Manufacturers across the globe are focused on improving the accuracy and user-friendliness of tubeless insulin pumps to gain standard approvals for commercialization. For instance, the first automated tubeless insulin pump, Insulet’s Omnipod 5, received FDA approval in January 2022. Omnipod 5 is the first product that can be controlled via smartphone. Such ongoing groundbreaking innovations are expected to boost tubeless insulin pump market growth going ahead.

Key Tubeless Insulin Pump Market Insights Summary:

Regional Highlights:

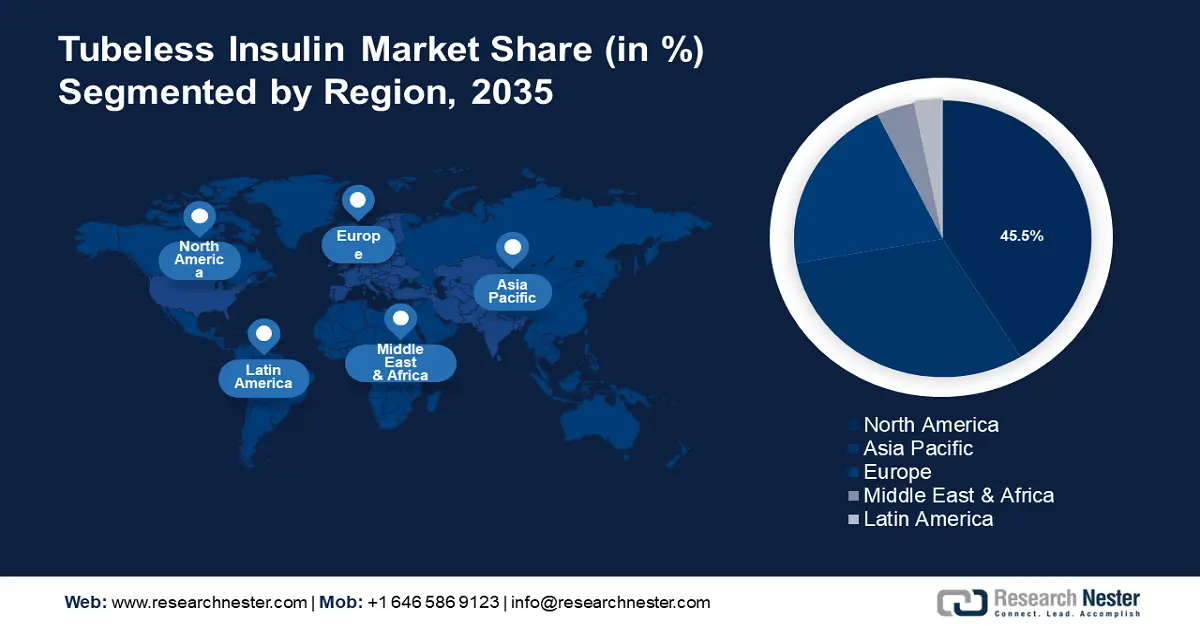

- The North America tubeless insulin pump market will secure over 45% share by 2035, driven by product innovations and rising awareness of advanced diabetic care.

Segment Insights:

- The hospitals segment in the tubeless insulin pump market is projected to hold the highest market share by 2035, attributed to rising awareness, advanced diabetic care in hospitals, and improved healthcare infrastructure.

- The insulin patch/pod segment in the tubeless insulin pump market is expected to capture the largest share by 2035, fueled by the ease of use and minimal supervision required for blood glucose management, replacing traditional syringe combinations.

Key Growth Trends:

- Rising cases of diabetes

- Increasing aging population in developing countries

Major Challenges:

- Stringent government regulations

Key Players: Insulet Corporation, Tandem Diabetes Care, Roche Diabetes Care, Cellenovo, Abbott, Terumo Corporation.

Global Tubeless Insulin Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.86 billion

- Projected Market Size: USD 16.69 billion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Tubeless Insulin Pump Market Growth Drivers and Challenges:

Growth Drivers

-

Rising cases of diabetes: As per the WHO, diabetes accounts for around 2 million deaths worldwide annually and a study published in Lancet states incidents of type 2 diabetes have increased after the COVID-19 pandemic. The government expenditure to manage diabetes has also increased in many countries, with the U.S. and Switzerland leading in diabetes-related expenditure. The need for advanced diabetes care has led to a boost in the demand for tubeless insulin pumps.

-

Increasing aging population in developing countries: As per a WHO report, there will be a rise in the geriatric population by 2050, and 80% of the older population will be concentrated in developing countries. The surge in the aging population along with the rising graph of diabetes cases in developing countries have been a major driving factor in the increase in demand for tubeless insulin pumps.

-

Continuous innovations to improve quality of life metrics: There have been steady advancements in continuous insulin delivery systems to facilitate ease for users. Tubeless insulin pumps are easier to use, and convenient, and also improve quality of life metrics when compared to multiple dosages of insulin injections. The integration with smartphones of other wearable technology such as smartwatches allows real-time diabetes management. The ease of use has generated greater demand and has pushed manufacturers to create more affordable products to boost accessibility in new markets.

Challenges

-

High costs and technical challenges: The application of tubeless insulin pumps is associated with high long-term costs. The higher costs are detrimental to affordability, especially in middle to low-income countries where diabetes cases are high. The use of these pumps is mildly complex and may require training which can deter certain sections of users. The lack of awareness in developing countries may also impede the growth of this sector.

-

Stringent government regulations: The approval of tubeless insulin pumps may take time due to stringent government regulations. Regulatory hurdles may delay the introduction of new products to the tubeless insulin pump market which can impede growth.

Tubeless Insulin Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 16.69 billion |

|

Regional Scope |

|

Tubeless Insulin Pump Market Segmentation:

Component Segment Analysis

The insulin patch/pod segment in the tubeless insulin pump market accounted for the largest share and it is expected to retain its position during the forecast period. The growth of the patch pump segment can be attributed to its ease of use as it can be attached to the skin with minimal supervision for blood glucose management. Due to their user-friendly nature, they are fast replacing the traditional syringe combinations and facilitating the growth of this segment. In January 2024, Embecta Corp. announced the submission of an FDA 510 (k) for an insulin patch pump.

The remote segment is rapidly growing due to the integration of tubeless insulin pumps with smartphones. The ability to administer insulin delivery without direct contact with the device fosters better convenience for the users. The focus on convenience is boosting the growth of this segment.

End use Segment Analysis

Based on end-use, the hospitals segment will have highest tubeless insulin pump market share by 2035 owing to the rising awareness and technical insights on advanced diabetic care in hospitals and improving healthcare infrastructure. The availability of skilled healthcare professionals and a large number of hospital admissions requiring diabetic care are also expected to drive segment revenue growth during the forecast period.

Our in-depth analysis of the global tubeless insulin pump market includes the following segments:

|

Component |

|

|

Type

|

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tubeless Insulin Pump Market Regional Analysis:

North America Market Insights

North America industry is likely to account for largest revenue share of 45% by 2035. Product innovations, high disposable income in the population, and rising awareness of advanced diabetic care are drivers of the growth of this region. According to the Centers for Disease Centers (CDC) report (2021) 11.6% of the U.S. population was diagnosed with diabetes. The government's efforts in diabetes care is rising with frequent campaigns being conducted to raise awareness and it has boosted the adoption of tubeless insulin pumps across the country.

In Canada, 5.7 million of the population are diagnosed with type 1 or type 2 diabetes as reported by Diabetes Canada in 2022. Due to the availability of different types of tubeless insulin pumps and presence of well-established healthcare facilities in the U.S. and Canada, both countries are prominent contributors to the North America market.

Asia Pacific Market Insights

Asia Pacific tubeless insulin pump market is expected to record significant growth between 2026-2035. Two of the countries with the highest rate of diabetes are from Asia Pacific i.e. China and India. In 2021, 140.9 million people were diagnosed with diabetes in China while 74.2 million were diagnosed in India. The increasing cases have prompted the governments to invest more in the healthcare sectors and raise initiatives for diabetes care.

The region is also accepting the influx of better technology and innovations. The rate of disposable income in the middle class of countries such as China and India are also rising which allows users to be able to afford advanced diabetic care. These are some of the key drivers that is poised to make the Asia Pacific the fastest-growing market in the tubeless insulin pump sector.

Tubeless Insulin Pump Market Players:

- Insulet Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diabetes Care

- Cellenovo

- Abbott

- Tandem Diabetes Care

- Valeritas, Inc

- Medtrum Technologies

The tubeless insulin pump market is competitive and new players are emerging. Several global and regional players are competing in this sector. The sector is very innovation driven as the focus is to improve the convenience of end-users. The key players are focused on innovation, partnerships, mergers & acquisitions to increase their tubeless insulin pump market share.

Recent Developments

- In February 2024, Tandem Diabetes Care, Inc launched Tandem Mobi in the U.S. This will be the world’s smallest and durable insulin delivery system.

- In April 2023, FDA approved the MiniMed 780G system. This product is equipped with the Guardian 4 sensor and has a meal-detection technology. The product is capable of adjusting the sugar level every 5 minutes.

- In August 2022, Omnipod 5 was commercially launched in the United States by Insulet. The device can be integrated with the smartphones of users.

- Report ID: 6368

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tubeless Insulin Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.