Tube Ice Machine Market Outlook:

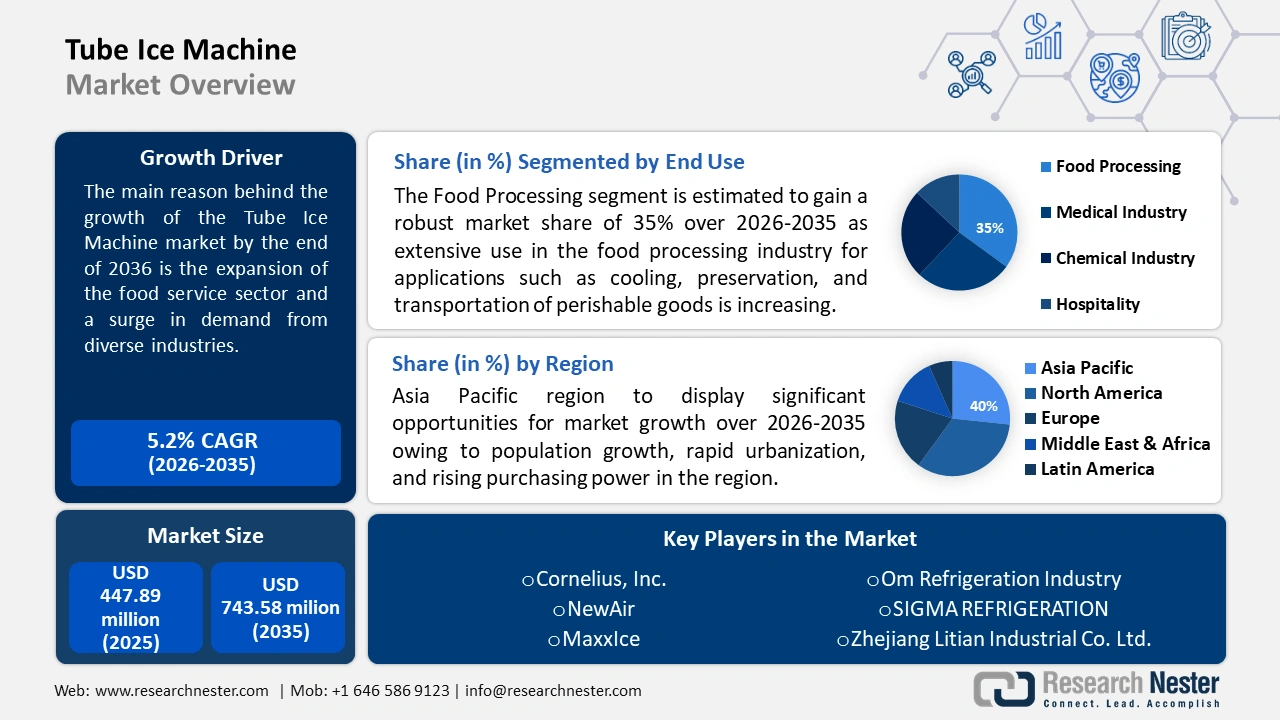

Tube Ice Machine Market size was over USD 447.89 million in 2025 and is poised to exceed USD 743.58 million by 2035, growing at over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tube ice machine is estimated at USD 468.85 million.

The primary function of tube ice machines is to produce cylindrical, long segments of ice that are frequently employed in the commercial and retail sectors for freezing and refrigeration. Tube ice devices are frequently employed by supermarkets, convenience stores, restaurants, and other establishments to maintain the freshness and low temperature of their food in display cabinets, refrigerators, and freezers. The ice cubes produced by the tube ice generator are uniform in shape and are effortless to store and transport. They are appropriate for locations that necessitate a substantial quantity of ice crystals.

The expansion of the food service sector and a surge in demand from diverse industries are among the main factors that contribute to the tube ice machine market growth. For instance, TUBE 5TON, a specialized machine that is specifically designed for commercial and extensive enterprises. It is engineered to generate millions of ice cubes through entirely automated operation. The ice molds are prepared for reuse in the renewal procedure within 15 minutes. It is perceived by hotels and bar-type establishments. It is under the Tamutom trademark and assurance.

Key Tube Ice Machine Market Insights Summary:

Regional Highlights:

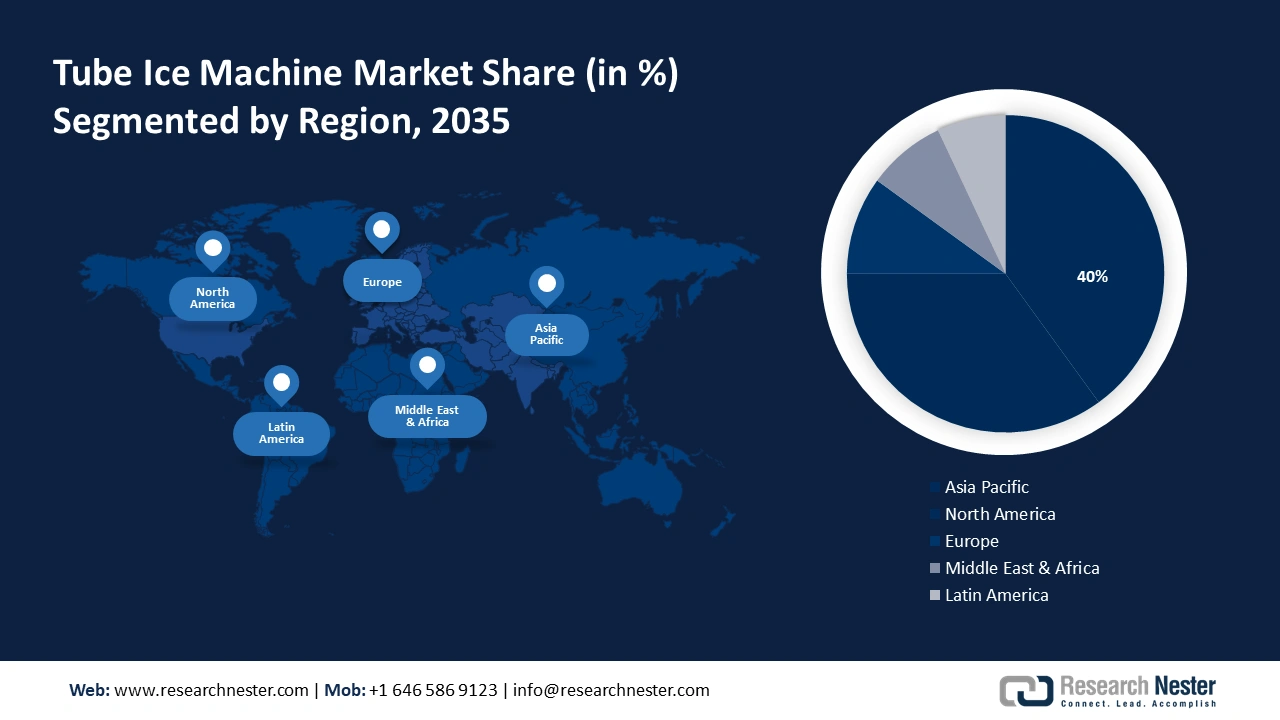

- Asia Pacific tube ice machine market is anticipated to capture 40% share by 2035, driven by population growth, rapid urbanization, and rising purchasing power in the region.

- North America market will achieve huge CAGR during 2026-2035, driven by a strong economy, advanced technologies, and increasing demand from multiple industries.

Segment Insights:

- The medium tubes segment segment in the tube ice machine market is expected to hold a 50.10% share by 2035, fueled by versatility and widespread applications across food, beverage, fisheries, pharmaceuticals, and construction.

- The food processing segment segment in the tube ice machine market is forecasted to achieve a 35% share by 2035, influenced by high demand for tube ice in seafood preservation, meat processing, and beverage packaging.

Key Growth Trends:

- Emission reduction and energy conservation

- Cognitive management

Major Challenges:

- Fluctuations in demand as a result of seasonal shifts

- Increasing concerns over water quality are hindering growth

Key Players: Nostalgia, Metalex Cryogenics Limited, The Scotsman, Om Refrigeration Industry, SIGMA REFRIGERATION, Zhejiang Litian Industrial Co. Ltd., Cornelius, Inc., NewAir, MaxxIce.

Global Tube Ice Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 447.89 million

- 2026 Market Size: USD 468.85 million

- Projected Market Size: USD 743.58 million by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Tube Ice Machine Market Growth Drivers and Challenges:

Growth Drivers

- Emission reduction and energy conservation – In the coming years, tube ice machines will pay more attention to energy conservation and emission reduction. They will use less harmful refrigerants and more efficient refrigeration technology in order to reduce the amount of energy that is consumed and the amount of carbon emissions that are produced.

Furthermore, the Energy Policy and Conservation Act (EPCA) mandates energy efficiency requirements for automatic industrial ice producers that manufacture cube-shaped ice with capacity ranging from 50 to 2,500 pounds of ice within a 24-hour timeframe. - Cognitive management – Tube ice machines will be able to achieve remote monitoring and smart management as a result of the development of technology that utilizes artificial intelligence and the Internet of Things. This will result in an improvement in the operational efficiency and defect warning capabilities of the machines.

Tube Ice Machines meet industry and customer needs. Capacities range from 1300 kg. Up to 40,000 kg/day tube ice. Ammonia (NH3) and Freon (R-22) cool these equipment. The technological advanced tube Ice Machine automatically freezes ice in vertical stainless steel tubes. - Advanced Biological freezing technology – As biotechnology continues to advance, tube ice machines will become an increasingly significant component in the field of biological freezing. These devices will offer more dependable options for the transportation and refrigeration of biological samples.

For instance, the concentration of ammonium in blood samples that are stored at ambient temperature for 30 minutes prior to centrifugation will increase by 31%. Blood samples may be chilled on ice or in ice water baths to minimize preanalytic error by placing them in precooled containers

Challenges

- Fluctuations in demand as a result of seasonal shifts – For distributors of ice makers, seasonal demand swings are a major obstacle. Accurate planning and allocation of resources help to balance production capacity with inventories to satisfy the varied demand in hotter climates or during warmer months. Inaccurate management of these variations results in shortages of inventory, extra manufacturing expenses, and lost sales opportunities, therefore influencing profitability and tube ice machine market competitiveness.

- Increasing concerns over water quality are hindering growth - The ice maker market is impeded by water quality concerns, which affect the safety and flavour of the ice that is produced. Due to concerns regarding water safety, consumers either refrain from purchasing ice producers or opt for alternatives. Manufacturers are under pressure to invest in expensive filtration systems, which could potentially reduce their tube ice machine market competitiveness and increase production expenses.

Tube Ice Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 447.89 million |

|

Forecast Year Market Size (2035) |

USD 743.58 million |

|

Regional Scope |

|

Tube Ice Machine Market Segmentation:

Type Segment Analysis

MMedium tubes segment in tube ice machine market is predicted to account for more than 50.1% revenue share by the end of 2035, Medium tube ice machines are versatile, and meant to have many applications, and are used in various sectors like Food, beverage, fisheries, pharmaceuticals, and construction. Medium tube ice machines may also produce small to big amounts of ice due to their moderate to high output capacity. Large industrial tube ice machines have a greater footprint than medium-sized ones. This makes them ideal for restaurants, pubs, convenience stores, and small food processors with little space. According to a study, Ice-making machines may require less frequent cleaning, but their maintenance is important to proper performance compared to open ice chests.

End Use Segment Analysis

Food processing segment is likely to account for around 35% tube ice machine market share by 2035. This segment requires large quantities of tube ice for processes like seafood preservation, meat processing, and these tube ice machines are also used for beverage packaging. Tube ice machines has extensive use in the food processing industry for applications such as cooling, preservation, and transportation of perishable goods that drive the tube ice machine market growth.

Moreover, tube ice machines can hygienically produce ice, meeting the stringent quality and safety standards required by the food processing industry. With the increasing global population and changing consumer preferences, there is a rising demand for processed food products.

Hospitality and fast food grew 7% globally in 2019. Americans 18yrs and older were surveyed about their quick-service restaurant consumption in 2016 and found out that 20% of respondents dine out at quick-service restaurants once a week, while 18% do frequently.

Our in-depth analysis of the global tube ice machine market includes the following segments:

|

Type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tube Ice Machine Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 40% by 2035, Population growth, rapid urbanization, and rising purchasing power in the region are driving the market, Also, Asia's population is expected to reach 6,682 million or 6,679,660,582 by 2035.

In China, shifting consumer preferences, increased disposable incomes, and the desire for storing consumable products like groceries rising the use of Ice making machines. Fuzhou Thermojinn International Trading Co., Ltd. manufactures of refrigeration equipment and ice makers at three 45,000-square-meter factories in Shengzhou, Zhejiang, Taizhou, Jiangsu, and Chongqing tends to drive the tube ice machine market growth.

Large fast-food businesses in South Korea are adopting more ice machines, driving industry expansion. A Korean firm, launched ice maker machines including RMN-A035 that has 13/Kg ice bin capacity and eco-friendly R-404A refrigerant that are safe from ozone-depleting substances thus, driving the industry demand.

North America Market Insights

The North America region will also encounter huge growth for the tube ice machine market during the forecast period and will hold the second position owing to the increasing frequency of obesity in this region. A strong economy, advanced technologies, and increasing demand from food services, healthcare, retail, and other industries are driving market expansion. Additionally, companies like Manitowoc Co Inc. offer new, high-quality ice machines that are widely known for their performance and dependability, fuelling tube ice machine market expansion.

Restaurants, hotels, and bars in the US need significant amounts of ice, and commercial ice manufacturing machines make it easy and efficient. For instance, TUBE 10, an ice making machine with water-contacting sections being stainless steposesel SUS304 or SUS316.This generates ice in tubes with outside dimensions of 22, 29, 35, and 41 mm thus, such machines help satisfy customer demand.

The HUBERT Kratos 69K-904 Full Dice Undercounter Ice Machine produces massive amounts of ice for fast-paced food service operations. This 22"L x 21"W x 32 3/4"H ice machine can handle big amounts of goods with its 120 lb. daily output capacity and 35 lb. bin storage capacity. The ice machine market grows because such machines meet customer need for cooling solutions in Canada.

Tube Ice Machine Market Players:

- HOSHIZAKI CORPORATION

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nostalgia

- Metalex Cryogenics Limited

- The Scotsman

- Om Refrigeration Industry

- SIGMA REFRIGERATION

- Zhejiang Litian Industrial Co. Ltd.

- Cornelius, Inc.

- NewAir

- MaxxIce

A few of companies have cornered the tube ice machine market and they're using tactics like mergers and acquisitions to further solidify their position.

Recent Developments

- The Scotsman, 2023 – Scotsman's new Prodigy ELITE® cube ice machine simplifies the process of owning, operating, and servicing an ice machine. Prodigy ELITE® offers a streamlined ownership experience by combining the ICELINQ® mobile app with convenient cleaning, service, and settings adjustments. Foodservice, healthcare, and hospitality applications are optimally adapted for Prodigy ELITE® units.

- Cornelius IDC Pro™, 2023 – This Cornelius innovation boasts reliability, cross-merchandising, and personalization. The IDC Pro gives over 3,260 combinations of 20 brands, 8 tastes, and. Easy product selection and navigation are made possible by our intuitive digital screen interface. Customers can always locate what they want quickly with the UI. Cornelius Flavor Shot enables customers blend or add flavor to their drink, offering them more alternatives.

- Report ID: 6195

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tube Ice Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.