Truck Platooning Systems Market Outlook:

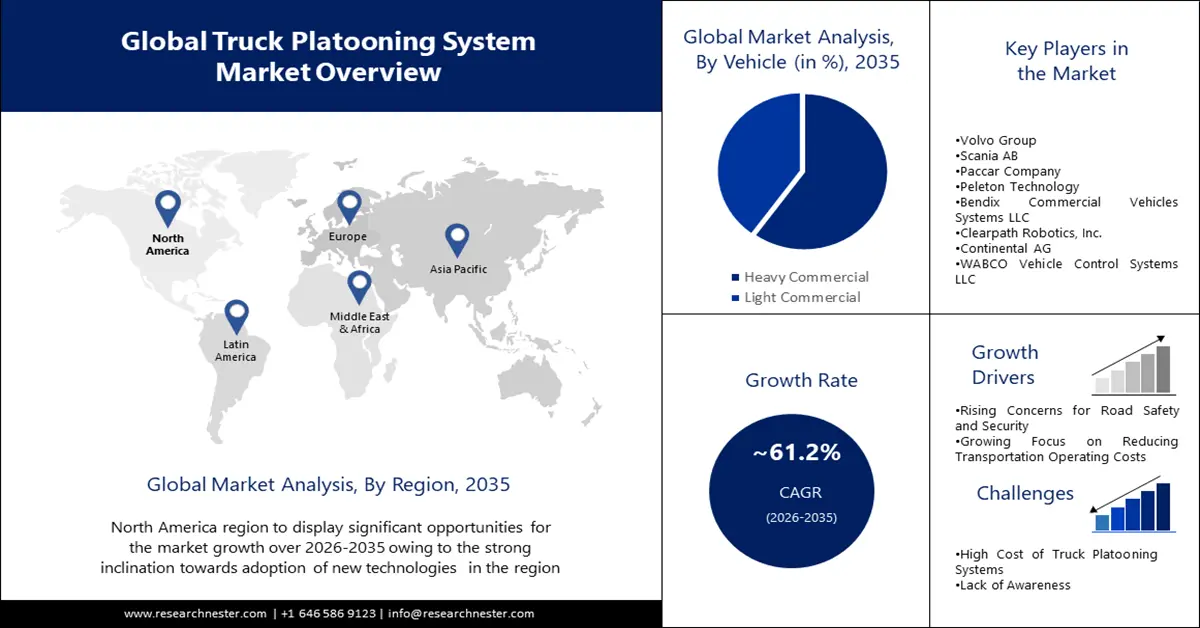

Truck Platooning Systems Market size was over USD 223.44 million in 2025 and is poised to exceed USD 26.47 billion by 2035, witnessing over 61.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of truck platooning systems is estimated at USD 346.51 million.

The market is primarily driven by the growth in car accidents due to driver errors and growing intent on lowering the transportation operational cost. As per the statistics, the highest number of road accidents were reported on highways which was 35% followed by state highways in India. Due to the wide demand for automated technologies in these sectors, the truck platooning system demand is anticipated to grow in various industries such as transportation, logistics, road development, and the IT sector.

Moreover, with the increasing production of commercial vehicles and rising demand for enhanced driver systems in vehicles, these technologies are gaining huge recognition. As per the data, approximately 24 million units of heavy buses, light commercial vehicles, and trucks were produced globally in 2021. These systems allow more predictive driving of trucks at the same time it also enhances the safety & security of other people on the road. New trends in the road freight sectors are enabling truck fleets to get equipped with the latest and advanced technologies.

Key Truck Platooning Systems Market Insights Summary:

Regional Highlights:

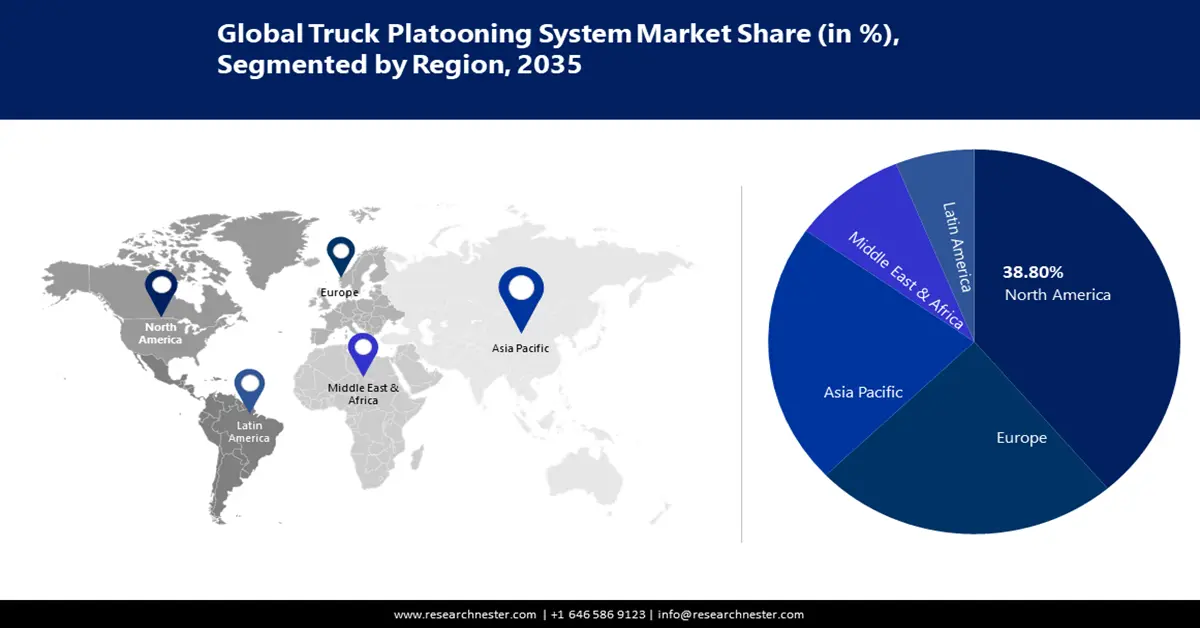

- North America truck platooning systems market will hold around 38.8% share by 2035, driven by regulatory support and increased investments in truck platooning technologies.

- Asia Pacific market will register significant growth from 2026 to 2035, fueled by growing investment in platooning operations, fuel efficiency goals, and technology adoption.

Segment Insights:

- The gps segment in the truck platooning systems market is anticipated to experience substantial growth during 2026-2035, driven by the ability of GPS to reduce accidents by assisting drivers in real-time decision-making.

- The heavy commercial segment in the truck platooning systems market is projected to hold the highest market share by 2035, fueled by improved road efficiency and safer transport.

Key Growth Trends:

- Rising Concerns for Road Safety and Security

- Growing Focus on Reducing Transportation Operating Costs

Major Challenges:

- High Cost of Truck Platooning Systems

- Lack of Infrastructure

Key Players: Daimler AG, Volvo Group, Scania AB, Paccar Company, Peleton Technology, Bendix Commercial Vehicles Systems LLC, Clearpath Robotics, Inc., Continental AG, WABCO Vehicle Control Systems LLC, TRATON SE.

Global Truck Platooning Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 223.44 million

- 2026 Market Size: USD 346.51 million

- Projected Market Size: USD 26.47 billion by 2035

- Growth Forecasts: 61.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, Sweden, United States, China, Japan

- Emerging Countries: China, India, Brazil, Mexico, Japan

Last updated on : 9 September, 2025

Truck Platooning Systems Market Growth Drivers and Challenges:

Growth Drivers

- Rising Concerns for Road Safety and Security – As the number of road accidents is increasing day by day the concerns regarding road safety and security are also increasing. The truck platooning system allows predictive driving in trucks and also allows road safety and security for both drivers as well people on the road. Young people are especially susceptible on the roads, and traffic accidents are the leading cause of death among children and adolescents (ages 5 to 29). 73% of all fatalities in traffic accidents include young males under the age of 25, who are more prone than females to be involved in crashes globally.

- Growing Focus on Reducing Transportation Operating Costs – Increasing demand for road safety among consumers and growing focus on reducing transportation operational costs is expected to drive the growth of this market in the forecast period.

- Growing Demand for Reduced CO2 Emission – The growing regulation on emission norms has pushed OEM and Tier 1 manufacturers to implement new technologies in heavy-duty vehicles. Additionally, various government authorities from various regions have implemented multiple regulations on CO2 emissions.

Challenges

- High Cost of Truck Platooning Systems – The truck platooning system is a high-cost technology that few people can afford. Therefore, this factor is projected to arise a limitation on the market growth in the forecast period.

- Lack of Infrastructure

- Environment Pollution

Truck Platooning Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

61.2% |

|

Base Year Market Size (2025) |

USD 223.44 million |

|

Forecast Year Market Size (2035) |

USD 26.47 billion |

|

Regional Scope |

|

Truck Platooning Systems Market Segmentation:

Technology Segment Analysis

In terms of technology, the GPS segment in the truck platooning systems market is poised to witness substantial growth by the end of 2035. These modules utilize GSM technology to locate vehicles efficiently. Similarly, each platoon of vehicles has installed GPS, RADAR, and cameras for quick response in circumstances that may prevent sudden accidents. A significant study conducted by Indiana University discovered that around 90% of accidents take place owing to human error. However, this technology can help in reducing the chances of accidents by helping the driver to take the correct decision at the correct time while driving.

Vehicle Segment Analysis

The heavy commercial segment is estimated to observe the highest share in the truck platooning systems market between 2025 – 2035 on the basis of vehicle segmentation in the truck platooning system landscape. Truck platooning systems are widely installed in heavy commercial vehicles to improve road efficiency, prevent drivers from road accidents, and make sure there’s faster delivery of goods.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Technology |

|

|

Vehicle |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Truck Platooning Systems Market Regional Analysis:

North American Market Insights

North America region is anticipated to hold over 38.8% market share by 2035, owing to the strong inclination towards the adoption of new technologies in the region. In addition, the development of favorable regulatory policies in the United States, and increasing investments in Truck Platooning Systems by market players are also projected to fuel market expansion. Besides, the transportation landscape plays a crucial role in operational logistics and trucks are one of a significant part of this sector in this region. In June 2018, FedEx, Volvo, and Carolina Turnpike Authority all together declared to test the platooning of Volvo trucks on the highway of North Carolina.

APAC Market Insights

It is anticipated that the Asia Pacific truck platooning systems market would experience significant expansion during the forecast period. The growth of the regional industry can be attributed to the growing investments to launch full-scale truck platooning operations in the region. Moreover, increasing demand for efficient and safer transportation, the requirement to reduce fuel consumption and emissions, and advancement in technology are factors driving the expansion of the market in the region.

Truck Platooning Systems Market Players:

- Daimler AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Volvo Group

- Scania AB

- Paccar Company

- Peleton Technology

- Bendix Commercial Vehicles Systems LLC

- Clearpath Robotics, Inc.

- Continental AG

- WABCO Vehicle Control Systems LLC

- TRATON SE

Recent Developments

- TRATON SE announced the acquisition of its remaining stake in Navistar International Corp. for a total cash consideration of USD 3.7 billion for expanding its product portfolio.

- Volvo Group and FedEx began the testing of connected truck platooning technology in North Carolina to reduce fuel usage in autonomous and connected trucks by driving in convoys.

- Report ID: 3874

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Truck Platooning Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.