Transportation Management System Market - Growth Drivers and Challenges

Growth Drivers

- Strict safety and compliance obligations: December 2024 amendments to the Toxic Substances Control Act (TSCA) by the EPA set high standards on manufacturers and importers of new chemicals, particularly those that persist, are bioaccumulative, and toxic, e.g., PFAS. Such amendments will abolish any coverings and stipulate a full safety review, as well as force a public disclosure of the determination of chemical safety. Manufacturers need to provide more comprehensive reports and information on chemical risks, environmental exposures, and proposed uses to address the added workload of reporting. These regulations drive chemical firms to adopt Transportation Management Systems (TMS) as a way of managing compliance documentation effectively, aligning audit readiness, and conforming to the legal mandates. These modifications are meant to safeguard human life and the environment in a better condition, as they avoid the entry of noxious chemicals.

- Regulatory evolution in the European Union: The European Union REACH Regulation requires that any company that manufactures or imports chemical substances in quantities of greater than 1 ton per year should complete their registration with the European Chemicals Agency (ECHA). The regulation plans to adopt a precautionary approach as it requires safety data provision, risk analysis, and refinements to be done regularly to make sure that chemicals are not subject to a high risk of adverse effects on human health or the environment.

REACH also encourages safer chemical alternatives to substances of very high concern, and improves the regularity of the chemical hazards of a given substance by making available a mutual public database of chemical hazards. This rigorous framework of regulatory strategies imposes intensive regulatory compliance needs, which introduces demand for the value of digital TMS to regulate complicated regulatory data, guarantee flawless documentation, and expedite logistics of the supply chain in the chemical industry. - Digitalization of logistics and chemical transport: Digitalization of chemical logistics is a profound innovation in chemical shipment. As per the 2023 Cefic report, the use of high technologies, such as AI-based route optimization, IoT-based real-time tracking, or blockchain-based documentation systems, helps streamline operations and make them more compliant with the regulatory framework. They enable accurate shipment tracking, automate documentation routines, and make better decisions in a changing supply chain context. While specific quantitative benefits such as percentage reductions in planning times are not provided, the report underscores widespread stakeholder recognition of these digital technologies as critical enablers for sustainability and competitiveness in chemical transportation. The implementation of such technologies supports better environmental reporting, risk mitigation, and compliance with increasingly stringent regulations.

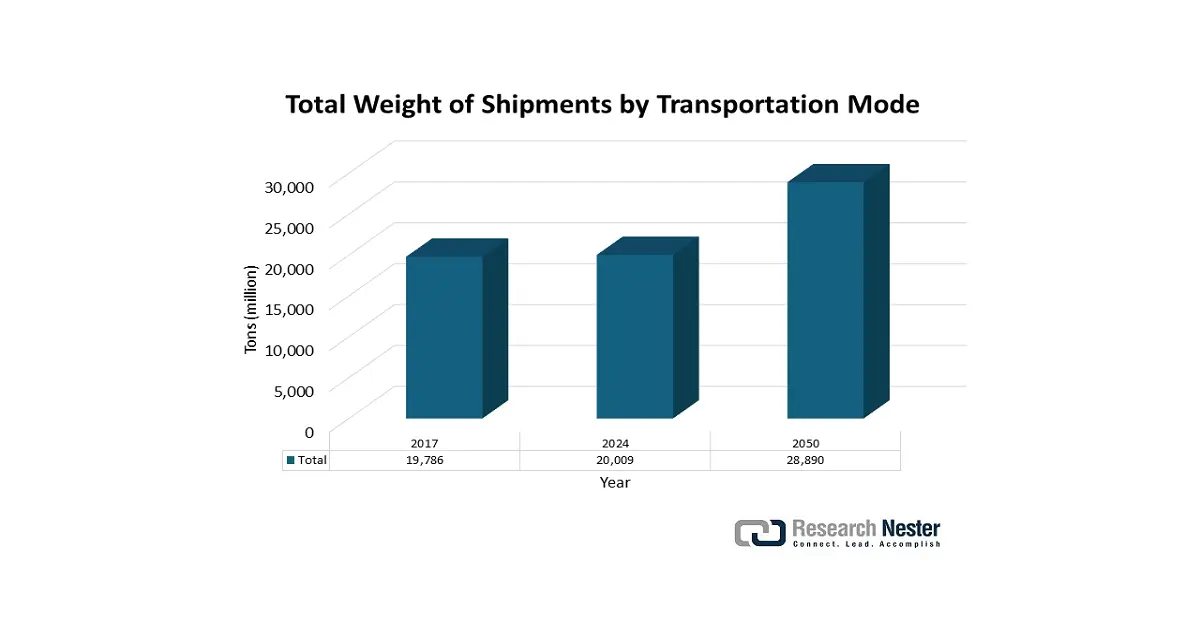

Freight Shipment Trends by Mode

The evolving weight and volume of freight shipments across truck, rail, water, and air modes are primary drivers for the Transportation Management System (TMS) market. As shipment volumes grow and logistics networks become more complex, businesses face immense pressure to optimize costs, capacity, and visibility across multimodal supply chains. A modern TMS is critical for automating mode selection, negotiating carrier rates, and consolidating less-than-truckload (LTL) shipments into cost-effective full truckloads (FTL).

(Source: Bureau of Transportation Statistics)

Challenges

- High regulatory compliance costs: Increasing EPA compliance and safety regulations in 2023 posed significant challenges to chemical manufacturing with the use of transportation management systems. According to the U.S. Congressional hearings, 67% of chemical manufacturers reduced the level of investment in the new technologies, and 83% were forced to re-divert the operational funds to maintain the pressure of the regulations. This regulatory pressure led to the slow expansion of facilities and compelled some manufacturers to relocate pockets of their operations overseas to cut costs. The SMEs were particularly dominated by a lack of ability to absorb increasing paperwork and compliance costs, restraining their growth and innovation in the U.S. chemical industry.

- Price volatility and competitive pressures: Volatility in feedstock prices can have a severe adverse impact on pricing stability and profit margins, given that the suppliers of transportation management systems have to deal with major price fluctuations. According to the Indian Oil Chairman at the World Economic Forum Davos 2025, crude oil prices are expected to vary between $75 and $80 per barrel in 2025, due to geopolitical expansions causing volatility, and this can compel the chemical manufacturers to continuously change supply and pricing models. This aspect of volatility makes long-term contracts impossible and budget planning a nightmare, besides enhancing risks to suppliers who aim at supplying products to satisfy the sustainability urge of consumers. Firms are being forced to generate more dynamic and flexible pricing policies at the expense of margin and competitiveness.

Transportation Management System Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 16.8 billion |

|

Forecast Year Market Size (2035) |

USD 48.8 billion |

|

Regional Scope |

|