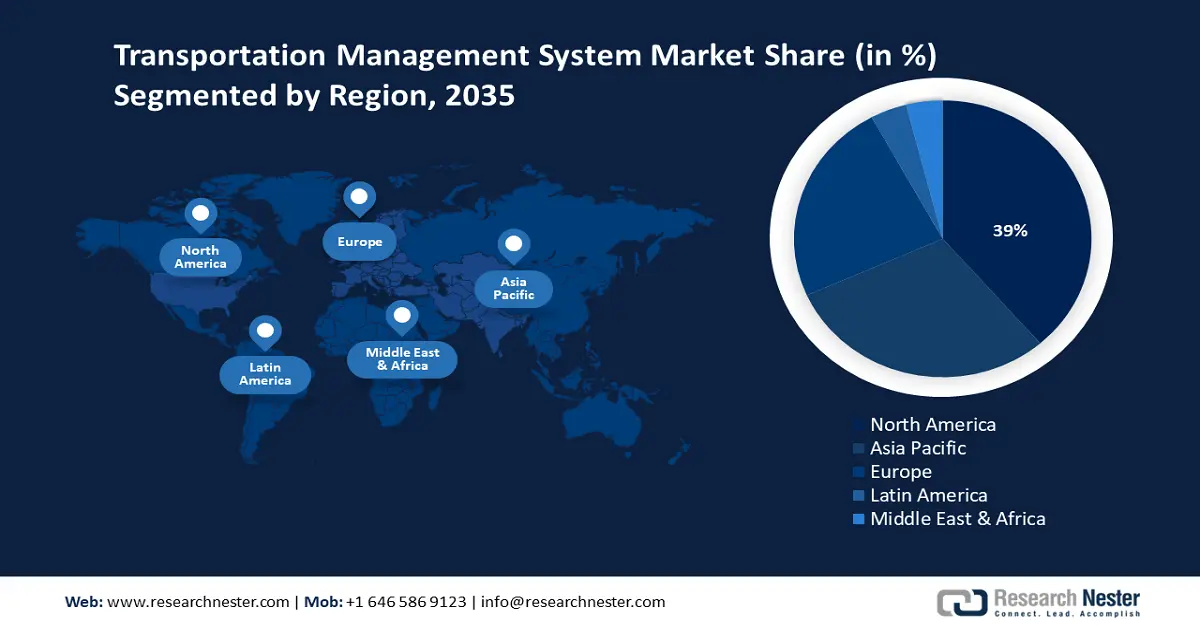

Transportation Management System Market - Regional Analysis

North America Market Insights

By 2035, the North American transportation management system market is anticipated to grow at a revenue share of 39%, attributed to the high investments in the digitalization of the supply chain and technologies in logistics. Recent years (2023) saw a rigid commitment of more than USD 50 billion in allocated funding to semiconductor and advanced manufacturing programs that led to a rise in freight tracking and sustainability, as well as chemical logistics modernization. By 2033, the chemical transportation demand is projected to increase by 15% and would necessitate increased TMS-enabled freight capacity and greater controls in monitoring hazardous materials. Federal programs such as the EPA’s Green Chemistry Program led to the adoption of more than 50 sustainable chemical processes in 2021, reducing hazardous waste and safety risks in logistics. Ongoing public-private collaborations continuously drive innovation in TMS technologies across North America, emphasizing scalability, regulatory compliance, and safe transport of chemicals.

The U.S. transportation management system market is expected to dominate the region, owing to rapid innovation driven by a highly advanced logistics infrastructure and robust private sector adoption. The Office of Clean Energy Demonstrations (OCED) announced USD 6 billion for 33 projects in 20 states focused on industrial decarbonization, the largest investment in this sector in American history, specifically targeting energy-intensive industries and strengthening the U.S. manufacturing and logistics base. The OECD also announced USD 890 million for three projects in California, North Dakota, and Texas to demonstrate advanced carbon capture, transport, and storage technologies that are highly relevant to decarbonizing freight operations.

The U.S. is a leader in the chemical sector; its leading-edge manufacturing is concentrated in automation and real-time data integration that contributes to increased supply chain resiliency and responsiveness. As of 2022, the U.S. has an enormous transport system that consists of 3,425,519 miles of public roads and a National Bridge Inventory that manages hundreds of thousands of bridges, making it possible to transport large amounts of goods and chemicals. These aspects make the U.S. market ready to experience endless growth of TMS, which will revolve around digital transformation and sustainability.

Canada’s transportation management system market is expected to grow substantially over the forecast years from 2026 to 2035, attributed to the rising transportation sector in the country. The transportation sector's share in the national economy in 2024 is estimated to contribute 4.3% of Canada's GDP, which is estimated at $96.5 billion, with a growth rate of 2.6% as compared to the immediate previous year. The transport sector generates close to one million Canadian jobs yearly and is at the core of easing the Canadian merchandise trade, whereby it was estimated to be about $1.55 trillion in five major trade corridors. In terms of mode, 46% of this value of trade was transported by road, 21.1% by sea, 11.6% by air, and 10.5% by rail.

The Canadian government keeps investing in clean energy and infrastructure; i.e., it has invested 1.5 billion into to Clean Fuels Fund to develop clean fuels and technologies under the Federal Sustainable Development Strategy. In 2024, cargo volumes and passenger traffic have experienced significant growth, mirroring the broader expansion seen across the global economy and logistics sector. Federal initiatives have motivated digitalizing documentation, real-time tracking of freight, and secure transportation processes with chemicals. Ongoing developments in the business of merchandise and investments in the freight infrastructure are keeping Canada at the cutting edge of transport logistics and management.

Asia Pacific Market Insights

The Asia Pacific transportation management system market is predicted to grow at a steady pace, with a 30% share during the projected years by 2035, driven by the considerable growth of the urban population and rising economic activities within cities. The region has a population growth of about 44 million per year, adding to its urban population, which drives the demand for transportation, requiring more sustainable and efficient transportation solutions. It is projected that 80% of future gains in economic activity in the Asia Pacific until 2050, according to the Asian Development Bank, will be based in urban environments, and thus continue driving growth in sophisticated TMS capabilities to streamline logistics flows and lessen congestion. Accompanying this transition, by Q3 2024, China’s outstanding green loans reached 35.75 trillion yuan (approximately $4.9 trillion), a 19% increase from 2023, with significant portions directed to green infrastructure and clean energy projects, including public transportation modernization. Such initiatives are an indication of the region’s dedication to sustainability in the urban transport sector, contributing to market growth.

The China transportation management system market is expected to lead the Asia Pacific region, attributed to its being the largest producer and consumer of chemical products, where the chemical industry contributes 20% of the total national industrial emissions and 13% of the total CO2 emissions in China. Necessary decarbonization of this segment is deemed to be one of the key concerns in the sense of the achievement of carbon neutrality of the country. Areas of transformation that are of significance to the identified key segments are ammonia, methanol, and ethylene, since they are the primary chemicals and have a high capacity to influence the national carbon output.

Opening up the way to low-carbon development Chinese government and industry are actively pursuing low-carbon development, involving technical innovation, policy support, and strategic investment. Such trends make high-value chemicals generated in the downstream increasingly resurgent concerning zero-carbon transition initiatives. The geographical distribution of chemical manufacturing is shifting toward areas with a high supply of green hydrogen and carbon capture, as is the case with China and its pathway toward a carbon-neutral future. This strategy positions China to be among the world leaders in establishing a green, competitive, and clean technology-based chemicals industry.

By 2035, India’s transportation management system market is set to grow with a significant growth rate, owing to the rising urban population, which in India was recorded as 522.9, compared to year 2.27% increase in the same figure. It is projected that the population of India living in an urban setting will be over 40% by 2030. The chemical industry of India accounted for more than 9% of the manufacturing gross value added in the country and 7% of total exports in 2024. It is estimated that the industry will exceed USD 300 billion by the year 2028. Policies of the government are focused on the enhancement of innovation, sustainable development, and the promotion of the ideas of a circular economy. Measures to improve targeted reforms assume that by the year 2040, the chemical industry is predicted to reach USD 1 trillion. The national and industry programs are concentrated on safety, green chemicals, and advanced logistics as sector growth drivers and environmental compliance.

Europe Market Insights

The transportation management system market in Europe is projected to experience an upward trend in the growth trajectory during the forecast years by 2035, driven by the solid industrial logistical requirements, the climate action policies, and the investments in digital freight solutions influence the Europe transportation management system market. The chemical sector of Germany is the largest in Europe, with a turnover of €225.5 billion in the year 2023, and 80% of the firms carry out R&D. The Chemical sector in France generated a turnover of €108.5 billion and a record 21% rise in capital expenditure on sustainability and innovation. The turnover of the UK chemical sector was 60 billion pounds, and a significant portion of it was devoted to environmental and safety work.

With the assistance of the European Green Deal, member states saw €400 million of new investments in green TMS solutions that made it possible to increase the demand for green logistics with member states. Nordic countries and the Netherlands can be considered as promoting the digital supply chain since it is carried out at the national level and in the framework of the EU, taking responsibility at the EU level, along with CEFIC.