Transparent Conductive Films Market Outlook:

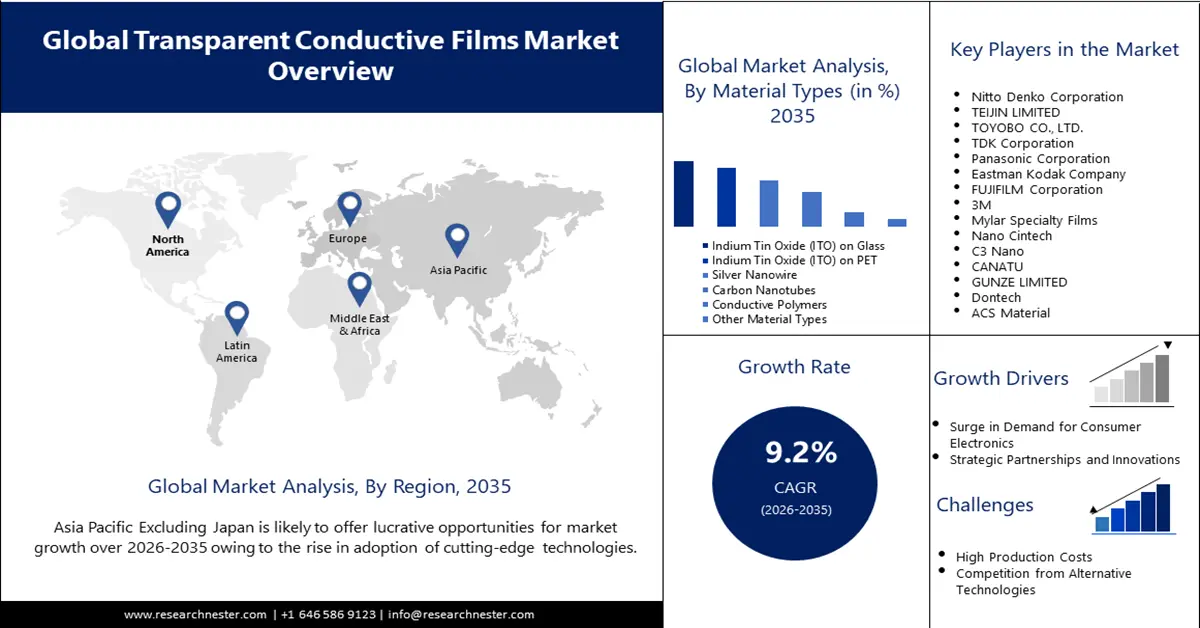

Transparent Conductive Films Market size was valued at USD 6.98 billion in 2025 and is expected to reach USD 16.83 billion by 2035, registering around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transparent conductive films is evaluated at USD 7.56 billion.

The growing demand for consumer electronics, such as smartphones, tablets, and wearables, is likely to spur market growth at an incredible rate. This surge in demand creates tremendous demand for high-performance transparent conductive films in the application of touchscreens and displays. For instance, in September 2023, Meta Materials Inc. signed a strategic cooperation agreement with Panasonic Industry Co., Ltd. The collaboration is focused on the joint development of NANOWEB films to drive market change and introduce new, groundbreaking applications in both the automotive and consumer electronics sectors.

Furthermore, the transparent conductive films market is constantly driven by innovations and opportunities. One such significant breakthrough was in May 2023 when researchers at the University of Surrey developed a new method to produce highly conductive and transparent silver nanowires. Such developments underline the dynamic research environment within the market and the likelihood of immense technological strides.

Significant developments underline companies' relentless pursuit to capture emerging opportunities and build a competitive edge. Industry leaders including Meta Materials and Panasonic, combined with innovative research, reflect the dynamism in the transparent conductive films market. These efforts are enhancing the capabilities of products and increasing their application across multiple industries. Through investment in R&D, companies ensure that their competitive stance is protected and make the industry's future promising.

Key Transparent Conductive Films Market Insights Summary:

Regional Highlights:

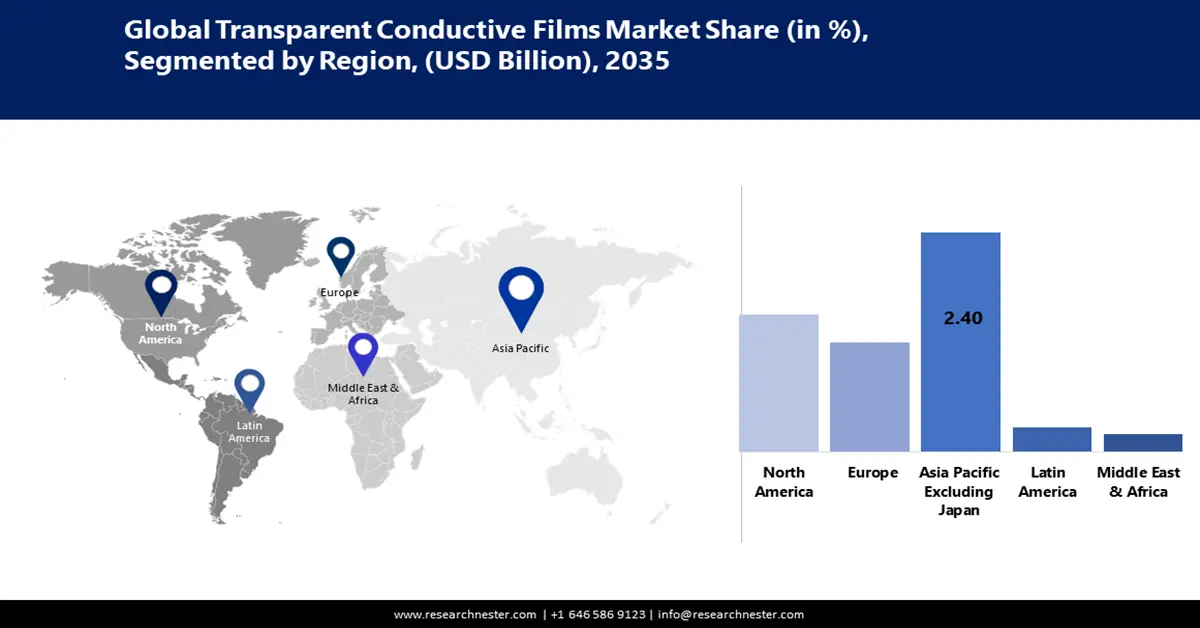

- The Asia Pacific transparent conductive films market will dominate around 42.80% share by 2035, driven by rising demand for smartphones and wearable electronics.

Segment Insights:

- The indium tin oxide (ito) on glass segment in the transparent conductive films market is anticipated to achieve a 28.30% share by 2035, driven by its well-established presence and reliability in various applications.

- The smartphones segment in the transparent conductive films market is projected to see significant growth till 2035, driven by rising sales of smartphones and widespread use of transparent conductive films in displays.

Key Growth Trends:

- Booming electronics industry drives adoption

- Growing sustainability focus

Major Challenges:

- Stringent regulations significantly impact transparent conductive film demand

- Fluctuations in raw material prices

Key Players: Nitto Denko Corporation, TEIJIN LIMITED, TOYOBO CO., LTD., TDK Corporation, Panasonic Corporation, Eastman Kodak Company, FUJIFILM Corporation, 3M, Mylar Specialty Films, and Nano Cintech.

Global Transparent Conductive Films Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.98 billion

- 2026 Market Size: USD 7.56 billion

- Projected Market Size: USD 16.83 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 17 September, 2025

Transparent Conductive Films Market Growth Drivers and Challenges:

Growth Drivers

- Booming electronics industry drives adoption - Growing demand for touch-screen devices, flexible electronics, and government measures to encourage energy efficiency drive the adoption of transparent conductive films. For example, in June 2023, Samsung Display announced the development of a new carbon nanotube-based transparent conductive film. According to the company, the new film is going to be more transparent and more conductive than current films. The improving foldable and rollable displays open up increased possibilities for new innovative product designs that have called for specialized conductive film variants.

- Growing sustainability focus- A major catalyzing factor driving the growth in demand for transparent conductive films is the escalating focus on sustainability, especially in the domain of electronics and optoelectronics. For example, Murata Manufacturing announced the development of a new material in November 2022, which integrated four contradictory properties—transparency, flexibility, conductivity, and safety—without any roadblocks. Major firms in the industry are likely to enter into partnerships with such businesses to collaborate on innovative applications where sustainability counts.

Challenges

- Stringent regulations significantly impact transparent conductive film demand- Stringent regulations greatly impact the demand for transparent conductive films, from influencing production processes to material choice and market dynamics. Environmental regulations, such as the EU's RoHS directive restricting hazardous substances in electronics strongly influences the choice of materials used in TCFs and adds to their cost. This dynamic can introduce a high degree of uncertainty of constantly changing standard requirements in the marketplace that manufacturers are expected to meet. Fluctuations in raw material prices- The price variations of raw materials significantly affect the profit and stability of the transparent conductive films market. Rising costs associated with alternative materials, such as silver nanowires and carbon nanotubes, push more volatility into the market, hence muddling long-term financial planning.

Transparent Conductive Films Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 6.98 billion |

|

Forecast Year Market Size (2035) |

USD 16.83 billion |

|

Regional Scope |

|

Transparent Conductive Films Market Segmentation:

Material Types Segment Analysis

The indium tin oxide (ITO) on glass segment will dominate the transparent conductive films market with a considerable revenue share of 28.3% by 2035 due to its well-established presence and reliability in various applications. However, the high production cost of Indium and its limited availability are making it difficult for this segment to grow at the same rate as other alternative materials. To cater to this issue, market players are focused on performance enhancement and making ITO films sustainable. This is expected to open new avenues in the market going ahead.

For example, in October 2023, Dai Nippon Printing Co., Ltd. and Microwave Chemical Co., Ltd. announced their new development related to a transparent conductive film using the microwave irradiation process for generating silver nanowires with a nanometer level that showed a good balance in high transparency and conductivity

Application Segment Analysis

The smartphones segment is expected to maintain its dominance, capturing a 23.3% revenue share by the end of 2035, due to rising sales of different types of smartphones and the widespread use of TCFs in touchscreens and displays. In September 2023, a report by Azo Materials underpinned the advantages of thin film electronics and increasing its rising demand in smartphone manufacturing. These include flexibility and lightweight with cost-effective features, which are ideal for applications ranging from wearable health monitors to foldable displays. Examples include smart bandages for wound monitoring and drug delivery and flexible OLED displays developed by Samsung for foldable smartphones and tablets.

Our in-depth analysis of the global market includes the following segments:

|

Material Types |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transparent Conductive Films Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 42.8% by 2035. This growth is due to the rising demand for consumer electronics, mainly smartphones, tablets, and wearable devices. The increase in population, together with the augmenting disposable incomes and adoption of cutting-edge technologies, is expected to further boost the market growth.

China’s market is estimated to record significant growth through through the forecast period. The growth of the market in China is spearheaded by the country's robust manufacturing base, strongly supportive government policies, and rapidly emerging technological progress. Companies are capitalizing on these favorable conditions to drive innovation and market expansion. A prime example of this is Zenithnano, a Chinese startup that, in July 2024, developed a groundbreaking, non-toxic alternative for transparent touchscreens. The development comes after China saw an increase in electric vehicle demand, thereby boosting the use of TCFs in automotive displays and touchscreens.

India's transparent conductive films market is expected to grow at a healthy CAGR till 2035. The country's growing consumer electronics industry, due to the surge in demand for smartphones and tablets, is one of the key factors driving this growth. Government initiatives through "Make in India" have been propagating domestic manufacturing and attracting investments in the electronic industries.

Several players are engaged in the development of top-of-the-line materials to meet the surging demand through innovative, state-of-the-art, transparent conductive films for applications in India and other developing nations. The result of this domestic production push has been concrete. A report by India Cellular and Electronics Association (ICEA) released in February 2024 states that India's electronics manufacturing sector has witnessed a significant spike, with the production of smartphones segment rising by 126% YoY.

The growth is further supported by the Production Linked Incentive of the government, attracted some of the world's leading players to set up new and expand the existing manufacturing facilities in India, hence increasing demand for high-quality TCFs and other electronic components.

North America Market Insights

North American transparent conductive films market is expected to witness lucrative CAGR till 2035. This growth can be attributed to increasing the adoption of technologies including OLED and flexible displays across several applications in consumer electronics, such as smartphones, TVs, and monitors. It also foretells the growing demand for transparent conductive films on account of a well-established electronics industry in the region and the rising demand for innovative and high-performance display solutions. Besides, the growing consideration towards sustainability and energy efficiency further fuels the market growth, as TCFs play a crucial role in such technologies as smart windows and solar panels.

The U.S. represents the largest market for transparent conductive films in North America. The maturity of technological infrastructure, coupled with high consumer spending and the presence of industry majors within the country, may be attributed to this dominance. For instance, in February 2022, Panasonic Corporation's Industry Company commercialized a double-sided full-wiring transparent conductive film using its original roll-to-roll construction method. This will foster increasing applications of high-performance TCFs mainly in vehicle-mounted displays and touch sensors.

Canada transparent conductive films market is projected to register substantial CAGR during the forecast period. Factors, such as the growing demand for wearable devices and flexible electronics in Canada, are interacting with an expanding automotive sector to drive market growth. In June 2021, Canatu Oy collaborated with DENSO Corporation to develop high-performance TCFs for automotive and other applications.

Transparent Conductive Films Market Players:

- Nitto Denko Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TEIJIN LIMITED

- TOYOBO CO., LTD.

- TDK Corporation

- Panasonic Corporation

- Eastman Kodak Company

- FUJIFILM Corporation

- 3M

- Mylar Specialty Films

- Nano Cintech

- C3 Nano

- CANATU

- GUNZE LIMITED

- Dontech

- ACS Material

- Dai Nippon Printing Co., Ltd.

- GEOMATEC Co., Ltd.

- Mianyang Prochema Commercial Co., Ltd.

- KANEKA CORPORATION

- CHASM

- Novarials Corporation

- MicroContinuum, Inc.

The transparent conductive films market is immensely competitive, with a few players dominating the market. Nitto Denko Corporation, TEIJIN LIMITED, TOYOBO CO., LTD., and TDK Corporation are some major companies in the market holding a share of around 77% through 2037. Companies are striving to remain competitive through engagement in sustainability initiatives, product launches, and strategic collaborations.

Research breakthroughs play a crucial role in boosting investments in transparent conductive film technology. In September 2023, NIH released a report that elaborated on a sophisticated yet innovative process for fabricating strong, flexible, and transparent conductive films. The innovative technique improves the electrical properties of such films and increases their durability against bending stress, making it highly competitive for use in the next generation of flexible electronic applications. As a result, this opens new opportunities for companies and manufacturers to produce high-performance flexible electronics more efficiently and cost-effectively.

Recent Developments

- In January 2024, FUJIFILM Corporation announced a 6-billion-yen investment in its Kumamoto site for expanding electronic materials production.

- In April 2023, researchers from Purdue created a patent-pending polymers that can form transparent organic conductors with the same properties as conventional conductors made from rare-earth minerals at a lower cost and more plentiful raw materials.

- Report ID: 6314

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transparent Conductive Films Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.