Transparent Aluminum Market Outlook:

Transparent Aluminum Market size was valued at USD 1.32 billion in 2025 and is projected to reach USD 3.29 billion by 2035, expanding at a steady CAGR of 9.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of transparent aluminum is estimated at USD 1.45 billion.

The primary growth driver for the expansion of the transparent aluminum market is the combined patronage of government agencies, primarily defense and aerospace. For instance, the global space economy is projected to grow from $630 billion in 2023 to $1.8 trillion by 2035, driving the development of advanced materials like transparent aluminum for applications such as infrared windows and armored vehicle components. Investments speak volumes about the Department of Defense's commitment to developing material capabilities that facilitate defense technologies. India has been developing a strong strategy to address this, with plans to invest nearly $90 billion in new transmission lines, substations, and other infrastructure between FY2022 and FY2032.

Transparent aluminum supply chain is backed by a robust network of producers, consumers, and raw material suppliers. Global export of aluminum articles and aluminum amounted to nearly USD 35 billion in 2023, and the largest exporter was China. Germany and the United States also export aluminum articles to a great extent around the world. Manufacturing capacity is rising to cater to the growing demand. This has partly been due to the modernization of smelters and secondary aluminum use.

Key Transparent Aluminum Market Insights Summary:

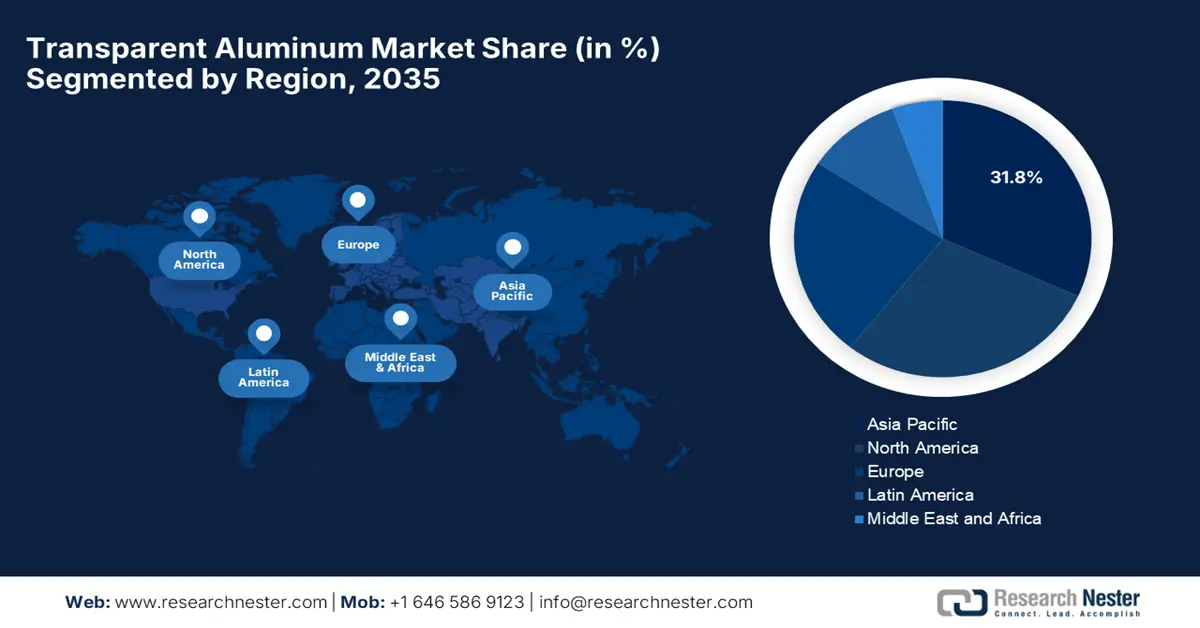

Regional Insights:

- The Asia Pacific transparent aluminum market is projected to command a 31.8% share by 2035 owing to applications in defense, automotive, and infrastructure.

- North America is anticipated to secure a 28.9% share by 2035 attributed to vigorous investments into defense, aerospace, energy, and chemical manufacturing industries.

Segment Insights:

- The ALON (aluminum oxynitride) segment is expected to capture 62.3% share by 2035 in the transparent aluminum market propelled by its transparent, lightweight, and ballistic-resistant advantages for next-gen defense and aerospace applications.

- The aerospace and defense segment is set to hold 41.3% share by 2035 due to its substitution of traditional glass in aircraft, UAVs, missile domes, and sensor windows under extreme operational conditions.

Key Growth Trends:

- Defense and aerospace innovation

- Infrastructure and energy efficiency

Major Challenges:

- Raw material supply constraints

- egulatory compliance and environmental pressures

Key Players: Coorstek Inc., CeramTec GmbH, Schott AG, Saint‑Gobain Ceramics & Plastics Inc., II‑VI Incorporated (Coherent Optical), AGC Chemicals Europe, Brightcrystals Technology, Morgan Advanced Materials plc, Murata Manufacturing Co., Ltd., McDanel Advanced Ceramic Technologies, Advanced Ceramic Manufacturing, LLC, Blasch Precision Ceramics Inc., Poongsan Corporation, LG Innotek (Advanced Materials).

Global Transparent Aluminum Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.32 billion

- 2026 Market Size: USD 1.45 billion

- Projected Market Size: USD 3.29 billion by 2035

- Growth Forecasts: 9.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 13 August, 2025

Transparent Aluminum Market - Growth Drivers and Challenges

Growth Drivers

- Defense and aerospace innovation: The transparent aluminum market is significantly propelled by the defense and aerospace sectors, where durable yet lightweight ballistic-resistant materials are a must. Applications such as armor vehicle windows, aircraft canopies, and sensor covers require a material with excellent clarity and strength. With government and private sector investments accelerating the development of next-generation defense technologies and space exploration, the need arises for advanced transparent materials capable of performing well under extreme conditions.

- Infrastructure and energy efficiency: The transparent aluminum market is expected to rise as a result of increased investments in building materials and energy infrastructure. Transparent aluminum is among the very few materials that provide excellent thermal insulation and impact resistance, thus well-suited for energy-efficient windows, solar panel covers, and smart building protective barriers. The focus by governments on sustainable urban development and renewable energy projects increases demand for these applications, which in turn encourages manufacturers to increase production and intensify R&D activities to improve material performance for durable and environmentally friendly architectural solutions. The UN Sustainable Development Goal 11 on Sustainable Cities and Communities, which focuses on creating inclusive, safe, resilient, and sustainable cities and human settlements, is centered on sustainable urban development. The majority of local governments in OECD nations are involved in policies related to housing, transportation, water, infrastructure, and climate change, and they also receive 55% of public investment. About 11% of OECD regions and 17% of cities have met the recommended SDG 11 targets.

- Expanding applications in smart cities and advanced architectural projects: The excellent properties of transparent aluminum, such as its durability, resistance to thermal expansion and contraction, and optical clarity, make it ideal for futuristic architecture and smart cities. There is growing interest in the application of transparent aluminum in building facades, secure windows, and blast-resistant glass, as the world's urban centers continue to expand, with more resilient infrastructure becoming necessary. With urban development taking place predominantly in the Middle East, Asia-Pacific, and North America, the transparent aluminum market in civil engineering and architectural applications is being driven by the investment in smart materials that ensure consistent, sustainable development and disaster-resilient buildings.

Transparent Aluminum Market Overview

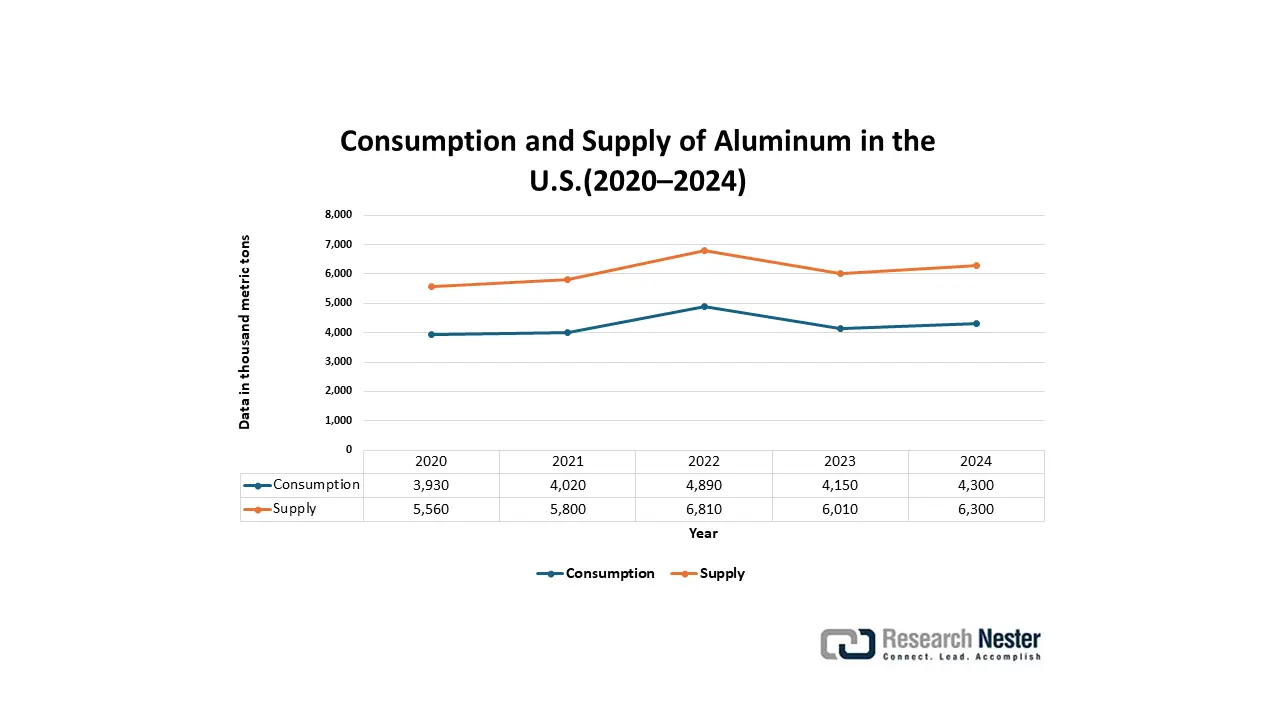

Domestic Production of Aluminum in the U.S. (2020-2024)

|

Production |

2020 (in thousand metric tons) |

2021 (in thousand metric tons) |

2022 (in thousand metric tons) |

2023 (in thousand metric tons) |

2024 (in thousand metric tons) |

|

Primary |

1,010 |

889 |

861 |

750 |

670 |

|

Secondary (from old scrap) |

1,420 |

1,520 |

1,480 |

1,560 |

1,600 |

|

Secondary (from new scrap) |

1,630 |

1,780 |

1,920 |

1,870 |

2,000 |

(Source: USGS.gov)

(Source: USGS.gov)

Challenges

- Raw material supply constraints: Key issues restraining the transparent aluminum market globally are due to the unavailability and high prices of key raw materials, like rare earths and specialty metals. The supply disruptions only aggravate the problem as geopolitical tension and trade restrictions disallow a smooth flow of goods, impacting consistent production and inflating lead times. These restrictions drive exorbitant costs of production, hence further lowering the manufacturer's capacity to meet the increasing demands of highly technical industries such as aerospace and electronics, resulting in transparent aluminum market growth hindrance and barriers to investments in capacity enhancement.

- Regulatory compliance and environmental pressures: Strict environmental rules and regulations set by the EPA and the ECHA force the transparent aluminum producers to face burdensome compliance measures and costs. Cheap raw materials and sometimes post-stamping processes are discouraged by the legislative design. The introduction of technical modifications resulting from newer safety laws and emission standards, plus monitoring requirements, has increased all operational costs. Such pressures curb innovation and decrease product turnover time, increasing market sluggishness and entry barriers, especially for those of the smaller manufacturers. This is expected to slow market growth, as companies struggle to juggle the implementation of the principles with profitability.

Transparent Aluminum Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 1.32 billion |

|

Forecast Year Market Size (2035) |

USD 3.29 billion |

|

Regional Scope |

|

Transparent Aluminum Market Segmentation:

Type Segment Analysis

The ALON (aluminum oxynitride) is expected to generate a major share of revenues in the transparent aluminum market, capturing around 62.3% by 2035, because it is a transparent and ballistic-resistant material when compared to other materials in the armor systems space. It weighs less than glass or other ceramics while offering a better level of protection against various threats. Its increased usage in next-gen military vehicles, drones, and space vehicles accounts for a substantial share of its market. The U.S. Department of Energy mentioned that ALON is best suited for lightweight armor dedicated applications and implementing energy-efficient defense technology. Similarly, the Oak Ridge National Laboratory describes ALON as transparent and the best choice for defense and aerospace optics, so it is of utmost importance to develop it according to military standards, while maintaining transparent performance capabilities when subjected to extreme environments.

Application Segment Analysis

The largest segment by application is aerospace and defense, accounting for 41.3% by 2035, because it substitutes for traditional glass covers in military planes, helicopters, and UAV canopies, missile dome covers, and sensor windows, partially due to the design requirements to overcome extreme pressures, temperatures, and ballistic impacts. The U.S. Air Force and NASA are actively evaluating ALON for future developments related to advanced cockpit enclosures and advanced surveillance systems. As per NASA Technical reports, transparent ceramics, including ALON, have been considered for space vehicle windows and optical domes because of their exceptional optical transmission, transmission characteristics, and long-term durability.

End use Segment Analysis

The largest segment by end use is military & security, accounting for 38.3% by 2035, due to increasing geopolitical tensions and defense modernization initiatives. The global demand for advanced protective materials is rapidly increasing. Transparent aluminum is emerging as a key protective material in personal protective equipment (PPE), UAV lenses, armored vehicles, and high-security infrastructure applications. The U.S. Department of Defense has recognized the material as a growth directive protective material in transparent armor systems, and lightweight and durable combat clothing and equipment. The impact of the new material on soldier mobility and the unit's payload is of growing interest to the DOD.

Our in-depth analysis of the global transparent aluminum market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

End use |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transparent Aluminum Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific transparent aluminum market is projected to hold a 31.8% share by 2035, due to applications in defense, automotive, and infrastructure. The region, particularly China, is experiencing strong domestic demand growth and government policies favoring the industry, making it the fastest-growing market in the world. The expanding transparent aluminum opportunity will be supported by increasing industrial investments with the adoption of high-performance materials for priority sectors. The increase in industrial production and regional variations in innovation are likely to be maintained beyond 2035.

China will play a significant role in the transparent aluminum market by 2026–2035 because of its robust domestic demand, robust government support, and established manufacturing industry. Growth areas are defense (including aircraft and vehicle applications), aerospace, and increasing usage in automotive applications, including glass and other parts (supported by catalogue listings), and with government support. Together, this level of burgeoning market demand combined with supportive government initiatives makes China's partial transition from rolled steel to transparent aluminum in many important industries likely through 2035.

China is the world’s largest producer of aluminum. Its dominance is driven by vast smelting capacity, abundant resources, and major investments in green hydropower-based production. In 2021, China Hongqiao Group, the world's largest private aluminum producer, proposed to relocate 1.94 million tons of aluminum capacity to the Honghe prefecture in southwest Yunnan province, according to a local official notification. According to a statement released by the Yunnan Industry Department, the aluminum giant intends to transfer capacity from six projects in its Shandong divisions to Yunnan Honghe New Material Co. under a capacity exchange plan. Hongqiao had pledged to relocate approximately 2 million tons of its yearly capacity from eastern Shandong province to Yunnan's Wenshan prefecture to improve access to hydropower, a cleaner source than coal. According to reports, more than 61% of the company's 6.47 million tons of permitted annual primary aluminum capacity will be located in Yunnan province, which accounts for approximately 11% of China's aluminum capacity.

North America Market Insights

North America has a 28.9% market share in the global transparent aluminum market of 2035, due to vigorous investments into defense, aerospace, energy, and chemical manufacturing industries. In North America, transparent aluminum (mainly aluminum oxynitride or ALON) is increasingly being used in high-performance applications that demand it to be lightweight, durable, and transparent.

In the U.S., a significant contributing factor for demand is funding from the Department of Energy (DOE) for advanced materials R&D, which included funding for optical ceramics and composite materials as part of the National Laboratory funding if the research improved energy efficiency and performance in adverse environments. The Environmental Protection Agency (EPA) is approving new regulations for sustainable, low-emission materials and testing, and affect industries where they pave the way forward for the use of materials that are recyclable and corrosion-resistant, such as ALON. The National Institute of Standards & Technology (NIST) also regularly incentivizes precision manufacturing and materials innovation, and NIST has advanced collaborations with national laboratories and the private sector.

Europe Market Insights

Europe is forecasted to earn a mere 23.5% share in the global transparent aluminum market due to emerging into the clear aluminum marketplace, largely due to growing needs in the aerospace, defense, and performance optics market segments. Annual growth will be fueled between the years 2026 and 2035 by a slew of EU-funded projects in materials innovation and sustainability. Germany and the UK lead the way with R&D investments in ALON (Aluminum Oxynitride) for armor-grade optics and the support of the European Defense Fund (EDF), encouraging integration of advanced ceramics to be used as a part of a defense system.

Further, aluminum demand in Europe remains strong, driven by transportation, construction, and packaging sectors, with a growing shift toward recycled aluminum to meet sustainability goals. Increasing EU regulations on carbon emissions are pushing industries toward low-carbon and circular aluminum solutions. In 2020, Europe's transportation industry used 4.3 Mt of aluminum, accounting for 34% of overall demand. Construction took 2.4 Mt (19%), followed by Electrical at 1.6 Mt (12%). After China and Australasia, Europe is expected to have the third-smallest increase in aluminum consumption globally, from 12.8 Mt in 2020 to 17.6 Mt in 2030. Nonetheless, the transportation sector will account for over half of this growth, followed by the construction sector at 16% and packaging at 13%.

Key Transparent Aluminum Market Players:

- Surmet Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Coorstek Inc.

- CeramTec GmbH

- Schott AG

- Saint‑Gobain Ceramics & Plastics Inc.

- II‑VI Incorporated (Coherent Optical)

- AGC Chemicals Europe

- Brightcrystals Technology

- Morgan Advanced Materials plc

- Murata Manufacturing Co., Ltd.

- McDanel Advanced Ceramic Technologies

- Advanced Ceramic Manufacturing, LLC

- Blasch Precision Ceramics Inc.

- Poongsan Corporation

- LG Innotek (Advanced Materials)

The worldwide transparent aluminum market is considerably consolidated, with U.S. firms such as Surmet and Raytheon prevailing in overseas competition due to their superior R&D capabilities and strong demand from the defense sector. The bulk of the European players (CeramTec, Schott, etc.) are either patented or licensed to manufacture aerospace-grade ALON and spinels and utilize strong export capabilities to ensure sustainable competitiveness. Emerging players from India and Malaysia are increasingly puzzling with major capacities, particularly if they are connected with innovation clusters backed by their respective governments. Overall, the strategies which companies seem to be using, include vertical integration, joint ventures, proprietary manufacturing technologies, and the intent to penetrate adjacent markets, specifically automobile optics and the renewable energy sectors. Global players appear to be investing in automated production capabilities, AI-based quality assurance, and localized production capabilities to reduce production costs and ensure acceptable performance levels to satisfy the supply chain.

Top Global Manufacturers in the Transparent Aluminum (AlON)

Recent Developments

- In July 2024, Surmet Corporation launched high-performance ALON infrared sensor domes specifically designed for unmanned aerial vehicles (UAVs). The domes had high thermal resistance with excellent optical transparency, which is required in advanced surveillance and targeting systems. These domes had been inserted into Northrop Grumman’s Global Hawk UAV upgrade, where approximately a 25% improvement in target acquisition accuracy was reported. Surmet’s aerospace division had year-over-year revenue gains of 15% propelled by strong aerospace demand, which is an indication that component acceptance of ALON material and treatments in next-generation aerial defense systems are taking off.

- In April 2024, Raytheon subsidiary Collins Aerospace introduced its latest ALON-based transparent armor panels intended for next-gen fighter aircraft and rotorcraft. The panels provide better optical clarity and ballistic protection while achieving a 30% reduction in overall weight relative to traditional glass composites. The development of these panels led to a 12% increase in orders for aerospace armor by the end of the year. The U.S. Department of Defense also made it part of its FY2025 Joint Light Tactical Vehicle (JLTV) vision systems procurement strategy, which is part of a planned implementation of new defense optics.

- Report ID: 7969

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transparent Aluminum Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.