Transient Elastography Devices Market Outlook:

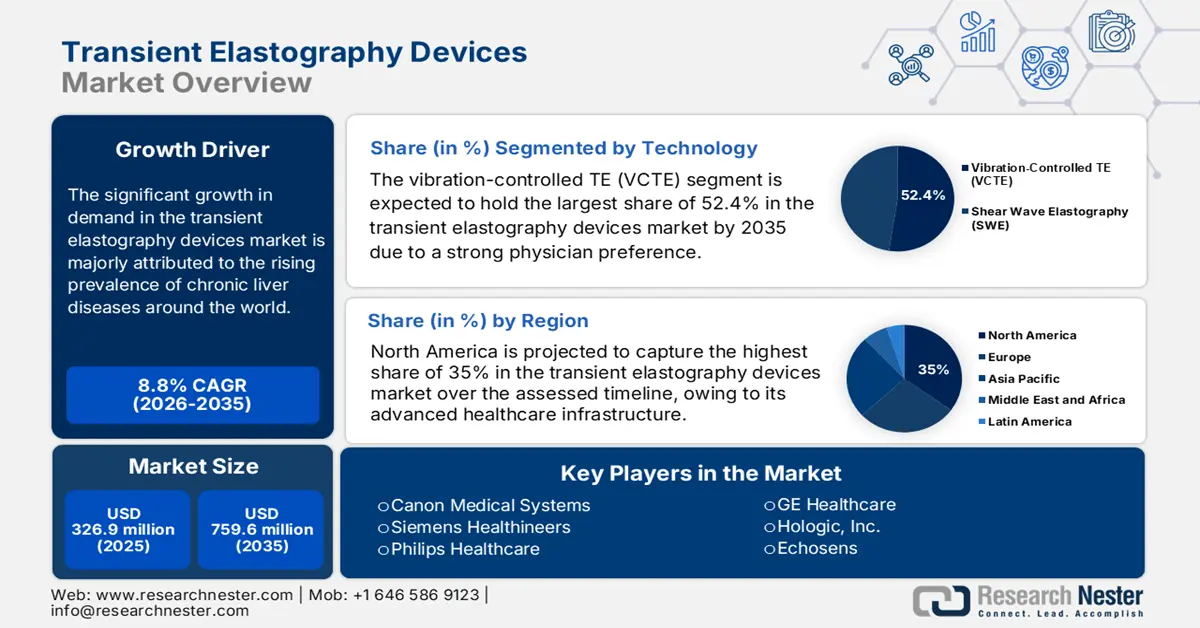

Transient Elastography Devices Market size was valued at USD 326.9 million in 2025 and is projected to reach USD 759.6 million by the end of 2035, rising at a CAGR of 8.8% during the forecast period 2026-2035. In 2026, the industry size of transient elastography devices is evaluated at USD 355.6 million.

The market is fueled by the rising prevalence of chronic liver diseases, including non-alcoholic fatty liver disease (NAFLD) and hepatitis B/C infections, around the world. In this regard, the WHO in April 2024 reported that 254 million people live with hepatitis B and 50 million with hepatitis C in 2022. Thus, several concerned authorities are investing heavily in this sector to increase public access to advanced diagnosis and treatment. For instance, in 2023, a screening program was released by the government of Europe, aiming to reduce liver fibrosis progression by the end of 2030, as per the European Association for the Study of the Liver.

The standard pricing structure in the market is highly stimulated by disruptions in the supply chain of raw materials and critical components. Testifying this, the International Trade Centre (ITC) reported that the major suppliers of such essentials, including ultrasound transducers, shear wave sensors, and AI-based processing units, were the U.S., Germany, and Japan. On the other hand, the global trade of medical instruments reached USD 167 billion, including the transient elastography devices. These dynamics demonstrate the device pricing changes in trade policies and geopolitics, which affects market accessibility and competitiveness globally.

Key Transient Elastography Devices Market Insights Summary:

Regional Highlights:

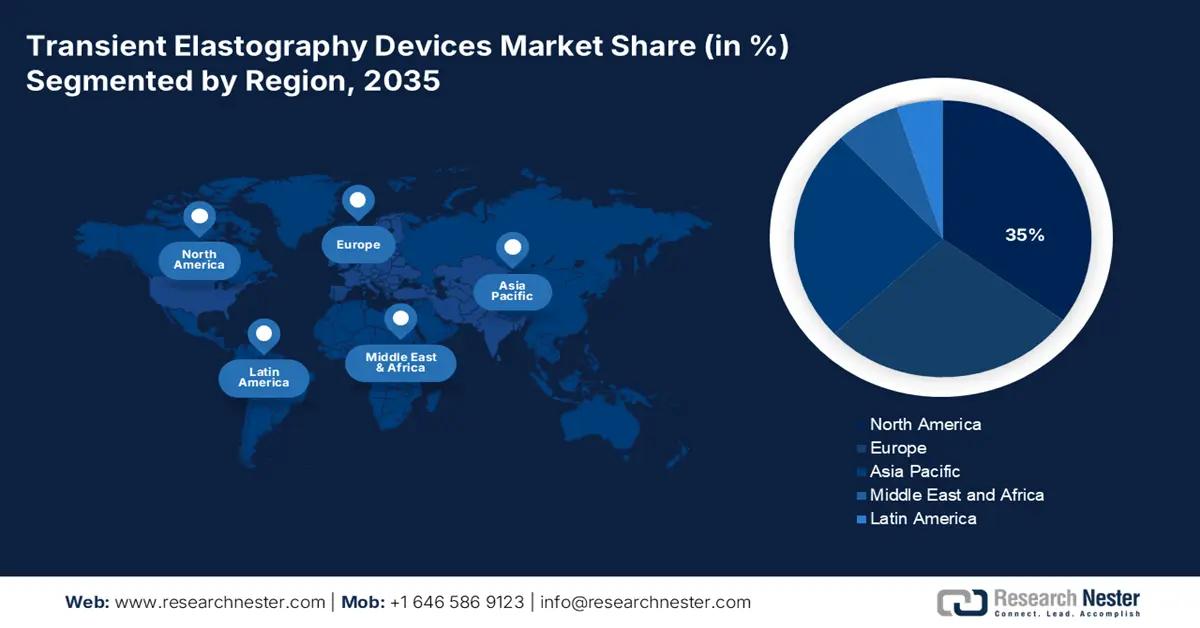

- North America in the transient elastography devices market is projected to hold a 35% share by 2035, supported by the advanced healthcare infrastructure, increasing liver disease prevalence, and expanding reimbursement coverage.

- Asia Pacific is anticipated to witness the fastest growth by 2035, propelled by escalating liver disease cases, rising healthcare investments, and strong contributions from emerging economies such as China and India.

Segment Insights:

- The vibration-controlled TE (VCTE) segment in the transient elastography devices market is projected to command a 52.4% share by 2035, propelled by strong physician adoption, established reimbursement frameworks, and proven clinical accuracy.

- The liver fibrosis assessment segment is expected to lead the market by 2035, driven by the rising prevalence of chronic liver diseases and increasing emphasis on early and precise fibrosis detection.

Key Growth Trends:

- Continuous investment in extensive R&D

- Rising liver disease prevalence

Major Challenges:

- Economic disparities and financial exhaustions

Key Players: Echosens, GE HealthCare, Siemens Healthineers, Canon Medical Systems, Fujifilm Holdings, Philips, Mindray Medical, Samsung Medison (Harman), SuperSonic Imagine (Hologic), Esaote SpA, Hitachi, Ltd., Shenzhen Mindray Bio-Medical, Heal Force Bio-meditech, Medonica Co. Ltd., Fukuda Denshi Co., Ltd., Sonoscape Medical Corp., BCF Technology Limited, Yokogawa Electric Corporation, Nihon Kohden Corporation, Honda Electronics Co., Ltd.

Global Transient Elastography Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 326.9 million

- 2026 Market Size: USD 355.6 million

- Projected Market Size: USD 759.6 million by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, Singapore

Last updated on : 29 September, 2025

Transient Elastography Devices Market - Growth Drivers and Challenges

Growth Drivers

- Continuous investment in extensive R&D: The integration of advanced technologies, such as artificial intelligence (AI) and cloud computing, is revolutionizing the efficacy and utility of the products available in the market. This is pushing organizations to invest heavily in developing more efficient and multi-functional solutions. For instance, the global research, development, and deployment (RDD) fund allocation in this field was dedicated to AI-enhanced elastography. Furthermore, the growing focus on innovating tools for delivering multi-organ fibrosis assessment and user convenience is expanding the pipeline of this sector.

- Rising liver disease prevalence: The global epidemic of non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH) is the primary demand driver. The American Liver Foundation report in July 2025 estimates that NAFLD affects approximately 25% of the U.S. population. On the other hand, the WHO's global hepatitis elimination strategy necessitates a widespread of screening and monitoring, creating a massive, sustained patient pool requiring non-invasive fibrosis assessment and driving device adoption in both developed and emerging markets.

- Major unmet demand in emerging markets: High adoption of advancements in technology in medical sector is mostly seen in developed economies. It is necessary for the regions such as Asia-Pacific and Latin America to persist in advancements. According to the July 2025 WHO data, nearly 75% of the people have chronic hepatitis B in the Asia-Pacific, with an estimated 254 million individuals worldwide suffering from chronic hepatitis B as of 2022. Sustained high rates of hepatitis B and C in these areas, combined with nascent screening programs, offer vast growth opportunities. Manufacturers with affordable solutions specific to these markets can seize this chance, with government efforts to enhance diagnostic facilities and address WHO elimination targets.

Global Trade Flow of Medical Instruments (Relevant to Transient Elastography Devices, 2023)

|

Country |

Export Value (USD) |

Import Value (USD) |

|

U.S. |

34.8B |

37.7 |

|

Germany |

18.4B |

13.1 |

|

Mexico |

17.6B |

4.62 |

|

Netherlands |

9.38 |

14.1B |

Source: OEC 2023

Challenge

- Economic disparities and financial exhaustions: Despite the government subsidies and reimbursement policy improvement, baseline affordability and high out-of-pocket costs are still a few of the major hurdles in the transient elastography devices sector. Particularly, in the regions with limited resources and budget-constrained healthcare systems, the available products become more expensive for a majority of individuals. In addition, the amplifying burden of financial exhaustion among payers may also impact the wide adoption in this field. However, innovative pricing models and policy reformations are enhancing affordability and availability in this category.

Transient Elastography Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 326.9 million |

|

Forecast Year Market Size (2035) |

USD 759.6 million |

|

Regional Scope |

|

Transient Elastography Devices Market Segmentation:

Technology Segment Analysis

Based on technology, the vibration-controlled TE (VCTE) segment is expected to hold the largest share of 52.4% in the transient elastography devices market by 2035. The segment's leadership is reflected by the strong physician preference and established reimbursement enlisting, particularly in hepatology practices. As a mainstream technology, this subtype has become the most valuable asset for liver stiffness measurement due to its proven accuracy, reproducibility, and value-based outcomes while being non-invasive, as demonstrated by numerous studies. The technology's proprietorship is further fueled by its incorporation and compliance with global medical standards and widespread availability across both hospital and outpatient settings, consolidating a steady and reliable consumer base.

Application Segment Analysis

In terms of application, the liver fibrosis assessment segment is poised to dominate the transient elastography devices market throughout the discussed timeframe. The rapid escalation in the population of patients with chronic liver diseases around the world is making this segment a priority for both service providers and dedicated MedTech pioneers. In this regard, the WHO report in April 2024 revealed that more than 1.3 million people were dying due to hepatitis each year till 2022, highlighting the need for early and accurate fibrosis detection tools. Moreover, the amplifying focus on combating risks and frequent incidences of liver-related ailments, such as NAFLD and hepatitis infections, is mandating the adoption of detecting and monitoring solutions from this sector.

End user Segment Analysis

Hospitals are leading the end-user segment due to their high patient volume, trained technician availability, and the necessity of detailed diagnostic workups. Complicated liver cases also usually need elastography to be integrated with other imaging devices and laboratory tests, which are usually done in the hospitals. Medicare reimbursement models and other national health systems' schemes for hospital-based services, combined with investments in sophisticated hospital facilities, preserve this segment's leadership.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Technology |

|

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transient Elastography Devices Market - Regional Analysis

North America Market Insights

North America is projected to capture the highest share of 35% in the transient elastography devices market over the assessed timeline. The region's strong emphasis on advanced healthcare infrastructure and robust adoption of non-invasive diagnostics is primarily driving this leadership. It also encompasses a continuously emphasizing patient pool, where nearly 4.5 million people are diagnosed with liver disease, with the people aged above 18, according to the Centers for Disease Control and Prevention report in January 2025. Moreover, the expansion in reimbursement coverage from Medicare and Medicaid is acting as a financial cushion for afflicted citizens, securing a greater cash inflow in this merchandise.

The U.S. is leading the transient elastography device market, and is fueled by the rising cases of nonalcoholic fatty liver disease affecting more than 38% of the people in the country, and this number has increased by 50% in the last three years, based on the American Diabetes Association data published in February 2024. Clinical adoption is strengthened by the American Association for the Study of Liver Diseases guidelines, which suggest elastography over biopsy. Further advancements in technology, such as innovations in integrating AI in devices, further enhance the accuracy and strategic deployments in point-of-care settings.

The Prevalence of Liver Diseases in the U.S. and Canada

|

Country |

Prevalence |

|

U.S. |

4.5 million |

|

Canada |

1 in 4 individuals |

Source: CDC January 2025, Liver Canada January 2025

APAC Market Insights

The Asia Pacific transient elastography devices market is predicted to be the fastest-growing landscape worldwide by the end of 2035. Heightening liver disease burden and proactive healthcare investments are the major growth drivers in this region. As per NLM data in March 2025 prevalence of NAFLD is expected to rise from 38.9%, representing a 43.2% increase over two decades. The contribution of emerging economies, such as China and India, is also adding to its clinical discoveries and commercial expansion in this category with significant investments.

China is showcasing a notable propagation in the market with its predominant captivity over raw material resources, an essential part of related tools. This can be testified by the 2024 report from the ITC, displaying this country is leading the proportion in the global piezoelectric crystal supply. Furthermore, the substantiation flow of capital from both government and private entities is also displaying a lucrative environment of business for leaders in this sector. This strategic dominance, coupled with rising domestic demand for non-invasive liver disease diagnostics, moreover places China as the leader in the global transient elastography devices market trajectory.

Europe Market Insights

The market for transient elastography devices in Europe is defined by high-quality healthcare systems, good disease awareness, and ongoing government engagement in non-invasive diagnostics. The Journal of Hepatology reported in August 2023 that liver disease accounted for 2 million deaths every year, representing 4% of all deaths. Further, the market is driven by a rising cases of non-alcoholic fatty liver disease (NAFLD) and viral hepatitis, clinical guidance favoring elastography over liver biopsies, and other factors. Technological developments such as hybrid devices that combine elastography and ultrasound, the expansion of applications beyond hepatology, and the incorporation of elastography into national screening programs are some trends.

Germany is leading the transient elastography devices market in Europe and is projected to hold the highest revenue share by 2035. The country is driven by an advanced healthcare infrastructure, high healthcare expenditure, and early adoption of advanced technologies in the healthcare sector. The report from the Federal Ministry of Health depicts that rising investments in digital diagnostics focus on non-invasive methods such as elastography. Further, the growth is driven by the rising prevalence of NAFLD, and strong reimbursement policies under the German statutory health insurance system. Further, the incorporation of AI in elastography devices into clinical workflows for enhanced accuracy and expanding screening programs for high-risk populations, driving the market growth.

Key Transient Elastography Devices Market Players:

- Echosens

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE HealthCare

- Siemens Healthineers

- Canon Medical Systems

- Fujifilm Holdings

- Philips

- Mindray Medical

- Samsung Medison (Harman)

- SuperSonic Imagine (Hologic)

- Esaote SpA

- Hitachi, Ltd.

- Shenzhen Mindray Bio-Medical

- Heal Force Bio-meditech

- Medonica Co. Ltd.

- Fukuda Denshi Co., Ltd.

- Sonoscape Medical Corp.

- BCF Technology Limited

- Yokogawa Electric Corporation

- Nihon Kohden Corporation

- Honda Electronics Co., Ltd.

The transient elastography devices market is enriched with the contribution of top MedTech developers and manufacturers. Global giants, such as Echosens and GE Healthcare, are augmenting international expansion with advancements in AI-driven diagnostics and portable tools. On the other hand, companies, including Samsung Medison and Mindray, are focusing more on offering solutions at competitive pricing to captivate a remarkable position in the cohort of suppliers for the price-sensitive regions. Moreover, they are also strategically forming alliances to align with government-backed healthcare programs to make their patent technologies more popular and accessible to consumers.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In February 2025, Philips has integrated AI into the workflow and quantitative measurement functions in the EPIQ Elite and Affiniti ultrasound systems to speed up examinations and increase the clinical confidence.

- In December 2024, Siemens Healthineers introduced ACUSON Sequoia 3.5, which is a major software and hardware update to the ACUSON Sequoia ultrasound system that uses artificial intelligence (AI), powered features for enhanced workflow and efficiency to improve the clinical performance.

- In May 2024, Echosens introduced a new guided vibration-controlled transient elastography (VCTE) technology, available on new FibroScan systems. Further, the tool takes 4 minutes to complete a full scan and uses two visual indicators, one for liver stiffness and the other for controlled attenuation parameter, which is used to support the operator in quickly identifying the optimal measurement location.

- Report ID: 665

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.