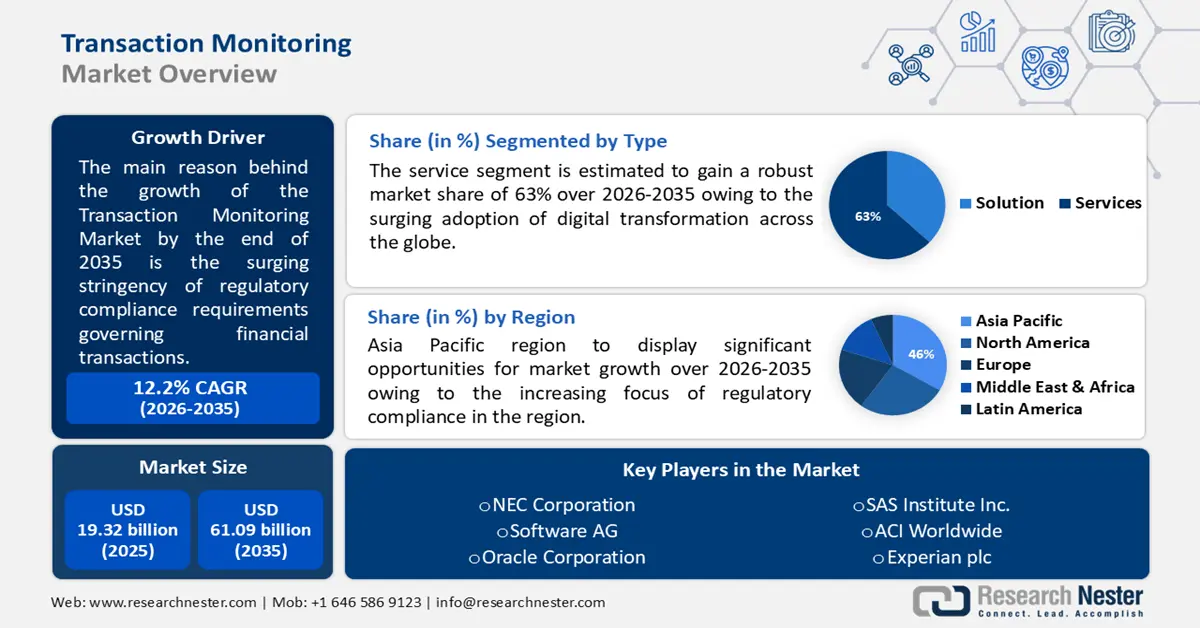

Transaction Monitoring Market Outlook:

Transaction Monitoring Market size was valued at USD 19.32 billion in 2025 and is likely to cross USD 61.09 billion by 2035, registering more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transaction monitoring is assessed at USD 21.44 billion.

The primary growth propelling factors for the transaction monitoring market market are the rising number of financial crimes and the surge in cases of money laundering cases. According to data published by the European Union in January 2024, each year, almost USD 715 billion to USD 1.87 trillion of the worldwide Gross Domestic Product is defiled by money laundering activities. Financial institutions and organizations across the globe are under mounting pressure to adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Transaction monitoring solutions have become indispensable tools for financial entities to mitigate the risks associated with non-compliance.

There are chances of financial penalties, reputational damage, and legal action associated with breaking regulatory norms. Given the growing non-compliance penalty, organizations are strongly pushed to invest in reliable transaction monitoring solutions.