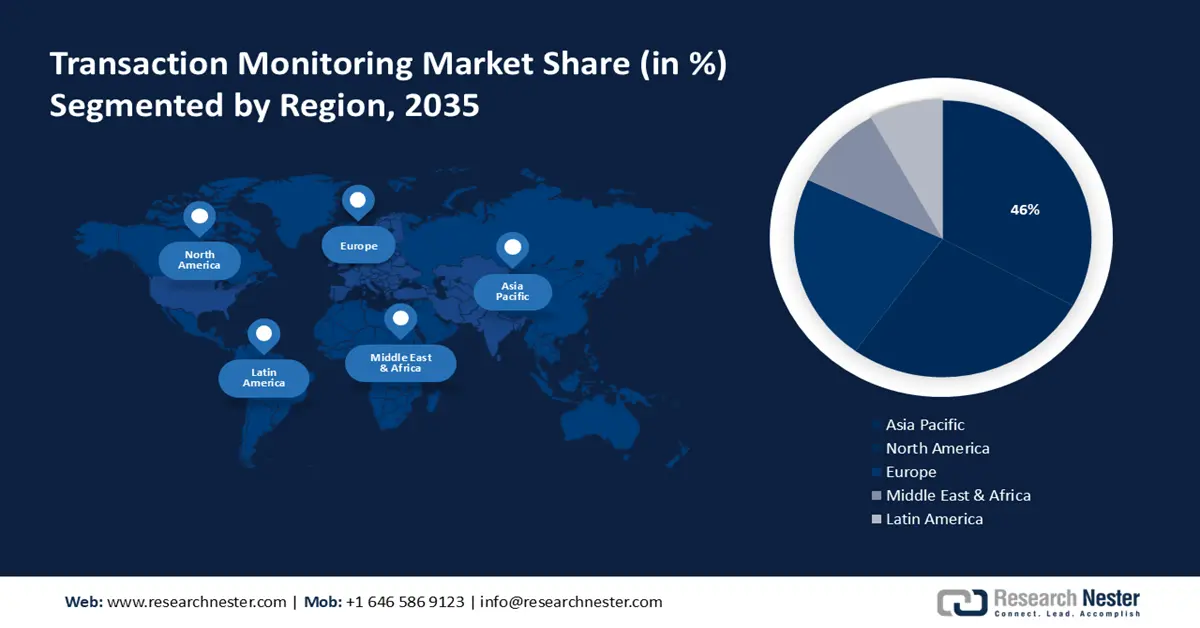

Transaction Monitoring Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific transaction monitoring market is predicted to hold the largest revenue share of 46% by 2035. The growth of the market can be attributed to the rising cases of money laundering in Asian countries. Market players in the countries are demanding efficacious solutions to handle anti-money laundering compliance. This creates growth opportunities for the market in South Asia and the Pacific region. Additionally, there has been an increasing adoption of digital payments in the region. For instance, according to the Press India Bureau in September 2024, UPI transactions have grown to 130 billion in the financial year 2023-2024. Companies are opting for robust transaction monitoring to prevent financial crimes.

North America Market Insights

The transaction monitoring market in the North America region is projected to hold the second-largest share. The prevalence of cross-border transactions in North America is a significant factor driving the demand for comprehensive transaction monitoring solutions. For instance, the United States Trade Representative stated that the U.S. goods and services trade under the United States-Mexico-Canada Agreement totaled USD 1.8 trillion in 2022. Additionally, the adoption of FinTech solutions is contributing to the growth of transaction monitoring in North America. FinTech companies, known for innovative financial services, face regulatory scrutiny, necessitating advanced monitoring systems. The escalating sophistication of cybersecurity threats is driving the demand for advanced transaction monitoring solutions.