Trade Finance Market Outlook:

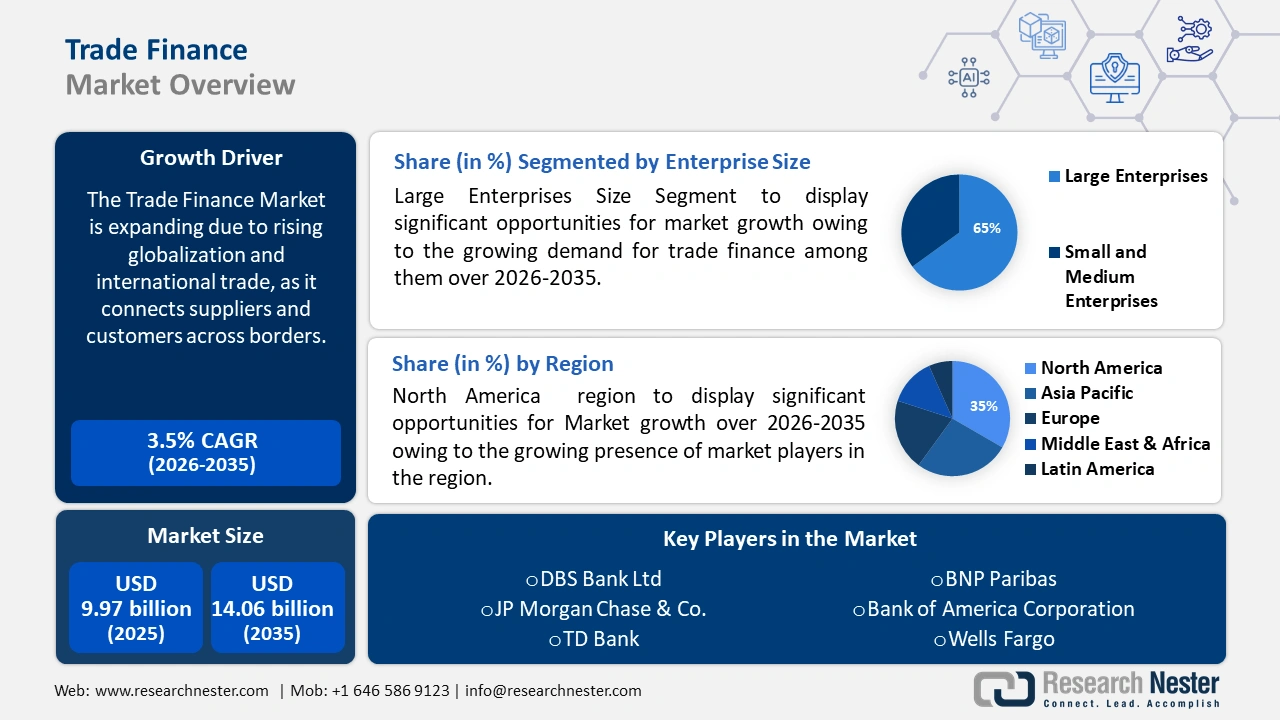

Trade Finance Market size was valued at USD 9.97 trillion in 2025 and is expected to reach USD 14.06 trillion by 2035, expanding at around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of trade finance is evaluated at USD 10.28 trillion.

International commerce and globalization have greatly accelerated the market's expansion. Financial solutions that can connect customers and suppliers across borders and time zones are becoming more and more necessary as firms expand globally. This crucial function is provided by trade finance, facilitating more seamless international commercial transactions. International trade in goods and services accounted for 25.0 % of the EU's GDP in 2022.

Moreover, businesses are exposed to a number of risks, such as credit risk, currency risk, and geopolitical risk, in an increasingly complicated world economy. Trade finance provides businesses with risk mitigation solutions, such as credit insurance and hedging tools which allow them to mitigate unexpected financial losses.