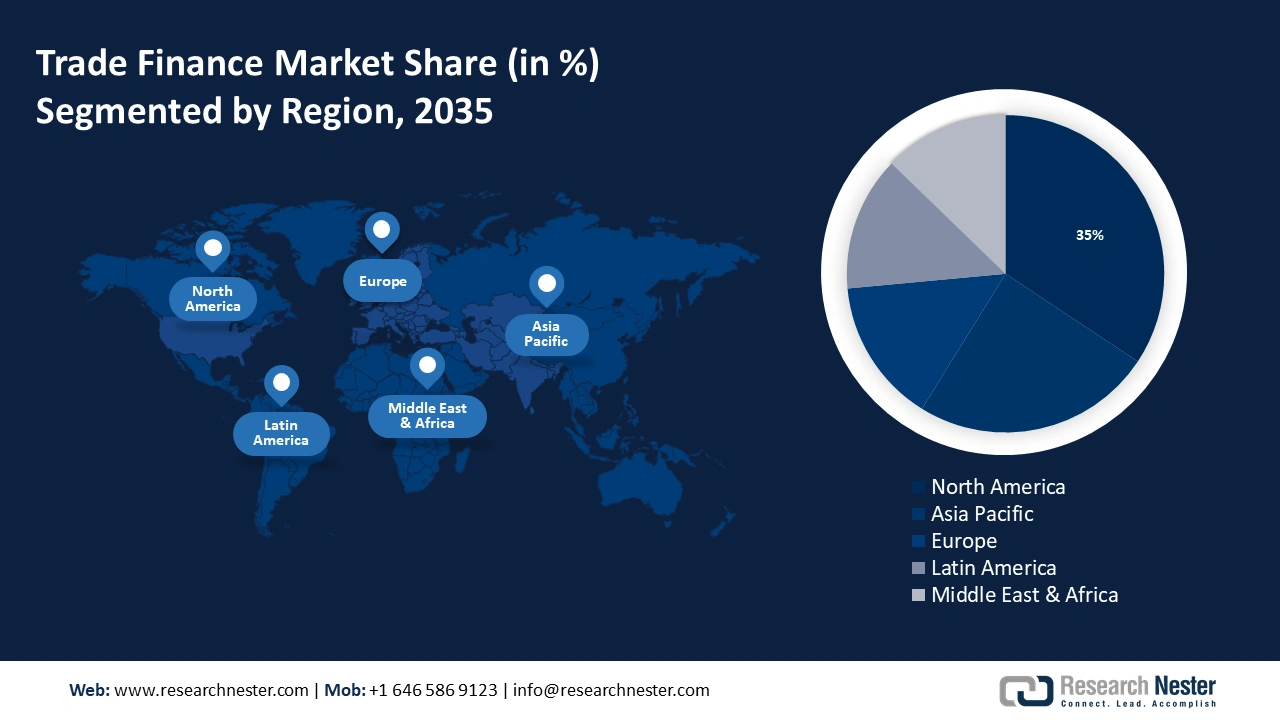

Trade Finance Market Regional Analysis:

North American Market Insights

The North America region will hold the largest share of 35% by the end of 2035. Some of the world's largest and most influential financial institutions, including major banks and financial centers such as New York, are present in the region. These institutions have a global presence and broad networks, allowing them to offer large volumes of trade finance services to businesses active in the field of International Trade. The United States is a major importer and exporter of goods and services in the world with export and import products and services worth USD 70 trillion. In addition, North America has a strong and diverse economy that is largely oriented towards international trade.

APAC Market Insights

The trade finance market in the Asia Pacific region is set to grow substantially during the time period between 2026-2035. India, China, and Japan considered the fastest escalating economies of the world with major international trade players are situated in the Asia Pacific region. Increased imports and exports have led to an increased demand for trade finance services to facilitate these transactions, as a result of the region's expanding middle class and rising consumption. In addition, the Asia Pacific region is a major business center due to its geographic proximity to some of the world's most important global supply chains and trading partners.