Trade Finance Market Outlook:

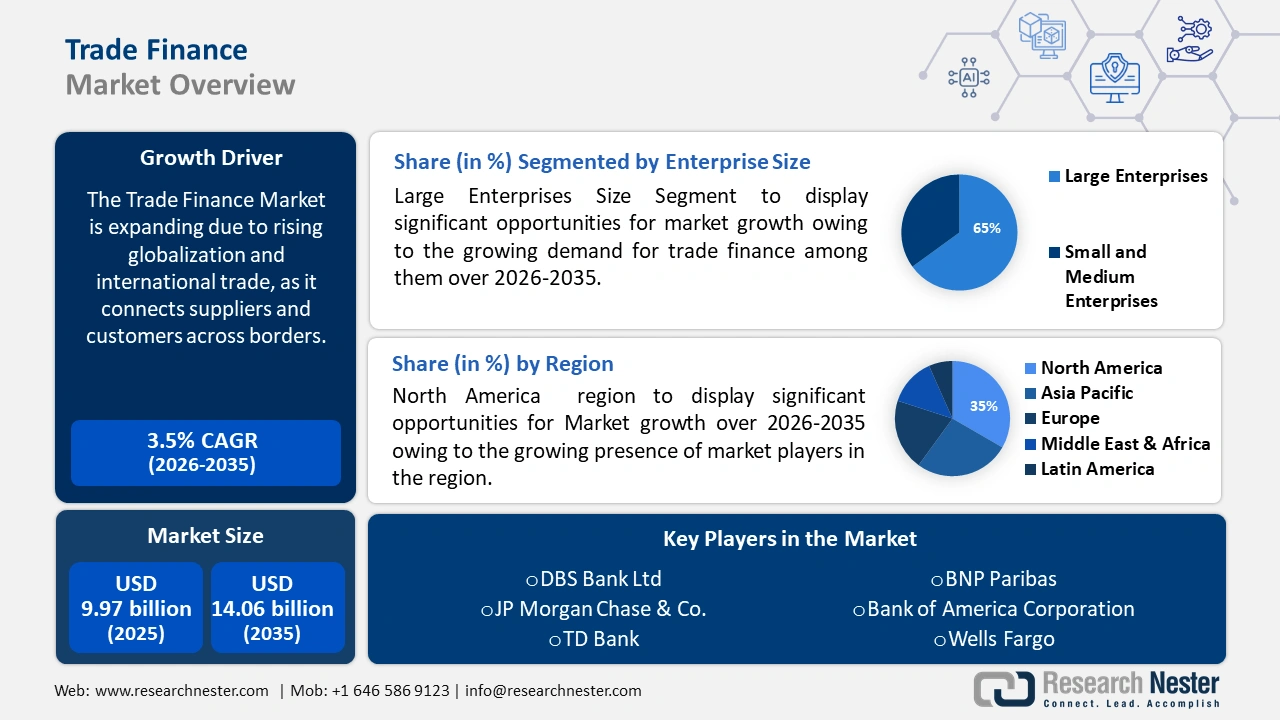

Trade Finance Market size was valued at USD 9.97 trillion in 2025 and is expected to reach USD 14.06 trillion by 2035, expanding at around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of trade finance is evaluated at USD 10.28 trillion.

International commerce and globalization have greatly accelerated the market's expansion. Financial solutions that can connect customers and suppliers across borders and time zones are becoming more and more necessary as firms expand globally. This crucial function is provided by trade finance, facilitating more seamless international commercial transactions. International trade in goods and services accounted for 25.0 % of the EU's GDP in 2022.

Moreover, businesses are exposed to a number of risks, such as credit risk, currency risk, and geopolitical risk, in an increasingly complicated world economy. Trade finance provides businesses with risk mitigation solutions, such as credit insurance and hedging tools which allow them to mitigate unexpected financial losses.

Key Trade Finance Market Insights Summary:

Regional Highlights:

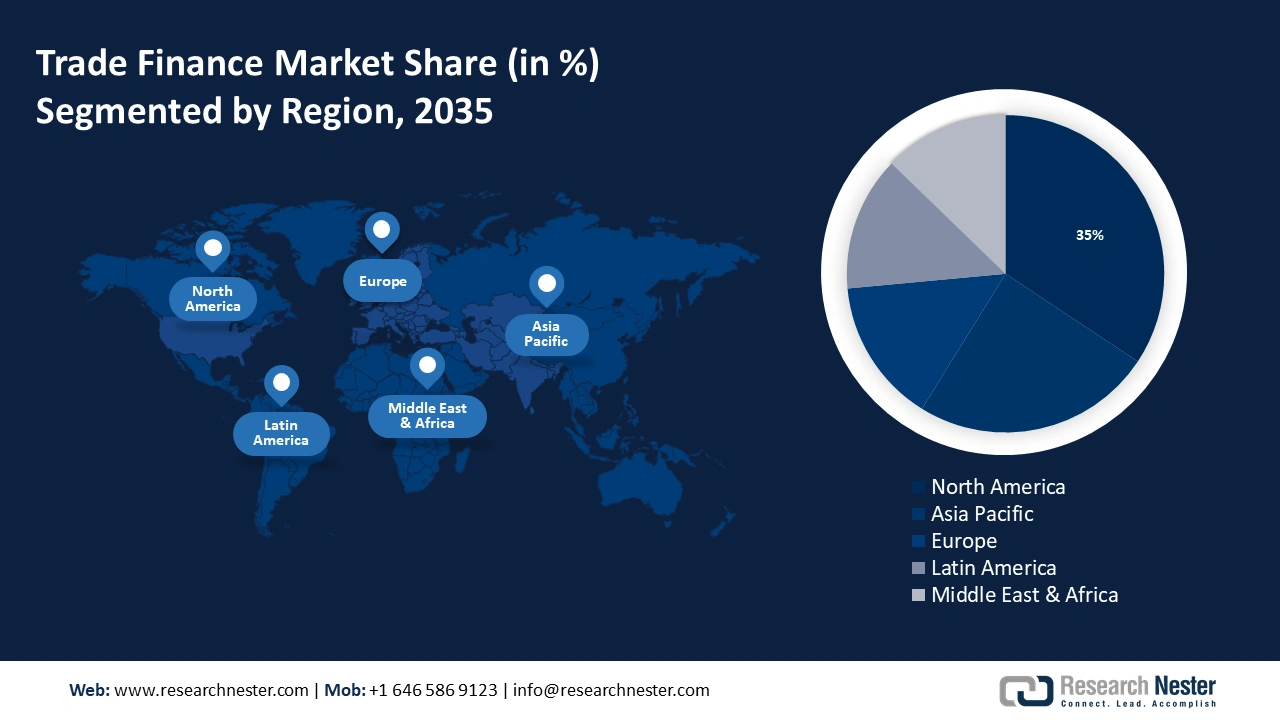

- North America trade finance market will secure over 35% share by 2035, attributed to the presence of major financial institutions and strong international trade.

- Asia Pacific market will exhibit substantial CAGR during 2026-2035, fueled by increased imports/exports and a growing middle class.

Segment Insights:

- The banks segment in the trade finance market is forecasted to achieve substantial growth through 2035, driven by the strong global relationships of banks in trade finance.

- The construction segment in the trade finance market is projected to see substantial growth till 2035, driven by the high financial needs of complex construction projects.

Key Growth Trends:

- Emerging trend for sustainable finance

- Growing technological advancement

Major Challenges:

- Complication associated with trade finance deals

- Regulatory standards are anticipated to hinder market growth between 2023-2036.

Key Players: BNP Paribas, Citigroup, Inc., TD Bank, Standard Chartered, Exim Bank of India, DBS Bank Ltd, JPMorgan Chase & Co., Santander Bank, Deutsche Bank AG, Bank of America Corporation.

Global Trade Finance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.97 trillion

- 2026 Market Size: USD 10.28 trillion

- Projected Market Size: USD 14.06 trillion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Singapore

- Emerging Countries: China, India, Singapore, South Korea, United Arab Emirates

Last updated on : 17 September, 2025

Trade Finance Market Growth Drivers and Challenges:

Growth Drivers

- Emerging trend for sustainable finance - The escalating demand for sustainable finance in the trade finance sector is raising the prospect of social, environmental, and governance principles. The sustainability of trade finance decisions is highly integrated into businesses and financial institutions.

Green bonds and ESG-linked loans are amongst the most frequently used sustainability trade finance instruments. Due to the growing awareness of climate and social issues, the integration of sustainable financial practices into the trade finance industry has become popular. - Growing technological advancement - The trade finance market expansion is supported by the rapid development of modern technologies and digitalization. In order to avoid fraud and errors, the use of Blockchain technology has introduced transparency and safety into supply chain finance and trade settlement.

Artificial intelligence and data analysis have been introduced to improve risk assessment and to make more accurate credit decisions to bridge the funding gap for SMEs. Innovative digital platforms were created by the Fintech Startups, to increase accessibility and affordability.

Challenges

-

Complication associated with trade finance deals - The global trade finance market is expected to face a challenge from the complexity of trade finance transactions, as well as higher risks related to trade finance.

-

Regulatory standards are anticipated to hinder market growth between 2026-2035.

- Accessibility to finance is another significant factor hampering the growth of the market during the forecast period.

Trade Finance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 9.97 trillion |

|

Forecast Year Market Size (2035) |

USD 14.06 trillion |

|

Regional Scope |

|

Trade Finance Market Segmentation:

Industry Outlook Segment Analysis

By 2035, construction segment is expected to capture over 30% trade finance market share. The construction sector has emerged as the market leader due to its special characteristics and high financial needs. A complex, cross-border supply chain is often involved in construction projects, which require extensive funding for the purchase of raw materials, heavy machinery, and skilled labor. These projects are also expected to be lengthy and require the availability of trade finance solutions, to ensure that operations continue for extended periods.

Service Provider Segment Analysis

Based on service provider, the banks segment is poised to dominate the market with a share of 40% through 2035. Banks are widely interconnected and have strong relationships with businesses all over the world, which makes them an indispensable link for international trade transactions. In cross-border transactions, where payment and delivery guarantees are of the utmost importance, this trust is very important.

In addition, the banks offer a wide range of commercial finance products and services including letters of credit, trade loans or documentary collections. Increased use of blockchain and digital transformation of banking processes in the banks could lead to increased scope for this segment over the next eight years. In order to enhance their trade finance solutions, banks are reported to be working with financial technology organizations in order to expand their customer base. In addition, 79 percent of customers said that the availability of banking services was made easier as a result of technological innovation in banking.

Our in-depth analysis of the global market includes the following segments:

|

Instrument Type |

|

|

Service Provider |

|

|

Trade Type |

|

|

Enterprises Size |

|

|

Industry Outlook |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Trade Finance Market Regional Analysis:

North American Market Insights

The North America region will hold the largest share of 35% by the end of 2035. Some of the world's largest and most influential financial institutions, including major banks and financial centers such as New York, are present in the region. These institutions have a global presence and broad networks, allowing them to offer large volumes of trade finance services to businesses active in the field of International Trade. The United States is a major importer and exporter of goods and services in the world with export and import products and services worth USD 70 trillion. In addition, North America has a strong and diverse economy that is largely oriented towards international trade.

APAC Market Insights

The trade finance market in the Asia Pacific region is set to grow substantially during the time period between 2026-2035. India, China, and Japan considered the fastest escalating economies of the world with major international trade players are situated in the Asia Pacific region. Increased imports and exports have led to an increased demand for trade finance services to facilitate these transactions, as a result of the region's expanding middle class and rising consumption. In addition, the Asia Pacific region is a major business center due to its geographic proximity to some of the world's most important global supply chains and trading partners.

Trade Finance Market Players:

- BNP Paribas

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Citigroup, Inc.

- TD Bank

- Standard Chartered

- Exim Bank of India

- DBS Bank Ltd

- JPMorgan Chase & Co.

- Santander Bank

- Deutsche Bank AG

- Bank of America Corporation

Recent Developments

- Standard Chartered’s Private Banking Division has introduced an innovative alternative lending solution targeting trade finance, extending access to its extensive portfolio of post-shipment short-term corporate receivables to its high net worth investors base. In this context, the exclusive right to supervise the distribution of such receivables is held by Standard Chartered Private Bank.

- The Exim Bank of India has introduced a new division in the International Finance Tec-City of Gujarat in the second half of 2023 in order to highlight the trade finance activities. In Asia, these actions will lead to the growth of trade finance.

- Report ID: 6024

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Trade Finance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.