Traction Transformer Market Outlook:

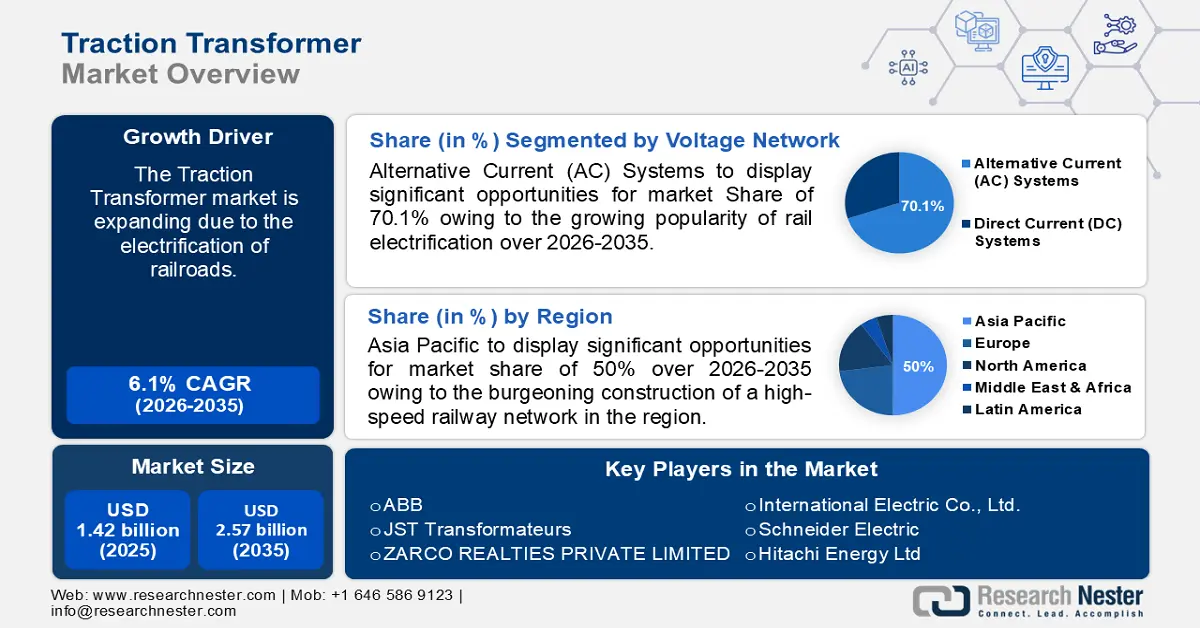

Traction Transformer Market size was valued at USD 1.42 billion in 2025 and is expected to reach USD 2.57 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of traction transformer is evaluated at USD 1.5 billion.

Railroad electrification is a crucial strategy for decarbonizing rail and has been steadily increasing over the past few decades. This is generating significant growth in the railroad industry's traction transformers, which deliver power to DC/AC motors in engines and are critical for electrifying and modernizing train lines. As more rail networks transition from diesel to electric, the need for traction transformers rises. According to The National Academies of Sciences, Engineering, and Medicine, approximately 25% of railways globally are electrified, and 50% of railway traffic occurs on electrified lines.

Moreover, high-speed trains, which are typically electric and use electricity from renewable sources (such as solar or hydroelectric power) rather than fossil fuels, result in lower CO2 emissions. Efficient traction transformers aid in effective electricity utilization and driving traction transformer market growth.

Key Traction Transformer Market Insights Summary:

Regional Highlights:

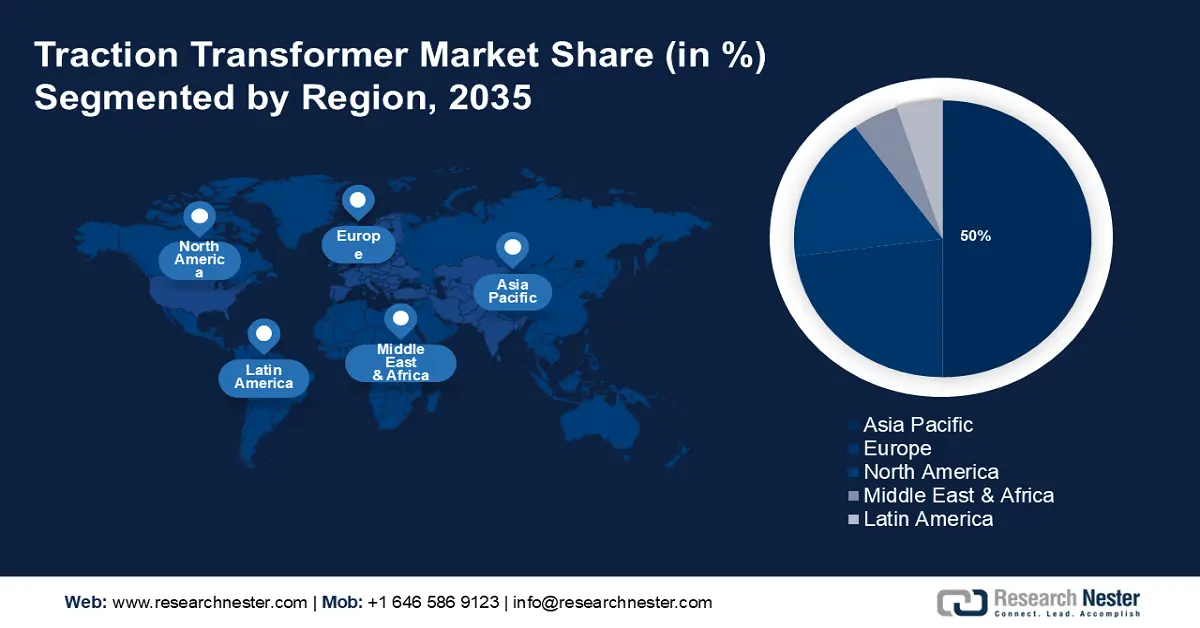

- The Asia Pacific traction transformer market will dominate around 50% share by 2035, driven by the expansion of high-speed rail and metro infrastructure across the region.

- The Europe market will register significant growth during the forecast timeline, driven by increased EU funding for metro projects and efforts to reduce road traffic congestion.

Segment Insights:

- The alternative current (ac) systems segment in the traction transformer market is projected to see substantial growth till 2035, driven by high efficiency in long-distance transmission and adoption in high-speed rail systems.

- The under the floor segment in the traction transformer market is anticipated to witness significant growth till 2035, influenced by improved thermal management and space optimization in modern rail networks.

Key Growth Trends:

- Rising environmental concerns

- Expansion and enhancement of metro systems

Major Challenges:

- Research and Development (R&D) expenses

- Infrastructure challenges

Key Players: ABB, JST Transformateurs, ZARCO REALTIES PRIVATE LIMITED, International Electric Co., Ltd., Schneider Electric, Hitachi Energy Ltd, Wilson Transformer Company, General Electric Company, Setrans Holding AS.

Global Traction Transformer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.42 billion

- 2026 Market Size: USD 1.5 billion

- Projected Market Size: USD 2.57 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Traction Transformer Market Growth Drivers and Challenges:

Growth Drivers

- Rising environmental concerns: Increasing focus on reducing greenhouse gas emissions is prompting many regions to electrify rail networks. Electrified rail systems, supported by efficient traction transformers, are less polluting compared to diesel-powered trains. Moreover, stringent environmental regulations are driving rail operators to adopt technologies that reduce emissions and energy use. Traction transformers that meet these standards are increasingly in demand.

- Expansion and enhancement of metro systems: As cities invest in upgrading and expanding their metro systems to improve public transportation and reduce congestion, the demand for modern, high-performance traction transformers increases. Metro systems are focused on improving energy efficiency to reduce operational costs and environmental impact. Advanced traction transformers contribute to this goal by ensuring efficient power conversion and minimizing energy losses. According to the International Association of Public Transportation, as of 2020, 193 metro cities across the world have an installed asset base of 731 lines for a total length of over 17,000 km and close to 13,000 stations.

Challenges

- Research and Development (R&D) expenses: Developing advanced traction transformers involve substantial R&D costs. These expenses are associated with designing, testing, and refining new technologies. High R&D costs can limit the ability of small or less well-funded companies to compete, concentrating market power among a few major players.

- Infrastructure challenges: Upgrading or modifying existing infrastructure to accommodate advanced transformers can be costly and complex, potentially delaying or complicating projects. Traction transformers require specific space and installation conditions. Urban rail systems, especially those in densely populated areas, may face space constraints that make installing or upgrading transformers challenging.

Traction Transformer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.42 billion |

|

Forecast Year Market Size (2035) |

USD 2.57 billion |

|

Regional Scope |

|

Traction Transformer Market Segmentation:

Voltage Network Segment Analysis

The alternative current (AC) systems segment in the traction transformer market is estimated to gain the largest revenue share of 70.1% by 2035. AC systems are known for their high efficiency and reliability in long-distance power transmission. Traction transformers in AC systems are designed to handle the variable loads and high power demands of rail systems, ensuring stable and continuous operation. The integration of smart technologies in AC traction transformers, such as remote monitoring and diagnostics, is becoming more prevalent. These advancements enhance the efficiency and reliability of rail systems. Many high-speed rail networks in Europe, such as TGV France use AC systems (25 kV AC). The need for efficient and reliable traction transformers in these systems influences global market trends.

Mounting Position Segment Analysis

Under the floor segment in the traction transformer market is estimated to contribute significant growth by optimizing space, improving thermal management, and leveraging technological advancements. Transformers mounted under the floor can benefit from the natural airflow and cooling provided by the train’s movement. This can reduce the need for additional cooling systems and improve the efficiency and longevity of the transformers.

Urban rail systems, such as subways and night rail networks, are increasingly adopting under the floor mounting solutions to optimize space and improve operational efficiency contributing to market growth.

Our in-depth analysis of the traction transformer market includes the following segments:

|

Voltage Network |

|

|

Mounting Position |

|

|

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Traction Transformer Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 50% by 2035, attributed to the burgeoning construction of a high-speed railway network. The area is home to several rail projects, including high-speed rail networks and urban metro systems, which are likely to boost the demand for traction transformers. In addition, governments of the region are stepping up to modernize their rail systems, leading to a higher demand for traction transformers. Asia may have more than 60,000 km of high-speed rail network by 2030, an increase of roughly 27,000 km from 2020.

China's fundamental national policy is to save energy, which may drive traction transformer market growth in the coming years. For instance, to save energy, guarantee safety, and safeguard the environment, the China Railway Electrification Engineering Group and the China Railway Eryuan Engineering Group have created a new kind of vegetable oil-insulated traction transformer for use on railroads.

In India, the government has been investing in the electrification of railway lines, which may boost the demand for traction transformers. Indian Railways has placed orders with Hitachi Energy India Ltd. for traction transformers that helped the Indian government realize its goal of electrifying the whole broad-gauge network in 2023.

Europe Market Insights

The traction transformer market in Europe is projected to experience a significant rise in revenue over the projected timeframe encouraged by the increasing funding for the construction of the metro network. To lessen traffic congestion on the roads, lower emissions, and boost the industry's digital connectivity, EU has made financing available to support rail infrastructure initiatives, which is expected to augment market demand for traction transformers. For instance, various rail upgrading projects have received around USD 6.63 billion in funding under the most recent EU Connecting Europe Facility grant provisions.

The traction transformer market in Germany may witness tremendous growth as the German government has intensified its efforts to promote train travel in the face of climate change and has provided subsidies to build more railroad lines.

After Germany, France, and Spain, Italy has the fourth-largest high-speed rail network in all of Europe and is the only nation to have staged a direct competition over its complete high-speed rail (HSR) network. As a consequence, the demand for traction transformers may rise in the country.

Traction Transformer Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- JST Transformateurs

- ZARCO REALTIES PRIVATE LIMITED

- International Electric Co., Ltd.

- Schneider Electric

- Hitachi Energy Ltd

- Wilson Transformer Company

- General Electric Company

- Setrans Holding AS

The traction transformer market consists of many key players who are launching various strategic initiatives to expand their market position in the industry. Major players leverage their extensive global networks to provide traction transformers worldwide, ensuring timely delivery and localized support.

Recent Developments

- In January 2024, ABB announced to provide the whole traction chain, including electric motors, transformers, and converters, in collaboration with Reloc, a regional contractor with expertise in modernizing and refurbishing locomotives used in Romania.

The initiative will enable them to achieve high levels of energy efficiency and dependability and will allow increases in drive train efficiency of approximately 5% overall when compared to the previous traction system that used DC motors. - In September 2022, Hitachi Energy Ltd announced the introduction of RESIBLOC Rail, an innovative oil-free and plug-and-play traction transformer that offers the customer a plug-and-play dry-type traction transformer solution that has never been possible before.

- Report ID: 6329

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Traction Transformer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.