Traction Motor Market Outlook:

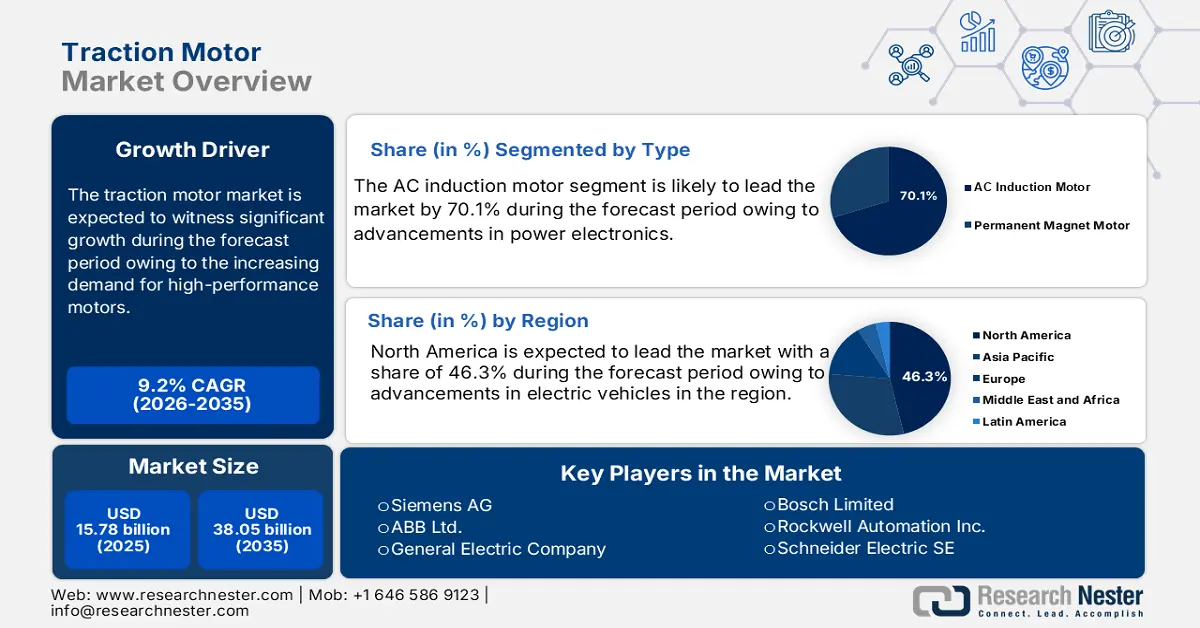

Traction Motor Market size was valued at USD 15.78 billion in 2025 and is expected to reach USD 38.05 billion by 2035, registering around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of traction motor is evaluated at USD 17.09 billion.

The progress of railway electrification projects is anticipated to increase the demand for traction motors, attributed to the government’s focus on sustainable and energy-efficient transportation systems. For instance, the DPIIT, a body of the Government of India is promoting the green logistics industry. The government aims to boost Indian Railway's freight share from the current 35-36% to 45% by 2030 through several strategic initiatives like the National Rail Plan. Globally, high-speed rail projects and metropolitans depend on advanced traction motor technology to ensure improved reliability and performance. This technological shift is expected to receive additional support from environmental regulations as well as increasing population density patterns and modern requirements for improved transportation systems for passengers and cargo.

The strong market interest in traction motors also receives support from major investments in electrified railway infrastructure by India, China, the U.S, and Germany. For instance, in January 2024, the Mumbai-Ahmedabad High-Speed Rail Project in India received a breakthrough when Larsen & Toubro Construction’s Railway Business Group obtained the 2x25 kV power supply electrification system contract. The railway electrification in India is expected to experience a major advancement through this project which sets the goal to reach train speeds of 320 km/h.

Key Traction Motor Market Insights Summary:

Regional Highlights:

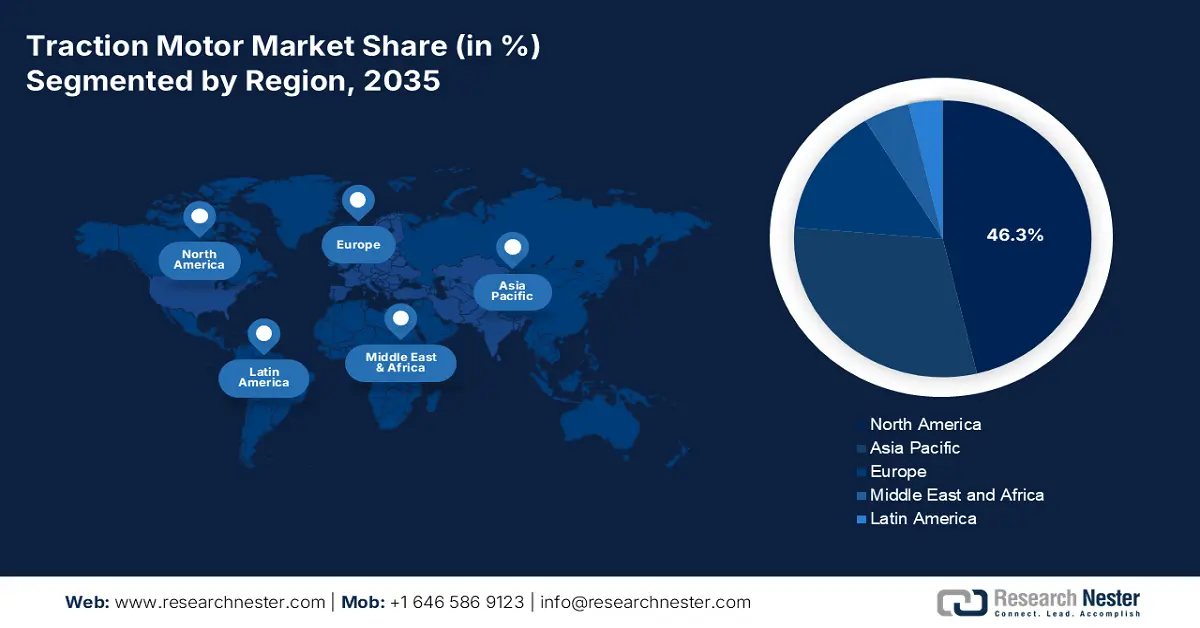

- North America dominates the Traction Motor Market with a 46.3% share, fueled by the focus on efficient traction motors for electric vehicles and supportive environmental regulations, enhancing growth prospects through 2026–2035.

- The Asia Pacific Traction Motor Market is anticipated to achieve rapid growth over 2026–2035, driven by investments in transportation infrastructure and government support for railway electrification.

Segment Insights:

- The Passenger Car segment is projected to see significant growth by 2035, fueled by EV adoption and charging infrastructure development.

- AC Induction Motors segment are projected to hold a 70.1% share by 2035, driven by advancements in power electronics and rare-earth independence.

Key Growth Trends:

- Surging demand for high-performance motors

- Growth in urban public transport

Major Challenges:

- Insufficient charging infrastructure

- Supply chain disruptions

- Key Players: Siemens AG, ABB Ltd., General Electric Company, Bosch Limited, and Nidec Corporation.

Global Traction Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.78 billion

- 2026 Market Size: USD 17.09 billion

- Projected Market Size: USD 38.05 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Traction Motor Market Growth Drivers and Challenges:

Growth Drivers

-

Surging demand for high-performance motors: The automotive and railway industries are increasingly adopting enhanced traction motors, creating a strong demand for material and technological advancements. Manufacturers are working on developing energy-efficient, high-torque motors, due to the rising performance requirements that demand these improvements. For instance, rare-earth magnets help motor performance by improving efficiency levels. One significant advancement in rare-earth magnets includes the strategic business relationship of Nidec Motor with Noveon Magnetics. The companies entered a five-year deal in February 2025 to deliver over 1,000 tons of finished sintered NdFeB rare-earth magnets. The EcoFlux magnets produced by Noveon use recycled materials to create a secure and environmentally friendly supply chain system.

-

Growth in urban public transport: Investments in electric bus systems, metro networks, and tramway infrastructure are expected to rise due to the global sustainable transportation initiatives. This is expected to drive the traction motor requirements. Public transport operators across cities continue to convert their fleet vehicles into more efficient and emission-reducing electric systems. The Go-Ahead Group declared its USD 521.5 million funding agreement with Wrightbus, to obtain up to 1,200 electric buses, in October 2024. Through substantial public investment, the zero-emission buses are expected to be deployed throughout London, Plymouth, and East Yorkshire, to advance sustainable transportation solutions.

Challenges

-

Insufficient charging infrastructure: The traction motor use remains limited as electric vehicles lack established charging facilities. Slow adoption of electric vehicles coincides with restricted EV charging infrastructure, as consumers experience inconvenience while raising barriers to population-wide adoption. Several railway systems continue using diesel locomotives, as electrification costs are high and project timelines are extended. The slow expansion of electric transportation cannot occur without proper infrastructure development, obstructing the growth of traction motor demand within automotive sectors and railways.

-

Supply chain disruptions: Supply chains endure major vulnerabilities, as the traction motors require rare-earth metals such as neodymium and dysprosium for their operation. The concentrated production of these materials in China and other countries makes their export control capabilities, trigger the supply disruptions and price instability of market policies and political tensions. The growing global demand for these materials intensifies the issue, owing to their applications in electric vehicles and renewable energy systems. Manufacturers have been examining novel approaches for magnet production including rare-earth-free motor design and waste recovery methods, and these methods remain limited across industries.

Traction Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 15.78 billion |

|

Forecast Year Market Size (2035) |

USD 38.05 billion |

|

Regional Scope |

|

Traction Motor Market Segmentation:

By Type (AC Induction Motor, Permanent Magnet Motor)

AC induction motor segment is likely to capture traction motor market share of over 70.1% by 2035, due to the advancements in power electronics and control systems. Continual developments in power electronics are leading to the successful integration of insulated gate bipolar transistors, improving the efficiency and performance qualities of AC induction motors suitable for traction needs. Technology advancements produce superior speed control features, minimized power waste, and increased dependability, resulting in accelerated acceptance of AC induction motors across different transportation domains. The traction motor market chooses AC induction motors, as these motors come with inherent qualities, including robust construction, lower maintenance requirements, and cost affordability. AC induction motors establish their sustainability through their independence on rare-earth materials, reducing their dependency on supply chains. The chronological importance of AC induction motors has grown as different industries rely on sustainable and affordable options.

Vehicle Type (Passenger Car, Commercial Vehicle)

The passenger car segment in traction motor market is expected to register significant revenue during the forecast period, owing to the increasing adoption of electric vehicles across the globe. Electric vehicle adoption continues to rise as consumers prefer following strict pollution requirements, government funding, and improved power cell technology. The environmental sustainability movement and energy conservation goals have increased the market demand for energy-efficient traction motors in passenger vehicles. The deployment of improved fast charging systems as well as charging infrastructure development makes EVs more widely usable for consumers.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Vehicle Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Traction Motor Market Regional Analysis:

North America Market

North America in traction motor market is set to capture over 46.3% revenue share by 2035. The growth is attributed to advanced electric vehicles and electrified transportation. Factory producers in the region are focusing on crafting efficient traction motors for electric and hybrid vehicles, as part of their sustainability and emission reduction initiatives. Comprehensive research and development have been dedicated to enhancing motor efficiency, durability, and performance in the region, along with environmental regulations and EV adoption policies.

The U.S. market is increasing due to considerable federal support for rail infrastructure development coupled with strategic collaboration among industries. In November 2023, the U.S. Federal Railroad Administration (FRA) granted Federal-State Partnership for Intercity Passenger Rail funding amounting to over USD 16.4 billion to 25 projects throughout the Northeast Corridor. These infrastructure projects work to improve and replace fundamental components of fundamental infrastructure to enhance both efficiency levels and reliability across the country’s top rail route.

The market in Canada is expected to experience significant growth, owing to the continual innovation in electric vehicle technology, and the industry’s maintenance of beneficial partnerships. For instance, in December 2023, Potential Motors collaborated with CFMOTO USA to embed its Terrain Intelligence and Off-Road OS into side-by-side vehicles for their initial application in these platforms. The strategic partnership between the companies is expected to improve vehicle performance as well as driver experience during off-road operations while advancing traction motor technologies in the country’s automotive domain.

Asia Pacific Market Analysis

The Asia Pacific traction motor market is expected to witness a rapid expansion between 2026 and 2035 attributed to rising investments in the transportation infrastructure. The governments throughout the region support railway electrification and metro rail projects to reduce fossil fuel dependence and boost energy efficiency. The drive toward sustainable urban mobility together with emission regulations adoption is anticipated to trigger electric and hybrid transportation solutions growth, and consequently increase the traction motor demand. The rising production amounts of electric vehicles and hybrid passenger cars within China, India, and Japan are expected to fuel the adoption of traction motor requirements. The market expands, due to the technological developments in motor efficiency and smart control system implementation. Manufacturers are dedicating their efforts to creating powerful traction motors that combine better power density attributes with superior thermal management systems.

The China traction motor market is expected to propel, attributed to the government programs and policies that exempt taxation and provide monetary incentives to promote new energy vehicles and charging infrastructure. These government actions serve as catalysts, driving the increased adoption of electric vehicles, therefore enlarging the market need for traction motors. The traction motor sector advancement in the country is expected to depend heavily on government support and strategic partnerships with investments. Stellantis finalized a USD 1.6 billion fund for purchasing 21% ownership in LEAPMotor, which stands as one of the top electric vehicle producers in China in October 2023. By establishing this alliance, Leapmotor intends to grow its international electric vehicle operations and demonstrate a powerful determination to advance advanced traction motor developments in the country.

The traction motor industry in India is growing rapidly owing to joint ventures and innovations in electric vehicles and railway technology. In November 2023, ABB signed an agreement with Titagarh Rail Systems to provide propulsion systems for various Indian metro projects. Through this partnership, Titagarh obtained the right to make ABB's traction motors and received auxiliary converters and traction converters as part of the agreement. Indian rail infrastructure benefits from this partnership, supporting the Atmanirbhar Bharat initiative through the domestic advancement of sophisticated transport technology systems. Strategic motor partnerships accelerate the country’s traction motor market development through their support of eco-friendly and efficient transportation services.

Key Traction Motor Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- General Electric Company

- Bosch Limited

- Rockwell Automation Inc.

- Regal Beloit Corporation

- Schneider Electric SE

- WEG S.A.

- Hyundai Rotem Company

- CRRC Corporation Limited

- Dana Incorporated

The competitive landscape of the traction motor market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In February 2023, Rockwell Automation launched a new digital motor control solution tailored for industrial and traction motor applications. Leveraging IoT connectivity and predictive maintenance, this solution is designed to optimize performance and extend the lifecycle of traction motors in heavy-duty environments.

- In February 2022, ABB Ltd. secured orders worth around USD 80 million from Stadler Rail AG for energy-efficient traction and high-performance battery technologies for high-capacity commuter trains.

- Report ID: 7225

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Traction Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.