Total Organic Carbon Analyzer Market Outlook:

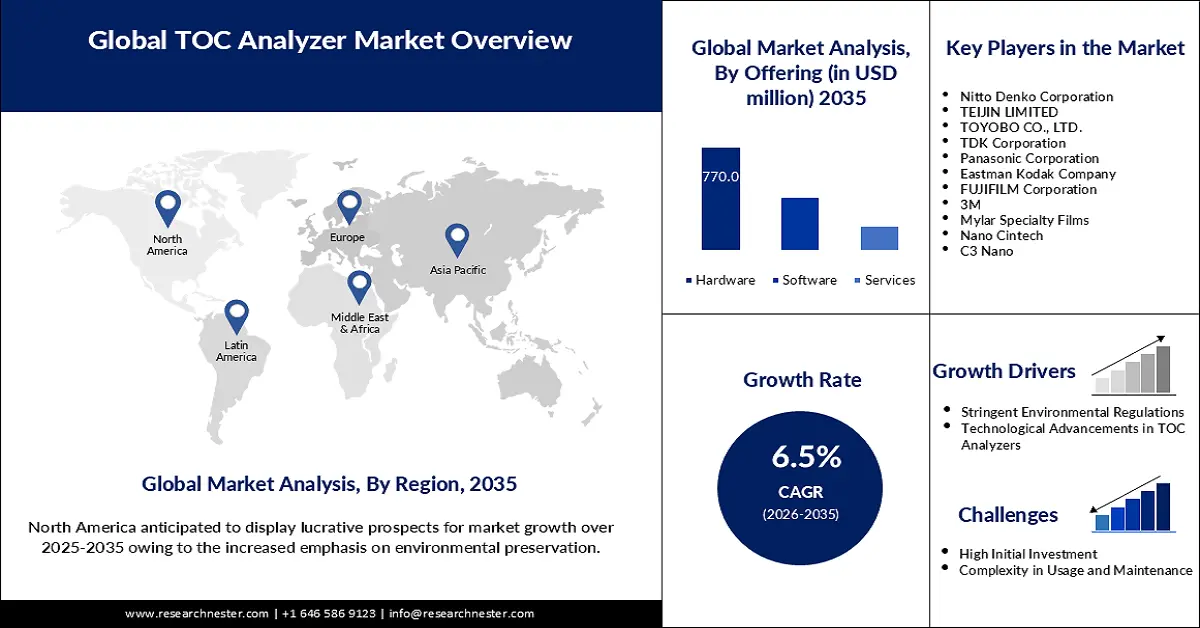

Total Organic Carbon Analyzer Market size was valued at USD 1.47 billion in 2025 and is likely to cross USD 2.76 billion by 2035, expanding at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of total organic carbon analyzer is assessed at USD 1.56 billion.

The increasing demand for water and wastewater treatment plants (WWTP) in various industries is the principal force, boosting demand for TOC analyzers. Stringent environmental regulations and high focus on monitoring water quality, particularly in the pharmaceuticals and semiconductor industries, support the demand. TOC analyzers have advantages over conventional analyzers by providing fast, accurate, and reliable measurements of organic carbon levels. APAC, Latin America, and North America are some regions that are projected to offer significant opportunities to TOC analyzer companies. This is because industrialization, urbanization, and environmentally related issues have been rapidly growing in these regions. For instance, in June 2023, Swan Analytical launched the compact version of its AMI LineTOC monitor for pure and ultrapure water systems. The new TOC analyzer developed is easy to set up and operate, fully meeting the requirements of the industrial segment, and also suitable for continuous medical water for injection and pure water monitoring in the pharmaceutical and associated industries, as well as ultrapure water in the semiconductor industry.

Investments in research and development are likely to further drive industries toward investment in upgrading their monitoring infrastructure, which is expected to boost the demand for TOC analyzers going ahead. Some companies are developing TOC analyzers with the latest technologies and strategic initiatives to tap into this opportunity. For instance, in February 2020, Electro-Chemical Devices (ECD) developed the TOC Analyzer, a precise and reliable Total Organic Carbon monitor for carbon levels at WWTPs. This analyzer is highly resistant to harsh conditions at the WWTPs. This, therefore, places the industry working towards innovation through improvement and new, technically advanced, sophisticated TOC analyzers.

Key Total Organic Carbon (TOC) Analyzer Market Insights Summary:

Regional Highlights:

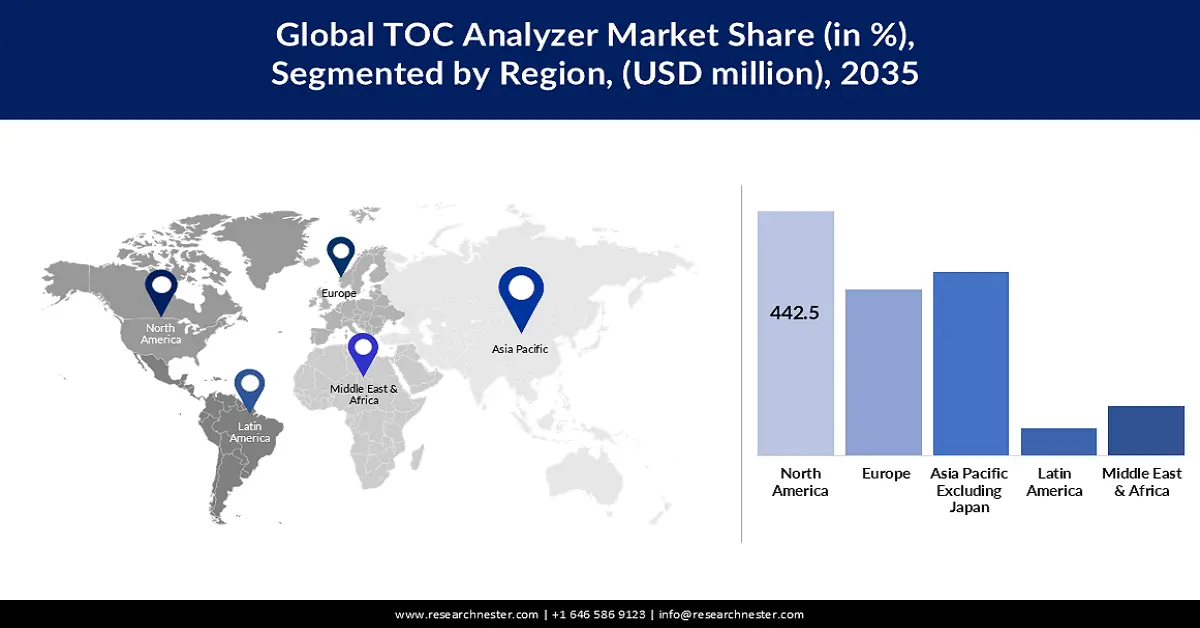

- The North America total organic carbon (TOC) analyzer market achieves a 32.10% share by 2035, driven by stringent government regulations and presence of major market players.

- The Asia Pacific market will exhibit massive growth during the forecast timeline, driven by rapid industrialization, urbanization, and strict government regulations on wastewater.

Segment Insights:

- The hardware segment in the total organic carbon analyzer market is expected to hold a 57.20% share by 2035, fueled by demand for advanced and reliable TOC analyzers.

- The high purity water segment in the total organic carbon analyzer market is projected to hold a 28.80% share by 2035, driven by strict purity requirements in biotech and pharma.

Key Growth Trends:

- Growing demand for TOC analyzers in the pharmaceutical industry

- Regulatory compliance

Major Challenges:

- High initial investment and maintenance

- Technical complexity

Key Players: Nitto Denko Corporation, TEIJIN LIMITED, TOYOBO CO., LTD., TDK Corporation, Panasonic Corporation, Eastman Kodak Company, FUJIFILM Corporation, 3M, Mylar Specialty Films, and Nano Cintech.

Global Total Organic Carbon (TOC) Analyzer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.47 billion

- 2026 Market Size: USD 1.56 billion

- Projected Market Size: USD 2.76 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Total Organic Carbon Analyzer Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for TOC analyzers in the pharmaceutical industry - Stringent water quality standards in the pharmaceutical industry are turning into guidelines for companies due to the requirement of ultrapure water in manufacturing processes. One key recent development in the sector exemplifies this growth. In March 2020, Suez Water Technologies & Solutions launched its TrueSense PRO Series TOC Analyzer, specifically engineered for pharmaceutical-grade water monitoring. This launch underlines the sector's commitment to technological innovation in meeting growing demands for water purity in pharmaceutical manufacturing, underlining the heightened sophistication of TOC analyzers in the industry's arsenal in tackling complex industry challenges.

- Regulatory compliance- Stringent regulations by health and environmental authorities worldwide mandate the monitoring and control of organic carbon levels in various applications. As a result, the United States Pharmacopoeia (USP), European Pharmacopoeia (EP), and Japanese Pharmacopoeia (JP) have recognized TOC as a mandatory test executed on purified water and water for injection (WFI). Such regulatory compliance encourages the adoption of TOC analyzers in industries for systematic strategies and quality of the product.

- Increasing demand for water and wastewater treatment- With rapid industrialization and urbanization, the demand for proper treatment of both water and wastewater is increasing multifold, especially in developing countries. According to a UNEP report, wastewater production is projected to rise significantly by 2030. This greater demand for water treatment, added to the benefits of TOC analyzers over traditional methods.

Challenges

- High initial investment and maintenance - TOC analyzers are expensive in terms of equipment, installation, operation, and maintenance. Among the key end users are SMEs and research institutions, which typically have limited budgets; therefore, these high upfront costs are quite a challenge to the growth of the total organic carbon (TOC) analyzer market and diffusion of TOC technology.

- Technical complexity - TOC analyzers are technically sophisticated devices whose operation and interpretation of results require technical expertise. Device complexity can, therefore, be a barrier for industries or regions that lack access to sufficient numbers of appropriately trained personnel. According to the Joint Committee for Guides in Metrology, the increased complexity in some measurement methods gives additional sources of uncertainty, hence less accuracy.

Total Organic Carbon Analyzer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.47 billion |

|

Forecast Year Market Size (2035) |

USD 2.76 billion |

|

Regional Scope |

|

Total Organic Carbon Analyzer Market Segmentation:

Offering Segment Analysis

The hardware segment is likely to retain its dominance in the total organic carbon (TOC) analyzer market by capturing a revenue share of 57.2% by 2035. The category includes a wide range of devices, from online to laboratory TOC analyzers, which, through their applications, cater to different industries. This spike is fueled by increasing demand for strong and reliable TOC analyzers filled with advanced features and enhanced capabilities.

The hardware segment has been driven by the growing popularity of TOC analyzers within a number of industries, such as wastewater treatment, pharmaceutical, and food & beverages. Key players in the hardware segment are channeling their efforts toward developing innovative and technologically advanced TOC analyzers. For instance, in October 2022, Endress+Hauser launched the CA78 and CA79 TOC analyzers for low-TOC value monitoring and supply to the power and semiconductor industries. Such advancements by key players are boosting the expansion prospect of the total organic carbon (TOC) analyzer market.

Type Segment Analysis

The online segment in the TOC analyzer market is projected to register lucrative CAGR during the forecast period. This growth is due to the increasing adoption of online TOC analyzers across all industries, resulting from real-time monitoring and control features. The shift from laboratory TOC analyzer to automated water release with the help of online TOC analyzers is driven by initiatives for quality improvement and cost reduction efforts in the production of purified water This is expected to further accelerate the expansion of this segment.

In June 2024, Shimadzu Corporation announced the launch of a new generation series model of the TOC-V online analyzer. Now, equipped with AI-driven advanced predictive maintenance and secured connectivity features, it becomes quite possible to seamlessly link up with Industry 4.0 ecosystems. The online TOC analyzes features a 30% reduction in analysis time as compared to previous models, thus making the TOC-V Series even more attractive for use in various industries where speed, precision, and continuity in processes are key to achieving optimized results.

Application Segment Analysis

In terms of application, the high purity water segment is expected to account for 28.8% of the TOC analyzer market share during the forecast period. This growth is fueled by the stringent need to protect high-purity water systems from contaminants like biofilm, germs, and organics, especially in pharmaceutical and biotechnological applications. TOC analyzers are critical in high-purity water quality, offering continuous, reliable monitoring that must meet strict regulatory requirements and audit standards in these industries.

To spotlight the segment's steady growth is, in April 2023, HORIBA Advanced Techno, Co., Ltd, a Group company of HORIBA Group offering measurement solutions for water quality business, reached an agreement for the acquisition of Tethys Instruments SAS. It further underscores the key role that TOC analyzers continue to play in applications requiring high-purity water while also underlining growth in the total organic carbon (TOC) analyzer market, driven by the steady march of improvements in relevant technologies.

Our in-depth analysis of the total organic carbon (TOC) analyzer market includes the following segments:

|

Offering |

|

|

Type |

|

|

Technology |

|

|

Application |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Total Organic Carbon Analyzer Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 32.1% by 2035. This growth is due to stringent regulations imposed by various governments and increased emphasis on environmental preservation. Also, the presence of major market players in the region gives a demand push to TOC analyzers for various applications across industries, including, pharmaceuticals and semiconductors. Growing demand for organic pollution assessment of water and an increase in the need to analyze water and wastewater treatments support the market growth in North America.

The U.S. market is expected to account for a significant share of 88.9% during the forecast period. The strict regulatory framework—impacted especially by the water quality and pollution control concerns linked to the EPA—has been potent in driving TOC analyzers' adoption. For instance, in January 2023, the U.S. EPA issued its Effluent Guidelines Program Plan 15, targeting the reduction of PFAS discharging industries. The said development is likely to further drive demand for TOC analyzers as industries invest in the upgrade of their monitoring infrastructure to comply with regulations.

The TOC analyzer market in Canada is anticipated to capture an 11.1% share during the forecast period. This has led to a surging demand for advanced solutions related to monitoring water. The government of Canada has been rather sensitive to this concern over the last few years and has come up with policies and initiatives that are meant to achieve better quality water by protecting its freshwater resources. These initiatives are likely to drive growth in the TOC analyzer market in Canada, with growing needs from industries like pharmaceuticals and oil & gas.

APAC Market Insights

The Asia Pacific total organic carbon (TOC) analyzer market is expected to witness massive growth till 2035. This high growth rate can be attributed to rapid industrialization coupled with urbanization that is resulting in growing water pollution and strict government regulations on treating wastewater. Growing pharmaceutical and semiconductor industries in the region require stringent water quality control, which is a primary driver of the market.

China is poised to account for total organic carbon (TOC) analyzer market share of more than 42.2% during the forecast period. Due to rapid industrial development and urbanization, water pollution has increased and also propelled the need for advanced water treatment solutions in the country. In February 2023, the Chinese government issued the "14th Five-Year Plan" for the pharmaceutical industry targeted green manufacturing and environmental protection. Hence, this policy is likely to raise further adoption of TOC analyzers in the pharmaceutical industry, thereby fueling market growth in China.

The Indian total organic carbon (TOC) analyzer market is projected to capture a 23.6% share by 2035. Increasing demand for TOC analyzers in this country could be due to the growth of the pharmaceutical sector along with increasingly stringent regulatory policies. In July 2023, HORIBA Group introduced state-of-the-art water monitoring products to aid India's Jal Jeevan Mission. It includes new UV-VIS, Ion-Selective, Colorimetry, and Combustion-based NDIR technologies for advanced innovation in rural and urban water quality monitoring across India. The trend is further likely to fuel demand for TOC analyzers in India as companies strive to adhere to stringent quality norms and regulatory requirements.

Total Organic Carbon Analyzer Market Players:

- Nitto Denko Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TEIJIN LIMITED

- TOYOBO CO., LTD.

- TDK Corporation

- Panasonic Corporation

- Eastman Kodak Company

- FUJIFILM Corporation

- 3M

- Mylar Specialty Films

- Nano Cintech

- C3 Nano

- CANATU

- GUNZE LIMITED

- Dontech

- ACS Material

- Dai Nippon Printing Co., Ltd.

- GEOMATEC Co., Ltd.

- Mianyang Prochema Commercial Co., Ltd.

- KANEKA CORPORATION

- CHASM

- Novarials Corporation

- MicroContinuum, Inc.

Some key players leading the total organic carbon (TOC) analyzer market include Shimadzu Corporation, Hach, Xylem, and General Electric. These companies offer highly advanced TOC analyzers with additional features and functionalities. Manufacturers are also expanding their respective product portfolios, targeting industries and applications with diverging needs and allocating resources to research and development in order to maintain competitiveness. For example, in April 2024, Beckman Coulter Life Sciences introduced QbD1200+, a Total Organic Carbon analyzer with associated pharmaceutical and biopharmaceutical applications. This launch is a testament that the industry shall consistently design innovative and develop advanced features for the TOC analyzer.

Recent Developments

- In March 2024, Analytik Jena introduced the multi-N/C x300 series of TOC/TN analyzers for environmental and pharmaceutical analysis. These analyzers are designed to be user-friendly with robust hardware, intuitive software, and flexible automation options, reducing sample preparation, calibration, and maintenance time.

- In February 2024, TDK Corporation received ISCC certification for their TOC analyzers produced in Málaga. This certification is mandatory for TDK to be allowed to promote that their TOC analyzers are made from 100 percent bio-circular film.

- In May 2023, Lummus Technology and Siemens Energy partnered to acquire assets from Siemens Energy's water solutions portfolio, including intellectual property, trade secrets, and research. This acquisition will expand Lummus' sustainable water and wastewater treatment offerings in petrochemical and refining facilities.

- In March 2023, Veolia Water Technologies & Solutions introduced the Sievers TOC-R3 online Total Organic Carbon analyzer. The analyzer aims to help industrial manufacturers make profitable process decisions, reduce costs, and avoid environmental penalties.

- Report ID: 6311

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Total Organic Carbon (TOC) Analyzer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.