Torsion Tester Market Outlook:

Torsion Tester Market size was over USD 27.69 billion in 2025 and is anticipated to cross USD 44.68 billion by 2035, witnessing more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of torsion tester is assessed at USD 28.91 billion.

The main reason for the growth of the torsion tester market is the rising need to test and analyze how materials and components tolerate and react under torsional forces. Torsion testing looks at how materials twist or turn, examining materials and products we use daily like screws, springs, parts of syringes, wire, and tubes, which are made to endure such motion. The torsion tester market is key in helping makers figure out critical traits of materials, such as twisting strength, cut strength, and how materials act when applied on with torsional force. Torsion testing gear mimics and gauges how materials and components react to twisting stress, giving valuable clues about their mechanical traits and properties. The push for torsion testers comes from various sectors, like car, aerospace, machinery, and healthcare industries.

Key Torsion Tester Market Insights Summary:

Regional Highlights:

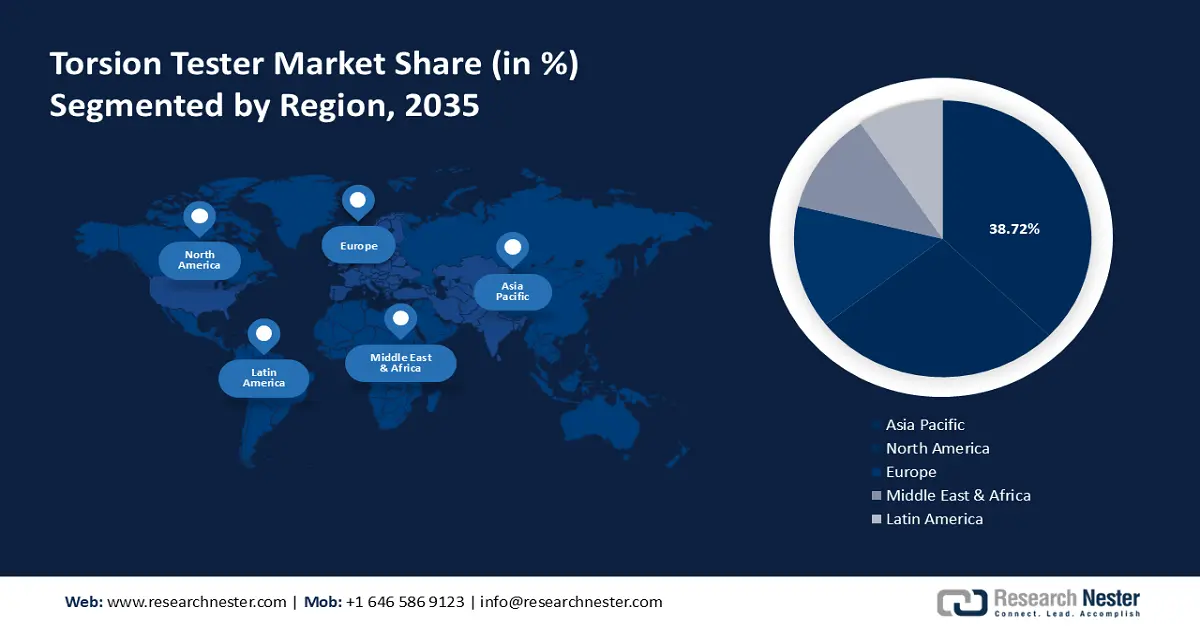

- By 2035, the Asia Pacific region is anticipated to secure over 38.72% revenue share in the torsion tester market, attributed to the rising need for exceptional material quality and testing.

- The North American region is poised to witness substantial growth through 2035, fueled by the increasing demand for stricter quality checks and material testing.

Segment Insights:

- By 2035, the electromechanical torsion testers segment is projected to account for around 38% share in the torsion tester market, propelled by the growing need for reliable and flexible testing tools.

- The metal segment is expected to hold over 44% share by 2035, supported by the rising requirement for torsion testers across expanding construction and automotive applications.

Key Growth Trends:

- End Use Industry Expansion

- Product Innovation and Quality Control

Major Challenges:

- Building Accurate Samples

- Complex Behaviour

Key Players: Instron, ADMET, Tinius Olsen, ZwickRoell, Shimadzu, MTS, Qualitest, GUNT, TesT.

Global Torsion Tester Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.69 billion

- 2026 Market Size: USD 28.91 billion

- Projected Market Size: USD 44.68 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.72% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 1 December, 2025

Torsion Tester Market - Growth Drivers and Challenges

Growth Drivers

- End Use Industry Expansion - The rise of industries like construction, automotive and transportation, aviation, and health care is accelerating the need for tools that test how things twist or act under twisting forces. These sectors need to carefully assess materials to make sure their products are safe and up to the mark, which is making the torsion testing market grow. Torsion tests are important in many fields such as the automobile industry, space and aircraft, machines, and medical fields. They're used on a variety of components and parts like screws for surgery, connectors, springs, wires, and tubes to check if they function efficiently.

- Product Innovation and Quality Control – The focus on product innovation and quality assurance is leading to the broader adoption of torsion testers. These devices help producers enhance product efficiency and ensure they meet quality standards, thus contributing to market expansion. Producers employ torsion testing machines to evaluate the torsional strength and performance of materials and parts, making sure they adhere to necessary standards and specifications.

- Globalisation and Industrialisation - The torsion tester market has seen growth due to the market widening and globalization. As sectors extend their operations and enter new markets, the need for torsion testing equipment rises, fueling the industry's growth. The growing population and urbanization are also leading to an increase in construction activities, which in turn drives the demand for torsion testers. Similarly, industrial growth in the automotive and aerospace sectors is adding to the market's expansion. The global expansion and entry into new markets by industries, coupled with increased construction activities and sectoral growth in automotive and aerospace, are significantly contributing to the heightened demand for torsion testing equipment.

Challenges

- Building Accurate Samples – Preparing a sample for torsion tests poses challenges, as the sample must have a consistent shape, ideally round or square, and lack defects, cracks, or rough spots that might affect twisting outcomes.

- Complex Behaviour - Torsion tests examine how materials react to twisting forces. Yet, these materials can show complex responses under such loads, making it tough to foresee their behavior accurately. The presence of uneven properties within the material, non-linear bending, and the concentration of strain adds layers of complexity to analyzing test results. Tackling these intricacies and precisely depicting how materials behave under torsion calls for sophisticated testing methods and analysis techniques.

Torsion Tester Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 27.69 billion |

|

Forecast Year Market Size (2035) |

USD 44.68 billion |

|

Regional Scope |

|

Torsion Tester Market Segmentation:

Type Segment Analysis

Electromechanical torsion testers segment is set to account for around 38% torsion tester market share by 2035. The segment growth can be attributed to the growing need for top-notch testing tools that deliver reliable and flexible outcomes. These devices are preferred for their precision in both research and business environments. The expansion of electric torsion testers is fueled by their easy-to-use design, making them appealing to a broad audience. Furthermore, their affordability makes them a favored choice among schools and small businesses. The demand for robust testing machines that can endure tough testing environments drives the expansion of servo hydraulic torsion Testers. Sectors like aerospace composites and automotive, which need high-force torsion testing, prefer these machines for their strength and efficiency.

Material Type Segment Analysis

By the end of 2035, metal segment is expected to hold over 44% torsion tester market share. The expansion of the building and construction sector is leading to a rise in the need for torsion testers, mainly to test materials like metals. The growing wealth and development of the automotive sector are also pushing the demand for torsion testers, especially for metals and composites. Every kind of material has specific uses across various industries. For instance, testing metal for twisting strength is vital in the automotive field to guarantee the durability and dependability of metal parts under torsional stress. Testing plastics for twisting is key in the packaging sector to understand how plastic wrapping materials react to twist forces. Testing composites for torsion is essential in the aerospace field to check the performance of composite materials in aircraft structures.

Our in-depth analysis of the torsion tester market includes the following segments:

|

Type |

|

|

Material Type |

|

|

Frequency Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Torsion Tester Market - Regional Analysis

APAC Market Insights

APAC region in torsion tester market is anticipated to hold revenue share of more than 38.72% by 2035. The Asia Pacific area is set to be a key space for torsion testers due to rapid growth in various fields such as automobile manufacturing, aviation, and biomedicine. The market pushed by a rising need for exceptional material quality and testing in these areas. The Asia Pacific region is quickly turning industrial, with countries like China and Japan at the forefront, boosting the need for torsion testers across sectors. Another factor boosting the growth of the torsion testing market in this region is the advancement in technology and new material creation as these new materials need unique testing tools.

China plays a key role in Asia Pacific's torsion tester market, thanks to its robust manufacturing sector and a focus on quality. Its mass manufacturing factories and overall industry, especially in vehicle production and electronics, drives the need for torsion testers to test different components and parts of complex machines under torsional forces.

Japan stands out for its high-quality focused production and technology centered advancements, adding to the torsion tester market's growth. Japan's goal at quality and fine engineering boosts the need for torsion testers in almost all kinds of fields.

North America Market Insights

The North American region will also encounter huge growth for the torsion tester market during the forecast period and will hold the second position. The North American zone stands out as a prime market for torsion testers, anchored by a robust auto and aerospace sector. This market is set to grow at a promising pace, pushed by the rising need for stricter quality checks and material testing. The increase in building and construction equipment work in North America also adds to this need for torsion testers. Moreover, the upsurge in industry work and metal fabrication activities in the region also fuels the demand for these testers.

The U.S. showcases a well-developed manufacturing sector, covering fields like aerospace, auto, and medical tools. This vast industrial landscape ensures a high need for torsion testers. Stringent rules on product safety and quality in the U.S. by regulatory bodies demand detailed material testing, thus boosting the torsion tester market.

Canada's solid auto sector, especially in Ontario, drives the demand for torsion testers in testing car parts. State funds and investments in infrastructure across Canada call for strong material tests, likely raising the need for torsion testers in the construction field.

Torsion Tester Market Players:

- Instron

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ADMET

- Tinius Olsen

- ZwickRoell

- SHIMADZU

- MTS

- Qualitest

- GUNT

- TesT

The torsion tester market is dominated by several key players. These companies are known for their high-quality products and services, which cater to various industries such as automotive, aerospace, biomedical, and metal fabrication.

Recent Developments

- Instron - Instron has unveiled the latest upgrade to its testing equipment range, the Torsion Add-On 3.0, tailored for the new Instron 6802 Series. This upgrade refines its design to harness the newest features available, offering users a more straightforward, secure, and intuitive handling experience. Its capacity to conduct tests in axial, torsion, and combined axial-torsion modes enables it to mimic the real-world application of products and parts within a test setting. Additionally, it aligns with numerous global testing standards, including ISO 11040-4, ISO 80369, and ASTM F543.

- ADMET - ADMET has recently expanded its lineup with the introduction of the table-top eXpert 3910 electromechanical fatigue testing systems. These devices employ effective voice-coil actuators suited for low-force stretch, squeeze, and bend tests over several million cycles. Built to be clean, silent, small, and nearly free of upkeep, the eXpert 3910 series is an excellent match for any test setting. Each system is equipped with the MTESTQuattro, a software controller designed for dynamic fatigue testing that simplifies the creation of both simple and complex motion patterns. Consistent with ADMET's high standards, the eXpert 3910 series offers customization options for unique needs and meets or surpasses ASTM and ISO testing benchmarks.

- Report ID: 6242

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Torsion Tester Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.