TMJ Implants Market Outlook:

TMJ Implants Market size was over USD 6.9 billion in 2025 and is anticipated to cross USD 12.01 billion by 2035, witnessing more than 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of TMJ implants is assessed at USD 7.25 billion.

The rising cases of TMJ disorders including jaw trauma and congenital deformities are prime factors augmenting the sales of TMJ implants. For instance, in February 2024, the National Institutes of Health’s (NIH) study revealed that the temporomandibular disorder (TMD) prevalence rate around the globe is around 34%. People between 18 to 60 years of age are more susceptible to TMDs. South America holds a dominant position with the TMD prevalence rate of around 47% followed by Asia (33%) and Europe (29%). The rising older population across the world is also a major contributor to the TMJ implants market growth.

Manufacturers of TMJ implants are employing several organic and inorganic strategies to enhance their profit shares and maximize market reach. For instance, in October 2024, Stryker Corporation one of the leading manufacturers of TMJ implants revealed that its reported net sales surpassed 11.9% to USD 5.5 billion in Q3 FY24. The organic net sales augmented by 11.5% with 10.3% from unit volume and 1.2% from higher prices. MedSurg and neurotechnology totaled USD 3.2 billion and orthopedics and spine amounted to USD 2.3 billion in the third quarter.

Key TMJ Implants Market Insights Summary:

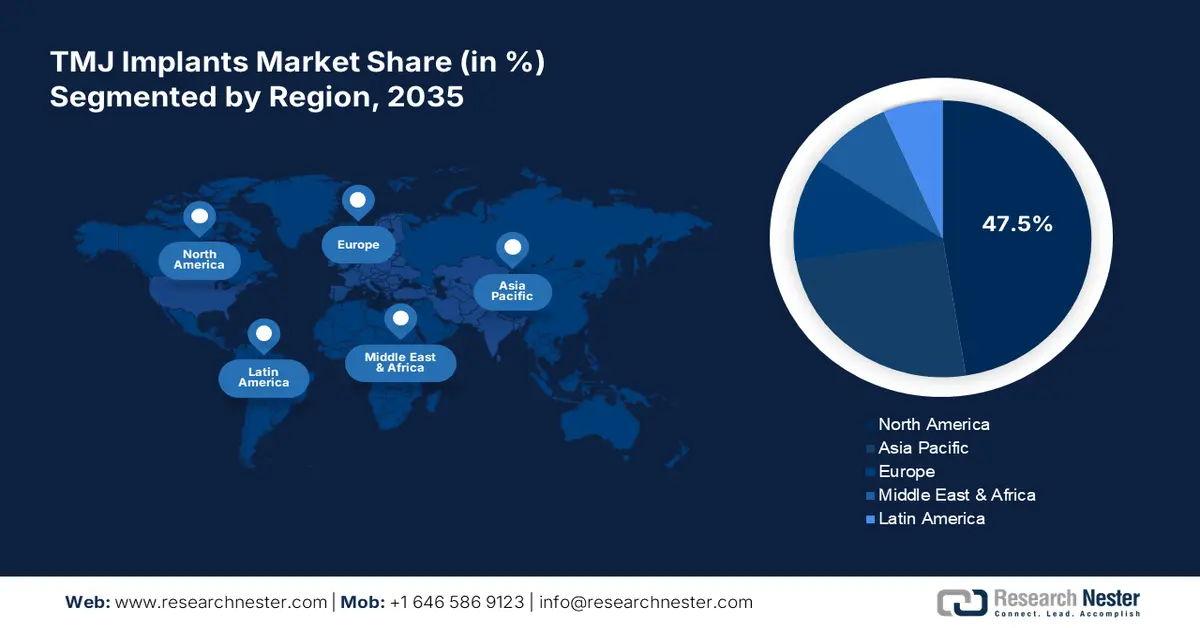

Regional Highlights:

- North America’s 47.5% share in the TMJ implants market is fueled by the strong presence of healthcare research organizations through 2026–2035.

- The Asia Pacific TMJ Implants Market is projected to grow rapidly by 2035, driven by manufacturing growth, favorable policies, and advanced medical implant innovations in countries like China and India.

Segment Insights:

- The Hospital segment is expected to achieve a 73.50% market share by 2035, driven by hospitals being the prime preference for surgeries due to skilled staff and advanced technology.

- The mandibular component segment of the TMJ Implants Market is expected to dominate with a 68.50% share by 2035, propelled by rising cases of maxillofacial disorders and trauma-related injuries.

Key Growth Trends:

- Introduction of surgical robots

- Minimally invasive surgery trend

Major Challenges:

- High surgical costs

- TMJ surgical complications

- Key Players: Zimmer Biomet Holdings Inc., Stryker Corporation, Ortho Baltic, and Xilloc Medical B.V.

Global TMJ Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.9 billion

- 2026 Market Size: USD 7.25 billion

- Projected Market Size: USD 12.01 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

TMJ Implants Market Growth Drivers and Challenges:

Growth Drivers

- Introduction of surgical robots: The integration of surgical robots and navigation systems are some of the latest trends set to drive the sales of TMJ implants in the coming years. Such advanced technologies increase the efficiency and precision of the surgical process creating a promising aspect among treatment seekers. Digital technologies such as predictive analytics, artificial intelligence, machine learning, augmented and virtual reality, and the Internet of Things aid medical professionals or surgeons in better decision-making and planning, which leads to success rates of TMJ implant surgeries and patient care offering high TMJ implants market growth prospects. For instance, in November 2024, Johnson & Johnson MedTech received approval from the U.S. Food and Drug Administration (FDA) for the use of OTTAVA. This robotic surgical system investigational device exemption (IDE) helps surgical teams perform operations more effectively and precisely.

- Minimally invasive surgery trend: Innovations in medications, implants, and surgical materials have lowered the TMJ implant surgery recovery time. The increasing adoption of minimally invasive surgeries is expected to significantly drive the TMJ implants market growth in the coming years. Minimal surgical time, shorter recovery periods, and low complication rates are driving TMD/TMJ patients to opt for minimally invasive surgeries, augmenting the revenue share of key players. For instance, the American Society of Plastic Surgeons reveals that around 25,442,640 minimally invasive cosmetic procedures were totaled in 2023. Furthermore, the National Institutes of Health (NIH) reveals that the success rate of a single minimally invasive TMJ surgery is 75.92%, and minimally invasive TMJ surgery + additional arthrocentesis is 84.62%.

Challenges

- High surgical costs: The high costs associated with pre & post temporomandibular joint surgeries and implants are a major factor hindering TMJ implants market growth. Patients with low incomes often find it difficult to invest in such advanced surgical procedures. The lack of reimbursement policies in underdeveloped or developing regions further hampers TMJ implant sales.

- TMJ surgical complications: Like other surgical procedures, TMJ surgeries are susceptible to failures, need for revision surgeries, and infection. Such complications create misconceptions of TMJ implant surgeries among patients, which directly affects the revenues of key players. Furthermore, the concern related to the long-term durability of TMJ implants that drives the need for replacement or revision surgeries also hampers the overall TMJ implants market growth to some extent.

TMJ Implants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 6.9 billion |

|

Forecast Year Market Size (2035) |

USD 12.01 billion |

|

Regional Scope |

|

TMJ Implants Market Segmentation:

Component (Mandibular Components, Fossa Prosthesis, Screws)

Mandibular component segment is projected to dominate TMJ implants market share of over 68.5% by 2035. The rising cases of Maxillofacial disorders are directly influencing the sales of prosthetic solutions including mandibular components. The National Institutes of Health (NIH) estimates that Maxillofacial injuries between 17-69% worldwide depend on various factors such as traffic, environmental, and socioeconomic. The older population more susceptible to dental disorders is the prime demographic augmenting the sales of dental implants. The growth in trauma and accident cases is also fueling the sales of mandibular and reconstruction solutions. For instance, the American Association for the Surgery of Trauma reveals that millions of trauma cases occur worldwide annually.

End user (Hospitals, Dental Clinics, Others)

In TMJ implants market, hospital segment is expected to hold revenue share of over 73.5% by the end of 2035. Hospitals are the prime preference for any surgical operations owing to the presence of skilled staff and advanced technologies. The high success rates, specific case wards, and experienced doctors, and pharmacies act as promising factors for treatment seekers. The report by the National Institutes of Health (NIH) reveals that over 310 million major surgical operations are performed annually worldwide. Out of this majority of surgeries are performed in hospitals.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Material |

|

|

Indication |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

TMJ Implants Market Regional Analysis:

North America Market Forecast

North America TMJ implants market is set to account for revenue share of more than 47.5% by the end of 2035. The strong presence of healthcare research organizations, rising cases of TMJ issues, the existence of advanced healthcare facilities and industry giants, and continuous technological innovations are augmenting the overall market growth. Both the U.S. and Canada are estimated to offer lucrative opportunities to TMJ implant manufacturers in the coming years.

In the U.S., the strong presence of key players and a hike in the cases of temporomandibular cases is significantly augmenting the TMJ implants market growth. The National Institutes of Dental & Craniofacial Research reveals that around 10 to 12 million U.S. adults experience temporomandibular joint pains. Manufacturers in the country are focusing on the development of TMJ implants produced using advanced materials such as titanium and ceramic. Such moves by the companies are boosting their revenue shares and also uplifting the position of the U.S. in the global market.

In Canada, the rising trauma injuries & accident cases, advancements in TMJ treatment options, and the presence of research organizations are collectively contributing to the market growth. For instance, the Statistique Canada reveals that around 2/3rd of Canadians have experienced trauma cases in their lifetime. Major cases leading to Maxillofacial surgeries fuel the demand for TMJ implants.

Asia Pacific Market Statistics

The Asia Pacific TMJ implants market is set to expand at the fastest pace during the projected period. The expansion of manufacturing units, supportive government policies for medical equipment production, rising favorable insurance policies, and high fund allocations of innovative healthcare facilities are propelling market growth. China and India are emerging as the most opportunistic marketplaces for TMJ implant manufacturers. The presence of high-tech companies is set to significantly drive the TMJ implants market growth in South Korea and Japan.

In China, the rising awareness of TMJ disorders, the presence of innovative medical implant manufacturers, and advancements in surgical techniques are expected to augment the market growth. Innovations in 3D printing and customization trends are also driving the sales of personalized TMJ implants.

In India, supportive government policies and initiatives are estimated to contribute to the growth of the TMJ implants market. For instance, as per the analysis by the India Brand Equity Foundation (IBEF), the 100% open policy for foreign direct investments (FDI) in the country’s medical device market is generating lucrative opportunities for TMJ implant manufacturers. Between April 2000 to March 2024 around USD 3.28 billion FDI inflows were totaled in the country.

Key TMJ Implants Market Players:

- Zimmer Biomet Holdings Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Ortho Baltic

- Xilloc Medical B.V.

- B. Dental Devices Ltd

- CADskills

- RAOMED

- Aetna Inc.

- Fortis Healthcare Limited

- Raffles Medical Group

- Materialise N.V.

- Keystone Dental

- Auxein Corporation

- Dentsply Sirona, Inc.

- Max Healthcare

- Ortho Max Mfg. Co. Pvt. Ltd.

The TMJ implants market is characterized by the presence of industry giants and the emergence of new companies. Leading companies are employing marketing strategies such as new product launches, technological innovations, strategic collaborations & partnerships, mergers & acquisitions, and global expansion to earn high profits and maximize their market reach. Collaborations with high-tech companies are leading to the development of advanced TMJ implants. Supportive government policies are also driving the attention of key players to expand their manufacturing activities in other regions.

Some of the key players include:

Recent Developments

- In February 2024, Materialise N.V. announced the launch of a fully personalized TMJ total arthroplasty system. This is an innovative solution with a combination of guides, implants, and digital planning that streamlines effective patient-specific TMJ treatment.

- In September 2023, Urbanek announced the expansion of its commercial operations in North America. Through this move, the company is offering its innovative TMJ implant solution to treat over 10 million TMJ/TMD patients in the region.

- Report ID: 6905

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

TMJ Implants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.