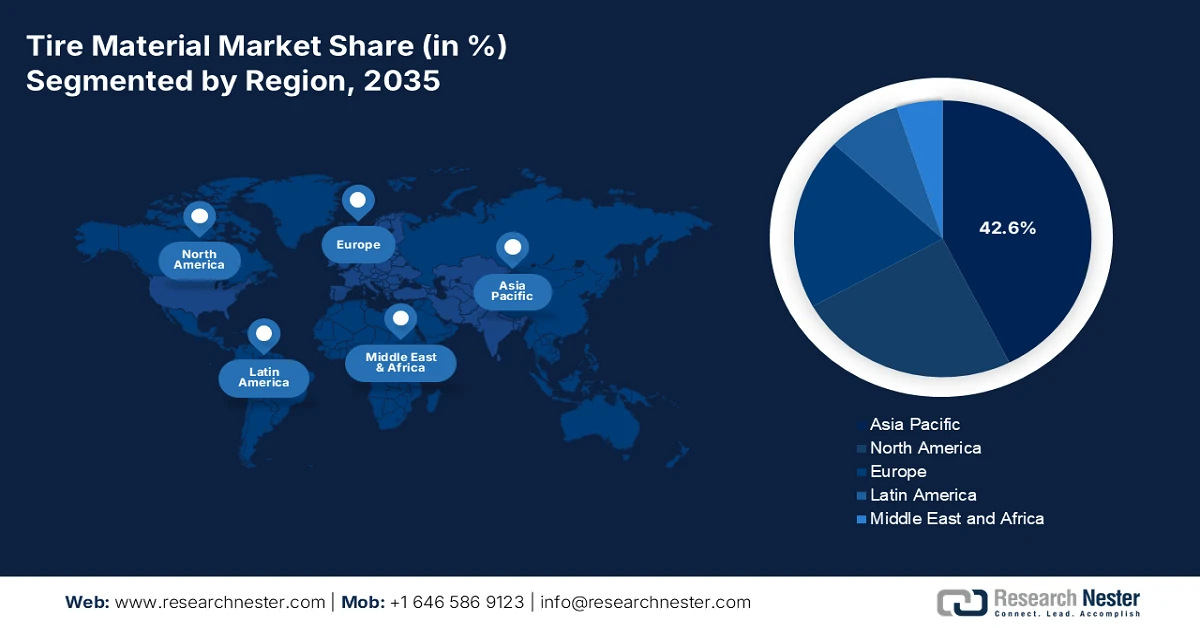

Tire Material Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to garner the largest market share of 42.6% by the end of 2035. The market’s upliftment is highly driven by generous advancements in chemical research and development, the presence of robust government sustainability mandates, and rapid automotive production. According to official statistics published by the AFMA Organization in July 2024, the light vehicle industry in the region has experienced a 0.8% growth as of 2023, highly propelled by economic recovery as well as resolved supply chain risks. Besides, China has led this growth with an 11% year-on-year (YoY) increase in vehicle units sold, which is followed by 8% in India and 15% in Japan. Moreover, Thailand has aimed to produce 725,000 electric vehicles every year by the end of 2030, while Indonesia has significantly attracted EV projects, including BYD’s USD 1.3 billion factory, all of which are positively impacting the market’s exposure.

The tire material market in China is growing significantly, owing to massive automotive production, the existence of government sustainability mandates, chemical and industrial scale infrastructure, as well as research and development innovation. As stated in an article published by the CEN ACS Organization in January 2025, the country’s chemical product manufacturing and chemical raw materials industry effectively grew by 9.5% as of 2024. However, domestic enterprises across different industries reduced by an average of 4.3%. Besides, the country’s government has significantly rolled out huge economic stimulus measures, which includes loans of over USD 1.3 trillion to assist localized governments in paying their respective debts and effectively stimulate their respective economies, thereby making it suitable for bolstering the market.

The aspects of government investments in chemicals, rapid industrialization and automotive demand, green chemistry adoption, policy and circular economy initiatives are readily responsible for uplifting the market in India. As stated in an article published by the IBEF Organization in December 2025, the chemical industry in the country is one of the most influential industries for manufacturing, readily contributing nearly 7% of the gross domestic product (GDP). The industry significantly manufactures more than 80,000 commercial products in bulk chemicals, agrochemicals, petrochemicals, specialty chemicals, fertilizers, and polymers. Besides, the chemical industry in the nation amounted to Rs. 21,50,750 crore (USD 250 billion) as of 2024, and is projected to surge to Rs. 35,26,800 to Rs. 39,67,650 crore (USD 400 billion to USD 450 billion) by the end of 2030, thus proliferating the market’s upliftment in the country.

Europe Market Insights

Europe tire material market is expected to emerge as the fastest-growing region during the forecast period. The market’s development is highly propelled by the existence of strict regional sustainability mandates, the rise in electric vehicle adoption, and circular economy approaches. According to official statistics published by the SOCI Organization in December 2025, chemicals are the ultimate part of the region’s manufacturing industry, significantly responsible for the majority of investment, amounting to 17.7% of the total. Besides, the Europe Commission has estimated that generous investment is essential between 2030 and 2050, with the chemical industry accounting for 37% or €12.9 billion every year. However, other estimates for suitable funding of net-zero strategies in the industry recommended that the shift can cost an estimated €35 billion per year, thus denoting a huge growth opportunity for the market.

The market in Germany is gaining increased traction due to the availability of government-funded sustainability programs, robust chemical industry infrastructure, and strong automotive manufacturing. As stated in a data report published by the GTAI in 2025, the country is considered the world’s largest car-producing hub, with 60% branded vehicles readily manufactured by domestic OEMs, and of these, 24% have been physically developed in the country as of 2023. Besides, there has been a record of over 1.6 million all-electric vehicle registrations by the end of 2024, along with nearly 160,000 charging stations, of which over 125,000 were categorized as normal charging stations, with more than 35,000 fast-charging stations. Moreover, different automotive organizations have recorded huge registrations, thus enhancing the market’s demand in the country.

Organizational Groups with Maximum Transactional Patent Registrations in Germany (2025)

|

Company Name |

Registration |

Share of Registration in % |

|

Bosch |

3,026 |

6.2 |

|

Volkswagen |

2,525 |

5.2 |

|

Schaeffler |

991 |

2.0 |

|

BMW |

927 |

1.9 |

Source: GTAI

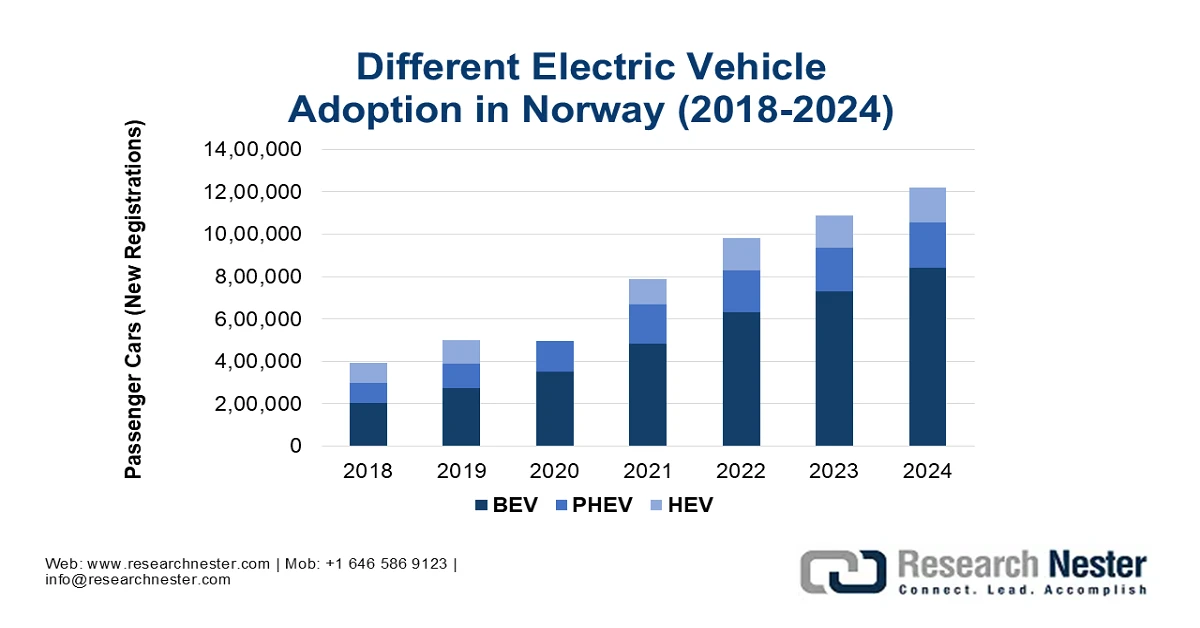

The push for chemical industries to implement eco-friendly tire materials, achieve carbon neutrality targets, increase electric vehicle penetration, and implement aggressive sustainability policies are factors that are boosting the tire material market in Norway. As per an article published by the EVTCP Organization in 2025, as of 2024, electric vehicles accounted for 89% of new car sales in the country, denoting a rise from 82% in 2023, and gradually moved near to the 2025 objective. Besides, the average payer’s pricing of the latest passenger cars reduced to €48,000, with Tesla remaining the most popular car. Moreover, the country has successfully surpassed its ultimate target of 9,000 fast chargers, gaining an average of 87 battery electric vehicles per charger. Meanwhile, the continuous rise in battery, plug-in hybrid, and hybrid electric vehicles is also proliferating the market in the country.

Source: EVTCP Organization

North America Market Insights

North America tire material market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by advanced chemical manufacturing, sustainability mandates, and an increase in demand for automotive. Based on government estimates published by the USITC Government in January 2024, more than 1 million people are employed in the U.S. for producing motor vehicles as of 2022, which represents over 8% of the domestic manufacturing employment. In addition, automotive exports account for the majority of U.S. exports, catering to 8% to 10% of exports. Besides, automotive assembly tends to act as a multiplier in localized communities, wherein every additional assembly employment enhances local jobs by 6.6%. Therefore, with continuous growth in this industry, the market is gradually increasing in the region.

The presence of the EPA green chemistry program, an increase in energy chemical production, advanced manufacturing programs, and the existence of clean energy chemicals are responsible for boosting the tire material market in the U.S. As per an article published by the Center for Sustainable Systems in 2026, 82% of energy in the country derives from fossil fuels, 8.7% from nuclear, and 9.1% from renewable sources. Besides, the country comprises an estimated 463,400 TWh of renewable energy technical potential, which is more than 100 times the electricity consumption and less than 1% of its utilization. Besides, as per the January 2026 EIA Government article, there has been a decrease in energy-based carbon dioxide emissions by 2.2% this year in comparison to 2025, thereby making it suitable for bolstering the market’s exposure in the overall country.

Renewable Energy Utilization in the U.S. (2020-2023)

|

Energy Source (Quads) |

2020 |

2021 |

2022 |

2023 |

|

Geothermal |

0.12 (1.6%) |

0.12 (1.5%) |

0.12 (1.5%) |

0.12 (1.5%) |

|

Solar |

0.51 (7.0%) |

0.63 (8.2%) |

0.76 (9.4%) |

0.88 (10.6%) |

|

Hydroelectric |

0.97 (13.3%) |

0.86 (11.2%) |

0.87 (10.7%) |

0.82 (9.9%) |

|

Wind |

1.15 (15.8%) |

1.29 (16.9%) |

1.48 (18.3%) |

1.45 (17.6%) |

|

Biomass |

4.55 (62.3%) |

4.75 (62.1%) |

4.86 (60.0%) |

4.98 (60.4%) |

Source: Center for Sustainable Systems

The tire material market in Canada is gaining increased exposure, owing to government sustainability mandates, automotive industry transformation, trade and resource advantage, along with the presence of research and innovation programs. As per an article published by the Government of Canada in August 2024, the wide-ranging transition to electric vehicles is crucial to decarbonizing on-road transportation, accounting for 20% of the country’s overall greenhouse gas emissions, of which 50% has been produced by light-duty vehicles and passenger cars. Besides, the Minister of Energy and Natural Resources declared a federal investment of USD 7.5 million for 35 projects through the Zero-Emissions Vehicles Awareness Initiative (ZEVAI). This investment has been suitable for educating and raising awareness among the population regarding zero-emission vehicles, thus uplifting the market’s exposure.