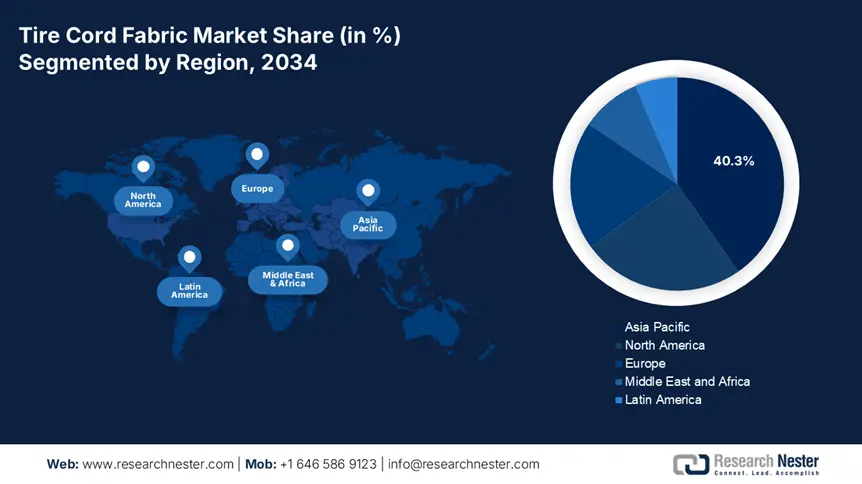

Tire Cord Fabric Market - Regional Analysis

Asia Pacific Market Insights

By 2034, the Asia Pacific market is expected to hold 40.3% of the market share due to strong growth from automotive and EV demand throughout Asia Pacific, in particular, which has seen car sales surge in the region due to growth in economic activity from states, post-COVID. The tire cord fabrics segment generated revenues totaling USD 2,990.2 million in 2024, with a projected CAGR of 6.7% through 2030. Globally, the wider market has been projected to grow, from USD 6.21 billion in 2024 to approximately USD 12.26 billion by 2034, at a growth rate of approximately 7.3%. Much of the growth in this area can be attributed to innovations, advancements in the technology sector, and regional infrastructure growth, especially in China and India, which are pushing growth in new materials such as rayon, because of its status as one of the fastest-growing segments of apparel, automotive, fibrous and textured fiber segment and future expectations for tire development over the next 10 years.

China is the largest automotive market in the Asia Pacific, and is likely to drive the directional growth of tire cord fabric, accounting for a regional CAGR of ~6-8% and expected to consume high-performance cords, including nylon and rayon. According to the projections of USD 6.20 billion to USD 12.26 billion by 2034, these are positive growth signals domestically. Given China's established leadership position in producing cars and EVs, it is almost a given that there will be continued use and differentiation of advanced tire fibers through 2034.

APAC Tire Cord Fabric Market: Country-Wise Industrial & Automotive Insights

|

Country |

Automotive Industry Expansion |

Manufacturing Base |

Infrastructure Development |

Vehicle Sales Growth |

Technological Innovation |

|

China |

Largest global vehicle producer (27M units, 2023) |

50+ tire cord fabric plants |

$1.2T infrastructure spending (2021-25) |

5.4% YoY sales increase (2023) |

120+ patents in high-strength materials (2023) |

|

India |

4th largest auto market (5M+ units, 2023) |

12 major tire cord facilities |

26,000 km highway expansion (2020-24) |

8.1% YoY sales growth (2023) |

Adoption of nylon 66 for radial tires |

|

Japan |

Leader in high-performance tires |

8 advanced R&D centers |

$300B smart city projects (2023-30) |

4.2% EV sales surge (2023) |

Aramid fiber integration in premium tires |

|

South Korea |

5th largest auto exporter |

6 automated tire cord plants |

$60B transport infra upgrade (2022-26) |

3.8% domestic sales rise (2023) |

AI-driven quality control systems |

|

Thailand |

ASEAN automotive hub (1.9M vehicles, 2023) |

10+ export-focused factories |

$10B Eastern Economic Corridor |

11.2% commercial vehicle growth (2023) |

Sustainable rubber compounding tech |

|

Vietnam |

Fastest-growing auto assembly base |

4 new tire cord plants (2022-23) |

$65B North-South expressway |

24% YoY motorcycle sales jump (2023) |

Localized carbon fiber production |

North America Market Insights

North America market is expected to hold 24.7% of the market share, and it is expected to grow from USD 411 million in 2025 to USD 566 million in 2034 at a CAGR of 3.8% for 2025–2034. This growth can be attributed to strong automotive manufacturing and replacement tire demand, due to the rising freight transportation activity. Synthetic tire cord fabric demand will continue to lead due to its higher tensile strength and resistance to heat. The collaborations between OEMs and multi-fiber tire fabrics for electric vehicles will help spur market demand throughout the region.

The U.S. tire cord fabric market is also estimated to rise from USD 346 million in 2025 to USD 471 million in 2034, with a CAGR of 3.7%. This growth in the U.S. tire cord fabric market is attributed to the extensive auto manufacturing industry and replacement tire demand. Many tire manufacturers are investing assets to manufacture high-performance rayon and polyester tire cord to keep pace with sustainability requirements. An expected spike in electric vehicle sales between 2025-2030 (projected to be over +31% of new car sales) will drive the conversion and need for high-performance & heat-resistant tire cord fabrics in the U.S.

Europe Market Insights

Europe market is expected to hold 19.5% of the market share, stimulated by the EU regulations on tire labeling and tire performance accuracy, prompting more high-strength, lighter fabrics in tractor and car tires (passenger & commercial vehicle tires). The forecast estimates consumption will rise to 419 kilotons by 2034 on the back of the EV transition and the need for low-weight durable tires to drive better fuel economy and lower CO₂ emissions profiles. Some key suppliers are developing and improving aramid and polyester cord advancements.

Europe Tire Cord Fabric Market: Country-Wise Insights

|

Country |

Manufacturing Capabilities |

Sustainability Regulations |

Automotive Industry Dynamics |

|

Germany |

8 high-tech production plants |

EU Green Deal compliance (55% CO₂ reduction by 2030) |

3.1M vehicles produced (2023) |

|

France |

5 automated cord fabric units |

AGEC Law mandates 30% recycled materials in tires |

1.7M passenger cars sold (2023) |

|

Italy |

4 specialized steel cord plants |

National Recovery Plan funds for green tires |

700K+ commercial vehicles made (2023) |

|

Spain |

3 major nylon/polyester facilities |

Spanish Circular Economy Strategy (2025 targets) |

2.4M vehicles exported (2023) |

|

Poland |

Fastest-growing Eastern EU hub |

REACH SVHC restrictions on synthetic rubber |

600K+ EV batteries produced (2023) |

|

Netherlands |

Key logistics/distribution center |

Dutch Climate Agreement (carbon-neutral logistics) |

25% of EU tire testing R&D |