Timing Devices Market Outlook:

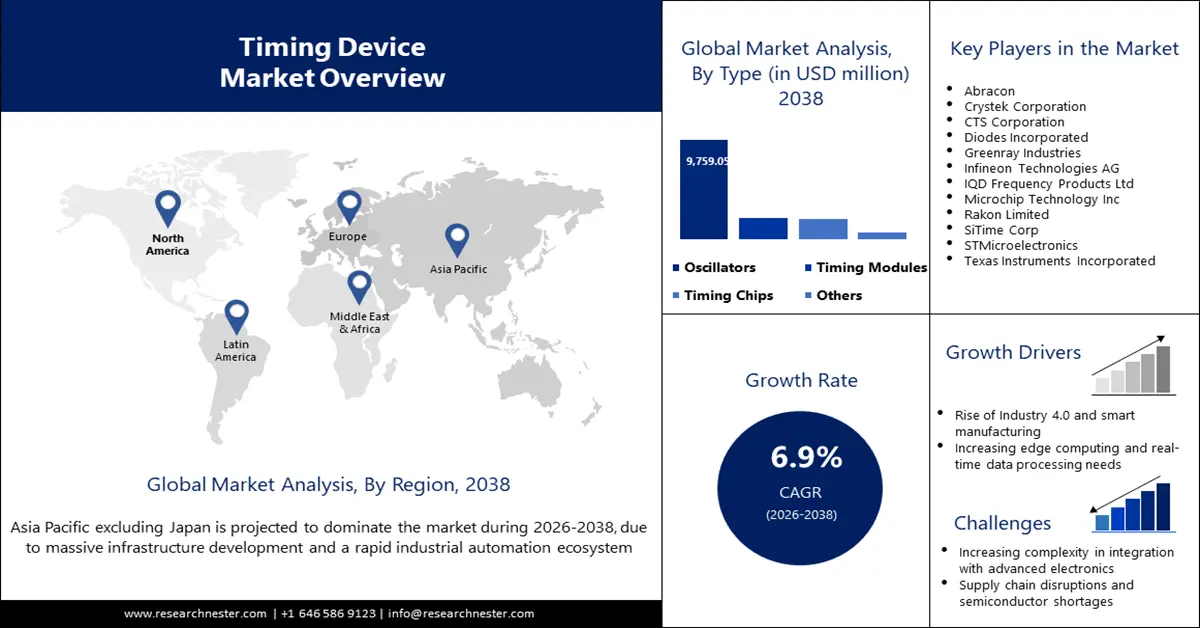

Timing Devices Market size is valued at USD 5.9 billion in 2025 and is expected to reach USD 15 billion by the end of 2038, registering a CAGR of 6.9% during the forecast period. In 2026, the industry size of timing devices is estimated at USD 6.7 billion.

The growing demand for high-speed connectivity is expected to boost the global market growth in the coming years. According to the Global Connectivity Report 2022, global connectivity remains a distant prospect, with internet penetration rates rising by 95% across 13 nations. As a result, the demand for different reliable and precise timing solutions also increases, primarily for synchronization purposes across different applications. The rising demand for timing devices for connectivity purposes drives the increased production of these devices to be incorporated across various applications, such as 5G, the Internet of Things, and others.

The fundraising announcement by regulatory bodies to support the penetration of autonomous vehicles also fuels the growth of the market. For instance, in March 2025, the EU announced USD 1.1 billion of public-private investments to support the transition of the automotive industry towards connected, AI-powered, and automated vehicles. The integration of timing devices in autonomous vehicles is integral owing to the need for millisecond-level precision for data processing from different incorporated sensors and making split-second decisions.

Timing devices Market - Growth Drivers and Challenges

Growth Drivers

- Growth of consumer electronics: The rapid expansion of the consumer electronics sector is expected to fuel the market due to appropriate functionality of consumer electronics products, such as smartphones, tablets, and others, the integration of timing devices is crucial. In addition, consumer electronics products are becoming increasingly sophisticated and feature-rich. For instance, in January 2024, Samsung unveiled the latest flagship Neo QLED 8K QN990F, Vision AI, future display technologies, and lifestyle TV as newly developed sophisticated and feature-rich consumer electronics products and technologies. As a result, the need for reliable and accurate timing signals surges.

- Proliferation of data centers and cloud computing: The growth of the timing devices market is anticipated to be fueled by the proliferation of data centers and cloud computing. For example, Amazon’s announcement of USD 13 billion in June 2025 for the expansion, operation, and maintenance of infrastructure for data centers in Australia. The proliferation of data centers and cloud computing infrastructure leads to an increase in the demand for precise synchronization of functions across more distributed applications.

- Growing demand for wearable health monitoring devices: The emergence of wearable health monitoring devices, including smart watches, smart rings, and others, is expected to accelerate the timing devices sector growth. The integration of timing solutions, such as real-time clocks, event counters, and timers, is integral in wearable health monitoring devices to provide appropriate data timestamping, monitor health activities, and enable sensor readings. To meet the rising demand for wearable health monitoring devices, Samsung launched its first Galaxy Ring in July 2024. People use the Samsung ring to measure and analyze their health attributes and activities, such as energy levels, sleep, and others.

Challenges

- Cybersecurity risks in connected timing systems: Connected timing systems are vulnerable to cybersecurity attacks due to their reliance on data processing in real-time and network communication. For instance, in August 2022, Montenegro was hit with a large cyber-attack. This incident crippled state-run transportation services, electricity, water systems, and an online platform for multiple days. Such cyberattacks significantly alter the reliability and security of timing devices and hamper the overall market growth.

- Limited awareness in the underdeveloped countries: Limited awareness of timing devices in the underdeveloped countries due to poor connectivity emerges as a challenge for market growth. According to a report by the World Bank released in June 2023, despite improvements, only 36% of the population in Africa had access to broadband connections in 2022. This indicates the extent to which the internet connection in underdeveloped countries lags, and as a result, access to information regarding the timing devices becomes limited among the population. This can hinder the adoption of timing devices.

Global Timing Devices Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2038) |

USD 15 billion |

|

Regional Scope |

|

Timing Devices Market Segmentation:

Type Segment Analysis

The oscillators segment is expected to dominate by 2038, accounting for a market share of 64.5% due to the essentiality of the incorporation of oscillators in timing devices. Companies nowadays make significant investments in the production of oscillators for timing devices. For instance, in August 2022, Rakon released a new low g-sensitivity Temperature Compensated Crystal Oscillator (TCXO) RPT7050LG, which has excellent stability in a package size of 7.0 x 5.0 x 1.5 mm. Such advancement of oscillators fuels the scope to make timing devices more precise and reliable in terms of functionality in harsh environmental conditions.

End-user Segment Analysis

The consumer electronics segment is anticipated to experience steady growth with a market share of 37.05% by the end of 2038, owing to high usage of timing devices in consumer electronics. The consumer electronics sector has a high reliance on oscillators and RTCS used in smartphones, tablets, laptops, and other devices to ensure their effective functionality. Timing devices in these products are capable of providing quick signalling for communication, processing, and multimedia operations.

Material Segment Analysis

The crystal segment is expected to account for a revenue share of 55.2% by the end of due to the fuelling demand for crystal oscillators, autonomous vehicles, 5G networks, and IoT devices. Crystal oscillators are widely used in autonomous vehicles to provide stable clock signals for the key electronic elements and the central processing unit of the vehicles. Companies have been focused on the development of new-generation crystal oscillators. One such example is the announcement of the production of temperature-compensated crystal oscillators (TCXO) by Kyocera in April 2024 for the management of higher capacity and high-speed communication.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End-user |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

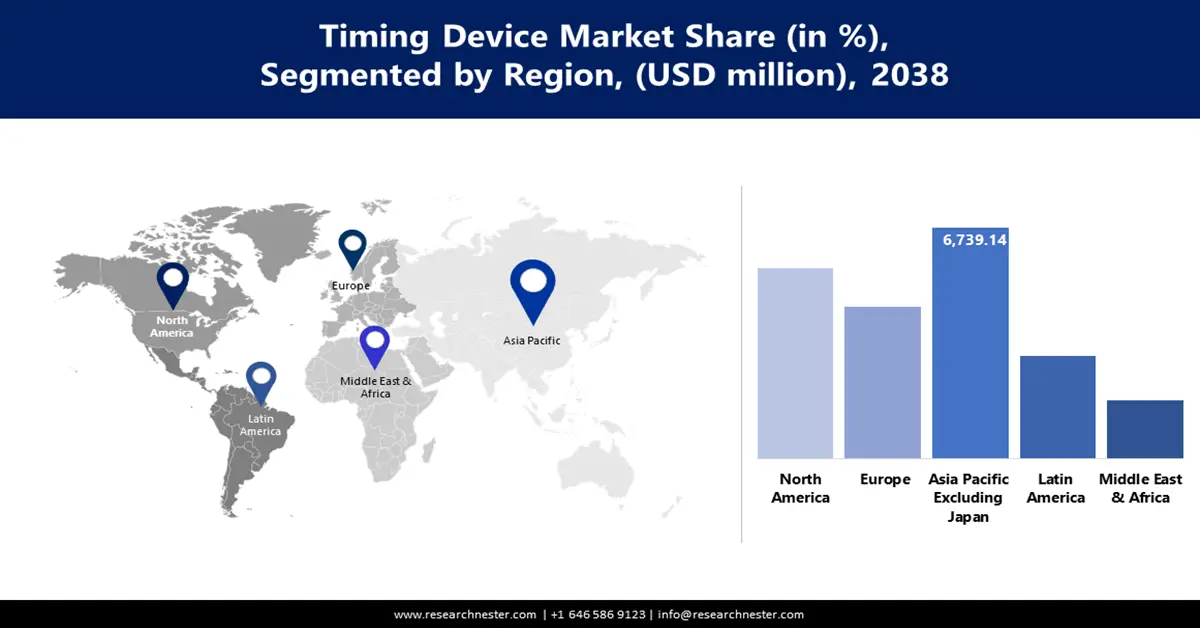

Timing Devices Market - Regional Analysis

Asia Pacific Excluding Japan Market Insight

The Asia Pacific excluding Japan market is expected to be dominant, holding a share of over 40.2% by 2038, owing to the rapid industrial automation ecosystem. Companies in the Asia Pacific are making significant investments in industrial automation. For instance, in October 2022, an agreement was signed between Omron Corporation and Kirin Brewery Company for the stock purchase of the Kirin Techno-System Company to develop Digital Transformation (DX) solutions collaboratively. The solutions will use inspection data, and for that, timing devices are required.

China is setting itself up as a growing market, expanding at a CAGR of 8.8% during the forecast period due to the dominance of the country in the manufacturing of electronics. As reported by the Centre for the National Interest in August 2024, through the Made in China 2025 initiative, billions of dollars have been invested to funnel state subsidies into companies to produce electronics products, including smartphones and advanced digital displays. These electronic goods cannot function appropriately without precise timing technologies.

South Korea is poised to expand at a CAGR of 7.7% during the forecast period due to rapid digitalisation across the nation. As a digital powerhouse globally, heavy investment is made in South Korea for innovative technologies, including semiconductors, AI, next-generation networks, big data, cybersecurity, and quantum computing. As per the International Trade Administration, spending on AI in South Korea is anticipated to reach USD 3.4 billion in 2027. In addition, increasing adoption of automation technologies is expected to fuel the market due to the requirement for precise timing in different automation systems. With the installation of 1,012 robots against 10,000 manufacturing workers, South Korea emerges as the country with the highest density of robots.

North America Market Insight

North America is projected to emerge as one of the fastest-growing timing devices markets by 2038, with an expansion at a CAGR of 6.6% during the forecast period due to the rapid advancement of AI. The expansion of data centres across the nation is another factor expected to fuel the market growth. In April 2025, the International Energy Agency reported that due to the increasing AI use, more electricity consumption is expected to take place in the U.S economy by 2030 for data processing purposes in the manufacturing of goods that are energy-intensive, such as steel, aluminium, cement, and others. By 2030, a 20% growth in electricity demand can be influenced by data centres in advanced economies. The likelihood of more data processing using AI and the growth of electricity consumption can surge the demand for timing devices in the coming years.

Rising industrial automation is the primary factor fuelling the market growth in the U.S. As reported by The International Federation of Robotics in April 2024, investing heavily in automation, U.S companies have contributed to the growth of the installation of robots by 12% by 2023, which accounts for 44,303 units in total. Robotic arms, such as AGVs and cobots, are synchronized by the precise timing devices to ensure efficient coordination, minimization of latency, and optimization of task accomplishment, which reflects industrial automation’s effective safety management and efficiency.

Government initiatives, such as the establishment of the National Institute of Standards and Technology (NIST), also play a crucial role in the growth of the timing devices market by carrying out wider research and development programs. Such initiatives have resulted in the development of precise atomic clocks, the creation of encryption standards, and the advancement of relevant technologies.

Canada market is expected to register a CAGR of 5.5% during the forecast period due to rising smart grid implementation across the nation. Investments by the government in smart technologies also fuel the market growth. By the end of 2025, the government plans to spend USD 32.7 million in Canada Plan for green infrastructure, transit, trade, social infrastructure, and tourism projects. The rising smart grid implementation influences the need for more precise synchronization in the grid.

Europe Market Insight

The timing devices market of Europe is poised to expand at a CAGR of 5.4% during the forecast period, owing to rapid 5G adoption in infrastructure. Initiatives by the regulatory bodies for the advancement of digital infrastructure also influence the market growth. For example, in December 2024, the approval of the conclusions on the White Paper regarding the provision of assistance for future initiatives related to digital infrastructure by the EU Council has led to an investment of around USD 349.29 million in nationwide technological advancement, including innovation for the next-generation networks. 5G adoption and the development of digital infrastructure drive the requirement for precise time synchronization across various applications.

In 2025, Germany dominated the timing devices market in Europe and is likely to retain its dominance during the forecast period, expanding at a CAGR of 7.1% due to the growth of the telecommunication sector. In 2023, around USD 15.8 billion was invested in Germany for network expansion and novel technologies, including private networks and 5G. Advancements in the automation sector in Germany also fuel the growth of the timing devices market. With the motive of replacing the Industry 4.0 forum, Manufacturing-X was initiated in July 2023 in Germany with an emphasis on the formation of a resilient, connected, and sustainable landscape of manufacturing. As a result, the demand for solutions for more precise and reliable synchronization is expected to increase in Germany.

The UK timing devices industry is likely to experience a CAGR of 5.7% during the forecast period due to high government investment in Research and Innovation (R&I). As reported by the UK Parliamentary and government publications in July 2025, the government is committed to making a total investment of USD 27.4 million in 2025, exclusively for the improvement of nationwide digitalization.

Growing investment in autonomous vehicles in the UK is also a key driver behind the growth of the timing devices industry. For instance, in May 2024, an investment of USD 1.5 billion in autonomous vehicles was announced by the AI company Wayve. Investment in research and innovation increases the chances of the emergence of more advanced timing devices, and investment in autonomous vehicles increases the likelihood of rising adoption of different timing devices.

Key Timing Devices Market Players:

- Abracon

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crystek Corporation

- CTS Corporation

- Diodes Incorporated

- Greenray Industries

- Infineon Technologies AG

- IQD Frequency Products Ltd

- Microchip Technology Inc

- Rakon Limited

- SiTime Corp

- STMicroelectronics

- Texas Instruments Incorporated

The global timing devices sector is highly competitive, comprising key players operating at global and regional levels. Due to the advancement of 5G, IoT, and automotive, with the emergence of new companies and the existence of large companies involved in the utilisation and production of timing devices, the competitive landscape of the global market has become highly intensified. Companies are making significant investments in research and innovation for the advancement of timing devices. Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, Skyworks announced the launch of the SKY63104/5/6 family of jitter attenuating clocks, and the SKY62101 ultra-low jitter clock generator. These are the very first 18fs rms phase jitter clocks for Ethernet and PCI, and are developed based on 5th generation MultiSynth and DSPLL technologies.

- In April 2024, Renesas Electronics Corporation expanded its portfolio of timing solutions with the launch of the new FemtoClock 3, an ultra-low 25fs-rms clock solution. These timing devices are supposed to be used in wireless infrastructure, industrial applications, and data centers.

- In August 2024, Abracon launched AR50LC Rubidium Oscillators, a new-generation timing devices. The device is functional in applications where size constraints emerge as a matter of concern, including inside high-precision scientific instruments and terrestrial communication networks.

- Report ID: 5219

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Timing Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert