Time-sensitive Networking Market Outlook:

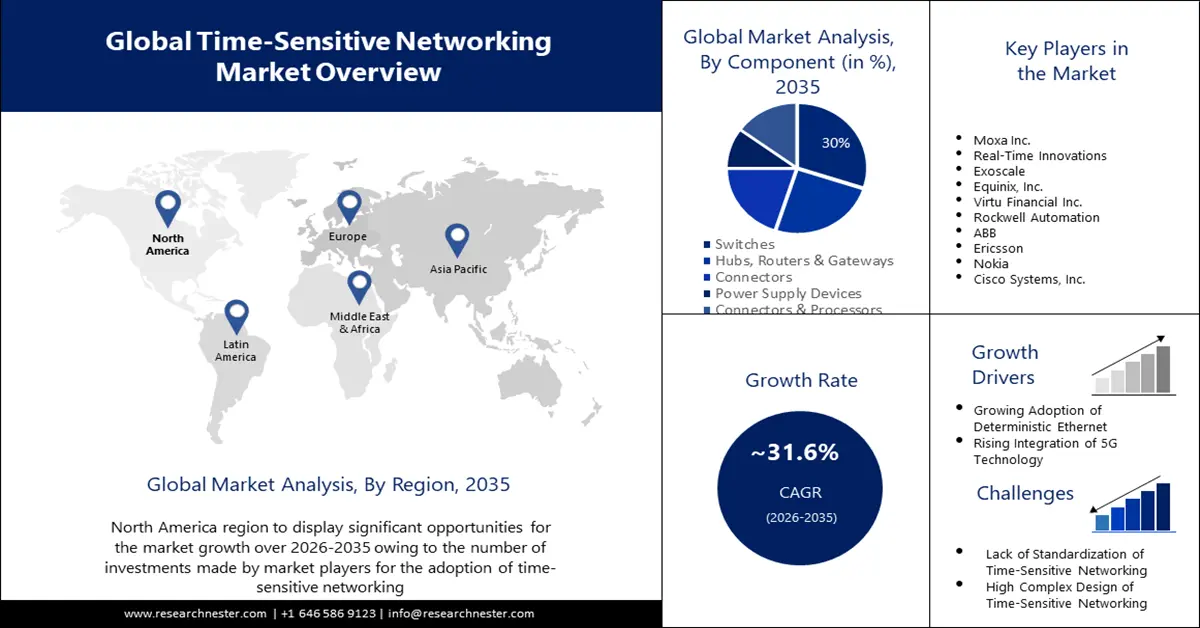

Time-sensitive Networking Market size was valued at USD 538.28 million in 2025 and is expected to reach USD 8.39 billion by 2035, registering around 31.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of time-sensitive networking is evaluated at USD 691.37 million.

This growth of the market is poised to be dominated by the growing automation of industries. For instance, over 32% of companies have at least one function that is automated in the world. Hence, with this, the need for real-time data is also growing which is why the demand for time-sensitive networking is expected to observe a surge.

Furthermore, government in different nations are initiating their efforts in research and development for the enhancement of time-sensitive networking. For instance, recently, an application case for robotics using time synchronization and time-aware shaping scheduling characteristics was presented by NIST and industry researchers in a wireless time-sensitive networking situation. Therefore, this factor is also projected to influence the demand for time-sensitive networking market.

Key Time-sensitive Networking Market Insights Summary:

Regional Highlights:

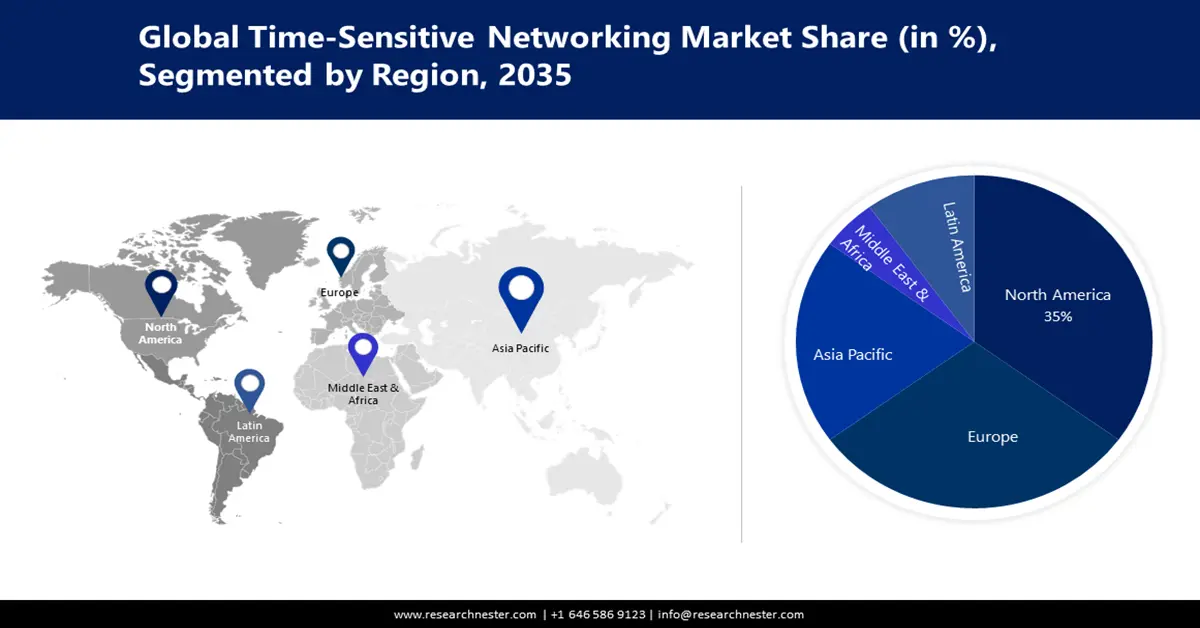

- North America time-sensitive networking (TSN) market will hold more than 35% share by 2035, driven by increased investments in time-sensitive networking, demand for IIoT, and government support for smart factory automation.

- Europe market will register significant growth during the forecast timeline, driven by a strong manufacturing base and rising development of autonomous vehicles.

Segment Insights:

- The ieee 802.1 as segment in the time-sensitive networking market is forecasted to achieve a 30% share by 2035, driven by enhanced reliability and 5G integration capabilities.

- The switches segment in the time-sensitive networking market is expected to achieve a 30% share by 2035, driven by the rising number of data centers necessitating seamless data transfer using TSN switches.

Key Growth Trends:

- Growing Adoption of Deterministic Ethernet

- Rising Integration of 5G Technology

Major Challenges:

- Lack of Standardization of Time-sensitive Networking

- High Complex Design of Time-sensitive Networking

Key Players: Moxa Inc., Real-Time Innovations, Exoscale, Equinix, Inc., Virtu Financial Inc., Rockwell Automation, ABB, Ericsson, Nokia, Cisco Systems, Inc.

Global Time-sensitive Networking Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 538.28 million

- 2026 Market Size: USD 691.37 million

- Projected Market Size: USD 8.39 billion by 2035

- Growth Forecasts: 31.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 16 September, 2025

Time-sensitive Networking Market Growth Drivers and Challenges:

Growth Drivers

- Growing Adoption of Deterministic Ethernet - The time-sensitive networking market, or TSN, is mostly driven by the growing need for deterministic Ethernet for real-time applications. Industrial control applications can benefit from predictable and low-latency communication using the TSN set of IEEE standards. Data delivery that is consistent and dependable is made possible by deterministic Ethernet, and this is crucial for real-time applications including robotics, machine vision, and process control. Real-time communication is becoming more important than ever owing to the growing deployment of Industry 4.0 and the Industrial Internet of Things (IoT). Due to their lack of determinism, traditional Ethernet networks are unable to satisfy the demands of these applications, which leads to unpredictable packet loss and communication delays. Conversely, deterministic Ethernet offers essential assurances for instantaneous communication.

- Rising Integration of 5G Technology - There is an enormous opportunity for the time-sensitive networking business with the introduction of 5G technology. Many TSN applications, including real-time communication, industrial automation, and autonomous vehicles, depend on ultra-low latency, high dependability, and large bandwidth capacities, all of which 5G networks are intended to deliver. Gaining more flexibility and scalability for TSN networks is one of the main benefits of 5G technology. Physical connections are no longer necessary thanks to 5G, which makes it feasible to create extremely dependable and low-latency wireless connections between devices. TSN applications, including industrial automation and robotics, are currently more mobile and flexible as a result of this.

- Surging Demand for Automotive - The worldwide car sales grew from nearly 65 million vehicles in 2021 to approximately 66 million automobiles in 2022. Modern automobiles and other on-road and off-road vehicles including recycling cranes, construction vehicles, mining vehicles, and forest machinery are just a few examples of the many automotive systems that have benefited from enhanced functionality and features made possible by embedded software in recent years. The automotive software has drastically grown in size and complexity as a result of the growing demand for new software-based capabilities in these systems. Tight time constraints pertain to a large number of automotive embedded systems. For this reason, while developing these systems, programmers must not only control software complexity but also ensure time consistency. Due to this the adoption of time-sensitive networking in automotive is growing.

Challenges

- Lack of Standardization of Time-sensitive Networking - One of the main issues facing the time-sensitive networking (TSN) business is the absence of standardization. Time-sensitive applications may profit from deterministic communication capabilities offered by the TSN set of Ethernet standards. Nonetheless, consumers may experience confusion and interoperability problems due to the existence of multiple competing TSN protocols in the time-sensitive networking market. Various industry consortiums are currently developing multiple TSN standards. Although the functionality provided by all of these standards is meant to be identical, there are some minor variations in their implementation and capabilities.

- High Complex Design of Time-sensitive Networking - Due to its complex network systems and unique technical requirements for reliable and timely data packet transmission, time-sensitive networking (TSN) poses a challenge to the industry. The complexity of designing, managing, and implementing TSN networks presents a major challenge. In order to guarantee successful deployment, a thorough understanding of TSN standards and protocols is required. This includes knowledge of topics like timing and synchronization, traffic shaping, stream reservation, fault tolerance, and redundancy. Furthermore, integrating several apps and devices with different configurations, capabilities, and vendor-specific protocols is part of the design process. As such, the intricacy of the process drives up expenses and time limits, making it especially challenging for smaller businesses and sectors to interact with TSN networks.

- Growing Risk of Cyber Attack

Time-sensitive Networking Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

31.6% |

|

Base Year Market Size (2025) |

USD 538.28 million |

|

Forecast Year Market Size (2035) |

USD 8.39 billion |

|

Regional Scope |

|

Time-sensitive Networking Market Segmentation:

Type Segment Analysis

The IEEE 802.1 AS segment in the time-sensitive networking (TSN) market is expected to capture the highest revenue share of about 30% during the forecast period. IEEE 802.1AS, which was initially designed to facilitate plug-and-play video and audio applications, had just been enhanced. In actuality, IEEE 802.1AS is a significant standard change that preserves backward compatibility with the old standard while addressing 5G integration requirements. Furthermore, IEEE 802.1 AS standards prioritized enhanced reliability and cost savings, two factors critical to small-area network applications. Mechanisms are used by the IEEE 802.1AS protocol to confirm that every device connected to a network is following the protocol. For instance, an Ethernet switch is not included in the carrying time if it is discovered to not operate IEEE 802.1AS. For numerous local area network applications, reliable performance is crucial, and this is what this offer. Hence, the segment is expected to observe the significant growth in the market over the forecast period.

Component Segment Analysis

The switched segment in the time-sensitive networking market is expected to gather the largest revenue share of about 30% in the coming years. In the Time-sensitive Networking (TSN) market, switches hold the biggest market share as a result of their vital function in network infrastructure, which includes connectivity and the facilitation of accurate and low-latency communication. Reliable and timely data transport is ensured by TSN switches, which are built to handle TSN characteristics including time synchronization and Quality of Service (QoS) guarantees. Switches have become the most popular component in the time-sensitive networking market owing to their scalability, versatility, and extensive availability from several suppliers. This has made them the go-to option for establishing TSN solutions. Moreover, owing to the rising number of data centers which is necessitating seamless transfer of data the segment is growing. By December 2023, there were projected to be about 10,977 data center locations worldwide.

Our in-depth analysis of the global time-sensitive networking market includes the following segments:

|

Type |

|

|

Component |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Time-sensitive Networking Market Regional Analysis:

North American Market Insights

The North America time-sensitive networking market is projected to hold 35% of the revenue share by the forecast period. This growth of the time-sensitive networking market in this region is set to be influenced by a surge in several investments made by market players for the adoption of time-sensitive networking. Furthermore, this region also has a huge demand for IIOT in industrial applications. Additionally, the government in this region is also investing significantly in smart factory automation which is also dominating the demand for time-sensitive networking.

European Market Insights

The time-sensitive networking market in Europe is also estimated to have significant growth during the forecast period. This is region is having notable presence of manufacturing units is this region. Also, the development of autonomous vehicles is also surging is this region which is also encouraging the time-sensitive networking market expansion in this region.

Time-sensitive Networking Market Players:

- Moxa Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Real-Time Innovations

- Exoscale

- Equinix, Inc.

- Virtu Financial Inc.

- Rockwell Automation

- ABB

- Ericsson

- Nokia

- Cisco Systems, Inc.

Recent Developments

- May 30, 2023: Leading provider of industrial communications and networking, Moxa Inc., announced that it has become a promoter member of Avnu Alliance, the industry forum advancing the interoperability of the time-sensitive networking (TSN) ecosystem by bringing deterministic capabilities into open, standards-based networking. With a focus on developing a really unified and high-performance network architecture that allows all forms of traffic to coexist for real-time communication, low latency, and high reliability requirements across a variety of applications, Moxa's joining offers great promise.

- January 5, 2021: NXP Semiconductors, a pioneer in automotive semiconductors, and Real-Time Innovations (RTI), the largest developer of software frameworks for smart machines and real-world systems, announced their collaboration. With a flexible, modular, and scalable platform, RTI Connext Drive can now operate natively on NXP's automotive-grade S32G vehicle network processors, enabling zonal electrical/electronic (E/E) architecture.

- Report ID: 5762

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Time-sensitive Networking Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.