Thrombopoietin Receptor Agonist Market Outlook:

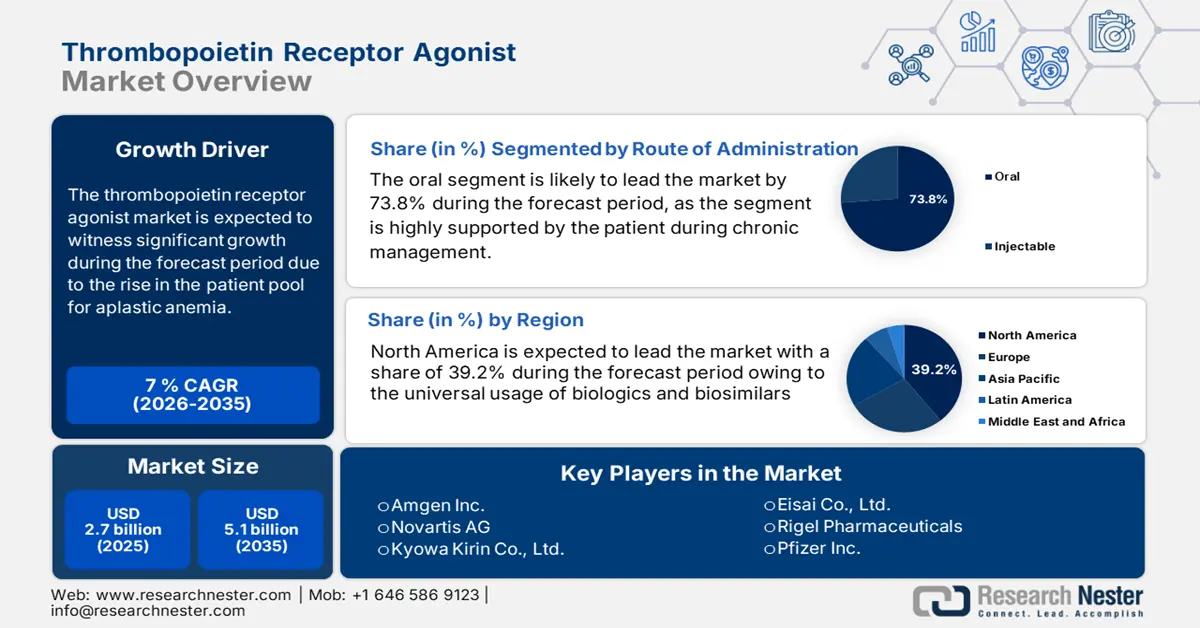

Thrombopoietin Receptor Agonist Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 5.1 billion by the end of 2035, rising at a CAGR of 7% during the forecast period, from, 2026-2035. In 2026, the industry size of thrombopoietin receptor agonist is evaluated at USD 2.8 billion.

The market is fueled by the rising patient pool for aplastic anemia, immune thrombocytopenia (ITP), hepatitis C-related thrombocytopenia, and chemotherapy-induced platelet disorder. The National Organization for Rare Disorders report released in July 2022 states that nearly 3.3 per 100,000 adults are affected by immune thrombocytopenia in the U.S. Further, the global prevalence increases the number; WHO reports show that elderly populations in Italy and Japan have higher incidences, and that expanded hematology testing in China and India has led to rise in diagnosis rates.

On the supply chain side, recombinant protein or small molecule synthesis is used to manufacture the thrombopoietin receptor agonist (TPO-RA), and is highly reliant on Active Pharmaceutical Ingredient imports from Europe and India. As per the Ministry of Chemicals & Fertilizers Department of Pharmaceuticals report in March 2023 depicts that China plays a key role in the API market. Further, the NLM report in February 2024 states that 87 drugs were approved in China in 2023, accounting for 67.8, including TOP-RA. The Bureau of Labor Statistics has depicted that the producer price index rose to 0.6% from June 2024 to July 2025 for pharmaceutical biologics products. Furthermore, governments are actively investing in research, development, and deployment for expanded indications in TPO-RA.