Thrombopoietin Receptor Agonist Market Outlook:

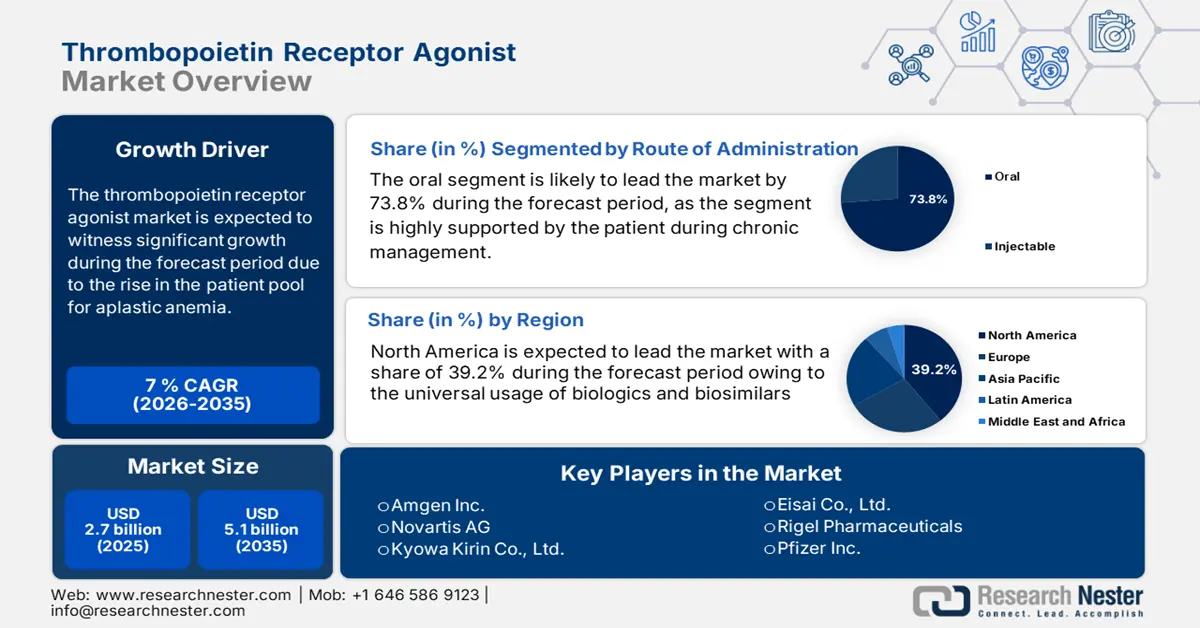

Thrombopoietin Receptor Agonist Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 5.1 billion by the end of 2035, rising at a CAGR of 7% during the forecast period, from, 2026-2035. In 2026, the industry size of thrombopoietin receptor agonist is evaluated at USD 2.8 billion.

The market is fueled by the rising patient pool for aplastic anemia, immune thrombocytopenia (ITP), hepatitis C-related thrombocytopenia, and chemotherapy-induced platelet disorder. The National Organization for Rare Disorders report released in July 2022 states that nearly 3.3 per 100,000 adults are affected by immune thrombocytopenia in the U.S. Further, the global prevalence increases the number; WHO reports show that elderly populations in Italy and Japan have higher incidences, and that expanded hematology testing in China and India has led to rise in diagnosis rates.

On the supply chain side, recombinant protein or small molecule synthesis is used to manufacture the thrombopoietin receptor agonist (TPO-RA), and is highly reliant on Active Pharmaceutical Ingredient imports from Europe and India. As per the Ministry of Chemicals & Fertilizers Department of Pharmaceuticals report in March 2023 depicts that China plays a key role in the API market. Further, the NLM report in February 2024 states that 87 drugs were approved in China in 2023, accounting for 67.8, including TOP-RA. The Bureau of Labor Statistics has depicted that the producer price index rose to 0.6% from June 2024 to July 2025 for pharmaceutical biologics products. Furthermore, governments are actively investing in research, development, and deployment for expanded indications in TPO-RA.

Key Thrombopoietin Receptor Agonists Market Insights Summary:

Regional Highlights:

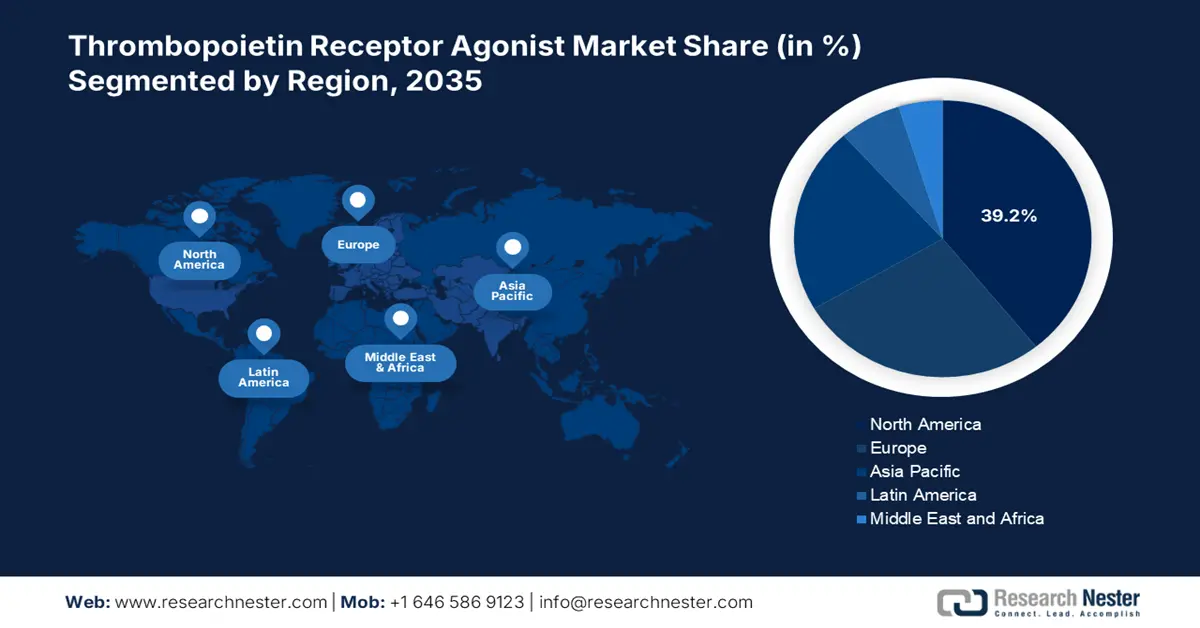

- North America is anticipated to secure a 39.2% share in the thrombopoietin receptor agonist market by 2035, supported by early adoption of oral therapies, high disease incidence, and strong reimbursement structures.

- Asia-Pacific is projected to claim a 21.8% share by 2035, underpinned by expanding access to specialty care, national reimbursement reforms, and increasing preference for affordable oral non-peptidic agents.

Segment Insights:

- In the route of administration segment within the thrombopoietin receptor agonist market, the oral sub-segment is forecast to account for 73.8% of the share by 2035, sustained by higher patient preference for chronic management and reduced hospital dependency.

- Under the drug class segment, the non-peptidic tpo-ras are set to capture 68.5% of the share by 2035, reinforced by their oral bioavailability, longer half-life, and strong safety profile in prolonged use.

Key Growth Trends:

- Cost reduction and adoption in TPO-RA Biosimilars

- Product innovations and strategies by key players

Major Challenges:

- Drug cost in developing and developed markets

Key Players: Novartis AG, Kyowa Kirin Co., Ltd., Eisai Co., Ltd., Rigel Pharmaceuticals, Pfizer Inc., Shionogi & Co., Ltd., LG Chem Life Sciences, Hanmi Pharmaceutical, Cadila Healthcare (Zydus Lifesciences), Dr. Reddy’s Laboratories, CSL Limited, Sanofi, GlaxoSmithKline plc, Sun Pharmaceutical Industries Ltd., Hetero Drugs Ltd., Lupin Limited, Inno Biologics Sdn Bhd, Biocon Biologics, Teva Pharmaceutical Industries Ltd.

Global Thrombopoietin Receptor Agonists Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 2 September, 2025

Thrombopoietin Receptor Agonist Market - Growth Drivers and Challenges

Growth Drivers

- Cost reduction and adoption in TPO-RA Biosimilars: Global cost-containment policies and maturing biosimilar frameworks at FDA/EMA are strong demand drivers. The NLM article published in March 2024 states that the biosimilars prices have reduced from 15–35% lower list prices than reference biologics, and are projected to save the amount of $38 billion to $124 billion from 2021 to 2025. These dynamics signal substantial future affordability gains and wider adoption of TPO-RA biosimilars as of 2025.

- Product innovations and strategies by key players: The FDA approved a prefilled, single-use autoinjector of romiplostim in 2023 to enable patient self-administration, focusing on improving treatment adherence and reduce healthcare resource use. Further, the WHO report states that cross-regional partnerships in Asia and Africa for global access to eltrombopag in 2024 to increase availability in low- and middle-income nations. These advancements combined with post-marketing surveillance and lifecycle management initiatives, the TPO-RA market is expected to drive sustained annual growth.

- Rising disease incidence driving TPO-RA: According to the May 2024 NLM report, the incidence of pediatric ITP is estimated at 1 to 6.4 per 100,000 annually, although rates could be higher since the figures cited are only symptomatic hospitalized cases, with the highest being between the ages of 2 to 5 and during adolescence. This rise in disease burden has been followed by a rise in prescriptions of TPO-RA from 2022 to 2025, as indicated in the FDA's Drug Utilization Database (2024). These trends indicate the pivotal role of TPO-RAs in treating thrombocytopenia, with the The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the market expected to further increase due to better diagnostic rates and increasing treatment guidelines.

Novel Therapies for Treatment of Immune Thrombocytopenia

|

Target |

Drug class |

Mechanism |

Agents |

Development status |

|

Macrophage |

Syk inhibitor |

Decrease in ADCP (inhibition of macrophage phagocytosis) |

Fostamatinib |

Approved (US) |

|

Macrophage |

BTK inhibitor |

Decrease in ADCP (inhibition of macrophage phagocytosis) |

Rilzabrutinib |

Phase 3 (NCT04562766) |

|

Plasma cells |

Proteasome inhibitor |

Inhibits plasma cell production of anti-platelet antibody |

Bortezomib

|

Phase 1 (NCT03013114) |

|

Plasma cells |

Anti-CD38 antibody |

Inhibits plasma cell production of anti-platelet antibody |

Daratumumab |

Phase 2 (NCT04703621) |

|

Antiplatelet antibodies |

FcRn blocker |

Increase clearance of anti-platelet antibody |

Efgartigimod |

Phase 2 (NCT03102593 |

|

Platelet |

Neuraminidase inhibitor |

Decrease in platelet desialylation thus reducing their destruction in the liver |

Oseltamivir |

Phase 2 (NCT01965626) |

|

Classical complement pathway |

C1s inhibitor |

Decrease in CDC (antibody inhibits C1s activity) |

Sutimlimab |

Phase 2 (NCT04669600) |

Source: NLM, April 2022

TPO-RA Regulatory Approvals Indications in the U.S. and EU

|

Drug (Generic) |

FDA-Approved Indications (2022–2025) |

EMA-Approved Indications (2022–2025) |

Key Therapeutic Areas |

|

Avatrombopag |

ITP – Adults with chronic ITP after insufficient response to previous treatment. CLD – Adults with CLD scheduled for a procedure. |

ITP – Primary chronic ITP in adults refractory to other treatments. CLD – Severe thrombocytopenia in adults with CLD scheduled for invasive procedure. |

ITP, CLD |

|

Eltrombopag |

ITP – Adults & pediatric (≥1 yr) with chronic ITP after insufficient response to corticosteroids, immunoglobulins, or splenectomy. SAA – Adults & pediatric (≥2 yrs) in combination with IST, or patients unresponsive to IST. HCV – Thrombocytopenia in chronic hepatitis C to enable interferon-based therapy. |

ITP – Patients (≥1 yr) with primary ITP ≥6 months refractory to other treatments. SAA – Adults with acquired SAA refractory to IST or unsuitable for transplant. HCV – Adults with chronic HCV thrombocytopenia preventing optimal interferon-based therapy. |

ITP, SAA, HCV |

|

Romiplostim |

ITP – Adults & pediatric (≥1 yr) with ITP after insufficient response to corticosteroids, immunoglobulins, or splenectomy. |

ITP – Adults & pediatric (≥1 yr) refractory to other treatments. |

ITP |

|

Lusutrombopag |

CLD – Adults with CLD scheduled for a procedure. |

CLD – Severe thrombocytopenia in adults with CLD undergoing invasive procedure. |

CLD |

Source: Science Direct, May 2022

Challenges

- Drug cost in developing and developed markets: In Canada, the treatment cost reduces patient access to TPO-RA drugs. A complete treatment cycle may exceed $27,118, according to the NLM report in June 2024, and these are out-of-pocket costs for most patients without full insurance. The absence of strong public reimbursement policies, along with the fragmentation of insurance coverage, discourages market penetration. Pricing strategies based on affordability or local production incentives could unlock future growth prospects, particularly for biosimilar or generic TPO-RAs.

Thrombopoietin Receptor Agonist Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 2.7 billion |

|

Forecast Year Market Size (2035) |

USD 5.1 billion |

|

Regional Scope |

|

Thrombopoietin Receptor Agonist Market Segmentation:

Route of Administration Segment Analysis

In the route of administration segment, the oral sub-segment dominates the segment and is projected to hold the share value of 73.8% by 2035. The oral TPO-Ras is the patient's preferred route to support chronic management and minimize hospital dependency. As per the Agency for Healthcare Research and Quality data, the hospitalization time has been reduced via oral outpatient regimens and by enhancing cost efficiency in the healthcare sector. Further, CPI data has revealed that oral medications are prescribed mostly in the healthcare sector, which shows a steady rise in the pricing and reimbursement acceptance. The oral therapies have increased treatment adherence and improved the quality of care in patients.

Drug Class Segment Analysis

Under the drug class market, the non-peptidic TPO-RAs hold the largest segment share and are poised to have 68.5% of the share value in 2035. Non-peptide TPO-RAs, such as eltrombopag, avatrombopag, and lusutrombopag, are desired for oral bioavailability, a longer half-life, and excellent safety in prolonged administration, demonstrating efficacy in adult and pediatric chronic immune thrombocytopenic purpura and liver-disease-associated thrombocytopenia, as cited by FDA prescribing information and orphan drug designations. According to the NLM report published in March 2025, adults with chronic primary ITP discovered that the combination of avatrombopag with romiplostim and eltrombopag saved €6,083,231 over three years in drug and monitoring costs versus treatment without avatrombopag.

End user Segment Analysis

Hospitals lead the end-user segment and are expected to hold the share value of 61.4% by 2035. The segment is fueled by their primary role in starting treatment with immune thrombocytopenia (ITP), aplastic anemia, and chemotherapy-induced thrombocytopenia. Hospitals offer access to specialized hematology treatment, as New York Prebyterian report published in November 2024, nearly 3,000 children are affected due to the ITP in North America hospitals based on the diagnostic facilities, and parenteral administration equipment, mostly for peptidic TPO-RAs such as romiplostim that need healthcare provider oversight. Combination therapies and supportive care are also propelling this segment's growth through the trend towards such treatments and care in tertiary centers.

Our in-depth analysis of the Thrombopoietin Receptor Agonist market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Route of Administration |

|

|

Indication |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thrombopoietin Receptor Agonist Market - Regional Analysis

North America Market Insights

The thrombopoietin receptor agonist market in North America is projected to hold a market share of 39.2% at a CAGR of 6.8% by 2035. The U.S. and Canada are the largest contributors, with the U.S. contributing most because of its large patient base and Medicare/Medicaid coverage for chronic immune thrombocytopenia (ITP), aplastic anemia, and chemotherapy-induced thrombocytopenia. The region is fueled by the early adoption of innovative oral therapies, high disease incidence, and robust reimbursement structures. The NLM report in September 2023 depict that 9.5 per 100,000 people in the U.S. suffer from chronic ITP, the most prominent treatment area for TPO-RAs. Rising geriatric populations and cancer-related platelet disorders also fuel demand. Besides that, the presence of specialty pharmacy networks, good pricing policies, and higher public funding will further reinforce North America's leadership.

The thrombopoietin receptor agonists market in the U.S. is driven by strong government support, a rising geriatric population with chronic immune thrombocytopenia, and streamlined access via Medicare and Medicaid. As per the NLM report in January 2023, the ITP has increased in prevalence among people aged above 60, who comprise the majority of TPO-RA prescriptions. According to NIH and AHRQ, the U.S. federal spending in thrombocytopenia, including TPO-RAs, offers expanded Medicare coverage via updated eligibility policies. Federal R&D support is robust, with the NIH supporting on thrombopoiesis research over the past ten years, which further supports long-term drug innovation.

Asia Pacific Market Insights

The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the market share of 21.8% at a CAGR of 7.8% by 2035. The market is driven by the increased access to specialty care, thrombopoietin prevalence, and national reimbursement reforms. Japan and China lead the region in government funding on rare diseases and extensive clinical research. Oral non-peptidic agents are clearly becoming more popular in the area due to their affordability and suitability for outpatient treatment. The growing elderly patient population, rising patient awareness, and policy-driven market entry are further expanding the market growth in the region. Further, the clinical trials and public-private partnerships drive innovation and expand the The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the thrombopoietin receptor agonist market.

India is the most prominent nation dominating the thrombopoietin receptor agonist market and is anticipated to occupy a considerable market share by 2035. The The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the thrombopoietin receptor agonist market in India is driven by the enhanced hematology infrastructure, rising immune thrombocytopenia diagnoses, and availability of oral therapies, aided by government healthcare initiatives. The Research Gate article released in December 2024 states that the prevalence of thrombocytopenia in India is nearly 5.6%. Ongoing collaborations with multinational pharmaceutical companies surge the drug availability and adoption across the country.

Europe Market Insights

The thrombopoietin receptor agonist market in Europe is expanding rapidly and is poised to hold the market share of 27.4% at a CAGR of 6.6% by 2035. The market is driven by rising cases of immune thrombocytopenia and chronic liver diseases, along with reimbursement frameworks. According to the NLM article in July 2024, the prevalence of ITP in Europe is recorded as 1 in 5 per 10,000, with an annual incidence recorded to be 1 in 25,600 to 37,000 in the region. Further, the European Health Data Space initiative is actively spending in R&D on rare hematological and hepatic diseases, surging the The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the thrombopoietin receptor agonist market entry and strengthening the regional pipeline for novel TPO-Ras.

Germany is leading the thrombopoietin receptor agonist market in Europe and is anticipated to maintain the market share of 24.7% by 2035. The region is fueled due to its strong investments in next-gen biologics, early adoption of oral formulations, and a robust regulatory pathway. The Federal Ministry of Health remains supportive of fast-track approvals and price talks for rare disease medications under Germany's AMNOG system, which is of direct benefit to high-cost treatments such as TPO-RAs. The sophisticated diagnostics infrastructure in the country and dense network of physicians for hematological conditions lead to high treatment penetration.

Key Thrombopoietin Receptor Agonist Market Players:

- Amgen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Kyowa Kirin Co., Ltd.

- Eisai Co., Ltd.

- Rigel Pharmaceuticals

- Pfizer Inc.

- Shionogi & Co., Ltd.

- LG Chem Life Sciences

- Hanmi Pharmaceutical

- Cadila Healthcare (Zydus Lifesciences)

- Dr. Reddy’s Laboratories

- CSL Limited

- Sanofi

- GlaxoSmithKline plc

- Sun Pharmaceutical Industries Ltd.

- Hetero Drugs Ltd.

- Lupin Limited

- Inno Biologics Sdn Bhd

- Biocon Biologics

- Teva Pharmaceutical Industries Ltd.

The global thrombopoietin receptor agonist market is very competitive and is dominated by the leading players such as Amgen, Kyowa Kirin, and Novartis. These players are leveraging patent therapies such as Promacta and Nplate. Regional licensing, strategic alliances, and biosimilar R&D are redefining the competition in the The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the thrombopoietin receptor agonist market. Manufacturers in India, such as Zydus and Dr. Reddy’s, are aiming for cost-effective generics, whereas Hanmi and LG Chem in South Korea are investing more in oral small molecule RAs. Nowadays, companies are aiming for oral delivery technologies and diseases related to thrombocytopenia. Various regions are leading the sector with innovation and competition both in generic segments and specialty pharma.

Below is the list of some prominent players operating in the global The thrombopoietin receptor agonist market in the APAC is the fastest-growing region and is poised to hold the thrombopoietin receptor agonist market:

Recent Developments

- In July 2025, Sobi announces the FDA approval of Doptelet (avatrombopag), which is used for treatment of thrombocytopenia in pediatric patients above one year with persistent or chronic immune thrombocytopenia.

- In August 2025, Novartis announced positive Phase III VAYHIT2 trial results for ianalumab plus eltrombopag, used to treat primary immune thrombocytopenia (ITP) by prolonging safe platelet levels in patients previously treated with corticosteroids.

- Report ID: 2566

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.