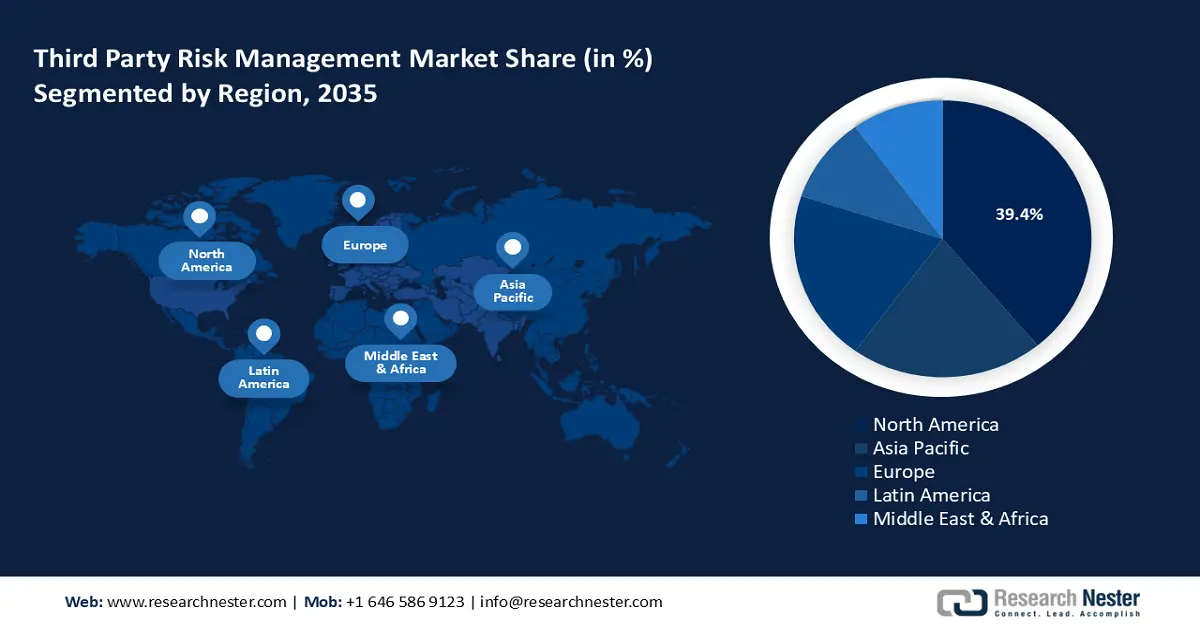

Third Party Risk Management Market Regional Analysis:

North America Market Insights

North America in third party risk management market is set to account for more than 39.4% revenue share by the end of 2035 owing to the increasing prevalence of cyber threats. TPRM solutions providers are bolstering their cybersecurity offerings to leverage the rising demand for risk management solutions. instance, in October 2024, 6clicks, a leading provider of AI solutions for cyber governance and risk in the region was named a Cool Vendor in the 2024 Gartner Cool Vendors in third party risk management report.

Furthermore, continued oversight and guidance by the Federal Reserve, along with other U.S. agencies, prompts businesses in North America to implement robust management practices. Additionally, the rising adoption of digital tools and technologies, including cloud services, heightens the requirement for TPRM solutions. Furthermore, the regional supply chain disruptions caused by the pandemic have highlighted the need to assess third party vulnerabilities.

The U.S. holds a significant revenue share in the North America third party risk management market. The stringent compliance requirements in the U.S. drive the adoption of third party risk management services. For instance, the Cybersecurity Maturity Model Certification (CMMC) is required for companies in the Defense Industrial Base DIB (DoD) supply chain. Companies in the U.S. operating within the supply chain risk management segment are set to leverage from offering solutions for the stringent certification frameworks. For instance, in August 2024, LMI announced a contract to develop the Supply Chain Risk Evaluation Environment (SCREEn) for the U.S. Department of Defense (DoD) Chief Digital and Artificial Intelligence Office (CDAO), and the contract is valued at USD 43 million.

Furthermore, sectors such as healthcare are increasingly integrating TPRM solutions to comply with stringent data privacy regulations such as HIPAA. The finance sector in the U.S. is projected to improve its standing as a major end user of TPRM services by the end of the forecast period. Companies are leveraging collaboration to create robust TPRM platforms for effective risk management in the BFSI sector. For instance, in December 2024, MetLife and General Atlantic announced the formation of Chariot RE with an initial combined equity investment of over $1 billion that is poised to provide risk management solutions in reinsurance.

Canada is a lucrative market in the North America third party risk management sector owing to rising demand from multiple end use industries. Unlike the U.S. market, where compliance frameworks are industry-specific, Canada has an approach that emphasizes universal data protection standards such as the Personal Information Protection and Electronic Documents Act (PIPEDA) and the General Data Protection Regulation (GDPR). The stringent frameworks drive demand for TPRM services in the country.

Furthermore, the rise of a digital ecosystem has amplified the significance of TPRM as businesses in Canada expand in the international markets. Businesses are expanding their portfolio to provide robust TPRM services and leverage the opportunities in the domestic market of Canada. For instance, in August 2024, Abaxx announced the acquisition of PrivacyCode Inc., and the acquisition is poised to boost the risk management tools portfolio of Abaxx.

Europe Market Insights

The Europe third party risk management market is poised to exhibit a rapid growth during the forecast period. The implementation of NIS-2 directives by the European Union (EU) to improve the security of supply chains has created lucrative markets within Europe that key players in the TPRM sector are tapping into. In October 2024, the implementing regulation of NIS-2 was applied to specific categories of companies providing digital services as the EU seeks to improve cybersecurity measures. Additionally, the Digital Operational Resilience Act (DORA) was implemented in Europe from January 2023 to ensure that the financial sector in Europe remains resilient in the event of critical operational disruption.

The robust regulatory frameworks in Europe create a burgeoning market for key companies operating within the market to offer effective TPRM solutions, as well as expand their services to other markets. For instance, in March 2024, Aon plc announced the launch of the digital platform, Partner Risk Insights, to help U.S. organizations simplify the way they manage insurance-related third-party risk.

Germany is positioned as a burgeoning market in the Europe third party risk management market due to its status as an economic and industrial powerhouse, requiring robust TPRM solutions. The well-established manufacturing sector in Germany requires regular supply chain assessment. Furthermore, the German Supply Chain Due Diligence Act (SCDDA) requires enterprises with central administration in the country to ensure due diligence obligations boosting demand for TPRM solutions to evaluate risks in the vendor ecosystems.

Additionally, the increasing proliferation of cloud services in various sectors is positioned to boost a continued demand for TPRM services. To leverage the opportunities, businesses are launching efficient solutions in the domestic market. For instance, in August 2024, Coalition announced the launch of its Active Cyber Insurance in Germany through its subsidiary, Coalition Insurance Solutions GmbH which is designed to help businesses spot and respond to emerging cyber threats.

France is a lucrative market in the Europe third party risk management market. The increasing digitalization drive in the country creates opportunities in the TPRM market, and the European Union drives growth, with businesses actively seeking TPRM solutions to secure supply chains and improve cybersecurity. Additionally, the ESG reporting requirements for corporations’ prompt companies to invest in robust TPRM consultancy services to mitigate risks.

Additionally, companies with a presence in France are integrating the DORA frameworks to provide heightened TPRM solutions. For instance, in August 2024, ProcessUnity announced the launch of its turnkey Digital Operational Resilience Act (DORA) solution for entities regulated in the European Union (EU) and their business partners. With more businesses seeking to effectively navigate the stringent regulatory frameworks, the sector in France is poised to provide a stable stream of opportunities in the TPRM market.