Thioglycolic Acid Market Outlook:

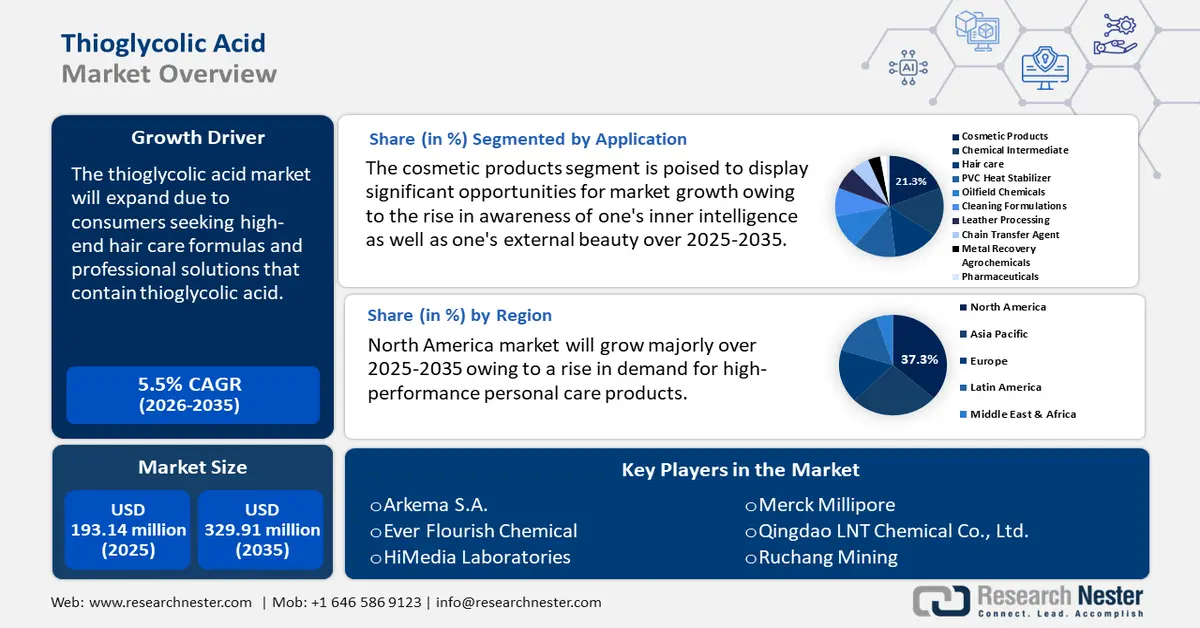

Thioglycolic Acid Market size was over USD 193.14 million in 2025 and is anticipated to cross USD 329.91 million by 2035, growing at more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thioglycolic acid is assessed at USD 202.7 million.

The thioglycolic acid market is experiencing tremendous growth due to its increasing demand for cosmetic care products. Thioglycolic acid, also known as mercaptoacetic acid, has depilating, restructuring, and antioxidant properties. Thioglycolic acid is utilized in hair care products and other cosmetic products including depilatory creams and perm formulations. Cosmetics including hair products, depilatories, and eyelash-waving products include thioglycolic acid. It can be used as a straightening, waving, reducing, or antioxidant agent. To enable structural changes in hair, like permanent waves or hair straightening, thioglycolic acid, and its salts are utilized to alter hair. Additionally, they are used to chemically break down hair fibers, making it easy to remove undesired hair from the skin by just wiping it off.

|

Country |

Export Value for Hair Products (USD Million) |

Country |

Import Value for Hair Products (USD Million) |

|

U.S. |

1630 |

U.S. |

1730 |

|

Germany |

1510 |

Germany |

916 |

|

Italy |

1360 |

UK |

794 |

|

France |

1200 |

China |

717 |

|

Mexico |

845 |

Canada |

676 |

Source: OEC

The Observatory of Economic Complexity reported that with total commerce of USD 16.7 billion in 2022, hair products ranked 254th globally. Hair product exports increased by 2.79% between 2021 and 2022, from USD 16.3 billion to USD 16.7 billion. Hair product trade accounts for 0.071% of global trade. According to the Product Complexity Index (PCI), hair products are ranked 494th.

Furthermore, key manufacturers such as AK Scientific, Alfa Aesar, American Custom Chemicals Corporation, and others maintain competitive pricing strategies to cater to diverse sectors such as cosmetics, chemicals, and leather processing. Affordable and consistent pricing has made thioglycolic acid an essential ingredient in hair care formulations, PVC heat stabilizers, and leather treatment processes.

Below is the pricing of thioglycolic acid by leading manufacturers in the market:

|

Manufacturer |

Product |

Quantity |

Price (in USD) |

Updated Year |

|

AK Scientific |

2-Thioglycolic Acid |

500 grams |

110 |

2021 |

|

Alfa Aesar |

Mercaptoacetic Acid, 97+% |

500 grams |

49 |

2024 |

|

American Custom Chemicals Corporation |

Thioglycolic Acid 95% |

1 liter |

6,413.6 |

2021 |

|

Medical Isotopes, Inc. |

Thioglycolic Acid |

50 grams |

875 |

2021 |

|

Sigma-Aldrich |

Thioglycolic Acid Solution -70% (w/w) in H |

50ml |

42.2 |

2024 |

Key Thioglycolic Acid Market Insights Summary:

Regional Highlights:

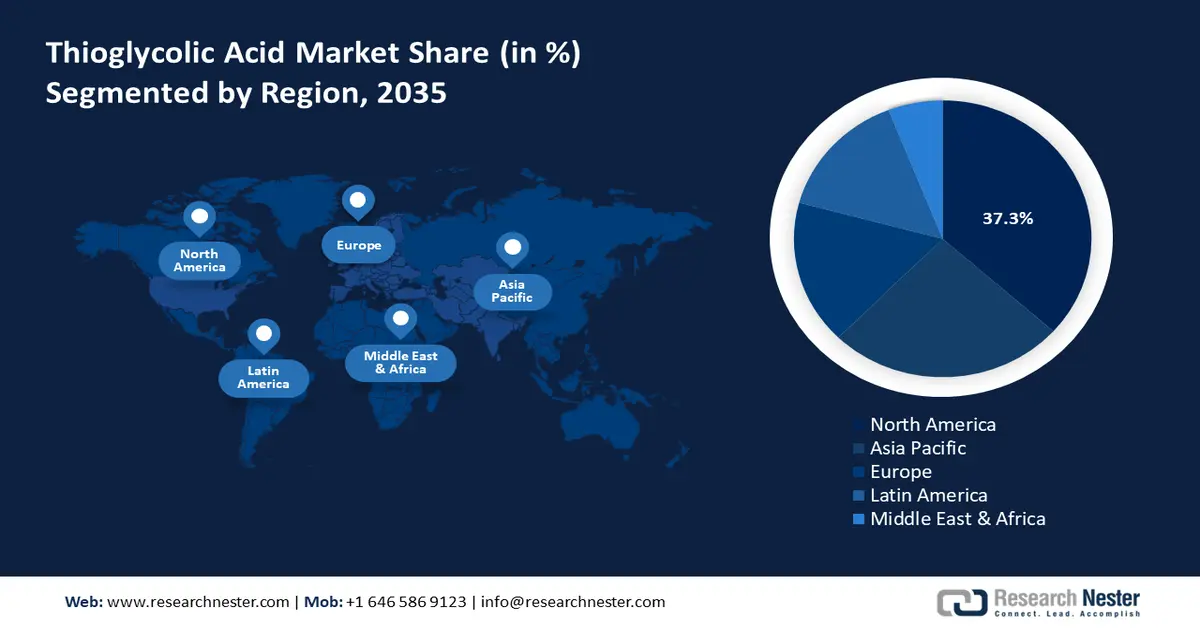

- North America holds a 37.3% share in the Thioglycolic Acid Market, driven by the rise in demand for high-performance products and pharmaceutical applications, ensuring robust growth through 2035.

- Asia Pacific’s thioglycolic acid market is anticipated to see significant growth by 2035, driven by the growth of chemicals industry and increasing demand from personal care and pharmaceutical sectors.

Segment Insights:

- The Leather segment is expected to hold a significant market share by 2035, driven by the effective use of thioglycolic acid for hair removal in leather production.

- The Cosmetic Products segment of the Thioglycolic Acid Market is projected to hold over 21.3% share by 2035, driven by increasing beauty consciousness and disposable income among both men and women, boosting demand for hair care and depilatory products.

Key Growth Trends:

- Increased applications in various industries

- Growing use in targeted drug delivery systems and treatment of hormonal imbalance conditions

Major Challenges:

- Severe side effects and health hazards

- Stringent regulations and laws

- Key Players: Arkema S.A., Bruno Bock Chemische Fabrik GmbH & Co. KG, Ever Flourish Chemical, HiMedia Laboratories, Merck Millipore, Qingdao LNT Chemical Co., Ltd., Ruchang Mining, Swan Chemical, Thermo Fisher Scientific Inc., Innova Global.

Global Thioglycolic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 193.14 million

- 2026 Market Size: USD 202.7 million

- Projected Market Size: USD 329.91 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, South Korea, Japan, Brazil

Last updated on : 13 August, 2025

Thioglycolic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Increased applications in various industries: In dermatology, thioglycolic acid is used for chemical peeling procedures. It functions as a keratolytic agent, encouraging cell turnover and exfoliating the skin's outermost layer. Thioglycolic acid-containing chemical peels treat skin issues like fine wrinkles, acne, and hyperpigmentation. Also, metals are extracted using thioglycolic acid, especially in the mining sector. It helps separate and recover different metals from ores by forming compounds with them.

Copper, cobalt, and nickel are among the metals that can be extracted with thioglycolic acid. According to the U.S. Geological Survey in 2020, the world's copper reserves reached 870 million tons, while the annual demand for copper is 28 million tons. Moreover, thioglycolic acid is used as a starting point for the synthesis of different substances. Esters, thioglycolate salts, and various derivatives are made with it. These compounds are used as metal complexing agents, textile colors, and medicines. - Growing use in targeted drug delivery systems and treatment of hormonal imbalance conditions: HIV and vaginal infections are two serious gynecological conditions that are becoming more common globally. In 2023, there were 39.9 million HIV-positive individuals worldwide. Of these, 1.4 million were children under the age of 15, and 38.6 million were adults over the age of 15. Moreover, women and girls made up 53%. Recent research focused on improving vaginal drug delivery systems through thiolation, specifically using thioglycolic acid (TGA) on starch-graft-poly (acrylic acid) (WS-g-PAA) to enhance mucoadhesion by forming disulfide bonds with mucus glycoproteins. The study showed that thiolated WS-g-PAA exhibited significantly greater mucoadhesion, potentially increasing the efficacy of vaginal drug delivery.

Additionally, a 2021 NIH study explored a mucoadhesive gel made from TGA-immobilized chitosan and di(2-ethylhexyl) phthalate (DEHP) as a hormone therapy for menopausal syndrome. This gel demonstrated non-cytotoxicity in vitro and superior mucoadhesive properties, and in vivo studies on ovariectomized rats indicated that its intravaginal administration improved menopausal symptoms. The study concluded that the combination of sustained-release DEHP and mucoadhesive TGA-immobilized chitosan gel can relieve menopausal syndrome symptoms at DEHP concentrations within the safety levels of tolerable intake.

Challenges

-

Severe side effects and health hazards: When thioglycolic acid comes into contact with the skin, eyes, digestive system, or respiratory system, it can result in serious burns and chemical harm. It can cause systemic toxicity and is caustic. Thioglycolic acid can cause irritation or damage to the skin, mucous membranes, and eyes. It is known to harm the eyes and inflict serious burns on the skin. Therefore, the thioglycolic acid market expansion is anticipated to be constrained by the numerous adverse effects and health risks linked to the use of thioglycolic acid.

- Stringent regulations and laws: As a chemical substance, thioglycolate is regulated and has safety concerns. Manufacturers face challenges in adhering to strict regulations controlling the use of particular chemicals in cosmetic formulations. To meet safety requirements, compliance with these rules usually calls for constant monitoring and formulation of changes. Due to growing skin sensitivity, Health Canada added thioglycolic acid esters to the list of substances that are restricted in Canada in July 2023. Thioglycolic acid esters are governed by Cosmetics Regulation 1223/2009, which is found in Annex III (prohibited compounds), entry 2b. Furthermore, thioglycolic acid (TGA) is prohibited in many nations, including China.

Thioglycolic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 193.14 million |

|

Forecast Year Market Size (2035) |

USD 329.91 million |

|

Regional Scope |

|

Thioglycolic Acid Market Segmentation:

Application (Chemical Intermediate, Hair Care, Cosmetic Products, PVC Heat Stabilizer, Oilfield Chemicals, Cleaning Formulations, Leather Processing, Chain Transfer Agent, Metal Recovery, Agrochemicals, Pharmaceuticals)

Cosmetic products segment is projected to hold thioglycolic acid market share of over 21.3% by the end of 2035. Cosmetics are now an essential part of every modern person's life. Furthermore, one of the main forces behind the usage of cosmetics in the global thioglycolic acid market is the rise in awareness of one's inner intelligence as well as one's external beauty coupled with the increasing disposable income. In addition to women, males are increasingly using cosmetics in their daily lives, which is supporting the expansion of the demand for cosmetics worldwide. When compared to other nations, the U.S. has the greatest average disposable income. The gross disposable income of U.S. residents is USD 54,854 on average. Luxembourg has the second-highest average disposable income (USD 49,860), followed by Switzerland (USD 43,035). Australia and Germany round out the top five nations with the highest average levels of disposable income, with USD 42,547 and USD 42,433, respectively.

Vertical (Cosmetics, Oil & Gas, Plastic & Polymer, Leather Processing, Cleaning Agents)

The leather segment in thioglycolic acid market will garner a significant share during the projected period. Thioglycolic acid is employed as a depilatory agent in the initial phases of leather manufacture. It facilitates the effective removal of hair from animal hides, which is an essential process in the production of leather. The chemical is quite useful in this application because it can break down keratin, which improves the quality and productivity of leather production. Thioglycolic acid is used in the textile industry as a reducing agent to enhance color fastness and dye penetration during cloth dying procedures. A major factor propelling this thioglycolic acid market has been the rising demand for premium leather goods and textiles, especially in developing nations. For instance, India exported USD 3.68 billion worth of leather goods, footwear, and leather goods in 2021.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thioglycolic Acid Market Regional Analysis:

North America Market Statistics

North America in thioglycolic acid market is likely to account for around 37.3% revenue share by 2035. The market is expanding as a result of the rise in demand for high-performance products to satisfy changing consumer demands in the personal care and cosmetics sector. Thioglycolic acid is increasing in demand as a stabilizing ingredient in medication formulation due to the region's highly developed pharmaceutical sector. The promotion of sustainable practices by regulatory agencies such as Health Canada and the Food and Drug Administration (FDA) in North America is anticipated to increase sales of cosmetics that contain thioglycolic acid. The main contributors to the market include nations like the US, Canada, and Mexico. Additionally, the leading companies in the thioglycolic acid market are embracing new technologies and quick developments in thioglycolic-based formulations, which increase the product's efficacy and boost customer satisfaction.

Moreover, in the U.S., TGA serves as a stabilizer in the production of polyvinyl chloride (PVC), enhancing the durability and quality of PVC products. The compound is also utilized in the oil and gas industry for corrosion inhibition and in the leather industry for hair removal processes. Therefore, the expanding oil and gas industry will propel the thioglycolic acid market. According to the U.S. Department of Energy, the oil and gas sector will generate USD 1.6 trillion in federal and state tax revenue between 2012 and 2025, which will help fund the upkeep of public infrastructure, hospitals, and schools nationwide. The expanding demand in these sectors contributes to the increasing use of thioglycolic acid in the nation.

APAC Market Analysis

Asia Pacific thioglycolic acid market will grow at a significant rate during the forecast period. Factors include the growth of the chemicals industry, the increase in disposable income, and the increasing demand from the pharmaceutical and personal care sectors. It is projected that the growing consumer demand for high-end, safe, and effective hair and skin care products backed by cutting-edge research and environmentally friendly composition will quicken the thioglycolic acid market's overall expansion. Furthermore, strict guidelines are implemented by governing bodies' regulatory frameworks to guarantee consumer safety and environmental sustainability.

In China, in the cosmetics and personal care sector, thioglycolic acid is a key component in hair care products, such as perming and depilatory creams, catering to the increasing consumer demand for grooming and beauty solutions. Additionally, China’s robust oil and gas industry utilizes thioglycolic acid as a corrosion inhibitor and in processes like petroleum refining, enhancing operational efficiency. According to the U.S. Energy Information Administration, refinery runs, or the processing of crude oil reached an all-time high of 14.8 million barrels per day (b/d) in China in 2023.

In India, the pharmaceutical industry uses TGA to improve drug delivery systems, particularly in developing mucoadhesive formulations for targeted treatments. Also, TGA is used in agricultural applications such as in the formulation of pesticides and fungicides. Therefore, its growing use in various industries has positioned it as a major importer of TGA. India received 129 shipments of thioglycolic acid between March 2023 and February 2024 (TTM). During this time, India purchased 11 shipments of thioglycolic acid in February 2024 alone. This represents a 175% sequential increase from January 2024 and an 83% year-over-year improvement from February 2023.

Key Thioglycolic Acid Market Players:

- Arkema S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bruno Bock Chemische Fabrik GmbH & Co. KG

- Ever Flourish Chemical

- HiMedia Laboratories

- Merck Millipore

- Qingdao LNT Chemical Co., Ltd.

- Ruchang Mining

- Swan Chemical

- Thermo Fisher Scientific Inc.

- Innova Global

The existence of both major international chemical corporations and specialized manufacturers defines the competitive environment of the thioglycolic acid market. These businesses compete based on pricing, technological innovation, product quality, and worldwide reach. Large companies have integrated operations, from procuring raw materials to production and distribution, which benefits them in terms of cost control and supply chain management. Companies are focusing on product differentiation, such as creating low-odor formulations or more skin-friendly variants of thioglycolic acid, due to the fierce competition, especially in high-volume thioglycolic acid markets like cosmetics applications. To increase the range of applications for thioglycolic acid and enhance its functionality in already-existing applications, numerous businesses are investing in research and development.

Recent Developments

- In March 2023, Arkema showcased its latest breakthroughs at the In-Cosmetics event in Barcelona. Arkema provides high-quality ingredients and technologies for customers who prioritize sustainability criteria in personal care, skin care, nail care, and hair care.

- In April 2023, Thermo Fisher Scientific, Inc. focused on sustainability activities in the thioglycolic acid sector. The company uses eco-friendly production methods and strives to reduce waste throughout manufacturing procedures.

- Report ID: 7030

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thioglycolic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.