Thioglycolate Market Outlook:

Thioglycolate Market size was valued at USD 135.2 million in 2025 and is expected to reach USD 220.23 million by 2035, registering around 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thioglycolate is evaluated at USD 141.28 million.

The global thioglycolate market is projected to experience significant growth due to the rising disposable income levels, which have subsequently increased the demand for hairdressing, hair care, and depilatory products. The increased demand for thioglycolic acid and its salts in hair care and hair removal products directly drives the thioglycolate market since thioglycolates, such as calcium thioglycolate and ammonium thioglycolate, are key derivatives for thioglycolic acid used in these formulations. In hair perming and straightening treatments, ammonium thioglycolate breaks disulfide bonds in hair proteins, allowing for reshaping, while calcium thioglycolate is a primary active ingredient in depilatory creams, effectively breaking down keratin for painless hair removal. Therefore, as consumer preferences shift towards at-home beauty treatments and salon-quality products, the demand for these formulations is on the rise.

Thioglycolic acid, along with its esters and salts, helps to change the structure of hair fibers, resulting in permanent waves or straighter hair. According to the European Union's Cosmetics Regulation, thioglycolic acid, its salts, and its esters can be used in hair straightening or waving treatments at a concentration of 8% for everyday use and 11% for professional usage when the pH is between 7 and 9.5. Depilatories and other hair products that are eliminated after application at 5% (pH 7 to 12.7) and 2% (pH 7 to 9.5) can also contain thioglycolic acid and its salts.

The global trade of hair products, including perming solutions, hair relaxers, and depilatory creams, is significantly driving the thioglycolate market since these products rely on thioglycolate as key active ingredients. Below is a table showing the global commerce of hair care products in 2022:

|

Country |

Export Value for Hair Products (USD Million) |

Country |

Import Value for Hair Products (USD Million) |

|

U.S. |

1630 |

U.S. |

1730 |

|

Germany |

1510 |

Germany |

916 |

|

Italy |

1360 |

UK |

794 |

|

France |

1200 |

China |

717 |

|

Mexico |

845 |

Canada |

676 |

Source: OEC

Based on the Observatory of Economic Complexity report, hair products were ranked 254th in the world in 2022 with a total trade of USD 16.7 billion. Exports of hair products rose from USD 16.3 billion to USD 16.7 billion in 2022, a 2.79% rise. The commerce in hair products amounts to 0.071% of all trade worldwide. Hair products are ranked 494th as per the Product Complexity Index (PCI).

Key Thioglycolate Market Insights Summary:

Regional Highlights:

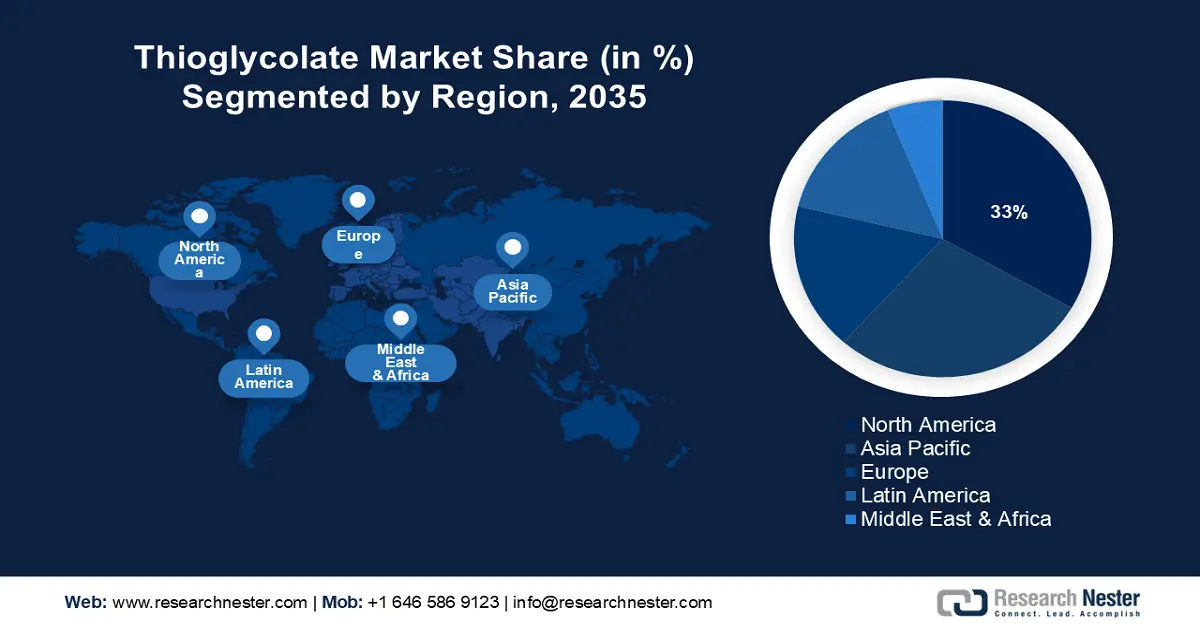

- North America dominates the thioglycolate market with a 33% share, driven by the strong presence of advanced industries and robust demand, ensuring sustained growth through 2035.

- The APAC region is expected to achieve significant growth in the Thioglycolate Market by 2035, driven by the provided growth drivers during the projected period.

Segment Insights:

- The Calcium Thioglycolate segment is anticipated to achieve over 33.2% market share by 2035, driven by rising demand for depilatory creams and aesthetics.

Key Growth Trends:

- Surging demand in the oil and gas industry

- Increased mining production capacity of copper

Major Challenges:

- Adverse effect on human health

- Stringent regulatory laws

- Key Players: BASF SE, Akzo Nobel N.V., The Dow Chemical Company, Merck KGaA, Arkema S.A., and Thermo Fisher Scientific, Inc.

Global Thioglycolate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 135.2 million

- 2026 Market Size: USD 141.28 million

- Projected Market Size: USD 220.23 million by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Thioglycolate Market Growth Drivers and Challenges:

Growth Drivers

-

Surging demand in the oil and gas industry: The expanding oil and gas sector is driving the thioglycolate market due to the increasing use of thioglycolic acid and its derivatives as corrosion inhibitors and oxygen scavengers in drilling, refining, and pipeline maintenance. In oil extraction and processing, metal corrosion is a significant challenge, and thioglycolates help prevent oxidation and extend the lifespan of equipment, reducing maintenance costs.

As global energy demand rises, particularly in regions such as North America, the Middle East, and Asia Pacific, oil and gas exploration activities are expanding, leading to higher consumption of thioglycolates in industrial applications. Additionally, with stricter environmental regulations, oil companies are seeking more efficient and specialized chemical treatments, further fueling demand for thioglycolates in pipeline protection, refinery operations, and gas sweetening processes. - Increased mining production capacity of copper: The mining production capacity of copper is driving the thioglycolate market since thioglycolic acid and its derivatives are used as flotation agents in the copper extraction process. The Government of Canada reported that global production of refined copper rose from 25.3 million tons in 2022 to 26.6 million tons in 2023, a 4.8% rise. Compared to 21.1 million and 4.2 million tons, respectively, the year before, this total comprised 22.1 million tons from primary sources and 4.5 million tons from secondary sources.

Apart from copper, it is also used in the recovery and separation of other metals such as nickel and cobalt. As global demand for copper rises, driven by industries such as electronics, renewable energy (solar panels, electric vehicles), and construction, mining companies are ramping up production to meet supply needs. This expansion increases the consumption of thioglycolates, as higher copper output requires more flotation agents.

Additionally, the push for more efficient and sustainable mining processes is encouraging the production of specialized chemicals, further boosting the thioglycolate market growth. The following table illustrates the global mining production of copper in 2023 by country:

|

Ranking |

Country |

Quantity in tons |

Share |

|

1 |

Chile |

5,000 |

23% |

|

2 |

Peru |

2,600 |

12% |

|

3 |

Democratic Republic of Congo (DRC) |

2,500 |

11% |

|

4 |

China |

1,700 |

8% |

|

5 |

U.S. |

1,100 |

5% |

|

6 |

Russia |

910 |

4% |

|

7 |

Indonesia |

840 |

4% |

|

8 |

Australia |

810 |

4% |

|

9 |

Zambia |

760 |

3% |

|

10 |

Mexico |

750 |

3% |

|

11 |

Other countries |

3,100 |

14% |

|

Total (rounded) |

|

22,000 |

100% |

Source: Government of Canada

Challenges

-

Adverse effect on human health: Thioglycolic acid's detrimental impacts on human health include ingestion, inhalation, and skin absorption; these factors are expected to impede the market's expansion. According to DOT, ACGIH, and NIOSH, thioglycolic acid is a corrosive chemical that is listed as a hazardous substance. Contact or other acute short-term health impacts from thioglycolic acid exposure can cause severe skin irritation and burning, as well as eye impairment.

Breathing in thioglycolic acid can result in wheezing, coughing, and dyspnea. Exposure to thioglycolic acid may result in long-term, chronic health impacts that can persist for prolonged periods, including cancer and reproductive risks. There are stringent regulatory rules on the use of thioglycolic acid to manage and prevent such risks. - Stringent regulatory laws: As a chemical substance, thioglycolate is regulated and has safety concerns. Manufacturers face challenges in adhering to strict regulations controlling the use of particular chemicals in cosmetic formulations. To meet safety requirements, compliance with these rules usually calls for constant monitoring and formulation of changes. For instance, as a result of growing skin sensitivity, Health added thioglycolic acid esters to the list of substances that are restricted in Canada as of July 13, 2023. Thioglycolic acid esters are governed by Cosmetics Regulation 1223/2009, which is found in Annex III (prohibited compounds), entry 2b. Furthermore, thioglycolic acid (TGA) is prohibited in many nations, including China. It is regarded as a prohibited pesticide in the U.S.

Thioglycolate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 135.2 million |

|

Forecast Year Market Size (2035) |

USD 220.23 million |

|

Regional Scope |

|

Thioglycolate Market Segmentation:

Type (Calcium Thioglycolate, Potassium Thioglycolate, Ammonium Thioglycolate, Sodium Thioglycolate, Others)

Calcium thioglycolate segment is projected to dominate over 33.2% thioglycolate market share by 2035. The segment is growing owing to the rising demand for depilatory creams. The maintenance of beauty standards for both men and women has increasingly become a contentious issue, particularly about the presence of excessive body hair. One significant component found in hair removal products is calcium thioglycolate. Depilatory creams have gained considerable popularity among individuals who prioritize their aesthetics, specifically concerning the removal of unwanted body hair in areas such as the arms and legs. These products function by breaking down hair proteins, thereby facilitating the removal of hair.

Chemical depilatories offer a rapid, cost-effective, and painless method for the temporary removal of hair. Calcium thioglycolate is effective for removing heavy metals, specifically Pb(II) and Cd(II), from water bodies. Recent studies showed that rice straw biochar (RBC) treated with calcium thioglycolate exhibits excellent adsorption capabilities. The modification process enhances the biochar by adding calcium carbonate, calcium oxalate, and sulfur-containing functional groups, significantly improving its ion exchange capacity and complexation performance.

Application (Personal Care & Cosmetics, Chemical Processing, Pharmaceuticals, Textiles, Others)

The automotive parts will garner a significant share in thioglycolate market during the assessed period. Nowadays, cosmetics are a necessary component of every modern person's existence. Additionally, the growing awareness of one's inner intelligence and outward attractiveness, along with rising disposable income, are major factors driving the use of cosmetics in the global industry. When compared to other nations, the United States has the greatest average disposable income.

The gross disposable income of Americans is USD 54,854 on average. Luxembourg has the second-highest average disposable income (USD 49,860), followed by Switzerland (USD 43,035). Australia and Germany round out the top five nations with the highest average levels of disposable income, with USD 42,547 and USD 42,433, respectively. In addition to women, men are also utilizing cosmetics more frequently in their daily lives, which is contributing to the global increase in demand for cosmetics.

Our in-depth analysis of the global thioglycolate market includes the following segments:

|

Type |

|

|

Function |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thioglycolate Market Regional Analysis:

North America Market Statistics

North America thioglycolate market is expected to dominate revenue share of around 33% by the end of 2035. As a result of its widespread application in numerous industries, North America has recently emerged as the market leader for thioglycolate worldwide. The varied industrial environment of North America, which includes the U.S., Canada, and Mexico, uses thioglycolate in several sectors. The region's diverse industrial landscape, regulatory climate, and consumer tastes impact the dynamics of the global market.

The thioglycolate market for formulations based on thioglycolate is influenced by regional consumer tastes, which specifically value efficacy and simplicity in personal care products. Furthermore, owing to the region's highly developed pharmaceutical industry, thioglycolic acid is becoming increasingly in demand as a stabilizing element in drug composition. Sales of cosmetics containing thioglycolic acid are expected to rise as a result of regulatory bodies such as Health Canada and the Food and Drug Administration (FDA) in North America promoting sustainable practices.

Additionally, thioglycolate stabilizes the manufacturing of polyvinyl chloride (PVC) in the U.S., improving the quality and longevity of PVC products. Additionally, the chemical is used in the leather industry for hair removal procedures and in the oil and gas business to suppress corrosion. Thus, the thioglycolate market acid is driven by the growing oil and gas sector. The U.S. Department of Energy estimates that between 2012 and 2025, the oil and gas industry would bring in USD 1.6 trillion in federal and state tax income, which will be used to support the maintenance of schools, hospitals, and public infrastructure across the country. The nation's use of thioglycolic acid is rising as a result of the growing demand in these industries.

APAC Market Analysis

Asia Pacific thioglycolate market is expected to grow at a significant rate during the projected period. The expansion of the chemicals industry, rising disposable income, and rising demand from the personal care and pharmaceutical industries are some of the contributing factors. The thioglycolate market growth is anticipated to be accelerated by the rising consumer demand for upscale, safe, and efficient hair and skin care products supported by state-of-the-art research and ecologically friendly composition. Additionally, the regulatory frameworks of governing organizations enforce stringent criteria to ensure environmental sustainability and consumer safety.

Calcium thioglycolate is a crucial ingredient in hair care products including depilatory and perming creams in China's cosmetics and personal care industry, which meets the growing demand from consumers for grooming and beauty products. Thioglycolic acid is also used in China's thriving oil and gas sector to improve operational efficiency by preventing corrosion and in procedures such as petroleum refining. Refinery runs, or the processing of crude oil, peaked in 2023 at 14.8 million barrels per day (b/d) in China, according to the U.S. Energy Information Administration.

Thioglycolate is used by India’s pharmaceutical sector to enhance drug delivery methods, especially when creating mucoadhesive formulations for certain therapies. Thioglycolic acid is also utilized in agricultural applications, including the creation of fungicides and pesticides. As a result, it is now a significant importer of thioglycolic acid due to its expanding application in numerous industries. According to Volza's India Import statistics, 129 shipments of thioglycolic acid were received by India between March 2023 and February 2024 (TTM). These products, which represented a 4% growth rate over the preceding 12 months, were bought by 20 Indian buyers from 27 overseas exporters. In February 2024 alone, 11 shipments of thioglycolic acid were bought by India during this period. This is an 83% year-over-year gain over February 2023 and a 175% consecutive rise over January 2024.

Key Thioglycolate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V.

- The Dow Chemical Company

- Merck KGaA

- Aarti Industries Limited

- Arkema S.A.

- Thermo Fisher Scientific, Inc.

- Bruno Bock Chemishce Fabrik GmbH & Co. KG

- Jost Chemical Co.

- GFS Chemical Inc.

The thioglycolate market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key thioglycolate market players frequently use strategic moves like mergers, acquisitions, and expansions to increase their market presence and effectively fulfill the growing demand.

Recent Developments

- In March 2023, Arkema showcased its latest breakthroughs at the In-Cosmetics event in Barcelona. Arkema provides high-quality ingredients and technologies for customers who prioritize sustainability criteria in personal care, skin care, nail care, and hair care.

- In April 2023, Thermo Fisher Scientific, Inc. focused on sustainability activities in the thioglycolic acid sector. The company uses eco-friendly production methods and strives to reduce waste throughout manufacturing procedures.

- Report ID: 7189

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thioglycolate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.