Thin Film Solar Cell Market Outlook:

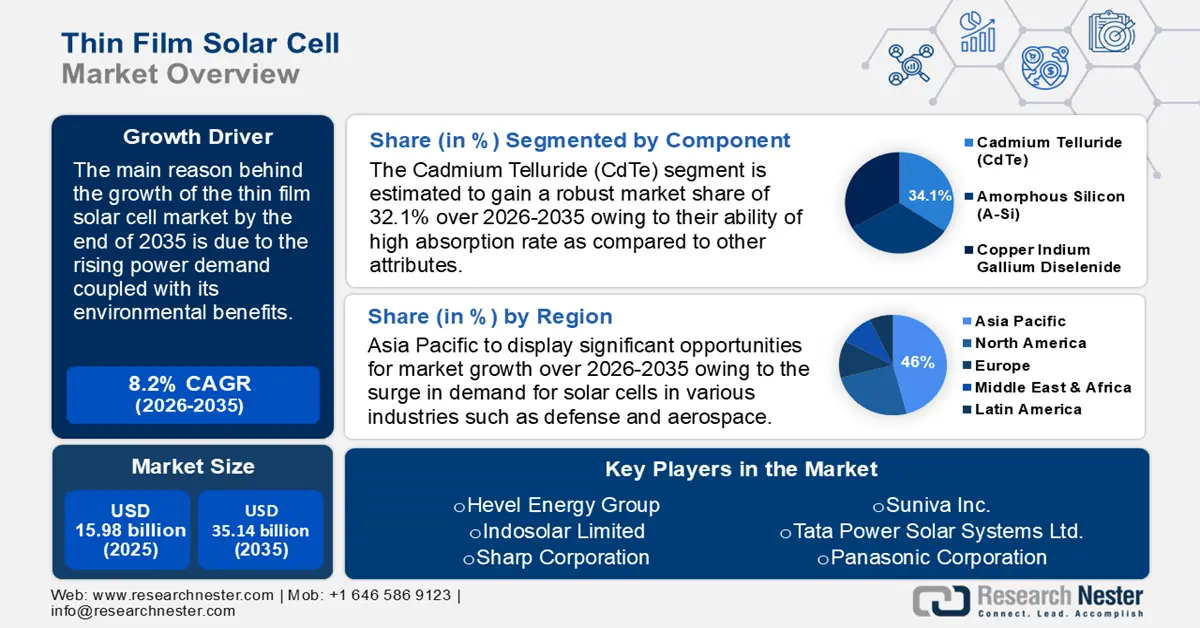

Thin Film Solar Cell Market size was over USD 15.98 billion in 2025 and is anticipated to cross USD 35.14 billion by 2035, growing at more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thin film solar cell is assessed at USD 17.16 billion.

The global thin film solar cell market has entered a new phase with its large-scale residential and industrial applications. In an emissions-constrained energy economy, energy-efficient, environmentally friendly, and high-volume solar cell or photovoltaic (PV) manufacturing plays a central role. This emerging sustainability and affordability paradigm is anticipated to open up new market opportunities for solar deployment. Furthermore, the inherent advantages and the continuous innovations in Copper indium gallium selenide (CIGS) thin film PV are positioned to replace traditional silicon solar cells over the next few years. A 2023 report by the Center for Climate and Energy Solutions estimated that renewables held about 29% of global energy generation in 2020 and will increase manifold during the forecast period.

Key Thin Film Solar Cell Market Insights Summary:

Regional Highlights:

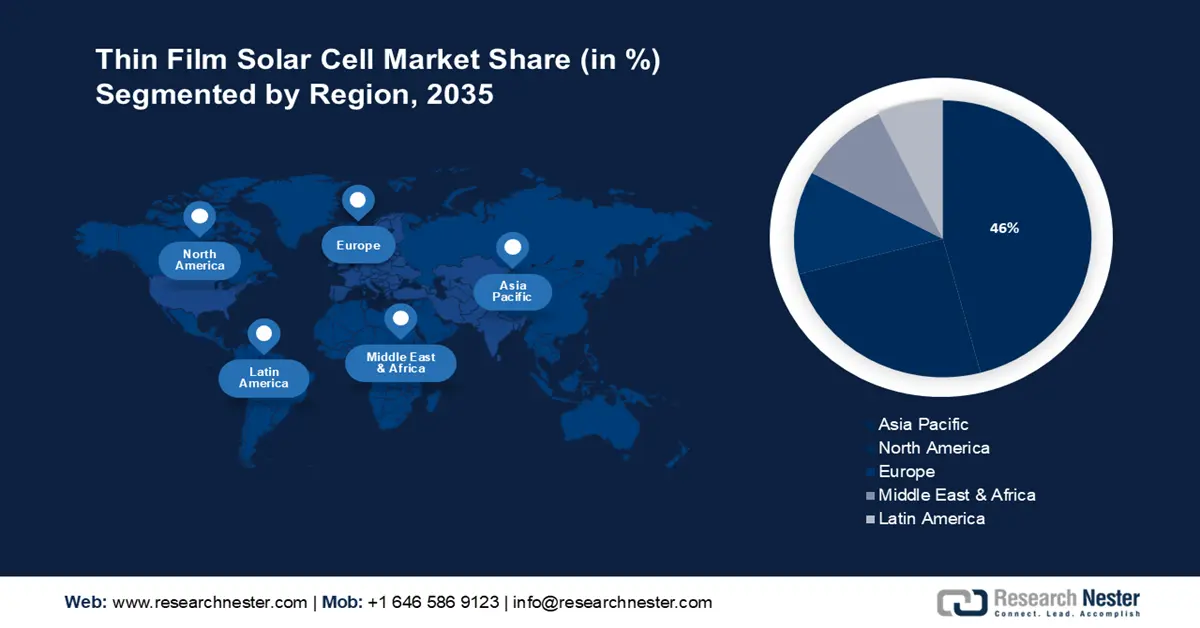

- The Asia Pacific thin film solar cell market will dominate around 46% share by 2035, driven by high demand for solar cells across defense, aerospace, and infrastructure sectors.

- The North America market will hold the second largest share by 2035, driven by rising renewable energy consumption and production supported by government campaigns.

Segment Insights:

- The on-grid connectivity segment in the thin film solar cell market is anticipated to witness robust growth till 2035, attributed to the expanding transmission system and affordability for budget-conscious users.

- The cadmium telluride (cdte) segment in the thin film solar cell market is expected to experience substantial growth through 2026-2035, driven by their high absorption rate and convenient production methods.

Key Growth Trends:

- Dominance of CIGS technology and its contribution to CO2 reduction

- Ongoing investments in Cadmium Telluride thin film solar cells

Major Challenges:

- High initial cost

- Strong competition

Key Players: Hanwha Qcells GmbH, Alps Technology Inc., GreenBrilliance Renewable Energy LLP, Hevel Energy Group, Indosolar Limited, Sharp Corporation, Suniva Inc., Tata Power Solar Systems Ltd., Panasonic Corporation.

Global Thin Film Solar Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.98 billion

- 2026 Market Size: USD 17.16 billion

- Projected Market Size: USD 35.14 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Thin Film Solar Cell Market Growth Drivers and Challenges:

Growth Drivers

-

Dominance of CIGS technology and its contribution to CO2 reduction: Among thin-film solar cell alternatives, CIGS is one of the most advanced and efficient. The CIGS-based PV modules IGS (Cu(In,Ga)(Se,S)2) absorbers are very effective in converting light directly into electricity. CIGS is well positioned in PV technologies with record efficiencies for production size modules of 16.5% and small cells of 21.7%. CIGS is anticipated to be used with suitable wide bandgap absorbers as bottom cells in tandem devices that offer efficiency beyond 30%. This demonstrates the potential of using CIGS PV technology in the overall solar cell industry and its future prospects are being explored for further improvements.

The regional markets are highly competitive and are striving to position CIGS in the building-integrated photovoltaics (BIPV). Europe-based OEMs or production equipment suppliers have peerless expertise in key production processes and CIGS tooling. Many are currently distributing and profiting from next-generation CIGS manufacturing processes for the treatment and deposition of semiconductor stacks, which exhibit promise in cutting down capex and opex costs in the future. Thin film PV, in terms of carbon footprint, has a clear advantage over commoditized mono crystalline silicon (c-Si). The former has a carbon footprint of 12-20 g CO2 equivalent per kilowatt hour, while the latter has a carbon footprint of 50-60 g CO2 equivalent per kilowatt hour of electricity. -

Ongoing investments in Cadmium Telluride thin film solar cells: Cadmium Telluride or CdTe solar cells can achieve high conversion efficiencies and have high absorption coefficients. CdTe cells are affordable and are being widely deployed in utility-scale solar installations. Investments in expanding production capabilities, leading to international trade. The U.S. Manufacturing of Advanced Cadmium Telluride Photovoltaics (US-MAC) Consortium launched in 2029 has accelerated investments and innovations in CdTe by leveraging R&D on advanced technologies. US-MAC has enabled the 40% supply of utility-scale PV to the U.S. market and 5% of the world market. Also, it successfully competes with imported silicon and has driven U.S.-based manufacturing.

In August 2022, the U.S. Department of Energy (DOE) launched CdTe Accelerator Consortium (CTAC) to develop CdTe technologies by increasing the efficacy of the thin-film solar cells and lowering costs. The CTAC is projected to achieve cell efficiencies above 24% by 2025 and 26% by 2030 while reducing the per-watt manufacturing cost. A funding of USD 17 million has been provided by the DOE for the consortium with the aim of trimming solar energy costs by 60% in the next 10 years.

With government initiatives, installing solar cells creates a higher return on investment. These initiatives reduce the payback period and boost the long-term savings on electricity bills, increasing the financial attraction of solar energy for both consumers and businesses. The U.S. Department of Energy (DOE) supports F&D focused on overcoming the present technological barriers for CIGS solar cells. In 2024 DOE announced Solar Energy Supply Chain Incubator funding of USD 38 million for R&D projects. In addition, governments frequently provide tax breaks or refunds as financial incentives or subsidies to reduce solar cell installation costs. These incentives lower the initial cost, making them more accessible to individuals.

Challenges

-

High initial cost: It can be costly to buy and install thin film solar cells, especially for small-scale and residential users. Because of this upfront expense, which includes the cost of solar cells, mounting systems, wiring, and installation labor, businesses and individuals may not consider solar energy. Using solar energy could save electricity bills over the long term, even though it might end up being more economical in the end. This could potentially extend the time it takes for the initial investment to pay off.

-

Strong competition: The market faces several challenges, such as intense competition and a constantly shifting regulatory landscape. The rapid advancement of technology is a significant global industry trend that may create challenges for organizations to influence. These elements may create severe challenges for companies operating in this landscape segment for the projected period, hence reducing their thin film solar cell market share.

Thin Film Solar Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 15.98 billion |

|

Forecast Year Market Size (2035) |

USD 35.14 billion |

|

Regional Scope |

|

Thin Film Solar Cell Market Segmentation:

Component Segment Analysis

Cadmium telluride segment in the thin film solar cell market is anticipated to exhibit substantial CAGR till 2035. The segment growth is augmented by their ability of high absorption rate as compared to other attributes. Moreover, convenient cadmium-telluride (CdTe) solar cells are easy to make because cadmium can be produced as a byproduct of lead, zinc, and copper mining, smelting, and refining processes.

This photoelectric method enables the production of photovoltaic panels at a relatively low price by using cadmium telluride. This is the only renewable energy source that uses the least amount of water in its production. According to a report by the National Renewable Energy Laboratory (NREL) in 2023, First Solar, an American company, has advanced from producing 25 MWp annually in 2005 to a goal of producing 21 GWp annually by 2024.

Connectivity Segment Analysis

The on-grid segment in the thin film solar cell market is expected to be the fastest-growing segment with a share of 71.2% attributed to the continuous and quickest rate of development owing to the expanding transmission system and electrical distribution. They are a great choice for consumers on a budget who want to use renewable energy as they are significantly affordable.

Furthermore, the off-grid segment is projected to have a significant share during the forecast period. Propelled by its popularity among people who want to use solar energy instead of relying on the power companies. Additionally, when not in use, they can be easily tucked away and folded as they are flexible and lightweight.

Application Segment Analysis

The utility segment in the thin film solar cell market is slated to be the largest growing segment till 2035. This tremendous gain is credited to the consumers' preference for using fewer fossil fuels. The European Commission 2024 claims that because solar energy can power and heat homes and businesses, it has the potential to integrate into the mainstream energy system. The plan includes adding more than 320 GW of solar photovoltaic capacity by 2025 and nearly 600 GW by 2030.

Moreover, builders and architects search for more visually appealing designs along with renewable energy solutions in their buildings. A report by the National Institutes of Health projected that approximately 2% of the global electricity demand can be covered using PV that exceeds 400 GW. This fuels the rooftop solar PV demand during the forecasted period.

Our in-depth analysis of the thin film solar cell market includes the following segments:

|

Component |

|

|

Connectivity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thin Film Solar Cell Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 46% by 2035. The growth in the region is driven by the surge in demand for solar cells in various industries such as defense and aerospace. A report by Boeing Aircraft in 2023, estimated that by 2042 the airline fleet growth rate would be 6.9% as compared to the airline traffic growth of 9.5%.

In China, there has been an increase in industrialization which demands more thin film solar cells in highways and residential complexes. The State Council of China published a report in 2022 stating that the urbanization rate crossed 60% in 2019, while in 2021 this rate surpassed 64.72% in this country. This also augments for solar PV mounting systems market revenue during the forecast period.

Increasing urbanization & infrastructure development in Japan act as a growing factor for the solar cell market expansion in this landscape. World Bank in 2021 propelled that with a population of 1.6% of the worldwide population, Japan remains on top in terms of rapid development in the modern era.

North America Market Insights

North America will also encounter huge growth in the thin film solar cell market value during the forecast period with a notable size and will hold the second position led by the surge in energy demand. A report by the U.S. Energy Information Administration in 2023 stated that renewable energy consumption and production had made records in 2022, surpassing 13% (13.18 quads and 13.40 quads respectively).

In the United States, there has been an increase in government campaigns and investments aimed at raising awareness about the use of renewable energy. A survey conducted in 2023 revealed that about 66% of U.S. adults are now prioritizing using an alternative energy source like hydrogen, solar, and wind power. Furthermore, the country is set to lead in establishing competitive, energy-efficient, and decentralized CIGS manufacturing and machinery supply for the global energy economy.

Canada is predicted to have a high demand for power demand which is further encouraging collaboration with the energy & power sector. Attributed to this, it is estimated to affect the overall growth of the thin film solar cell industry in Canada. A report in 2023, projected that the energy consumption in Canada significantly increased to 8585 petajoules from 2022 to 2021.

Thin Film Solar Cell Market Players:

- Jinko Solar Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hanwha Qcells GmbH

- Alps Technology Inc.

- GreenBrilliance Renewable Energy LLP

- Hevel Energy Group

- Indosolar Limited

- Sharp Corporation

- Suniva Inc.

- Tata Power Solar Systems Ltd.

- Panasonic Corporation

The most profitable PV producers are presently prevalent in the U.S. and Southeast Asia. China is a world leader in PV and electronics manufacturing and has a strong presence in the thin film solar cell market. All thin film solar cell technologies share similar intrinsic advantages in fully integrated production facilities once economies of There is cost competitiveness with c-Si PV at the megawatt scale in various aspects of the c-Si value chain such as polysilicon, wafer, cell, ingot, and module. CIGS has emerged as a potential area of investment with high ROI, in terms of both opex and capex. Furthermore, technologies such as CIGS cdTe are well suited to manufacturing with automation and Industry 4.0 approaches.

Recent Developments

- In August 2022, Hanwha Qcells GmbH acquired about 66% of Hanover-based LYNQTECH GmbH. The goal of the Hanwha Q Cells acquisition was to strengthen its position as a comprehensive supplier of clean energy solutions for end users, both residential and commercial.

- In May 2022, Jinko Solar Co. signed a distribution agreement with Aldo Solar, as it will receive the newest N-Type ultra-efficiency photovoltaic Tiger Neo modules from Jinko Solar, the leading provider of solar energy products in the country with a market share of over 30% in the Distributed Generation category.

- Report ID: 6356

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thin Film Solar Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.