Thin Client Market Outlook:

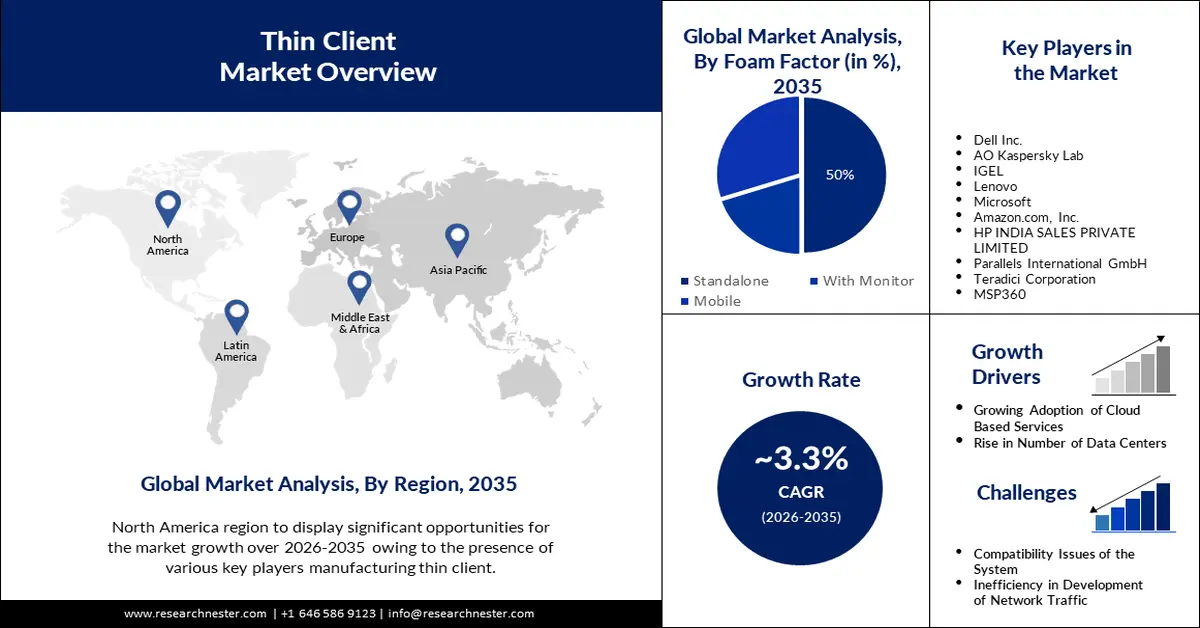

Thin Client Market size was valued at USD 1.64 billion in 2025 and is likely to cross USD 2.27 billion by 2035, registering more than 3.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thin client is assessed at USD 1.69 billion.

The major element to encourages the market expansion is a surge in remote working prevalence. In 2023, 11% of full-time employees work remotely, illustrating how quickly remote work environments have become the norm. At the same time, a significant 27% of employees have adapted to a mixed work style. Therefore, the market demand for thin clients is projected to grow. This is because end-user productivity constitutes one of the main issues with permitting remote work. Thin Clients address this issue since they are simple to install and set up, saving time when updating machines independently.

Moreover, numerous sectors have been searching for inexpensive gadgets that can easily replace or upgrade more complex conventional systems while also drastically minimizing desk space. These requirements are fulfilled by the thin client systems. The main factor driving the rising demand for these devices across a range of businesses is their ability to gradually cut energy consumption.

Key Thin Client Market Insights Summary:

Regional Highlights:

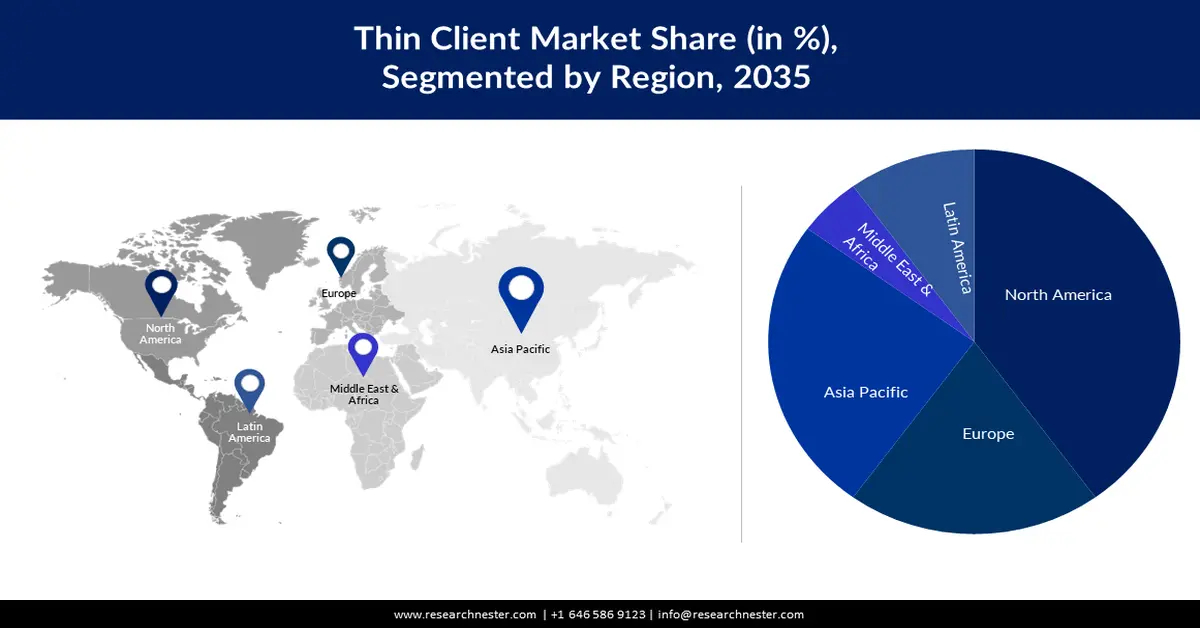

- North America thin client market will secure over 40% share, driven by presence of key players and rising internet penetration, forecast period 2026–2035.

Segment Insights:

- The large enterprises segment in the thin client market is projected to capture a 60% share by 2035, influenced by compatibility with centralized management, security features, and distributed workforce.

- The standalone segment in the thin client market is forecasted to hold a 50% share by 2035, driven by affordability, ease of administration, and deployment flexibility.

Key Growth Trends:

- Growing Adoption of Cloud Based Services

- Rise in the Number of Data Centers

Major Challenges:

- Compatibility Issues of the System

- Inefficiency in the Development of Network Traffic

Key Players: Dell Technologies Inc., HP Inc., Lenovo Group Limited, IGEL Technology GmbH, NComputing Co., Ltd., Fujitsu Limited, Cisco Systems, Inc., 10ZiG Technology, Inc., Advantech Co., Ltd., VXL Instruments Limited.

Global Thin Client Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.64 billion

- 2026 Market Size: USD 1.69 billion

- Projected Market Size: USD 2.27 billion by 2035

- Growth Forecasts: 3.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 16 September, 2025

Thin Client Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Adoption of Cloud Based Services - Previously, a single server was able to accommodate several apps owing to the introduction of web-based applications. However, shared hosting has been ineffective due to the rise in program complexity and user population, forcing companies to choose cloud-based solutions instead. Applications that users may use through their browsers rather than having to download them to their devices may be set up more easily using cloud migration. Through increased IT resource agility and efficiency as well as the provision of affordable cloud solutions to clients, cloud infrastructure is bridging the gap between IT and business. Numerous businesses in the thin-client industry are concentrating on either inorganic or organic cloud computing techniques. The ability of the business to obtain new technology and sales channels through targeted acquisitions and calculated expenditures is a determining factor in its strategy for expansion. Therefore, as cloud-based services grow in popularity worldwide, the market for virtual infrastructure is growing as well, which is fueling the need for thin client solutions.

- Rise in the Number of Data Centers - By December 2023, there were about 10,977 data center facilities across the globe. Thin clients serve a purpose in architectures based on server-based systems, in which the majority of processing and data storage is handled by a central server. The user subsequently employs the thin client as an access point to connect to the server. As a result, the thin client market growth for thin clients is also estimated to rise.

- Surge in Need to Handle IT Budgets -Since traditional PCs require a significant amount of local processing power and storage, they are associated with greater initial costs. On the other hand, thin-clients require fewer components since they rely on a centralized server to handle computation activities, which lowers their initial costs. Deploying these technologies, for instance, may involve a less upfront cost than buying traditional PCs for a company looking to improve its computer infrastructure. Large workforce organizations stand to gain the most from this, as the overall savings on hardware expenses may be greater. The solution's lower upfront costs also make it a desirable choice for organizations on a tight budget, particularly in industries like healthcare and education where massive installations are the norm.

Challenges

-

Compatibility Issues of the System

-

Inefficiency in the Development of Network Traffic - As topological complexity rises and the number of IT infrastructure components rises, network monitoring has grown in importance. The generation of statistical data has grown exponentially as a result of the growing complexity of networks. Because of its large volume, the management and operation teams may not always find value in the information gathered and used from this data. Thus, to further improve network performance, it is imperative to divide this enormous amount of data into manageable parts. Increasing the number of devices and users on a network is making security management more difficult.

- Rising Concern of Latency - For computer tasks, thin clients primarily rely on a reliable and strong network connection to connect to centralized servers. Performance can suffer in situations where network connectivity is erratic or interrupted, which can result in problems with operations and even downtime. For example, the solutions might encounter latency problems or disruptions when accessing crucial apps and data in settings with erratic internet connections, such as isolated or rural places. This reliance on network dependability can be problematic, especially for companies that operate in areas with patchy or nonexistent network infrastructure.

Thin Client Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.3% |

|

Base Year Market Size (2025) |

USD 1.64 billion |

|

Forecast Year Market Size (2035) |

USD 2.27 billion |

|

Regional Scope |

|

Thin Client Market Segmentation:

Form Factor Segment Analysis

The standalone segment in the thin client market is expected to gather the highest revenue share of about 50% during the forecast period. Without the requirement for a separate monitor or mobility characteristics, standalone thin clients provide a self-contained computing solution. For a variety of use scenarios, including office settings, where users need specialized computing devices with dependable performance, this form factor is recommended. Robust computing, flexibility, and simplicity of deployment are offered by standalone thin clients. Their expanding use is further aided by their affordability, ease of administration, and compatibility with current infrastructure.

Enterprise Size Segment Analysis

The large enterprises segment is estimated to hold 60% share of the global thin client market by 2035. The product's compatibility with centralized management techniques, cost-effectiveness, improved security features, and capacity to accommodate a geographically distributed workforce are the main drivers of this growth. Given this, these items are a wise and strategic option for businesses with intricate and demanding operating needs. Furthermore, there has been a surge in workload in organizations that necessity the use of thin clients. Also, the cyber attack on large organizations is growing which is making them incur huge losses. Ransomware impacted over 71% of businesses with an annual turnover of over USD 4 billion and about 55% of organizations with revenue between USD 9 and close to USD 49 million, globally.

Our in-depth analysis of the global thin client market includes the following segments:

|

Form Factor |

|

|

Component |

|

|

Enterprise Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thin Client Market Regional Analysis:

North American Market Insights

North American thin client market is projected to gather the highest revenue share of about 40% in the coming years. This growth of the market in this region is set to be dominated by the presence of various key players manufacturing thin clients. Additionally, with the growing internet penetration the market is estimated to grow even further. It was predicted that between 2024 and 2029, there will be a steady increase in the number of internet users in North America, amounting to approximately 50 million people (above 10 percent). Also, a growing number of academic institutions, including universities, research centers, and labs, are implementing thin client solutions to centrally control their monitors at the IT control department, which lowers energy consumption.

APAC Market Insights

Asia Pacific thin client market is also estimated to have notable growth in the coming years. This growth could be attributed to the rising use of thin clients in healthcare in this region. Thin client principles include centralized processing, low hardware requirements, remote access, simplified administration, and scalability. Thin clients are perfect for improving the security of healthcare applications since they follow these criteria, which also lead to a more efficient and safe computing environment.

Thin Client Market Players:

- Dell Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AO Kaspersky Lab

- IGEL

- Lenovo

- Microsoft

- Amazon.com, Inc.

- HP INDIA SALES PRIVATE LIMITED

- Parallels International GmbH

- Teradici Corporation

- MSP360

Recent Developments

- May 1, 2018: Dell Technologies is introducing the new Dell Wyse 5070 thin client, the company's most versatile and scalable thin client platform, which allows organizations to select the optimal configuration based on their employees' requirements. Additionally, support for 14th-generation PowerEdge server architecture and virtualized graphics choices for high-performance workloads are being added to Dell Technologies' VDI Complete Solutions, powered by VMware Horizon, at Dell EMC.

- October 11, 2022: An agreement was inked by Centerm and Kaspersky to work together on Cyber Immune Endpoints. As part of the partnership, Kaspersky will supply the KasperskyOS operating system along with associated cyber-immune goods and solutions, while Centerm will supply hardware.

- Report ID: 5675

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thin Client Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.