Thermosetting Plastics Market Outlook:

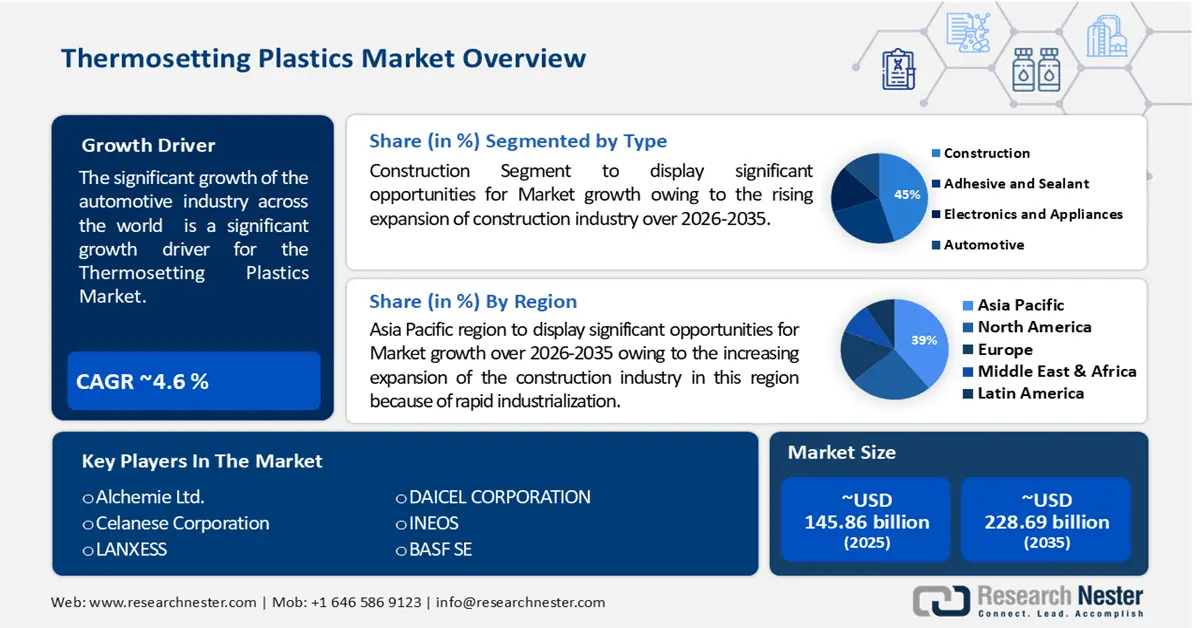

Thermosetting Plastics Market size was valued at USD 145.86 billion in 2025 and is set to exceed USD 228.69 billion by 2035, registering over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermosetting plastics is estimated at USD 151.9 billion.

The significant growth of the automotive industry across the world will primarily drive the thermosetting plastics market growth of thermosetting plastic. Passenger cars compose up the biggest share of motor vehicle sales across the world, showing approximately 70.4 percent of sales. China and the United States were the biggest markets for this segment in 2022, partially because of a culture of mass motorization widespread in the United States. China was one of the markets where passenger vehicle sales came back out from their 2020 decline, with the country’s 2022 sales volume some 9.9 percent over 2019 sales.

The main drivers of the raised requirement for plastics in car production are the connected themes of electrification and lightweight. Regional renewability efforts are incentivizing the conversion to fresh energy vehicles, specifically electric vehicles (EVs). By 2040, it is anticipated that battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) will contribute to 60% of international passenger vehicle manufacturing. The batteries utilized in EVs develop a substantial weight penalty – recently, an average medium-sized battery electric vehicle is around 37% more weighty than its conventional combustion engine. Higher weight converts to lower fuel effectiveness, so car producers are more and more turning to lighter substitutes to steel like aluminum and polymer composites to balance the issue.

Key Thermosetting Plastics Market Insights Summary:

Regional Insights:

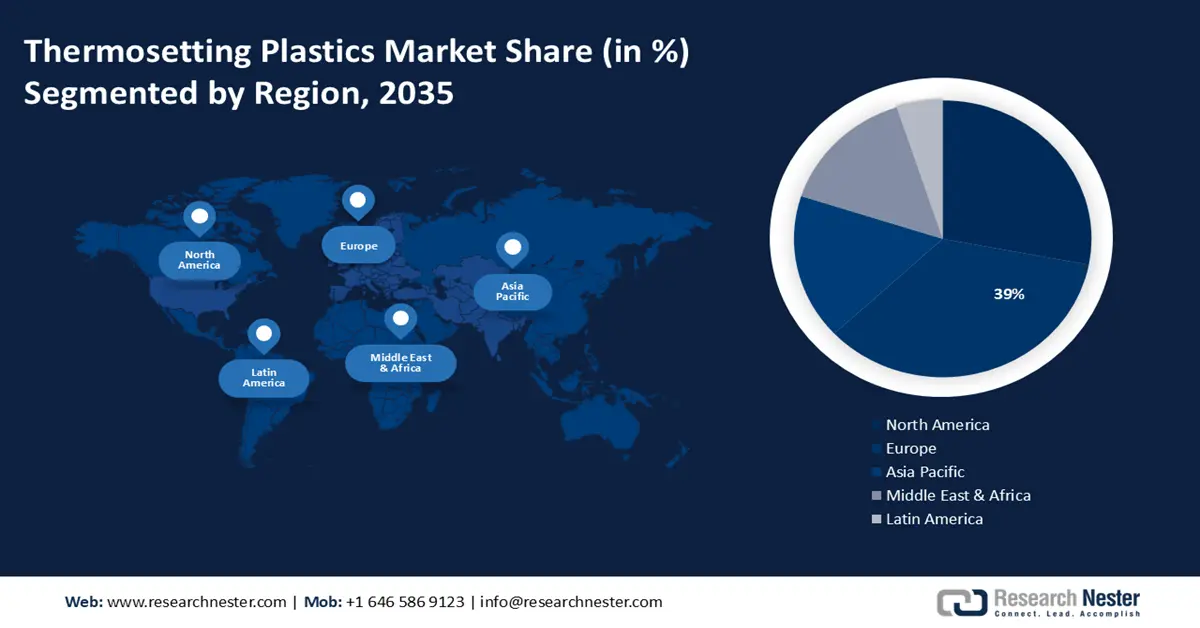

- Across 2026–2035, the Asia Pacific region in the thermosetting plastics market is anticipated to command a 39% share by 2035, supported by the accelerating expansion of the construction industry driven by rapid industrialization.

- By 2035, the North America region is expected to secure the second-largest share as its electrical and electronics sector advances.

Segment Insights:

- By 2035, the unsaturated polyesters segment of the thermosetting plastics market is projected to account for nearly a 43% share, propelled by outstanding thermal opposition, high strictness, high creep power, di-electrical properties, and supreme chemical flexibility properties.

- The construction segment is predicted to hold around a 45% share by 2035, fueled by the increasing expansion of the global construction industry.

Key Growth Trends:

- Increasing Utilization of Thermosetting Plastics in Composite Component Use

- Increasing Demand for Bio depended Thermosetting Plastics

Major Challenges:

- Increasing Feedstock Crunch and High Cost of Thermosetting Plastics

- Stringent Government Policies

Key Players: Alchemie Ltd., Celanese Corporation, LANXESS, DAICEL CORPORATION, INEOS, BASF SE, Covestro A.G., BUFA GmbH & Co. KG, Daicel Corporation, Eastman Chemical Company, Asahi Kasei Corporation, Mitsui Chemicals, Inc., NIPPON STEEL Chemical & Material Co., Ltd., INOAC Corporation.

Global Thermosetting Plastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 145.86 billion

- 2026 Market Size: USD 151.9 billion

- Projected Market Size: USD 228.69 billion by 2035

- Growth Forecasts: 4.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Germany, Japan, South Korea

- Emerging Countries: – India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 28 November, 2025

Thermosetting Plastics Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing Utilization of Thermosetting Plastics in Composite Component Use - Polyester resins and unsaturated polyester resins are created by the effect of polyhydric alcohols and dibasic organic which forms them an unsaturated synthetic. In the diacid serviceability, a generally utilized raw material is Maleic Anhydride. This create of thermoset is utilized in the toner of laser printers, sheet molding composites, and the majority of molding compounds. The building of kitchens, restaurants, and restrooms which need cost-efficient and washable walls utilizes fiberglass-increased plastic. These wall panels utilize polyester resins aligned with fiberglass. The rectified-in-place pipe applications have also begun to utilize this specific component widely. They are recently utilized for covering bridges and roads in the USA by their Departments of Transportation. A particular term is utilized for these, acknowledged the PCO Polyester Concrete Overlays. These are divided and cut with high levels of styrene that is dependent on isophthalic acid and this can go up to 50%. Even though epoxy-based materials are used in anchor bolt adhesives, polyester can be used as a substitute.

-

Increasing Demand for Bio-depended Thermosetting Plastics - Interest in bioplastics is rising as public concern of plastic waste gathering in natural environments rises. 2,5-Furandicarboxylic acid (FDCA) is the main base in the manufacturing of polyethylene 2,5-furandicarboxylate (PEF), a polymer that presents a renewable solution to substitute the generally utilized polymer polyethylene terephthalate (PET). A backcasting workshop with 42 specialists was held to recognize recent barriers and problems that block the commodification of FDCA-dependent products and to design possible pathways toward future thermosetting plastics market dispersion.

- Outstanding Performance Attribution - The cross-connected framework of thermosetting polymers provides extraordinary mechanical power and harness to the component. This power enables them to endure heavy loads and anxiety without disfigurement or failure. Once maintained, thermosetting polymers manage their shape and dimensions even under diverse temperature and humidity situations. This property is critical in applications that need tight indulgences and accurate stipulations. All these collectively will the thermosetting plastics market to grow massively.

Challenges

-

Increasing Feedstock Crunch and High Cost of Thermosetting Plastics - Utilization of vegetable oil for biofuel generation is projected to rise 46% to 54 million tonnes more than 2022-2027, increasing the share of vegetable oil generation addressed to meet the increasing biofuel requirements from 17% to 23%. In the United States, this rise in requirement is already limiting soybean oil export projects and assisting higher prices. Utilized cooking oil and animal fats are doubtful to give relief, as they are in even higher requirement because they present lower GHG secretions vehemence and match EU feedstock needs. The utilization of used cooking oil and animal fats approximately exhausts 100% of projected supplies over the anticipated period. Even when a wider range of wastes (like palm oil mill wastewater, tall oil, and other agribusiness waste oils) is acknowledged, the requirement still swells to approximately 65% of the global supply.

-

Stringent Government Policies

- Problems Related to Manufacturing Techniques

Thermosetting Plastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 145.86 billion |

|

Forecast Year Market Size (2035) |

USD 228.69 billion |

|

Regional Scope |

|

Thermosetting Plastics Market Segmentation:

Type Segment Analysis

The unsaturated polyesters segment will grow the most by the forecast period and will hold almost 43% in the thermosetting plastics market because of its outstanding thermal opposition, high strictness, high creep power, di- electrical properties, and supreme chemical flexibility properties. Unsaturated polyester resin in the international automotive composites market seems encouraging with scopes in different applications, comprising pickups, closure panels, body panels, fenders, GOR (grille opening strengthening), heat shields, and headlamp specula. The major operators for unsaturated polyester resin in the international automotive composites market expansion are the rising requirement for lightweight components and the execution advantages of enhanced composites over rival components. This will help to grow this segment of the thermosetting plastics market in a superior way.

End User Industry Segment Analysis

The construction segment will have superior growth during the forecast period and will hold around 45% of the revenue share of the thermosetting plastics market owing to the increasing expansion of the construction industry across the world. Encouragingly, the industry projects to get back some expansion momentum in 2024. Believing there is a modification of international economic steadfastness, anticipates recommending output expansion will grow by 3% and touch a yearly average of 4.2% between 2025 and 2027. Investment in the infrastructure and the energy and usefulness sectors is a major driver of complete construction output expansion. International economic expansion has slowed in the past 12 months due to high inflation and clamping financial situations, which are also restricting investment. Challenges to the international construction industry comprise the high costs of construction components and labor deficiencies. Thus, these will help this segment to have the highest growth in the thermosetting plastics market.

Our in-depth analysis of the global thermosetting plastics market includes the following segments:

|

Type |

|

|

Moulding Process |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermosetting Plastics Market - Regional Analysis

APAC Market Insights

The thermosetting plastic market in the Asia Pacific industry is likely to dominate majority revenue share of 39% by 2035. This growth will be noticed owing to the increasing expansion of the construction industry in this region because of rapid industrialization. Despite setbacks in construction and real estate activities at the time of the first half of 2020 as the international epidemic hit countries in Asia Pacific, the region is anticipated to rapidly pick up in 2021 and keep healthy expansion over the forecast period. The Asia Pacific region is set to stay the key construction and real estate market, contributing to approximately 40% of the global industry’s output worth by 2030 and helping the thermosetting plastic market to grow massively.

North American Market Insights

The thermosetting plastic market in the North America region will also encounter huge growth during the forecast period and will hold the second position owing to the advancement of electrical electronics sectors in this region. Electricity is basic to approximately all prospects of their lives and economy. The latest technologies, planning and functioning processes, grid architectures, and business practices will frame the electricity system and its lives for decades to come. Thus, North America will hold the second position in the thermosetting plastic market.

Thermosetting Plastics Market Players:

- Alchemie Ltd.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Celanese Corporation

- LANXESS

- DAICEL CORPORATION

- INEOS

- BASF SE

- Covestro A.G.

- BUFA GmbH & Co. KG

- Daicel Corporation

- Eastman Chemical Company

- Asahi Kasei Corporation

- Mitsui Chemicals, Inc.

- NIPPON STEEL Chemical & Material Co., Ltd.

- INOAC Corporation

Recent Developments

Celanese Corporation an international specialty materials and chemical organization, declared the launch of iDose TR by Glaukos Corporation utilizing Celanese’s VitalDose EVA to give constant drug release for the therapy of glaucoma. Several glaucoma and ocular hypertension patients are nonconforming with topical medication utilized because of intricate dosing regimens, adverse impacts, and eye-drop discrimination.

Celanese Corporation, an international specialty materials and chemical organization, declared it has been accepted by the U.S. Department of Energy (DOE)’s Office of Fossil Energy and Carbon Management as a Utilization Procurement Grants (UPGrants) vendor. Celanese is now the only producer offering low-carbon acetic acid under the ECO-CC product name, which positions the company to help municipalities meet the growing demand for more sustainable and circular solutions.

- Report ID: 5892

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermosetting Plastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.