Thermoplastic Prepreg Market Outlook:

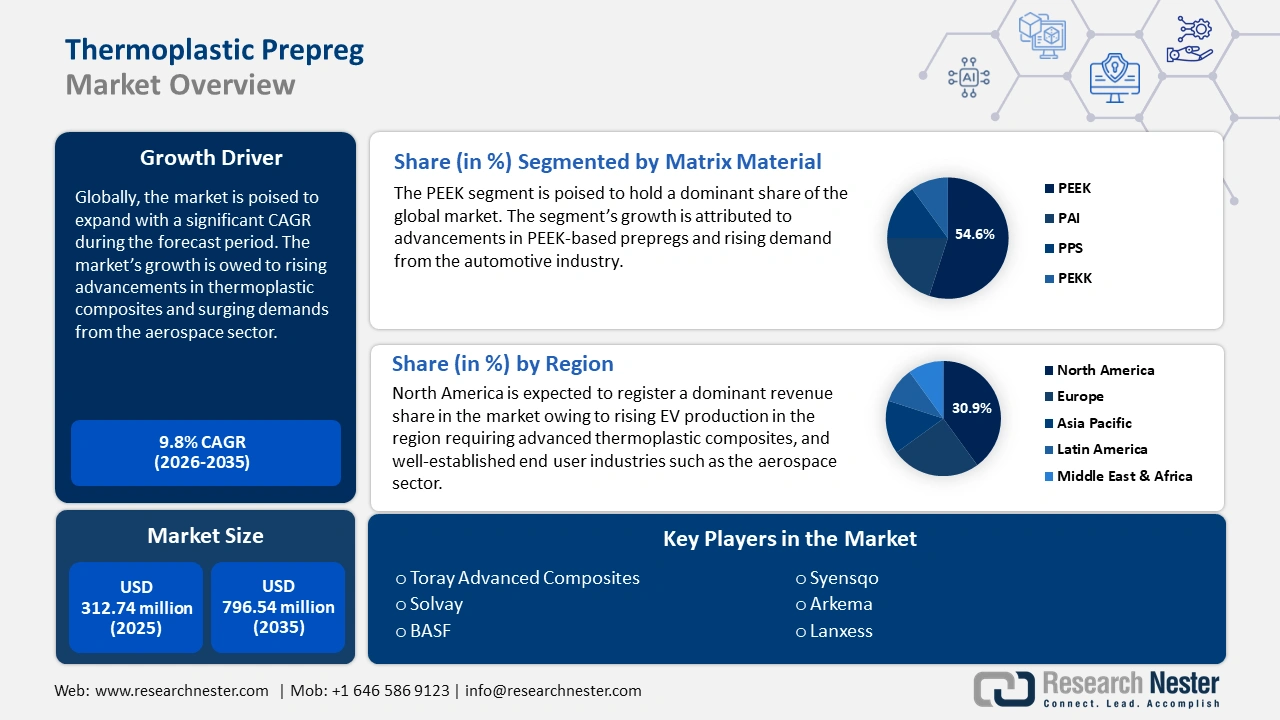

Thermoplastic Prepreg Market size was valued at USD 312.74 million in 2025 and is set to exceed USD 796.54 million by 2035, expanding at over 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermoplastic prepreg is estimated at USD 340.32 million.

The rising demand for durable and lightweight materials in the automotive and aerospace industries is a major driver of the market. They offer superior features in comparison to traditional materials. For instance, in May 2024, the National Aeronautics and Space Administration (NASA) published a literature review on the advances in thermoplastic composites over three decades. It stated that advancements in automation drive the adoption of thermoplastic composites, and thermoplastic composites prepreg quality has improved over time, offering nearly infinite room temperature shelf life. The growing adoption of thermoplastic composites drives demand for prepregs, creating opportunities for suppliers and manufacturers.

Additionally, the rising demand for fuel-efficient vehicles is a major driver for the market. Automakers are leveraging thermoplastic prepregs to produce lightweight components that improve fuel efficiency without making concessions on durability. In November 2024, the U.S. Environmental Protection Agency released the 50th annual Automotive Trends Report, highlighting the U.S. fuel economy of 2023 reaching a record high and greenhouse gas emissions (GHG) dropped to record low levels. The improving fuel economy and reduction in emissions create opportunities for thermoplastic prepregs to provide sustainable performance-enhancing solutions.

The thermoplastic prepreg market is poised to benefit from surging opportunities in the green energy market, especially in wind turbine manufacturing. Thermoplastic prepregs offer the durability and lightweight properties required to create turbine blades. For instance, in March 2022, the ZEBRA consortium produced the prototype of its 100% recyclable wind turbine blade made using Elium resin of Arkema, i.e., a thermoplastic resin known for its recyclable properties. Such advancements are poised to create opportunities in wind turbine rotor blade manufacturing, with a global manufacturing focus shifting to usher in a circular economy. The thermoplastic prepregs market is poised to leverage the favorable trends and continue its robust growth by the end of the forecast period.

Key Thermoplastic Prepreg Market Insights Summary:

Regional Highlights:

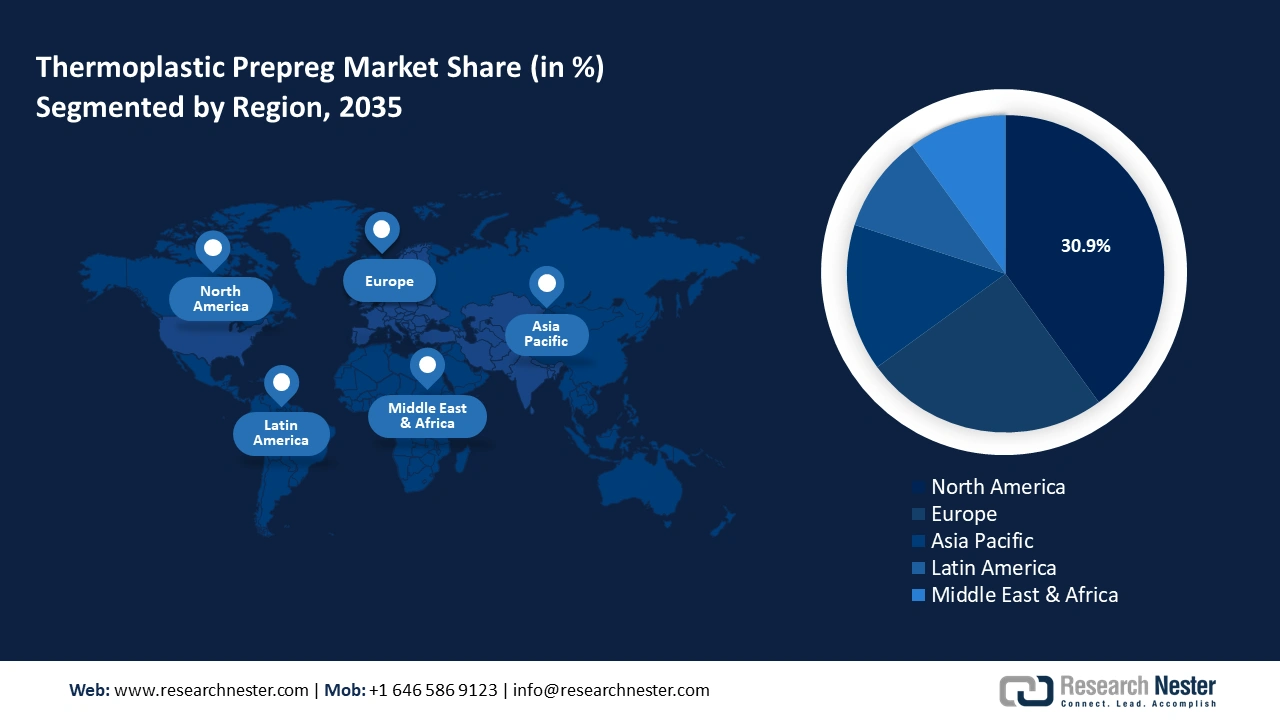

- North America thermoplastic prepreg market will account for 30.90% share by 2035, fueled by rising demands for thermoplastic prepreg from well-established aerospace, defense, automotive, and medical industries.

- Europe market will exhibit the fastest growth during the forecast period 2026-2035, driven by a strong focus on building a circular economy and advancements in thermoplastic composites.

Segment Insights:

- The poly-ether-ketone (peek) segment in the thermoplastic prepreg market is projected to hold a 54.60% share by 2035, driven by the exceptional thermal stability and demand from automotive and aerospace industries.

Key Growth Trends:

- Surging demand in aerospace applications

- Growing end use in the electric and hybrid vehicles sector

Major Challenges:

- Technical barriers to adoption in new applications

- High costs of production of high-performance thermoplastic prepregs

Key Players: Toray Advanced Composites, Solvay, BASF, Syensqo, Ensinger, Krempel GmbH, Hexcel Corporation, Arkema, Lanxess, SABIC, BASF SE, Teijin Limited.

Global Thermoplastic Prepreg Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 312.74 million

- 2026 Market Size: USD 340.32 million

- Projected Market Size: USD 796.54 million by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Thermoplastic Prepreg Market Growth Drivers and Challenges:

Growth Drivers

-

Surging demand in aerospace applications: The thermoplastic prepreg market is set to benefit from the increasing demand from the aerospace sector. The industry adopts thermoplastic prepregs to reduce the weight of the aircraft, improve fuel efficiency, and lower operational costs. Businesses are leveraging the rising demand by demonstrating advanced aerospace composite solutions. For instance, in May 2024, Hexcel announced that it would demonstrate high-performance, advanced lightweight composite materials for the Commercial Aerospace and Space & Defense Markets including HexPly prepreg materials.

Furthermore, recent developments in the market indicate the market’s expansion. For instance, in April 2024, Arris Composites Inc., secured USD 34 million in funding to scale its global operations and boost its presence in the aerospace market with thermoplastic composites solutions. Successful investment rounds in emerging players in the sector augur well for the future of the global thermoplastic prepreg market. - Growing end use in the electric and hybrid vehicles sector: The growing manufacturing of electronic vehicles (EVs) and hybrid vehicles has heightened the demand for lightweight materials that improve battery and fuel efficiency. Businesses are leveraging the demands by showcasing the latest innovations in a bid to boost adoptions in the automotive industry. For instance, in April 2024, the Toray Group announced participation in the National Plastics Event 2024 to showcase cutting-edge fibers and continuous composites solutions, including developments in the TORELINA PPS technology that is used for thermal management in the next-generation EV industry.

Furthermore, the expansion of end use applications within the automobile industry boosts demand for thermoplastic prepregs. Manufacturers are leveraging thermoplastic prepregs to build interior components and boost recyclability. For instance, in April 2023, Teijin Automotive Technologies announced the supply of exterior panels made of advanced composites to Lotus Emira. High-profile applications as such in the market validate the performance capabilities of advanced composite materials, benefiting the growth of the thermoplastic prepreg sector. - Increased investments in thermoplastic composites research: The thermoplastic prepreg market benefits from significant advancements in research to create composites with heightened properties and expand end use. Collaborations between companies and academic institutions to improve material performance benefit the adoption of thermoplastic prepreg. For instance, in February 2021, Leonardo and Solvay launched a joint research lab for thermoplastic composites that developed novel composite materials vital for the future of the aerospace industry. Such research-based collaborations have led to Solvay cementing its position as one of the market leaders in the thermoplastic prepreg market.

Additionally, the National Renewable Energy Laboratory (NREL) highlights advancements in groundbreaking thermoplastic resin research for wind turbine blades that are poised to boost the production of recyclable blades that do not end up in landfills. Furthermore, companies investing in research and expanding their composite portfolios are benefiting from applications in high-profile projects such as the Hi-Rate Composite Aircraft Manufacturing (HiCAM) project of NASA. In June 2022, Toray Advanced Composites reported supplying thermoplastic prepreg technologies to enable an increase in airframe manufacturing rates to the NASA HiCAM project. Such partnerships highlight the growing recognition of thermoplastic prepregs as a superior solution, benefiting the overall market’s growth.

Challenges

-

Technical barriers to adoption in new applications: The thermoplastic prepregs sector can face hindrances due to technological limitations in certain industries. The requirement of precision engineering can heighten production time and costs. Furthermore, industries that are unfamiliar with thermoplastic prepreg can face a steep adoption curve and delay penetration into untapped markets.

- High costs of production of high-performance thermoplastic prepregs: Despite burgeoning advancements in manufacturing technologies, the high investments required for the production of high-performance thermoplastic prepreg can cause a barrier for new entrants in the sector. This challenge is particularly evident for small and medium-sized enterprises (SMEs) seeking to compete in the thermoplastic prepreg market.

Continuous research to curb production costs is poised to navigate the production challenge. For instance, in November 2021, the METEOR project completed a study to optimize the production of high-performance thermoplastic prepregs with promising results.

Thermoplastic Prepreg Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 312.74 million |

|

Forecast Year Market Size (2035) |

USD 796.54 million |

|

Regional Scope |

|

Thermoplastic Prepreg Market Segmentation:

Matrix Material Segment Analysis

By 2035, poly-ether-ketone (PEEK) segment is estimated to capture thermoplastic prepreg market share of over 54.6%. A key driver of the segment’s dominance is the exceptional thermal stability offered by PEEK as a heat-resistant polymer. PEEK-based prepregs are experiencing increasing demand from the automotive and aerospace industries for components that can withstand extreme temperatures. Furthermore, the durability of PEEK makes it ideal for applications in medical implants.

Key players, such as Syensqo, are demonstrating advanced PEEK solutions to leverage the rising demands and expand their revenue share in the market. For instance, in October 2024, the Ajedium Peek e-motor slot liners of Syensqo were showcased at the Battery Show North America 2024 to highlight its usage in next-generation electric vehicle solutions. The PEEK film for 800V electric motor slot liners can outperform the copper fill and heat dissipation capabilities of traditional aramid papers, benefiting manufacturers by reducing dependence on conventional cooling systems. The innovation-centric approach by major market players is a testament to the segment’s growth potential.

The polyamide-imide (PAI) segment of the thermoplastic prepreg market is positioned to increase its revenue share by the end of the forecast period. The superior wear resistance offered by PAI-based prepregs is benefiting adoption across industries. Furthermore, businesses are investing in research to push the boundaries in the capabilities of advanced polymers to expand their applications across various industries. For instance, in July 2023, Drake Plastics announced the development of Torlon PAI heavy-wall injection molding technology. The advancement is a testament to the growing demand for high-performance polymers which can also be used as a matrix resin in thermoplastic prepregs.

Reinforcement Fiber Segment Analysis

The carbon fiber segment of the thermoplastic prepreg market is positioned to hold a significant revenue share in the market. The design flexibility offered by carbon fiber thermoplastic prepreg, along with repairability features, boosts its adoption. Apart from the major industries such as aerospace, automotive, and wind energy, emerging end users such as in sports & recreation are poised to expand the segment.

Furthermore, major market players are seeking to repurpose carbon fiber prepreg waste as a commitment to the circular economy initiatives. For instance, in July 2024, Toray Composite Materials America, Inc., announced the execution of a MoU with Elevated Materials under which the latter will scrap carbon fiber prepreg materials and boost the elimination of carbon fiber waste in the aerospace industry.

Our in-depth analysis of the global thermoplastic prepreg market includes the following segments:

|

Matrix Material |

|

|

Reinforcement Fiber |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermoplastic Prepreg Market Regional Analysis:

North America Market Insights

In thermoplastic prepreg market, North America region is poised to hold more than 30.9% revenue share by 2035. The regional market’s growth is owed to rising demands for thermoplastic prepreg from well-established aerospace, defense, automotive, and medical industries. The U.S. and Canada lead the revenue share in North America. Furthermore, North America boasts a stable supply chain for thermoplastic composites ensuring reduced disruptions and price stability. Additionally, the rising EV adoption in the region is projected to create a sustained demand for the material benefiting the continued growth of the sector.

Companies with a presence in the region are committed to reducing emissions. For instance, in May 2024, BASF Inc. announced opting for sustainable glass fiber in its Ultramid portfolio, and the glass fibers will be produced by 3B Fibreglass, a leading company and supplier of glass fiber solutions for the reinforcement of thermoplastic and thermoset polymers.

The U.S. holds a dominant share in the North America thermoplastic prepreg market. The advanced industrial ecosystem of the U.S. drives the sector’s growth due to increased consumption of the material. The expansion of the fuel economy in the U.S. is poised to drive demands for thermoplastic prepregs. The U.S. Environmental Protection Agency (EPA) released the Annual Automotives Report in May 2024, stating that the new vehicle fuel economy increased by 1.1 mpg, reaching a record high of 27.1 miles mpg. The trends create a favorable outlook for the thermoplastic prepreg market in the country as the material is ideal for creating lightweight components for vehicles.

Furthermore, increasing demand for reinforcement fibers has the potential for manufacturers to diversify product offerings. For instance, in October 2023, Ahlstrom launched a new glass fiber tissue line for high-performance building materials in the U.S. The advanced glass fibers can be incorporated into thermoplastic prepregs to improve the mechanical properties, and durability boosting the sector’s growth.

Canada is poised to expand its share in the North America thermoplastic prepreg market. The advanced manufacturing trends in the country propel the sector’s growth. Canada’s commitment to renewable energy, such as wind energy projects, creates opportunities for thermoplastic prepreg suppliers and distributors. Furthermore, advancements in carbon fiber production are positioned to improve the supply chain for thermoplastic prepreg manufacturers.

For instance, in July 2024, Alberta Innovates announced receiving USD 10 million for the Regional Innovation Ecosystems (RIE) to allow the former to establish a specialized production and testing facility to convert bitumen into carbon fiber. The commercialization of the production process stands to reduce the cost of carbon fiber, which in turn benefits the domestic thermoplastic prepreg sector of Canada.

Europe Market Insights

The Europe thermoplastic prepreg market is poised to exhibit the fastest growth during the forecast period. The strong focus on building a circular economy and advancements in thermoplastic composites are major drivers of the sector’s growth curve in Europe. The region has a strong automobile industry, led by Germany, and a thriving aerospace industry led by companies such as Airbus, that are integrating thermoplastic prepreg solutions to boost operational efficiency.

Furthermore, key players in the Europe thermoplastic prepreg market are advancing thermoplastic composites that have the potential to expand applications. For instance, in May 2023, Solvay launched a new Ketaspire PEEK for monolayer e-motor magnet wire insulation which is expected to provide heightened sustainability benefits. The advancements stand to drive demand for high-performance polymers benefiting the market of Europe.

Germany holds a dominant share in the thermoplastic prepreg market of Europe owing to a well-established automotive industry in the country and the presence of major market players in the composites sector. For instance, in October 2020, Ensinger commissioned a new prepreg facility in Germany, and an increase in facilities strengthens the domestic supply chain in the country.

Additionally, companies in Germany are at the forefront of innovation related to advanced composite materials, expanding their applications which in turn increases the revenue streams for the thermoplastic prepreg market. For instance, in October 2023, Evonik launched carbon-fiber-reinforced PEEK filament for 3D printed medical implants, expanding end use scope of the thermoplastic prepreg market.

France is poised to increase its revenue share in the Europe market. The market has the potential to witness an increase in thermoplastic prepreg manufacturing to cater to demands for advanced lightweight materials for next-generation aircraft. Furthermore, investments and acquisitions of domestic companies in France indicate the burgeoning potential of the market. For instance, in May 2022, Bemis Associates Inc., acquired the France-based manufacturing company, Protechnic. The acquisition is expected to boost Bemis’s portfolio of thermoplastic film manufacturing.

Thermoplastic Prepreg Market Players:

- Toray Advanced Composites

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay

- BASF

- Syensqo

- Ensinger

- Krempel GmbH

- Hexcel Corporation

- Arkema

- Lanxess

- SABIC

- BASF SE

The thermoplastic prepreg market is poised to register a profitable expansion during the forecast period. The competitive market has key players maintain their revenue share through continuous innovation and strategic investments. The major players are investing to expand to emerging markets in APAC, the Middle East, and Africa to establish production facilities and shore up supply lines. Furthermore, collaborations with OEMs ensure tailored solutions for the end user and can help in strengthening the market position of the companies.

Here are some key players in the thermoplastic prepreg market:

Recent Developments

- In March 2024, Arkema and Hexcel announced completion of the first aeronautical structure made of thermoplastic composites. The aerospace-grade materials were developed using Arkema’s Kepstan PEKK resin and Hexcel’s HexTow AS7 and IM7 carbon fibers with the final objective being to produce composite parts that can replace metallic materials (such as steel, aluminum, and titanium) in aircraft structures

- In April 2023, Solvay and GKN Aerospace announced a renewal of their collaboration. The partnership aims to expand the usage of thermoplastic composite materials on aerospace structures and Solvay is poised to remain the preferred supplier for TPC materials for GKN Aerospace.

- Report ID: 6826

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermoplastic Prepreg Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.