Thermal Transfer Ribbon Market Outlook:

Thermal Transfer Ribbon Market size was over USD 1.68 billion in 2025 and is projected to reach USD 3.09 billion by 2035, witnessing around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermal transfer ribbon is evaluated at USD 1.78 billion.

The growth of the market can be attributed to the increasing practices of cashless payments using barcode scanning. People are now more likely to use QR codes to complete transactions. Thermal printers carefully print these codes, which contain the bank information, to provide a crisper image, and it is anticipated to boost the growth of the market. The QR Code Reach growth increased by almost 96% between 2018 and 2020. According to a study of participants from the US and the UK, 47% of respondents were in favor of adopting QR codes.

In addition to these, factors that are believed to fuel the market growth of thermal transfer ribbon include the rising admission in hospitals, owing to COVID-19 and other chronic diseases. According to the World Health Organization, more than four out of every five deaths from CVD are attributable to heart attacks and strokes. Thermal printers are mostly used in the healthcare sector to record real-time rhythm strips on hospital cardiac monitors and also for printing patient identification. Moreover, the number of hospitals is also rising which in turn is driving the market growth. There were over 8,000 hospitals in Japan as of 2020. Moreover, in Korea, there were nearly 4ooo hospitals.

Key Thermal Transfer Ribbon Market Insights Summary:

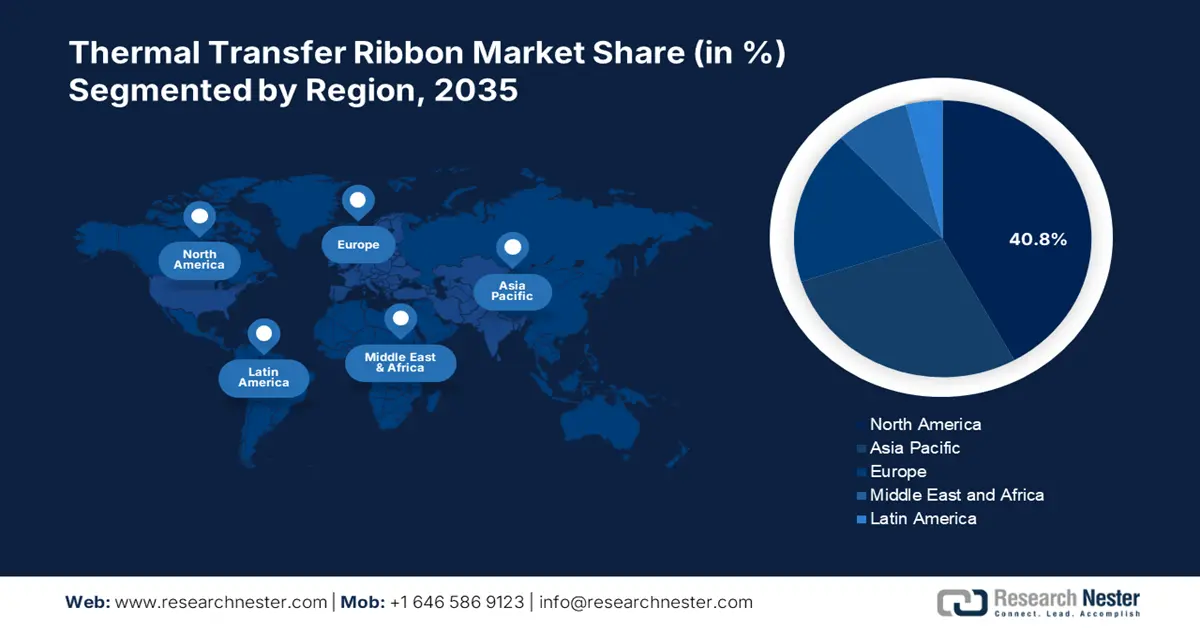

Regional Highlights:

- North America thermal transfer ribbon market will hold over 40.8% share by 2035, driven by rising cases of chronic illness increasing hospital admissions.

- Asia Pacific market will secure the second largest share by 2035, driven by rising trend of cashless payments and government efforts boosting digital transactions.

Segment Insights:

- The wax-resin material segment in the thermal transfer ribbon market is anticipated to hold a significant share by 2035, driven by the high durability and climate resistance of wax-resin ribbons.

- The transport & logistics segment in the thermal transfer ribbon market is projected to hold the largest share by 2035, driven by rising demand for home deliveries and growing e-commerce trends.

Key Growth Trends:

- Growing Integration of IoT in Printing

- Rising E-Commerce in the World

Major Challenges:

- Adverse impact on the environment

- Various substitutes of thermal transfer ribbon are available

Key Players: Abbott Services, Dai Nippon Printing Co., Ltd., ITW ShineMark, Analysis Armor Group, Hangzhou Todaytec Digital Co., Ltd., Zebra Technologies Corp, Ricoh Company, Ltd., Honeywell International Inc., General Co., Ltd., TSC Printronix Auto ID, Domino Printing Sciences plc.

Global Thermal Transfer Ribbon Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.68 billion

- 2026 Market Size: USD 1.78 billion

- Projected Market Size: USD 3.09 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Thermal Transfer Ribbon Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Integration of IoT in Printing – IoT connected brings many new features to printers, which is likely to boost the demand for thermal printers followed by the thermal transfer ribbon market. The number of Internet of Things (IoT) devices, such as vending machines, thermostats, security cameras, and networked printers, was predicted to reach 20 to 50 billion by 2020 all across the world.

-

Rising E-Commerce in the World – E-commerce has boosted the logistics, and online delivery of packages, with the growing e-commerce industry shipping labels, receipts, and barcodes also increased. Globally more than a quarter of all retail sales, or USD 5 trillion, were made through retail e-commerce for the first time in 2022. By 2025, total spending on retail e-commerce is likely to be around USD 7 trillion.

-

Growing Use of Thermal Printers in the Medical Sector – thermal printheads are used in making patient wristbands, labels, freezer storage, identification, and others. Owing to COVID-19, the number of patients visiting hospitals significantly rose. In the United States, hospitals saw over 1,55,000 covid patients as of January 2022.

-

New Launches of Thermal Printer Technology – For instance, the newest software that enables individuals to print at any time and any location is released by Toshiba America Business Solutions, Inc. Toshiba completely streamlines the printing process with its e-BRIDGE Global Print technology.

-

Increasing Use of Automatic Identification – Identification is an important application of security labels, such as barcodes, labels, and tags are all printed with the help of thermal printers and facilitate automatic identification. With a nearly 109% increase in cashless transactions from 2020 to 2025, Asia-Pacific will experience the fastest growth, followed by Africa and Europe with gains of around 76% and 79%, respectively, from 2025 to 2030.

Challenges

-

Adverse impact on the environment - a poly-based material is used in the production of thermal transfer ribbons. This material is extracted from crude oil products, which is likely to lead to increased mining and eventually will impact the market growth. Moreover, the production of this poly blades material generates a huge amount of waste material, which also contributes to environmental pollution and is expected to hamper the market growth.

-

Various substitutes of thermal transfer ribbon are available

-

Strict regulations on printing

Thermal Transfer Ribbon Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 1.68 billion |

|

Forecast Year Market Size (2035) |

USD 3.09 billion |

|

Regional Scope |

|

Thermal Transfer Ribbon Market Segmentation:

End-user

The global thermal transfer ribbon market is segmented and analyzed for demand and supply by the end-user industry into entertainment & hospitality, manufacturing, healthcare, retail, and transport & logistics. Out of the five end-user industries, the transport & logistics segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the rising demand for home deliveries and the growing trends of e-commerce. Thermal printers in the transport and logistics sector are highly used to seamlessly connect all locations along the transportation corridor. Along with this, it is also used in auto identification, it facilitates every step, from receiving materials to delivering them to customers. Platform-to-consumer delivery was used by roughly 2,700 million individuals in 2020. Moreover, in 2020, there were roughly 15 billion deliveries made throughout the world. In addition, global retail e-commerce sales were around 5 trillion dollars in 2021.

Product Types

The global thermal transfer ribbon market is also segmented and analyzed for demand and supply by product types into wax-resin material, resin material, and wax material. Amongst these three segments, the wax-resin material segment is expected to garner a significant share in the year 2035. Ribbons made up of a combination of wax and ribbon have extremely high durability. The primary driving factor for the wax-resin material segment is the strength it offers to the ribbon. Other than this, this material also increases the life span of the print taken from the printer. Moreover, it is immune to changing climatic conditions and fluctuating temperatures. Therefore, it is also suitable for products that are constantly in contact with changing temperatures.

Our in-depth analysis of the global market includes the following segments:

|

By Product Types |

|

|

By Head Type |

|

|

By Application |

|

|

By End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermal Transfer Ribbon Market Regional Analysis:

North American Market Insights

North America region is anticipated to hold over 40.8% market share by 2035, driven by rising cases of chronic illness increasing hospital admissions. Moreover, hospital invoices, patient information, and medical rhythms are being printed with more frequency using thermal printers. Every year, there are about 805,000 heart attacks in the US. 605,000 of those are first-time heart attacks. Also, there were nearly 77 million patient visits to health centers in the United States in 2010, and by 2020, there were over 114 million. On the other hand, the market size in the region is expected to expand on the account of the frequent use of barcodes for transactions. By 2020, 11 million US households scanned a QR code around 10 million scans were recorded in 2018.

APAC Market Insights

The Asia Pacific thermal transfer ribbon market, amongst the market in all the other regions, is projected to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the rising trend of cashless payments and higher efforts put in by the government to boost digital transactions. The Ministry of Economy, Trade and Industry (METI) created the "Cashless Vision" in 2018, and it contained suggestions for Japan's move towards a cashless society. It aims to have 40% of transactions be cashless by the time of the Osaka Expo in 2025, with a potential increase to 80% in the future. In addition to this, India recorded around 23 trillion digital transactions in the third quarter of FY23.

Europe Market Insights

Europe region is poised to witness substantial growth through 2035. The growth of the market can be attributed majorly to the rising demand for receipts, even in the world of digitization, paper receipt still hasn’t lost their touch. Almost 11 billion till receipts, which cost at least USD 34 million to produce, are distributed annually by UK merchants. Cash transaction is still a huge part of Europe’s economy, which also increases the demand for hardcopy receipts. According to the statistics of the European Parliament, cash accounts for more than 50% of all payment transactions in more than 75% of Member States, and it is the most common payment method overall in almost all Member States.

Thermal Transfer Ribbon Market Players:

- Abbott Services

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dai Nippon Printing Co., Ltd.,

- ITW ShineMark

- Analysis Armor Group

- Hangzhou Todaytec Digital Co., Ltd.

- Zebra Technologies Corp

- Ricoh Company, Ltd.

- Honeywell International Inc.

- General Co., Ltd.

- TSC Printronix Auto ID

- Domino Printing Sciences plc

Recent Developments

-

Domino Printing Sciences plc announced the launch of modern thermal transfer overprinters (TTO) from the new Vx-Series. It aims at improving the productivity of flexible food packaging machines. It maximizes production efficiency with the minimum use of ribbon.

-

TSC Printronix Auto ID (TSC) announces the collaboration with Distribution Management, it has become the authorized distributor of TSC's line of premium, high-performance thermal printers, OEM labels, and supplies available in North America.

- Report ID: 4746

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermal Transfer Ribbon Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.