Thermal Paper Market Outlook:

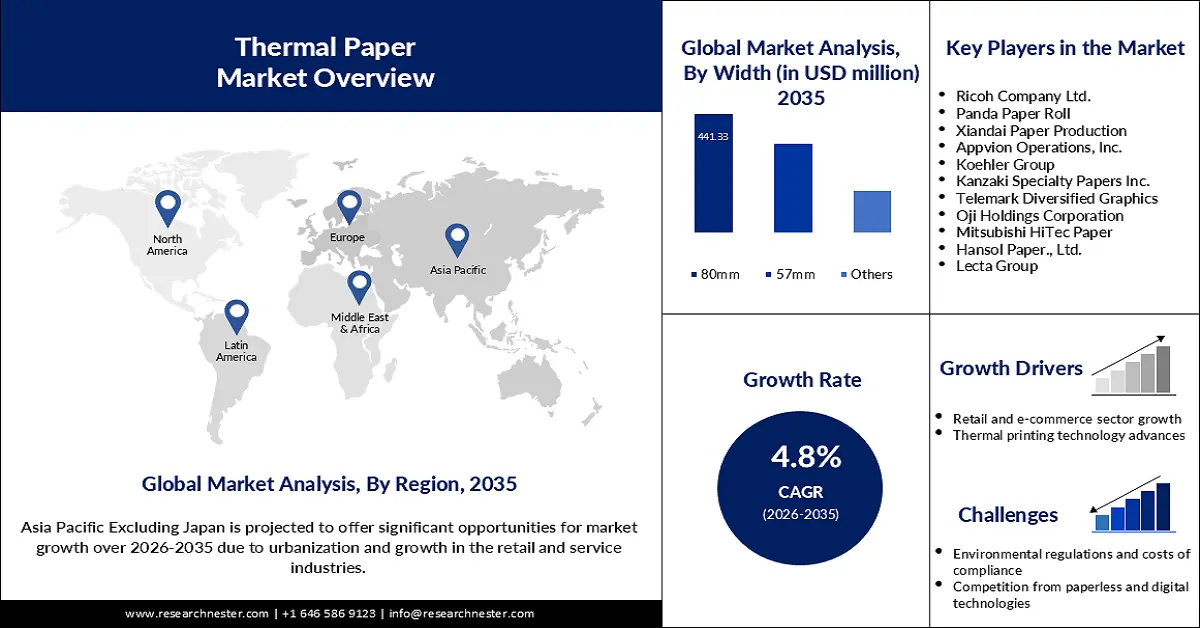

Thermal Paper Market size was over USD 5.18 billion in 2025 and is anticipated to cross USD 8.28 billion by 2035, growing at more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermal paper is assessed at USD 5.4 billion.

Applications of thermal paper in various sectors, such as retail, logistics, and healthcare, are anticipated to position the market for substantial growth. The adoption of these papers due to the general use of POS systems on receipts and records of transactions motivates growth. Increasing demand for fast and efficient printing in the retail and service industries drives this trend. Furthermore, new technological changes in thermal printing with better quality and higher speed are opening more avenues for market growth.

The thermal paper market trends are driven by different government initiatives more so in Europe and North America. Stringent regulations concerning environmental sustainability, for instance, drive manufacturers to produce environmentally friendly alternatives to traditional thermal paper, such as BPA-free and phenol-free alternatives. A report by the European Chemicals Agency in 2020 stated that BPA would face further restrictions in its use in thermal paper; hence, it would raise the demand for safer alternatives to meet these demands. The main purpose of such regulations is to ensure the safety of consumers and drive innovation into the market.

Key Thermal Paper Market Insights Summary:

Regional Highlights:

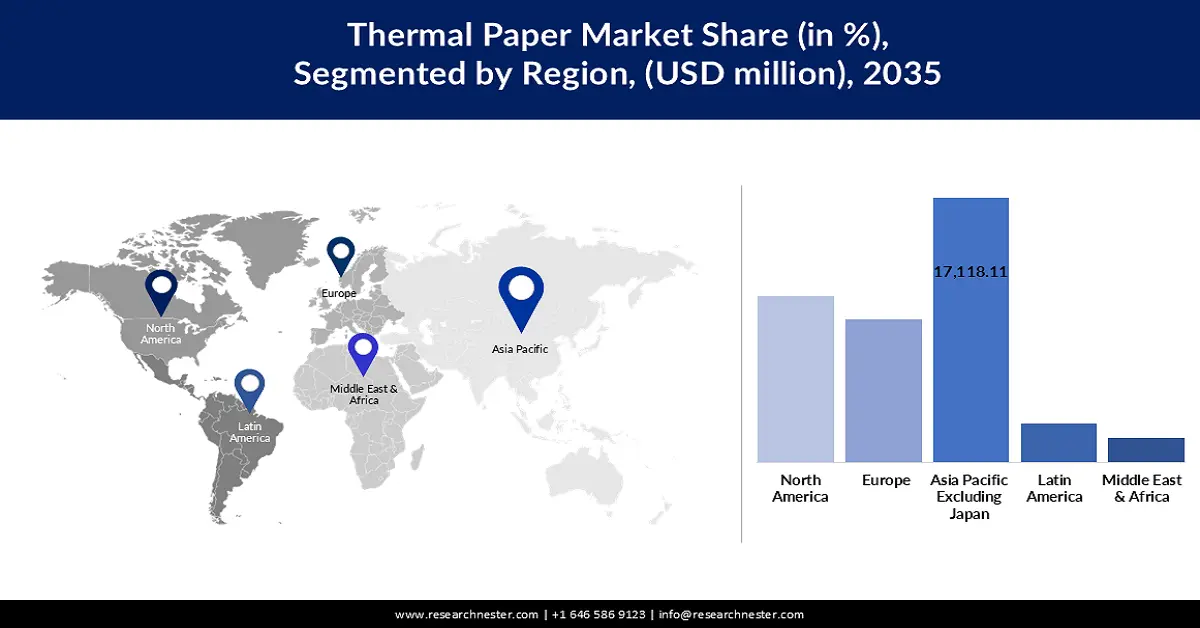

- Asia Pacific’s thermal paper market will account for 38% share by 2035, driven by urbanization and rising investments in POS systems.

Segment Insights:

- The 80mm width segment in the thermal paper market is anticipated to experience significant growth till 2035, driven by its wide adoption in POS systems and rapid CAGR of 7.1%.

- The top-coated segment in the thermal paper market is projected to experience rapid growth over 2026-2035, driven by enhanced durability and superior print quality.

Key Growth Trends:

- Growth of retail and e-commerce sectors

- Advances in thermal printing technology

Major Challenges:

- Competition from digital and paperless technologies

Key Players: NAKAGAWA Manufacturing (USA), Inc., Panda Paper Roll, Xiandai Paper Production, Appvion Operations, Inc., Koehler Group, Henan Province JiangHe Paper Co., Ltd.

Global Thermal Paper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.18 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 8.28 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 18 September, 2025

Thermal Paper Market Growth Drivers and Challenges:

Growth Drivers

- Growth of retail and e-commerce sectors: Retail and e-commerce continue to provide high demand for thermal paper due to the increased usage of POS systems and transaction records. The move towards digital payments, increased consumer expenditure worldwide fuel demand, and the development of effective printing solutions. Such demand has spurred corporations to expand into different markets: for instance, Amazon's expansion of its logistics network in April 2024 was inculcated with advanced POS systems, which, in return, increased demand in the market for high volumes of thermal paper.

- Advances in thermal printing technology: There has been rapid adoption of thermal paper due to advancements in printing technology to improve efficiency and quality in print outputs. Innovations such as speedy print speeds, high resolution, and energy-efficient printers are opening up prospects for growth. One major development was in May 2020, when Solenis launched a next-generation color developer in thermal papers to enhance the strength and the quality of prints in the paper.

- Rising demand for eco-friendly thermal paper: Consumers are increasingly seeking out thermal paper that does not contain harmful substances such as BPA, which further compels the demand for environmentally friendly thermal paper. Entry into the market of various sustainable replacements is becoming quite prevalent, especially in Europe and North America. For example, in May 2024, Appvion launched its EarthChem portfolio, comprising sustainable thermal products meeting global trends in sustainability—proof that greener levels of practice are rising in this industry.

Challenges

- Environmental regulations and costs of compliance: The thermal paper industry is not out of challenges, partly as the stringency of environmental regulations in Europe constrains the use of harmful chemicals in the production of paper. This drives up production costs and demands heavy investments in research and development. For example, the European Chemicals Agency (ECHA) announced further restrictions on the use of BPA in 2023, compelling manufacturers to invest in alternative materials.

- Competition from digital and paperless technologies: The thermal paper market also faces competition from the rapidly increasing trend of digitalization and moving to paperless transactions. With the increase in electronic receipts and other digital notes among companies and customers, the demand for thermal papers is likely to be affected adversely. In February 2023, a report by Research Nester indicated a 12% surge in the adoption of digital receipts throughout major retail chains in the U.S. as people are moving to modern mechanisms instead of relying on traditional paper-based mechanisms.

Thermal Paper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 5.18 billion |

|

Forecast Year Market Size (2035) |

USD 8.28 billion |

|

Regional Scope |

|

Thermal Paper Market Segmentation:

Width Segment Analysis

The 80mm width segment willdominate the thermal paper market with a share of 48.4% by 2035 due to its wide adoption in POS systems, generally in the retail and hospitality sectors. The segment is expected to maintain its leading position in the market and register a rapid revenue CAGR of 7.1% by 2035. This steady growth rate is one of the core reasons for the segment expansion including multifold purposes, cost-effectiveness, and compatibility with a broad category of printers. Panda Paper Roll launched a series of new 80mm thermal paper rolls for high-speed printing applications in March 2024. Innovations such as these are likely to strengthen the segment's leading position in the market going ahead.

Type Segment Analysis

The top-coated segment in thermal paper market is growing rapidly owing to the enhanced durability of this form of paper and superior print quality, hence suitable for applications that involve long-lasting prints. Technological advancement and growing demand from industry verticals such as retail and healthcare are key drivers. In February 2024, Barcelona-based Lecta Group extended its line of Termax thermal products with the introduction of two new high-quality grades of top-coated thermal paper—Termax TC20X and Termax TC20XB—that target the self-adhesive label market. Additionally, these new launches depict the rise in scope for this segment.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Technology |

|

|

Width |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermal Paper Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 38% by 2035. The growth within the region is due to urbanization and growth in the retail and service industries, especially in countries such as China and India. Also, increasing investments in POS systems and digital payment mechanisms will increase the demand for thermal paper. Overall, a rise in consumer spending due to an expanding middle class in the region will drive the outlook of the market.

China leads the market in APAC, where high growth is witnessed in the country due to its widespread retail network and rapidly growing e-commerce business. Incentives provided by the local government toward cashless transactions and the adoption of advanced POS systems act as driving factors. With the completion of the acquisition of Arjowiggins China in January 2024, Fedrigoni increased its operational footprint in Asia. The acquisition officially closed on December 29, 2023, and represents Fedrigoni's maiden entry into China, besides placing the company in a strategic position about the growing demand for specialty papers.

With the government's initiative of Digital India and the rising rate of growth in the retail sector, India is in a position to be a vital player in the market in Asia Pacific. The pervasiveness of digital payment systems across cities further spurs the demand for thermal papers. In July 2024, Grindwell Norton Ltd. inaugurated its Paper Maker manufacturing plant in Bengaluru, India. The plant’s manufacturing capabilities under the Atmanirbhar Bharat initiative, offer lucrative opportunities for manufacturers to launch more “Make in India” products, including, thermal papers.

North America Market Insights

The thermal paper market in North America is likely to experience steady growth, mainly due to the ever-growing adoption of POS systems and the expansion of the retail and logistics sectors. Technological advancement in thermal printing and increasing demand from retail and service industries for efficient transaction recording systems serve as major growth factors contributing to this rise. Besides, increasing emphasis on print quality and sustainability in the region will further help market expansion.

The U.S. dominates the market in North America, owing to its heavy retail network and steadily rising e-commerce. These include the increasing preference of people for digital payment systems as well as the increasing proliferation of POS terminals in a series of retail outlets. For instance, in March 2023, Twin Rivers declared that it had finalized the sale of Plaster Rock Lumber Corporation, its softwood lumber mill located in Plaster Rock, New Brunswick, to Groupe Lebel, an Eastern Canada lumber manufacturer and North America forest products leader. This deal furthers the strategy of Twin Rivers, focused on investing in and expanding its core business in specialty and kraft paper production.

Canada is another country showcasing considerable contribution to the thermal paper market. The industry is rising due to the growth in the retail sector and rising use of advanced printing technology. Players in Canada market are shifting toward sustainability, and the government is pressing towards an eco-friendly alternative to conventional thermal paper. For example, the Koehler Group to increase its network of active distributors in Canada, planned to meet the emerging high demand for value and sustainable thermal paper products from the retail and logistics industries. This strategic step will boost the market presence of the company and will help the overall growth of the market in Canada.

Thermal Paper Market Players:

- Ricoh Company Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NAKAGAWA Manufacturing (USA), Inc.

- Panda Paper Roll

- Xiandai Paper Production

- Appvion Operations, Inc.

- Koehler Group

- Henan Province JiangHe Paper Co., Ltd.

- Kanzaki Specialty Papers Inc.

- Telemark Diversified Graphics

- Oji Holdings Corporation

- Mitsubishi HiTec Paper

- Hansol Paper., Ltd.

- Lecta Group

- KRPA Holding

- Jujo Thermal Ltd. (Nippon Paper Industries Co., Ltd. )

- Shandong Chenming Paper Holdings Ltd

- RP Paper Impex

The thermal paper market involves key players focusing on the strategic expansion of product portfolios and geographical reach. Major companies like Ricoh Company Ltd., Koehler Group, Oji Holdings Corporation, and Mitsubishi HiTec Paper have been leading the market with continuous innovation and collaborations. These firms are focused on inventing environmentally friendly products and expanding their production capacity to meet the increasing demand around the world. For example, Quantum Capital Partners completed its acquisition of Mitsubishi HiTec Paper Europe GmbH in September 2023, further developing its network and competence within this specialty paper field, including thermal paper. This transaction forms part of an overall strategy of market position and capability building within the paper sector.

Here are some leading companies in the thermal paper market:

Recent Developments

- In March 2024, Sappi announced further expansion in the Lanaken mill thermal paper production capacity, located in Belgium, as part of the company's strategy to improve its product offerings and meet increasing market demand for high-quality thermal papers.

- In January 2024, Mitsubishi HiTec Paper Europe released a new generation of thermal papers for logistics and retail. This product line sets targets with higher print quality and durability under high demands.

- In November 2023, UPM and HP signed a collaboration agreement for the development of sustainable thermal paper solutions. This cooperation has been set to drive innovation in the thermal paper market toward more ecological materials and production methods.

- In August 2022, VFP Ink Technologies announced the release of a new chemical-free thermal paper with no controversial chemicals compared to 1470579 Blue Clean. This innovative paper is food contact-approved and presents an environmentally friendly alternative to conventional thermal papers in applications, thanks to its four-layered structure for enhanced printability and strength.

- Report ID: 6412

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermal Paper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.