Thermal Energy Storage Market Outlook:

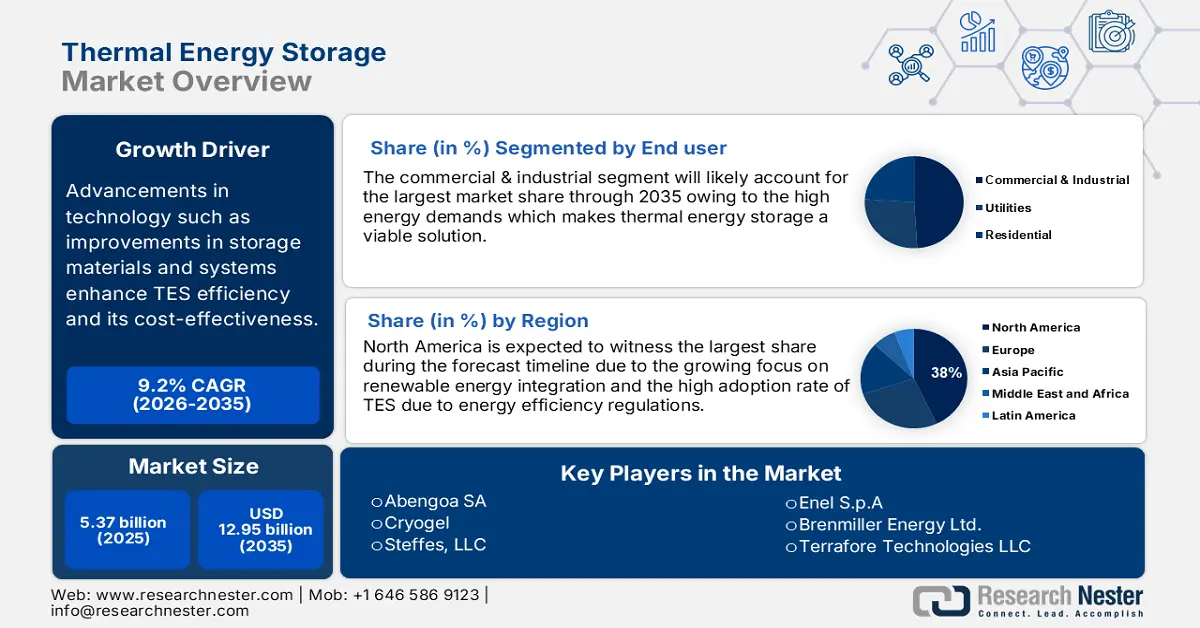

Thermal Energy Storage Market size was valued at USD 5.37 billion in 2025 and is likely to cross USD 12.95 billion by 2035, registering more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermal energy storage is assessed at USD 5.81 billion.

The growth of the market can be attributed to the growing need to augment the energy storage, so that it can be utilized at the time of emergencies. Generally, it happens through cooling or heating a medium in order to use the energy later. By 2040, thermal energy storage could increase potential long-duration storage, or LDES, capacity globally from a range of around 1 TW to 3 TW to between 2 TW and 8 TW.

In addition to these, factors that are believed to fuel the market growth of thermal energy storage include the rising efforts to boost the development of smart cities. With the growing infrastructure of smart cities, the need for sustainable energy is expected to grow. The Smart Cities USA project will improve San Jose's quality of life by fostering 25,000 CleanTech employment, fostering environmental sustainability, and driving economic growth. To achieve this development the City of San Jose, California partnered up with Intel to use Intel's IoT Smart City Demonstration Platform. On the other hand, the thermal energy storage market growth is also attributed to the growing production of electricity. Moreover, 2019 saw a 1.3% increase in global gross power production over 2018. Since 1974, annual increases in global power output have been constant.

Key Thermal Energy Storage Market Insights Summary:

Regional Highlights:

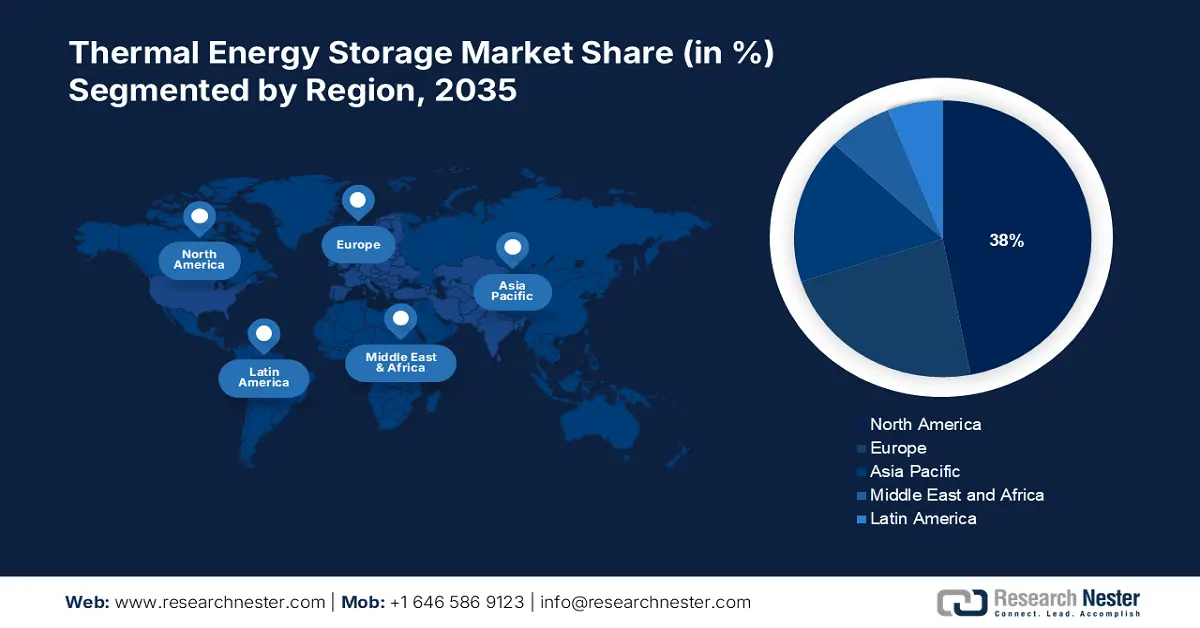

- North America thermal energy storage market will hold over 38% share by 2035, fueled by rising demand for heating/cooling systems and energy storage R&D.

- Europe market will attain a 25% share by 2035, driven by government-backed energy storage programs and rising electricity demand.

Segment Insights:

- The heating & cooling segment in the thermal energy storage market is expected to capture a significant share by 2035, driven by rising demand for air conditioning and energy-efficient thermal solutions.

- The commercial & industrial segment in the thermal energy storage market is poised for substantial growth during 2026-2035, driven by increasing energy demand in the industrial and commercial sectors.

Key Growth Trends:

- Growing Demand for Electricity

- Higher Generation of Solar Energy

Major Challenges:

- Limitation associated with container size and its thermal stability

- Lack of infrastructure in the developing countries

Key Players: New BrightSource, Ltd., Abengoa SA, Terrafore Technologies LLC, Baltimore Aircoil Company, Ice Energy Heat Pumps Ltd., Caldwell Partners International Inc., Cryogel, Steffes, LLC, Enel S.p.A, Brenmiller Energy Ltd.

Global Thermal Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.37 billion

- 2026 Market Size: USD 5.81 billion

- Projected Market Size: USD 12.95 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Spain

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Thermal Energy Storage Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Electricity – Large-scale uses of thermal energy storage are found in the realm of electrical energy generation. Hence, during times of high energy demand, electricity is generated using the stored heat energy. The January 2022 issue of the IEA's semi-annual Electricity Market Report states that in 2021 the demand for electricity increased by more than 1500 terawatt hours across the globe. It was the greatest ever in history.

- Higher Generation of Solar Energy – The sun's rays are reflected onto a collector in a concentrating solar power (CSP) system, creating heat that is used to generate electricity that can either be used right away or stored as thermal energy for later use. According to the International Renewable Energy Agency, by the end of 2020, there were 710 GW of solar PV installations worldwide. The highest capacity expansion of any renewable energy source occurred in 2020 with an increase of about 125 GW in new solar PV capacity.

- Growing Investment in Energy Transition– Rising expenditure on the technologies used for energy transition is expected to boost the thermal energy storage market growth. An all-time high of USD 1.3 trillion was invested globally in energy transition technologies in 2022, including energy efficiency. Although to stay on track, the annual investment needs to be quadrupled.

- Rising Generation of Thermal Power –Thermal power can be stored in underground tanks for future use. India produced around 88,000 million units (MU) of thermal power in November 2022, which is about 16% higher than the 75,000 MU it produced a year earlier.

- Rising Development of Smart Infrastructure – Applications for thermal energy storage can be found in urban spaces. Energy storage is acknowledged by utilities as being crucial to advancing the smart grid and, by default the smart cities. Around 43 megacities with populations over 10 million are projected to exist in the world by 2030, the majority of them in developing areas.

Challenges

- Limitation associated with container size and its thermal stability

- Storage of thermal energy can be expensive- the developing stage of thermal energy storage required extensive research and development to achieve its maximum efficiency, moreover the installation cost of the underground storage facilities is high. Therefore, the overall cost of thermal energy storage is expensive and is likely to hamper the market growth.

- Lack of infrastructure in the developing countries

Thermal Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 5.37 billion |

|

Forecast Year Market Size (2035) |

USD 12.95 billion |

|

Regional Scope |

|

Thermal Energy Storage Market Segmentation:

End-user Segment Analysis

The global thermal energy storage market is segmented and analyzed for demand and supply by end user into residential, commercial & industrial, and utilities. Out of these, three end user of thermal energy storage, the commercial & industrial segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing demand for energy for both industrial and commercial purposes. The global industrial sector's demand for power has grown by 3% since 2000. In addition, in 2021, retail power sales to businesses climbed by roughly 3%. Moreover, 0.14 trillion kWh, or nearly 3% of the total amount of energy, were used by the industrial and commercial sectors, worldwide.

Application Segment Analysis

The global thermal energy storage market is also segmented and analyzed for demand and supply by application into heating & cooling, and power generation. Amongst these two segments, the heating and cooling segment is expected to garner a significant share in the year 2035. The rejected heat from air conditioning units can be recovered using latent heat thermal energy storage devices, which can then be used to produce low-temperature hot water. Owing to the heat rejection from air conditioning systems, it reduces not only the amount of primary energy needed to heat residential hot water and also the damage to the environment. The growth of the segment is primarily attributed to rising demand for air conditioner. Almost 20% of the electricity consumed in buildings worldwide today is used by air conditioners and electric fans to stay cool. In addition to increasing emissions, the growing demand for space cooling is placing a tremendous amount of stress on the energy infrastructure of many nations. Moreover, over two-thirds of homes worldwide may have air conditioners by 2050. Together, China, India, and Indonesia will make up half of the total.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Storage Material |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermal Energy Storage Market Regional Analysis:

North American Market Insights

The thermal energy storage market in North America is projected to be the largest with a share of about 38% by the end of 2035. The growth of the market can be attributed majorly to the increasing demand for heating and cooling systems for the buildings in the region and rising efforts to boost the use of thermal energy. The Building Technologies Office (BTO) is concentrating on thermal storage research, development, demonstration, and deployment to hasten the commercialization and application of next-generation energy storage technologies for building applications. Buildings use over 39% of all primary energy and 74% of all electricity in the US. According to the Office of Energy Efficiency & Renewable Energy around 50% of building energy demand is currently met by thermal end uses, such as air conditioning, water heating, and refrigeration, and this percentage is expected to rise in the coming years in the United States.

Europe Market Insights

The European thermal energy storage market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the rising effort put in by the government to augment energy storage systems. For instance, the UK government created a SUPERGEN Energy Storage Hub in the UK to gather all the researchers that have expertise in energy storage research. This is likely to enhance the existing energy storage system technologies and the complete value chain system from energy storage to manufacturing. Moreover, the rising demand for electricity and rising cases of power outages are also expected to boost the market growth in the region.

APAC Market Insights

Further, the thermal energy storage market in the Asia Pacific is projected to hold a significant share by the end of 2035. The growth of the market can be attributed majorly to the presence of one of the largest thermal power plants in the region. Just 11 thermal power plants worldwide have a total installed capacity of 5 GW or more. China, Japan, and Taiwan are home to eight of them. Moreover, the largest thermal power plant in the world is located in Longjing, Taichung, Taiwan. It is an around 5,800-Megawatt coal-fired power plant that is owned and run by the government-owned Taiwan Electricity Corporation. Furthermore, China generated a record 617 terawatt-hours more overall electricity and 465 terawatt-hours more thermal power between January and August 2021 compared to the same time the previous year.

Thermal Energy Storage Market Players:

- New BrightSource, Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abengoa SA

- Terrafore Technologies LLC

- Baltimore Aircoil Company

- Ice Energy Heat Pumps Ltd.

- Caldwell Partners International Inc.

- Cryogel

- Steffes, LLC

- Enel S.p.A

- Brenmiller Energy Ltd.

Recent Developments

-

The Enel Group in partnership with Brenmiller Energy Ltd. Launched a new energy storage system in Snata Barabara, Tuscany. it is an innovative thermal storage system that is fully sustainable and capable of accelerating the energy transition.

-

Brenmiller Energy Ltd. announced the automation of thermal energy storage in its production unit in Dimona, Israel. The first production is expected to begin by May 2023. Furthermore, by the end of 2023, it is anticipated that full production capacity for up to 4,000 MWh of clean energy bGen TES modules yearly will be reached.

- Report ID: 4784

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermal Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.